PancakeSwap Data on TVL, Trading Volume, Users and Supply

The Uniswap of the Binance Smart Chain BSC has been growing as the overall BSC ecosystem. It’s the number one app on BSC leading in most of the metrics.

Let’s take a look at some of the data!

Here we will be looking at:

- Total Value Loc TVL

- Trading Volume

- Transactions

- Numbers of users

- Top pairs

- Price

The period that we will be looing at is form September 2020 to March 2021.

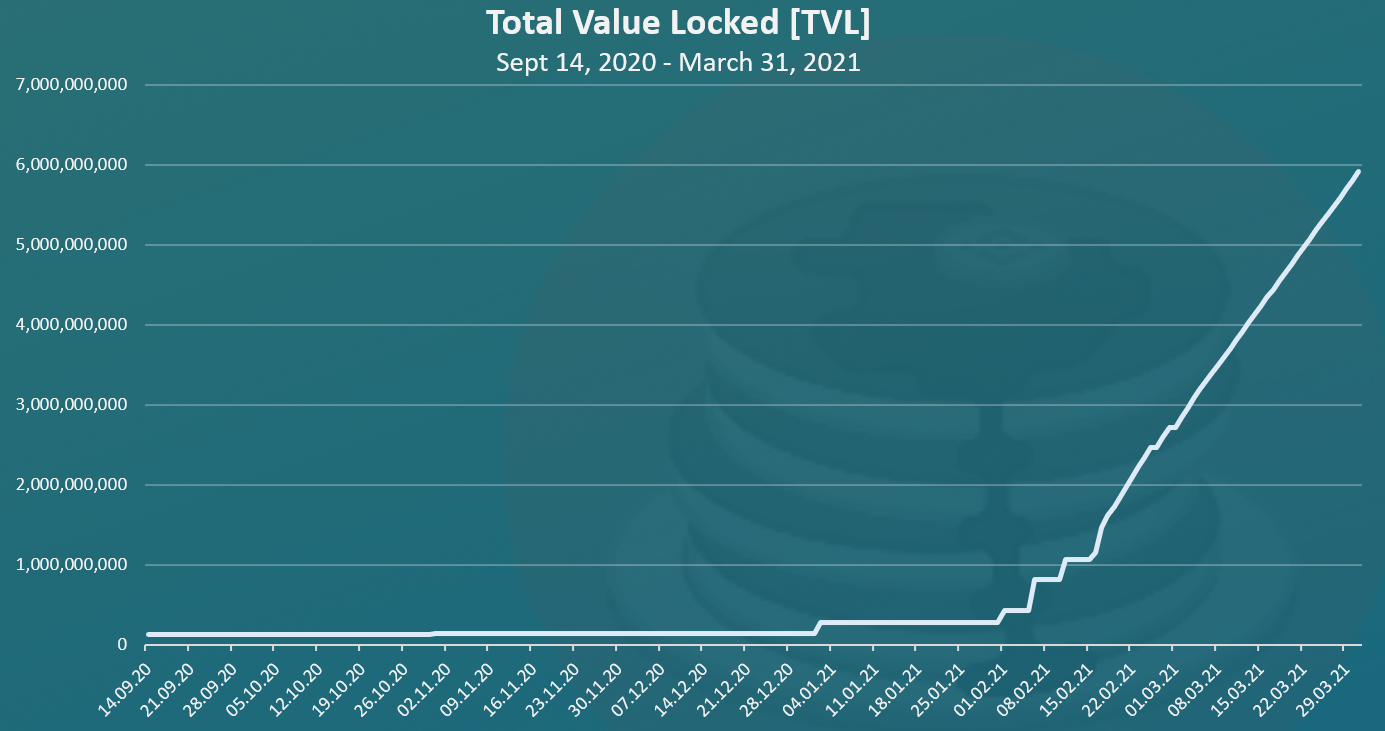

Historical Data on Total Value Lock on Pancake

Here is the chart.

Note: I wasn’t able to find clean data on TVL on Pancake so it’s a rough representation.

The main info page on Pancake has been broken for some time now.

As we can see up to January 2021 the trading volume on Pancake was quite small in terms of hundred of millions. The in January it started to grow and really exploding in February 2021, reaching more than three billion.

From there the TVL has kept growing reaching 6B at the moment of writing this. Quite an explosive growth.

