The Extent Of Misallocation In The Stock Market

Hey Jesstonk traders

The stock market is hotter than it's ever been. The headlines are becoming crazier and crazier; I'd say it's making crypto markets look like the safe bet when we compare volatility and the amount in losses or gains people are making on a given day, not only in USD value but in percentage movements, which isn't a bar crypto set low.

The market looks too hot for me, and I am pretty sure I'd burn my fingers, so I stay clear and watch from a safe distance. Collecting my sats daily and try to make sense of these markets without putting a cent into these frothy markets.

The economy and stocks are divorced

It doesn't take a genius to see that the main street economy is getting hammered by lockdowns, yet stocks have never been higher in the US. They are clearly not a measure of productivity or economic output, and rampant speculation has taken over on many of these stocks.

While we can look at individual stocks and the crazy PE ratios which I've done in the past, this time I thought I'd look at the stock market as a whole.

What is the Buffet Indicator

One way to measure the value of the stock market is with what some call the Buffet indicator.

The "Buffett indicator" divides the total market capitalization of a country's publicly traded stocks by its quarterly gross domestic product. Investors use it as a rough measure of the stock market's valuation compared with the size of the economy - According to business insider

Once you do the calculations, you can apply it to this table to see if a market is valued fairly or not.

| Ratio = Total Market Cap / GDP | Valuation |

|---|---|

| Ratio ≤ 73% | Significantly Undervalued |

| 73% < Ratio ≤ 94% | Modestly Undervalued |

| 94% < Ratio ≤ 115% | Fair Valued |

| 115% < Ratio ≤ 136% | Modestly Overvalued |

| Ratio > 136% | Significantly Overvalued |

The US stock market

Pulling from currentmarketvaluation they claim that as of January 21, 2021, the market sits at the following

- Aggregate US Market Value: $48.2T

- Current (Estimated) GDP: $21.5T

Where are we today (2021-01-27)?

The ratio of the US stock market sits at around 224%, which indicates that the US stock market significantly overvalued. It would have to drop by 60% of its total market cap to sit in the fair value range and pulling out liquidity like that would leave a lot of retail investors and pension funds broke.

In addition, many companies are zombified and living on their high valuations which allow them to refinance and take out more debt. If the markets were to correct, it would take down many companies who cannot produce enough free cash flow.

The South African stock market

If we take a look at the South African stock market, the 2020 GDP of the country measured in US dollars according to Statistia was $282.59 million, which is a 19.5% drop compared to the previous year. Naturally, lockdowns have hit business and economic activity hard and with a shrinking GDP in theory stock markets should contract too.

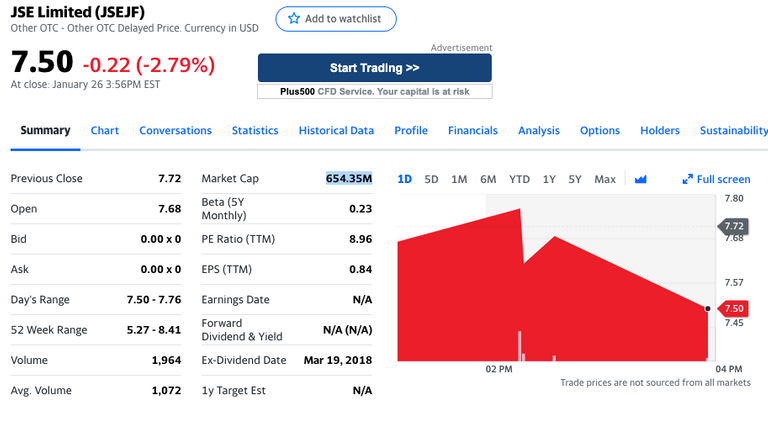

But not in a fiat money system, oh no! If we look at the market cap of the JSE (Johannesburg Stock Exchange) according to Yahoo Finance sits at $654.35M.

If we use the Buffer indicator, we can see that its a %231 higher than the country's GDP, putting it grossly overvalued range. In fact, the market would have to lose around 52% of its value to be seen as fairly priced according to this indicator.

This is one of the reasons why I've chosen to avoid getting into both the local and the US stock market of late and keep some cash handy for firesale prices. Naturally, if we do ever finally correct, it will be vicious to the downside and bears like me can pick up stocks cheap at a decent PE ratio.

Have your say

What do you good people of HIVE think?

So have at it my Jessies! If you don't have something to comment, comment "I am a Jessie."

Let's connect

If you liked this post, sprinkle it with an upvote or esteem and if you don't already, consider following me @chekohler and subscribe to my fanbase

| Safely Store Your Crypto | Deposit $100 & Earn $10 | Earn Interest On Crypto |

|---|---|---|

|  |  |

Posted Using LeoFinance Beta

Congratulations @chekohler! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

That’s an eye opening

I did not know about this index and it good to know it.

By this index looks like Irish market is significantly undervalued

But I guess this is just one parameter we need to looks at other aspects as well like country growth plan etc

Good read

Thanks a lot for sharing

Thats an interesting find how did you manage to pick out the Irish stock market?

Posted Using LeoFinance Beta

As long as interest rates are so low and money is so cheap this craziness is going to continue. What are all those well paid gamblers on wall street going to do, otherwise? :)

Posted Using LeoFinance Beta

Lol not much else you can do with the money that they are experts in, it's not as if they've ever built a business or created anything of value, all they know how to do is buy and sell stuff and think they're geniuses for playing with other peoples purchasing power