All Breaks Are Off, The Top Has No Limit

Hey Jesstonk lovers

If you haven't noticed the US stock market is an absolute madhouse with everyone with a TikTok or Instagram account thinking they are now a stock trading genius. When stocks only go up, no one thinks they can lose. It's so simple, you put money in, you take more money out, it's the magic pot of gold, and it's been on that trend for at least the last 40 years now.

Some of the gains have come through productivity, but a larger and larger portion has come from money printing, especially within the last 2 years. IT seems each year money printing takes up more responsibility for gains than actual growth and productivity.

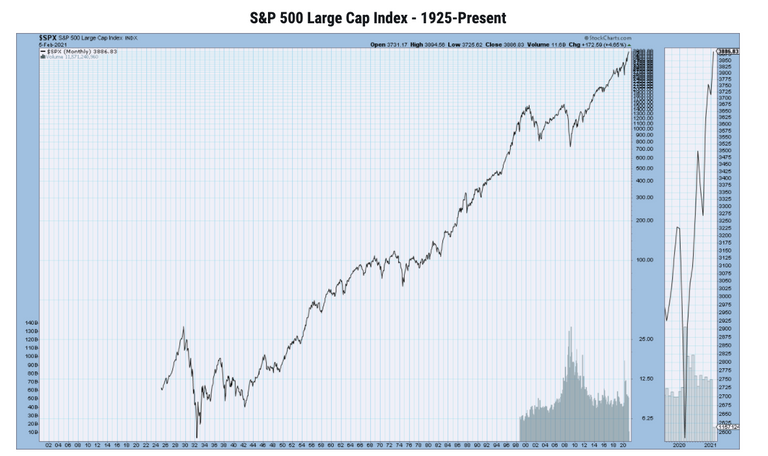

The S&P 500 index is a benchmark of American stock market performance, dating back to the 1920s. The index has returned a historic annualized average return of around 10% since its inception through 2019.

If you're getting an annualised 10% return on the S&P 500 then really a ham sandwich could sit at the trading desk, go long the S&P for the last 100 years and have made major gains.

I'll give you an example, if you got in at any point in the last 100 years using $100 as your entry point, this would be your averaged return.

| Year | Time | Return |

|---|---|---|

| 1920 | 100 Years | $1 378 061.23 |

| 1930 | 90 Years | $ 531 302.26 |

| 1940 | 80 Years | $ 204 840.02 |

| 1950 | 70 Years | $ 78 974.70 |

| 1960 | 60 Years | $ 30 448.16 |

| 1970 | 50 Years | $ 11 739.09 |

| 1980 | 40 Years | $ 4 525.93 |

| 1990 | 30 Years | $ 1 744.94 |

| 2000 | 20 Years | $ 572.75 |

| 2010 | 10 Years | $ 259.37 |

If we consider inflation and we include let's say the average is 2%, the returns could look even greater. Think this calculation is on a single $100 entry point and the gains over time are ridiculous.

So really do you have to be a genius investor to sit in some stocks, average in every year and ensure you make gains?

I don't think so, and neither does this data.

Source: stockcharts.com

Stocks are now a store of value

Stocks have become a hybrid store of value in a world where inflation drives the world. It's a way to protect against inflation when, in the past, it was a way to tap into cash flow. Many stockholders don't even care about the dividends or id there are dividends and care more about the asset's price.

This is why we see people buying stocks that have 40, 50, 100, even 1000 times the earnings ratio. They would rather own something that is seen as scarce than hold on to cash.

This narrative and consistent proof over the last how many years you've been alive reinforce this behaviour and get in on the game as they see others making money.

Shortsellers are out of the picture

If we look at all the factors driving the upward momentum, and the fact that the Fed will put a floor under any correction, stock markets will only go up. They're also a steady stream of new companies wanting to access the frenzy by going public with an IPO or SPAC.

This rampant speculation needs a corrective force, but with short-sellers pulling out of the market, that to me is the final break removed from the market.

The more I watch the market, the more I feel a crash up will be where we end up as this frenzy concludes.

Have your say

What do you good people of HIVE think?

So have at it my Jessies! If you don't have something to comment, comment "I am a Jessie."

Let's connect

If you liked this post, sprinkle it with an upvote or esteem and if you don't already, consider following me @chekohler and subscribe to my fanbase

| Safely Store Your Crypto | Deposit $100 & Earn $10 | Earn Interest On Crypto |

|---|---|---|

|  |  |

Posted Using LeoFinance Beta

At this point, holding cash is a money losing proposition. The money printing has gotten insane in the last 13 years.

I agree

I also felt that way but I know they don’t really have a choice no one wants to be the one dealing with the fall out of a complete crash so what can they do but more of the same

Posted using Dapplr

Agreed. This is passing the buck to the next generation. Eventually, someone will have to pay the bill.

Well they are already paying the bill, through the high rents young people need to pay for the same piece of land that went for nothing just a few decades ago! You see it in the devaluation of non-g7 nations who get the short end of the stick where their corrupt or ignorant leadership accept deals from developed nations to dump their debt on poorer nations.

There’s a lot of financial sleight of hand and because each year they get away with it makes them more brazen

A crash would be awful man I can’t even imagine the devastation it would bring since we so attached to our stuff our, our things, our job, our income if that goes away a lot of people will lose their marbles real quick

Upward trend of stock marketer means everything is going good is a Math these days.

Lot of these are over valued and there to fool people I guess

It’s that bubble that can burst anytime

Yeah I feel the same way it’s not about trying to find value it’s all about trying to make the number you had on your screen go higher!

Posted using Dapplr

learning something new everyday!

The hard thing is to remember everything :P

Posted Using LeoFinance Beta

LOL fuck I'm pretty sure half the shit I've learned I've forgotten hence the reason I dump it on chain I can always go back to it

Like it was already mentioned, holding money is a losing play because in a healthy economy your spending power decreases by about 4%/year. As long as I invest in companies that I predict will become worth more as time goes by, I don't think my money (placed in long shares such as tech and additive manufacturing) is at serious risk compared to day traders or options trading who are betting on companies based purely out of "green means go".

Posted Using LeoFinance Beta

I don't doubt your theory I am just not that clued up on stocks! Let's say for me, our inflation rate is close to 10% here!

If I invest in a stock I would need to know either the dividend payout + price appreciation of the stock would beat that 10% hurdle rate

That's a a lot to ask and my math ain't that good so I just HODL BTC for now the ARR is above my inflation and if I see companies that can best that sure I'll jump in I'm not against it

I've been watching the money printer go brrr especially since COVID came, and have been wondering what the consequences are going to be, especially with DeFi's presence in the economy now.

Thanks for this write-up!

Posted Using LeoFinance Beta

I've been thinking about that too, DE-FI I am not yet fully convinced on but what I do see is these lending markets, futures and options markets on bitcoin becoming very attractive

To me it's only a matter of time before bond and equity investors come over they can't ignore the yield rates forever or they'll be put out of business

Right - I don't know if there's any players in DeFi that are going to be around, long-term, but it seems clear to me that in a few decades, we're probably going to just call it all "finance:" I don't see any way that DeFi doesn't become the way we handle our accounting, as a society.

That's what I'm thinking that with all these protocols they will eventually talk to one another and we will just move capital around the world to where the best returns are regardless of boarders and instant!

Imagine how much efficiency you bring to the world with a tool like that

!ENGAGE 20

ENGAGEtokens.