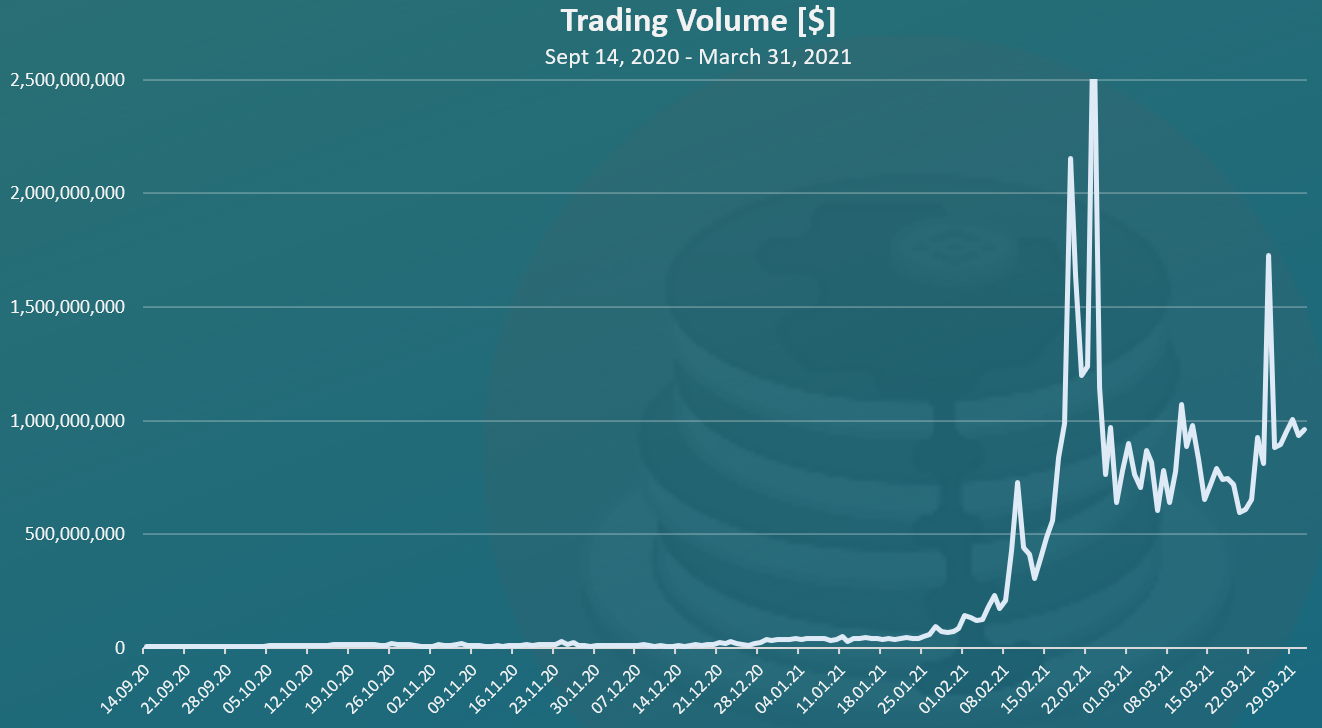

Trading Volume

Here is the chart for the trading volume.

This one is a bit more interesting than the TVL. We can see here the explosive growth on Pancake in February 2021 reaching more than 2.5B on some occasinos. In the lat period the trading volume has been in the range between 1B to 1.5B per day.

A note on the trading volume. Unlike the TVL where capital is locked in smart contracts, the trading volume can be played a bit with wash trading. Since the fees are smaller on BSC its cheaper to wash trade there. It also can be happening on Uniswap as well. The main point here is that the trading volume should be taking with some reserves due to possible wash trading. Still more legit than most of the CEXs where the trading is on a central servers and zero fees 😊.

