Mortgage Rates All Time Record Low - TIME TO REFINANCE!

When I retired 3 years ago I invested my federal Thrift Savings Plan in an annuity and every 3 years you have the opportunity to change your plan and portfolio. I had a meeting with my advisor a couple of weeks ago to talk about strategies for the renewal date coming up. One of the pieces of information that he asked to bring to the meeting was our current mortgage balance.

When I called my bank for the information I asked for my current balance ($41K), my term left on the loan (16 years), and my current interest rate (4.4%). We have an ARM (Adjustable Rate Mortgage) that "adjusts every 3 years" with the LOWEST it can drop is 3% and the HIGHEST it can raise is 9.0% over the course of the loan. I'm currently paying $450 a month, which is actually more than the required payment.

With today's economy and the Federal Reserve lowering their rates to help stabilize things, a 4.4% mortgage is way overpriced. And even though it's due to "adjust" in October of this year, the lowest it will go is 3.0%. Still not a good price in this market.

I did some online research and started mortgage shopping. I was able to get a 2.65% rate for the FIXED 10-year term. The only painful part of this process is the "Closing Costs" on applying for a new mortgage - currently running about $2K. Personally, I feel this is an absolutely ridiculous amount to charge for redoing the paperwork! However, it is definitely worth the expense.

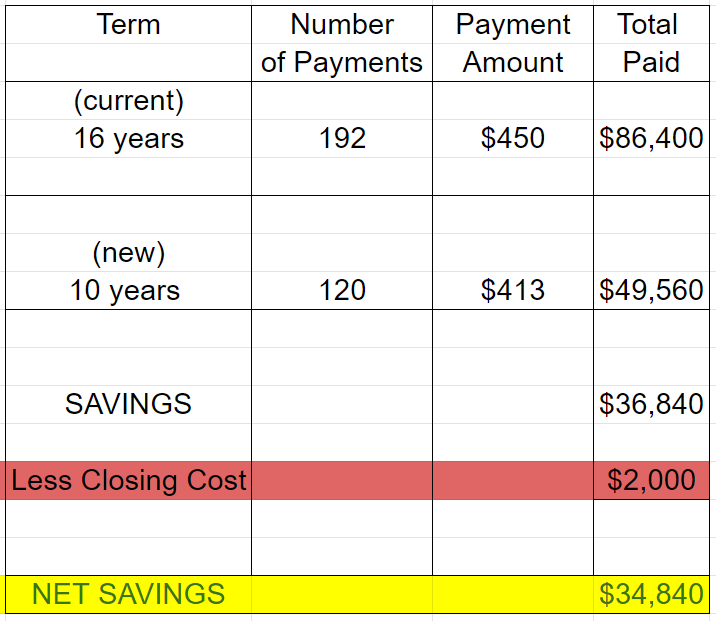

The new payment on the 10-year mortgage is $413, which is less than I'm paying now. And I dropped 6 years off the mortgage. Doing the math:

Not a bad day's work! So if you have an older mortgage it definitely bears looking into the possibility of saving yourself some major interest over the life of the loan. And most mortgage brokers will give you the option of adding the closing costs to refinanced mortgage so that you don't have to be out of pocket for that expense. It would reduce the savings due to paying interest on the $2000 for the entire 10 years, but still well worth the cost.

Another thing you can consider while making these decisions is that if you have equity built up (meaning that what we owe on the house is considerably less that the market value) the bank will offer you the opportunity to get some of that cash out. It could be a great time to do a renovation project!

And taking 6 years off the payment plan is very reassuring as well. Now at least I have a better shot of outliving my mortgage, lol. When you retire, the last thing you need is financial stress. Wondering if your retirement money is going to last and if you are going to be able to live the kind of lifestyle that you worked for all your life. I was fortunate to be able to retire at age 58 after working 30 years for the US Postal Service. I plan on doing my utmost to enjoy it!

Hive is a social blockchain where you can join communities, share and curate content and earn cryptocurrency that is growing in value. Sign up for an account at Sign up for Hive.

See how long it will take to oh off the closing cost. Even though refinancing my loan would cut $55/month off my payment it wound 36/months to jus tout of the closing cost. Money is better spent just paying down principal in my mind. You need over 1% reduction in rates to make me consider it. At 4% to 3.25% it’s not worth it considering I pay more to the principle each month.

Why could you only get a 3.25%? The rates are cheaper than that. I agree that .75% wouldn't be worth it. And you wouldn't be reducing your term?

With apr that’s what my lender was the saying is the best rate on a 30/fixed. I've only been in my house for 2 years. We pay as if we are going to pay it off in 15, but I don't want to be locked in at a 15 year rate with all this economic uncertainty. I like being able to cut back on the extra we pay if needed.

4.4% is Painful and 9% is a crime !

You should totally change that deal

Might even go down more by 2021 , it clearly shows the huge change ahead

Yes, that 4.4% certainly doesn't make sense today. We're told there's about a 30 day wait to get the paperwork done on the refinance because the appraisal and title abstract people are so far behind due to so many people refinancing right now. But maybe it will be even lower when they finally get around to doing it!

For sure ! And for sure it will go down more

This post has received a 100.00% upvote from @fambalam! Join thealliance community to get whitelisted for delegation to this community service.

Leo has doubled in price and now is worth more then Two Hive!

It looks to increase more. You may want to look at the Hive autovoter to earn passive income here, so you add to your Leo total, and if it pumps you will be better off with more Leo.

Here is the hive autovoter:

Hive autovoter: https://hive.vote/dash.php?i=15&id=1&user=ph-fund

Posted Using LeoFinance Beta