Uniswap Users Are Declining | Data on users, total value locked and trading volume

The Ethereum blockchain has some outrageous fees at the moment. This is mostly due to the rise of activity on the blockchain mainly driven by DeFi.

But with these high fees is it sustainable? BSC has given users an option now with low fees for the cost of centralization. We have seen some tremendous growth there in the last months.

DeFi in general keeps growing and the ETH blockchain is on the verge of its capacity. Of course when you transact large amounts those fees are not an issue but for smaller amounts or even a medium ones its becoming an issue. ETH2 couldn’t be here faster.

I have covered Uniswap data in the past, time to check how things are standing now.

We will be looking at:

- Total value locked

- Active Users/Wallets

- Trading volume

- Top pairs

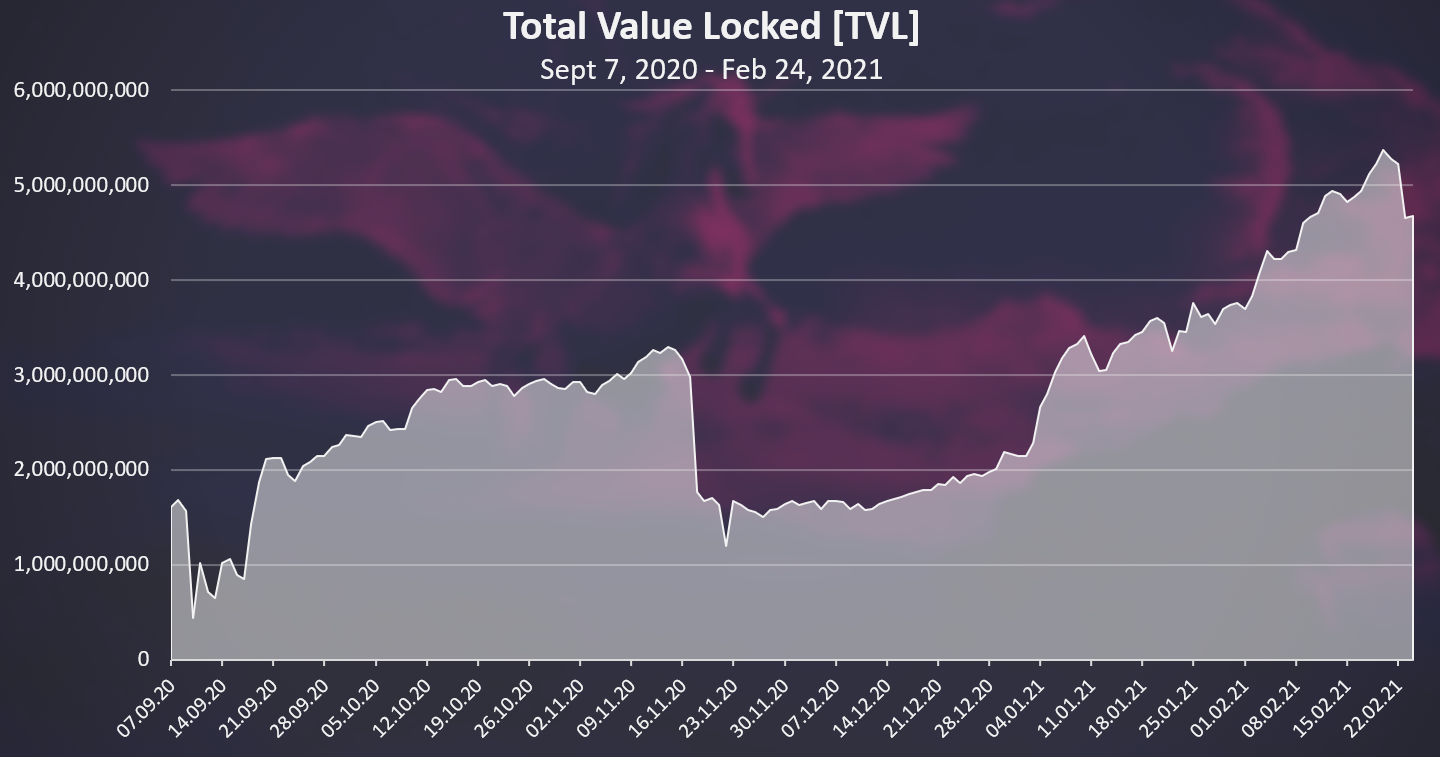

Total value locked [TVL]

Here is the chart for the total value locked on the platform from September 2020 to February 2021.