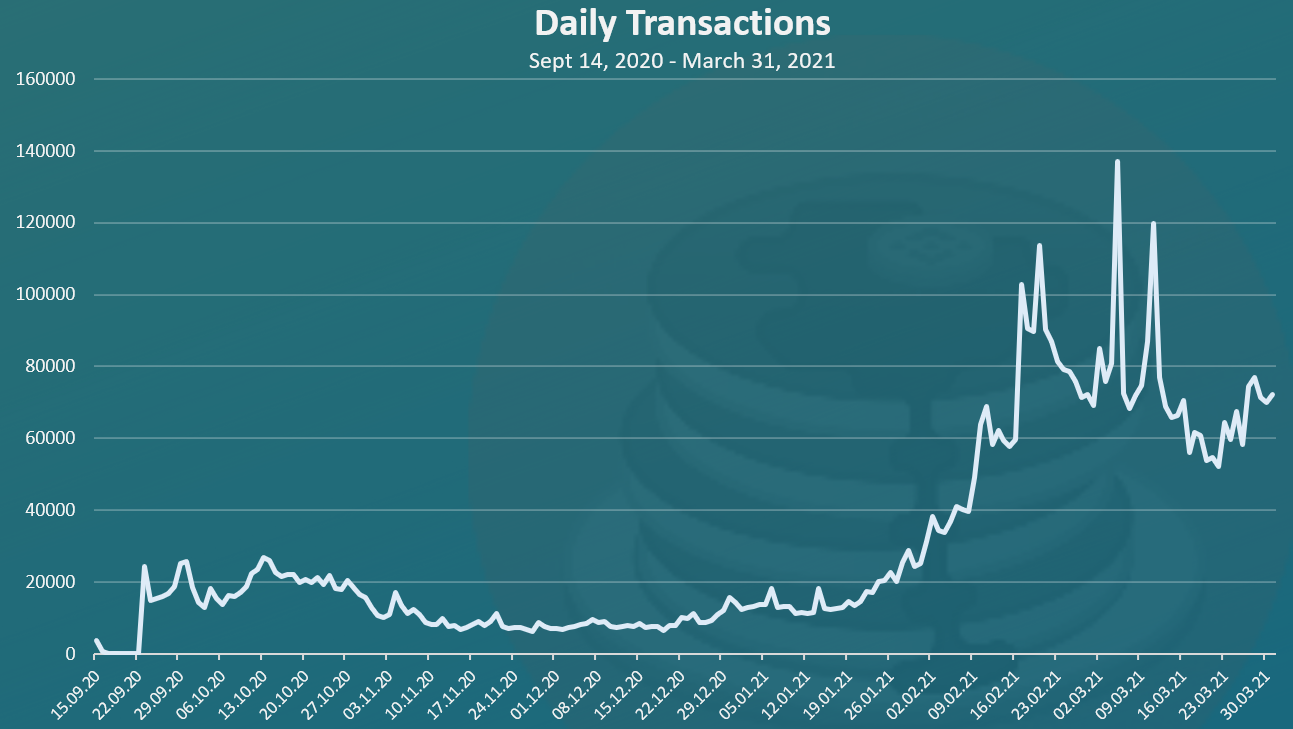

Daily Transactions

The chart for the daily transactions looks like this.

Some similarities with the trading volume here, with a spike at the end of February up to 140k transactions then a drop to 80k. The low fees on BSC allow for more daily transactions to be made.

