DieselPools ... what am I missing?

Why use DieselPools?

First up, let me be clear that I'm not 100% clear on the workings of Liquidity Pools in general, and have a basic (I hope) understanding of "impermanent loss"... I do understand the risks though, and have only dipped my toes into some pools in Binance (where I'm down a couple $100)... I bought into the pools when BTC was a lot higher though... so even if I just held BTC, I'd STILL be down a couple $100 ANYWAY... so that's cool.

On Binance though, I've been earning some daily BTC & BNB rewards for providing that liquidity though.

Then along comes Splinterlands SPS

... and a SWAP.HIVE / DEC pool

Anyone familiar and active with Splinterlands (and even a fair few I believe that have never bought a single card until now) will know about the SWEET SPS rewards coming from the daily airdrop.

Never heard of Splinterlans or SPS?

JOIN SPLINTERLANDS NOW and check out the airdrop details here: https://sps.splinterlands.com/airdrop ... just do it and thank me later... it's FREE to join & play (but to earn rewards you will need to spend $10 on the 'start pack' known as a Spellbook

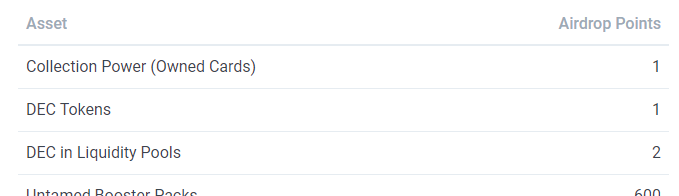

Double airdrop points for providing liquidity in DEC pools!

What that means is that if I HODL my daily quest, battle & season DEC rewards from the game, I earn 1 airdrop point for every 1 DEC (great incentive... and it's pushed the price of DEC to 7-8 times its soft peg value of 1,000 DEC = US$1).

BUT... if I put that DEC into the SWAP.HIVE / DEC liquidity pool (or any of the other DEC liquidity pools, then I'm getting 2x airdrop points for every 1 DEC... #SCORE!!!!

What a no-brainer! I'm HODLing my DEC to spend on Chaos Legion packs when that edition is released later this year ANYWAY

... so why not lock it into a liquidity pool and earn DOUBLE my SPS every day?

But Wait... there's a catch!

There's always a damn catch.

First, up: There are no LP rewards/fees when providing liquidity on the Diesel Pools. OK, so @Aggroed & @Yabapmatt (and other Splinterlands employees/investors) aside, who would want to provide liquidity for 0 returns?

Remember the double SPS airdrop points: Well... that was incentive enough for me to give it a try... but then I started noticing my assets values dropping in the pool. This is probably due to people swapping DEC for HIVE when it's trending up and vice versa when trending down (it's that impermanent loss risk I was talking about earlier)... which is cool, and is generally more than covered by LP rewards in normal pools (except when there are major spikes and corrections).

... but I digress... My actual question is this:

HOW are the DieselPool swap prices determined?

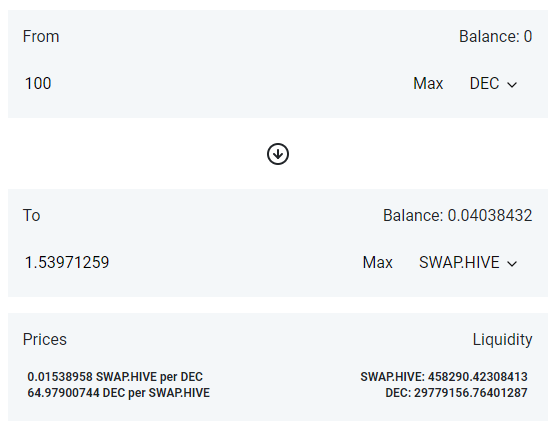

A screenshot of the SWAP.HIVE / DEC DieselPool a few minutes (probably hours, depending on how long this post takes me :P) ago:

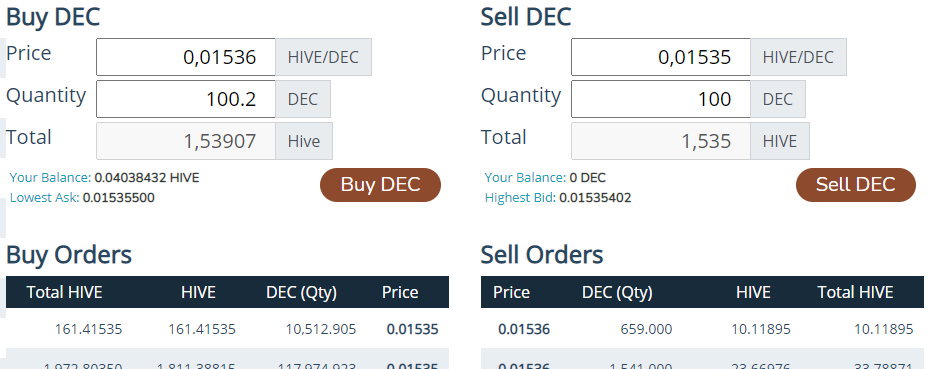

A screenshot of the Hive Engine SWAP.HIVE/DEC market at the exact same time:

What does this mean?

The way I understand it:

AND PLEASE correct me if I'm wrong here... the whole LP thing in general is still a little unclear to me.

Joe public can come along and swap 100 DEC receiving ~1.539 SWAP.HIVE in return on the DieselPool.

Joe Public would however only receive ~1.535 SWAP.HIVE if he simply sold his DEC on the open (Hive-Engine) market.

... and if Joe Public was a smart little developer, he could probably create a nice little bot that simply traded away merrily every few seconds swapping DEC on the DieselPool, taking that SWAP.HIVE and buying more DEC on the open market and then rinse/repeat without care or concern for fees eating up miniscule gains like in a regular liquidity pool.

i.e. Normally there would need to be a large enough arbitrage opportunity during a spike (or dip) before all the markets equaled out for his bot to make him some money... but in DieselPools this arbitrage seems to be there permanently... all at the expense of the liquidity provider... hmmmmmmmmmmm... I must be missing something... right?

Or why else would anyone want to provide liquidity ?

P.S. @Aggroed / @Splinterlands (if you're reading this) or anyone else more knowledgeable on LPs (and DieselPools specifically) than me:

Where are the DieselPool swap/exchange rates taken from?

Surely there should be SOME 'penalty'/cost (lower swap/exchange rate) on the guarantee/convenience of DieselPools vs the open market?

Thanks in advance to anyone that can shed some light! I'll be dishing out BRAAIBs (my own token in development) to anyone that (sensibly) comments and helps me understand what's going on here.

DISCLOSURE / DISCLAIMER

BRAAIB tokens for commenting are worth 0 at the moment, have 0 utility and liquidity, and are probably another 6-12 months away from being implemented at my Bistros.

...BUT... 1 BRAAIB will score you 1 x (real world) 500ml draught BraaiBery (my own craft beer) when it does eventually go live.

Posted Using LeoFinance Beta

https://twitter.com/BraaiBoy/status/1427977263329447939

https://twitter.com/ilbiscom/status/1429113929846992903

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Now, you are thinking with Diesel!

hahahaha... I'm always thinking (normally fueled by wood & charcoal though)... Diesel is definitely a new one for me ;-)

!BEER

View or trade

BEER.Hey @enforcer48, here is a little bit of

BEERfrom @braaiboy for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.I also think the same, I feel it is better to buy DEC(instead of pooling) , if my DEC is getting swapped , my airdrop point will decrease, and it keep my airdrop point fluctuating. (curated by r1s2g3)

Your post has been manually curated by @monster-curator Team!

Get instant cashback for every cards purchase on MonsterMarket.io. MonsterMarket shares 60% of the revenue generated, no minimum spending is required. Join MonsterMarket Discord.

Well... I've only put a small amount of DEC into the pool (in order to scoop up the double SPS airdrop points)... but I've been tempted to put 100% of my (earned) DEC into the pool for a 200% airdrop bump.

I'm comfortable HODLing less DEC if it's swapped out for SWAP.HIVE (I can always use the extra HIVE to buy more DEC)... my problem (it seems) is that I end up with less SWAP.HIVE & DEC at the end of the day (assuming enough swaps back and forth) instead of just less DEC and more HIVE (assuming all the swaps are DEC -> HIVE).

p.s. Thanks for weighing in @r1s2g3 ... You've scored some !BEER (well @monster-curator account anyway ;-) )... but the BRAAIB will go to your personal account on H-E.

