My take on the stock market now - Still bearish but looking for reversal signals

This post is long overdue as I was too caught up with writing about the ongoing fiasco of community elected witnesses versus Tron puppet witnesses.

The biggest news last week was probably the half percentage point emergency rate cut by the Federal Reserve. Interestingly, the stock market (using S&P 500 as example as usual) dipped after the rate cut was announced and rebounded the following day. However, the rebound was shortlived and the stock market came crashing down again.

Where is the stock market headed next? Zooming out to the weekly chart, we can see that the price bounced off the 100w SMA (288 on the $SPY chart). At this stage the 100w SMA seem to be a near term support. My take is that the price will be hovering the around that level in the coming week as we await the official Fed meeting on 17-18 March.

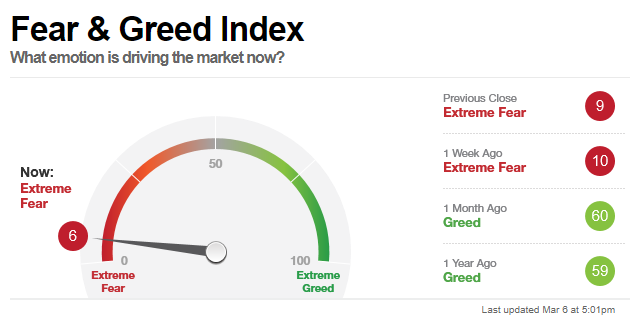

Market is now extremely fearful

The fear and greed index is typically a contrarian signal and the it is flashing extreme fear now.

Source

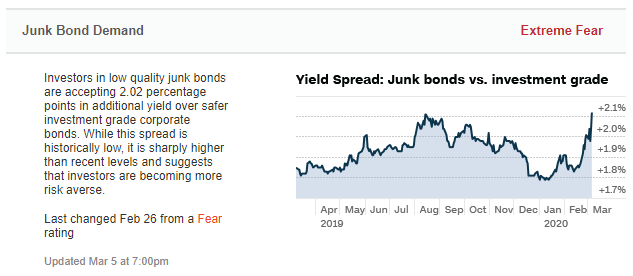

However, I do not think I will go and catch the falling knife so soon. The main thing that is still worrying me is the junk bond market.

Source

During this period we saw a massive selloff and capital flight in the junk bond market. The loss in confidence in high yielding bonds symbolize that the market is worried that these bonds might fail. These bonds are typically issued by companies, if the COVID-19 virus continues to slow business activities and disrupt supply chains, there is a fair chance that some companies may not be able to keep up with these debt obligations.

The problems with bonds failing is that it might trigger a domino effect. Many of these bonds are packaged into collateralized loans obligations (CLOs) that many banks have high exposure to. Hence, the emergency Fed rate cut was, in my opinion, to cushion the bond market and not really to help the stock market. The Fed is not dumb. They saw the systemic risk and quickly throw in some support.

The bond market is largely made up of institutional investors aka the smart money. Hence, I always look there for clues. If the big boys are spooked and not getting into high-yielding bonds, then I interpret that there are still structural problems in the financial market.

My current strategy

I have closed my bear spread with some profits. Given that the market is in extreme fear, there might be a bounce again which provides a better entry to go short again. From a technical analysis standpoint, I think that the 288 level on the $SPY is the near-term support. If it breaks, then the next meaningful support will be the 200w SMA which held the market in the previous selloff in Dec 2018. Since I am bearish for now, I will be waiting for some kind of bounce to some resistance level to buy some puts.

I remain bearish and will only turn bullish when I see confidence back into the junk bonds market. It is an interesting time and I will be playing it nimbly. This is also a good time to do more research and pick some stocks to buy them cheap when the time comes.

Finally, this post is not meant to be financial advice, please always do your due diligence and research.

10% of post rewards goes to @ph-fund and 5% goes to @steemworld.org to support these amazing projects.

Join the Steem ENS Discord server to interact with the community!

This article is created on the Steem blockchain. Check this series of posts to learn more about writing on an immutable and censorship-resistant content platform:

- What is Steem? - My Interpretation

- Steem Thoughts - Traditional Apps vs Steem Apps

- Steem Thoughts - A Fat or Thin Protocol?

- Steem Thoughts - There is Inequitable Value Between Users and Apps

- Make my votes count! Use Dustsweeper!

- What caused STEEM to get dumped? Why I think the worst might be over

- Steem 2020 is about having a "SMART U"

thanks for this post and this information

Thanks for reading!