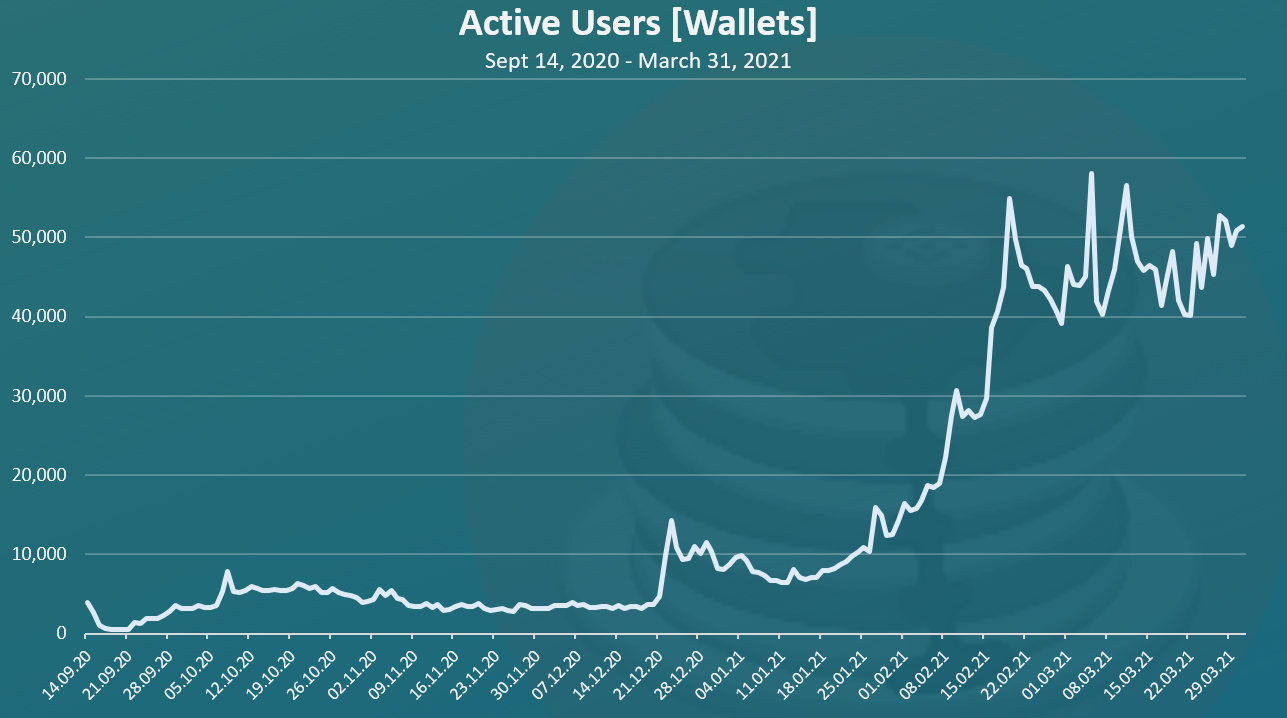

Numbers Of Users

The chart for the number of users/wallets looks like this.

A nice growth here as well, reaching more than 50k active wallets per day. These are some serious numbers for crypto. Again the low fees act more inclusively for the wallets with smaller stake allowing more active users.

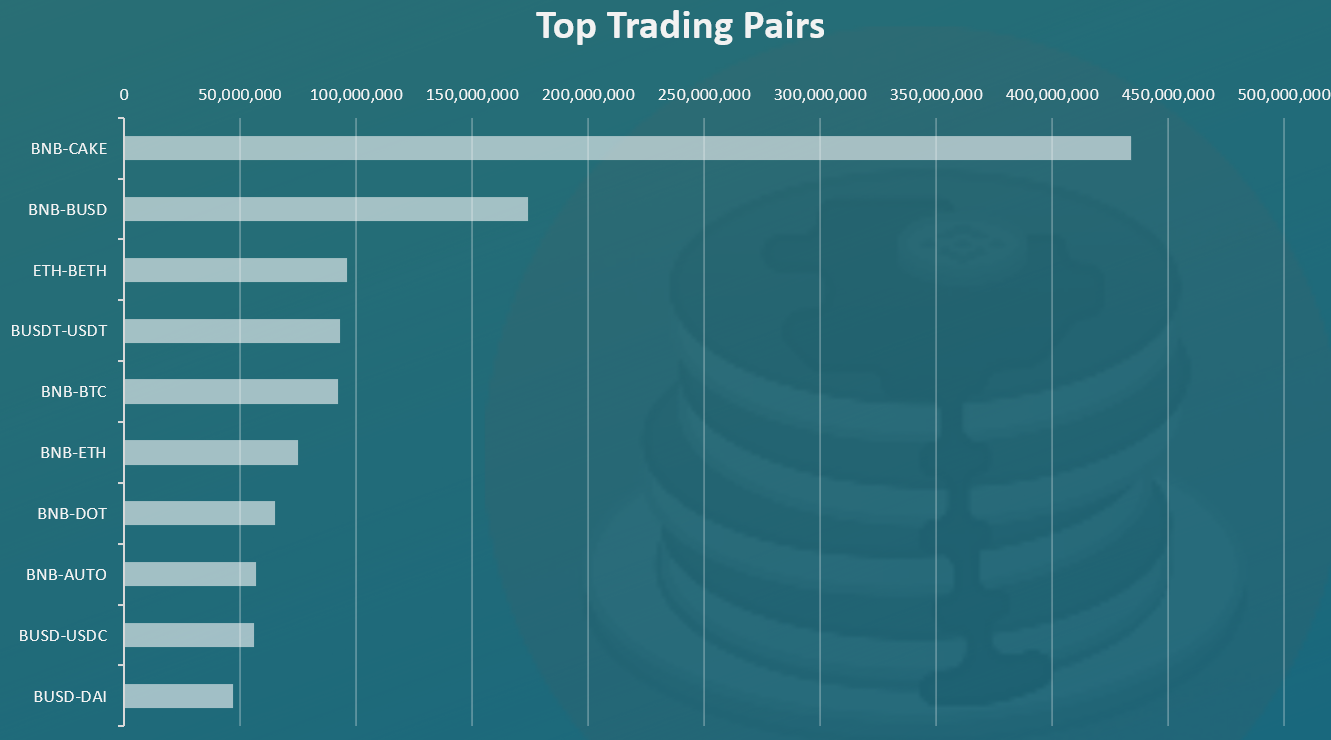

Top Pairs

Here is the table for the top 10 pairs on March 31, 2021.