!ENGAGE 15

Thanks braaiboy.

ENGAGEtokens.Hoping to earn and cash in those BRAAIB tokens soon! As you know, I'm a big fan of your BraaiBery beer!

!BEER

!WINE

!LUV

Congratulations, @wynella You Successfully Shared 0.100 WINE With @braaiboy.

You Earned 0.100 WINE As Curation Reward.

You Utilized 1/1 Successful Calls.

Contact Us : WINE Token Discord Channel

WINE Current Market Price : 0.500

<><

@braaiboy, you've been given LUV from @wynella.

Check the LUV in your H-E wallet. (1/1)

Yeah... it's gonna be a (tiny) while longer before we can use the BRAAIBs for real beer... but have a digital !BEER in the meantime ;-)

!ENGAGE 15

Posted Using LeoFinance Beta

ENGAGEtokens.You are not missing anything. Providing liquidity is basically saying you trust the rate to be correct. Not all tokens have such a tight spread as the one you referenced (not even DEC at all times) so you are not going to be outplayed automatically. Still, providing liquidity makes no sense without external bonuses (and even then you gamble the bonus beats what you lose by being the dumb side of the trade most of the time).

hahaha, thanks for the confirmation that I'm not actually mad :P

I'm gonna leave that little bit of DEC in the pools for a week or so and see how things average out... maybe the SPS bump makes up for it.

!BEER

!WINE

!ENGAGE 50

Congratulations, @braaiboy You Successfully Shared 0.100 WINE With @jelly13.

You Earned 0.100 WINE As Curation Reward.

You Utilized 1/2 Successful Calls.

Contact Us : WINE Token Discord Channel

WINE Current Market Price : 0.500

ENGAGEtokens.I'm also interested in finding out the details/specifics of utilizing pools. Thanks for your time in curating this post, sadly I'm too newb to be able to send any tokens your way but hopefully not for much longer xD

Thanks for popping in... I'm still figuring it out properly for myself. 🤘

P.S. We're all noobs in the beginning, but with a bit of graft that changes quickly. Gotta !LUV the hustle.

!ENGAGE 50

@braaiboy, sorry. :(

You can call the LUV bot a maximum of 1 times per day. To give more each day, check LUV Levels.

Thanks for the reply and the engage tokens, and for trying to send some luv as well.

ENGAGEtokens.Thanks for sharing! - @cieliss

Done.

!WINE

!LUV

!PIZZA

!BEER

Congratulations, @eii You Successfully Shared 0.100 WINE With @braaiboy.

You Earned 0.100 WINE As Curation Reward.

You Utilized 1/2 Successful Calls.

Contact Us : WINE Token Discord Channel

WINE Current Market Price : 0.260

@braaiboy! I sent you a slice of $PIZZA on behalf of @eii.

Learn more about $PIZZA Token at hive.pizza (6/10)

<><

@braaiboy, you've been given LUV from @eii.

Check the LUV in your H-E wallet. (1/10)

poor me, I don't know how to put my DEC in liquidity pool, lol

Posted Using LeoFinance Beta

It's really easy on TribalDEX:

... simply head on over to https://tribaldex.com/dieselpools/add and you can add liquidity (based on the tokens in Hive Engine - you can deposit HIVE from you Hive Wallet to Hive Engine via https://tribaldex.com/wallet/ or https://hive-engine.com/).

There a pools on BSC / CUB Finance too... but get a little more complicated moving your tokens onto the Binance Smart Chain using a wallet like MetaMask (I'm sure there are enough tutorials on that somewhere though).

!BEER

!WINE

!ENGAGE 15

Posted Using LeoFinance Beta

Congratulations, @braaiboy You Successfully Shared 0.100 WINE With @cicisaja.

You Earned 0.100 WINE As Curation Reward.

You Utilized 1/2 Successful Calls.

Contact Us : WINE Token Discord Channel

WINE Current Market Price : 0.271

ENGAGEtokens.Thank you... I did convert dec to sps before on tribaldek to try few days ago. so, I need to keep the DEC or Hive in the there?

Posted Using LeoFinance Beta