The BNB-CAKE pair is on the top by a lot here with more than 400M in liquidity.

The BNB-BUSD pair comes on the second place.

We can notice a lot of the top pair are with BNB. Out of the top 10, 6 are paired with BNB. This is locking more BNB and putting it to use. No wonder the price increase of BNB.

We can se the stables to stales pair in the top as BUSD-USDT, BUSD-DAI and BUSD-USDC.

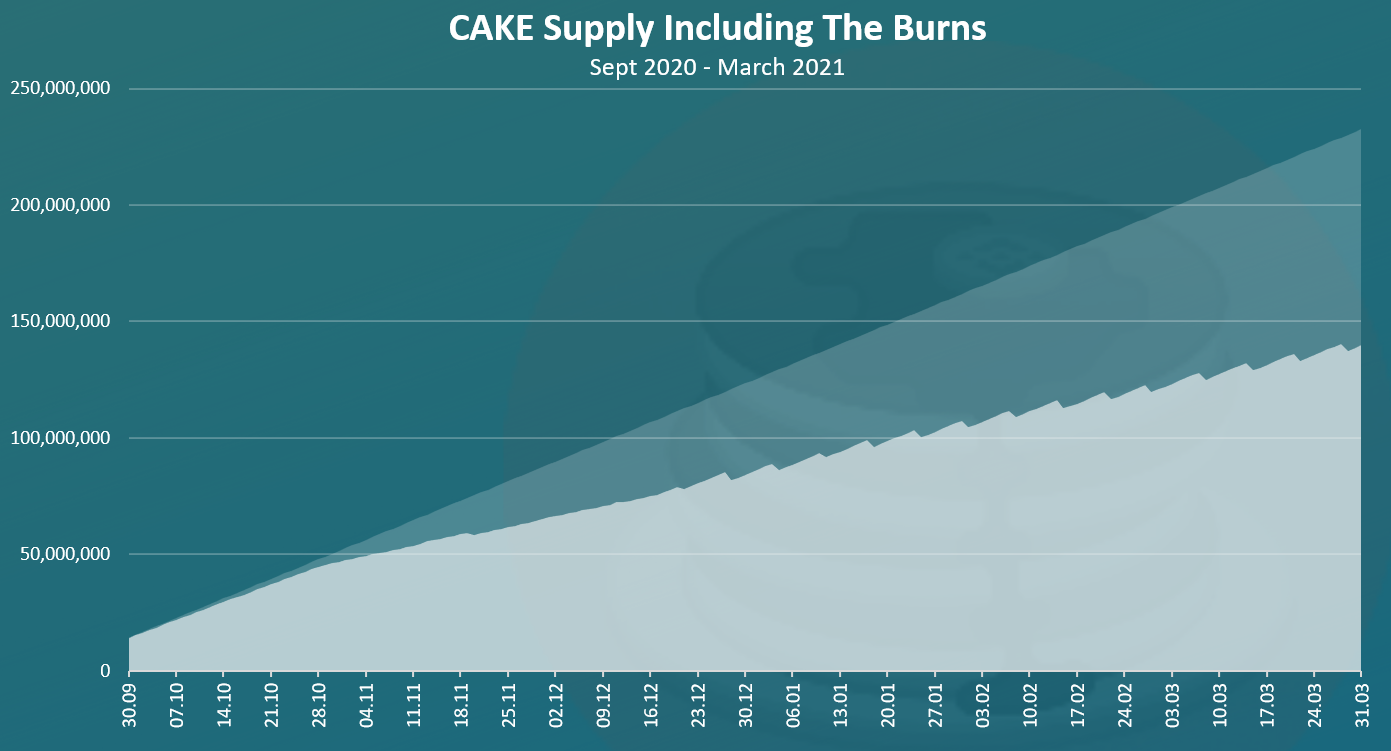

CAKE Supply

Here is the chart for the CAKE supply.

CAKE has a high inflation, but a lot of that is burned as well.

The CAKE emission rate is 40 tokens per block, but 15 are being burned ending with 25 tokens per block. Recently there was a voting to reduce the inflation further by 10% or 20%.

Also CAKE is burned from the lottery and the IFOs.

At the moment CAKE has 144M tokens in supply, adding just above 1M more tokens per day.

It will be a challenge to maintain the price with such an inflation, but If further reductions are made and more burn, everything is possible. The statement from the team is that they want to be inflation neutral in the long term.

Price

At the end the chart for the price.

CAKE has been trading under a dollar at first. Then the price kept growing to 17$, had a pullback to 10$, and then up again to around 18 where it stands now. The CAKE market cap is at 2.6B now, ranking it at 45th place.

Overall, quite an impressive numbers for PancakeSwap in the last months.

All the best

@dalz

Posted Using LeoFinance Beta

https://twitter.com/Dalz19631657/status/1377373920291004420

https://twitter.com/FinanceLeo/status/1377378999777730560

Wow! Pretty amazing numbers. If I'm looking at things correctly, Cub should be right about at the 2nd week of February. lol Looks like we could have a good month! :-)

I also went in and looked at Pancake's pools and farms. Looks like @Edicted may be right. Seems like the BNB/Cake pool is leading the way. That said, the reason it's leading the way is because of the 40x multiplier compared to nothing even close. It's "only" paying 99% APR. Looks like the Cub/BNB pool is kicking it's ass as is. Doesn't need help yet. That said, I'm certainly open to changes (not that my opinion means anything) but I still don't think it should be immediate. Wait for Kingdoms and reevaluate then. Just my opinion...

Posted Using LeoFinance Beta

A lot of options there :)

Posted Using LeoFinance Beta

I tried to find where cub is part of pancakeswap but can’t find it.

I think Cub finance did start at the right time.

Posted Using LeoFinance Beta

Hi @pouchon you can use the contract: 0x50d809c74e0b8e49e7b4c65bb3109abe3ff4c1c1 and add it in pancakeswap i mean that's what i did for mozart finance and climb token. Regards

If you mean can you find the token on Pancake yes you can ... just add it manually. Cub is basically using Pancake liquidity pools when you add liquidity.. later with the stake option you add that liquidity in the CUV vaults.

Posted Using LeoFinance Beta

Congratulations @dalz! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 5750 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Just shows you all the room CUB has to grow! Really enjoyed this post and the charts. Shows a slow but steady start like we have seen with CUB before it really starts to take off. I feel like people are just a little warry of it with all the rug pulls that have been happening and will start trusting CUB. Once that happens MOON!

Thanks!

BSC is growing, Pancake with it ... CUB has a lot of room in these conditions.

Posted Using LeoFinance Beta

2020 was famous for CAKE

and 2021 wil be famous for CUB.

Posted Using LeoFinance Beta

Godspeed :)

Posted Using LeoFinance Beta

https://twitter.com/JohnDoe04915899/status/1377664460215705607

Congratulations @dalz! You received a personal badge!

Wait until the end of Power Up Day to find out the size of your Power-Bee.

May the Hive Power be with you!

You can view your badges on your board and compare yourself to others in the Ranking

Check out the last post from @hivebuzz:

Pancake is on the roof..

Posted Using LeoFinance Beta

It is :)

Posted Using LeoFinance Beta

WoW 😳 very interesting datas. This TVL is just going exponential !

We can see that the TVL is the metric that is the most correlated with the underlying performance of the $CAKE asset.

Also, on a more bearish side despite the TVL climbing to ATH. Users and Daily volume is flat. You need both of these up for the LT appreciation of $CAKE.

Let’s wait and see !

Posted Using LeoFinance Beta

Users and volume are not as flat on a months scale :)

Only in days/week

Posted Using LeoFinance Beta

Indeed, I have always been too much focused on the short term I guess :D

I finally got the guts to try pancake swap and cub out, really enjoying both.

Posted Using LeoFinance Beta

Congrats!

Interesting, thanks for the data and charts. It seems like a second place to invest if ‘when APR on Cubfinance come down... If we are connected to Binance via Metamask can we navigate in the browser to pancake swap, connect wallet and participate?

Posted Using LeoFinance Beta

Yes