Overall an uptrend for the total value locked with some bump in the middle of November 2020. There were incentives with the UNI token at first and when they finished there was a drop in the TVL. Afterwards the TVL started increasing again reaching 5 billions in the last period.

What is interesting here to note is that the TVL is increasing in terms of USD. In terms of ETH the TVL haven’t grow as much. In December the price of ETH was around 600$ and the TVL around 2B, or around 3M in ETH equivalent value. At 5B these days and the ETH price of around 1600$, the ETH equivalent of TVL is still around 3M ETH.

Have in mind these are very rough numbers, but overall, they are showing that the increase in the TVL in dollar value, is mainly driven by the increase of the price ETH and not newly added ETH.

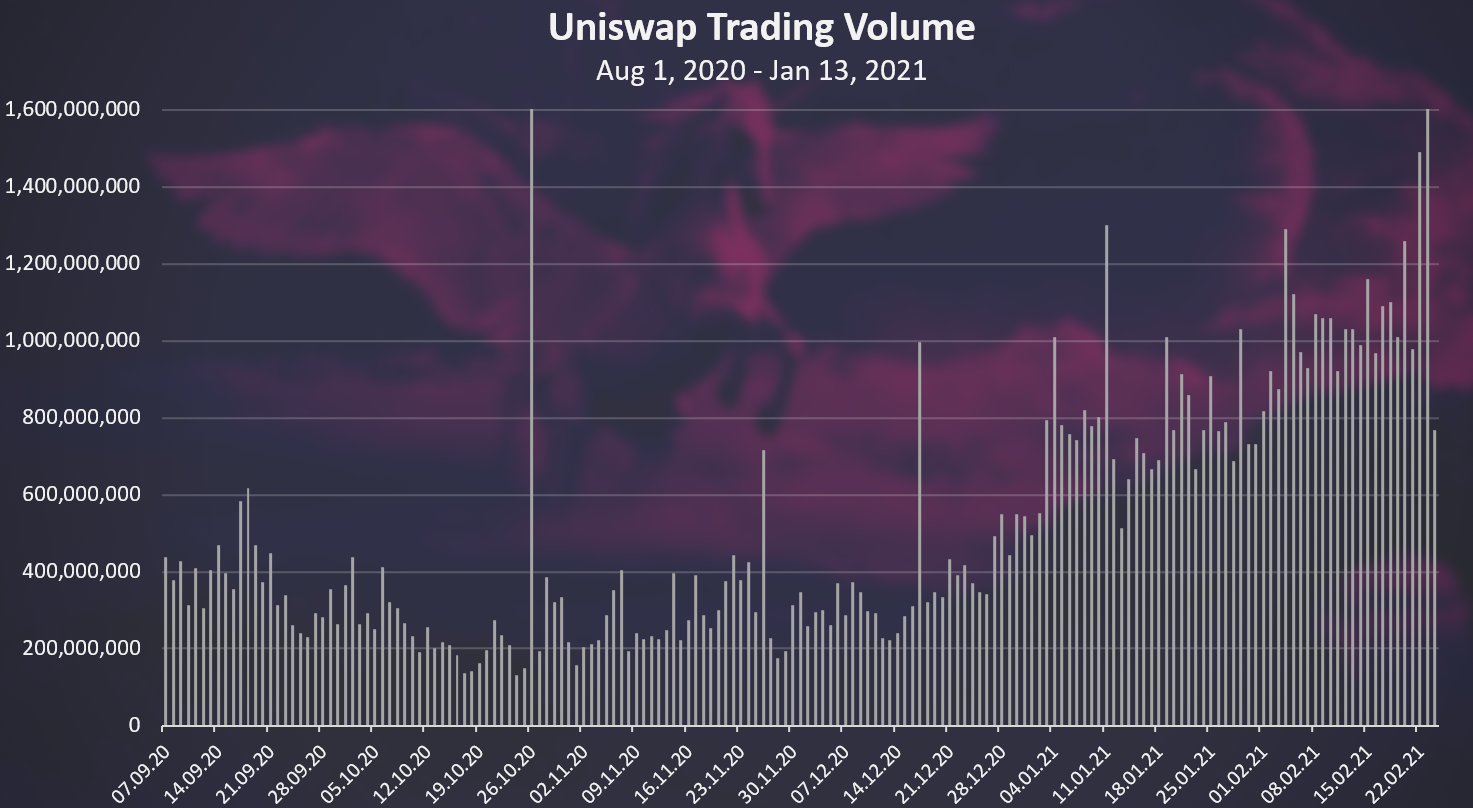

Trading volume

The chart for the trading volume looks like this.

The trading volume has a very similar pattern as the total value locked. It has increased in the last period to more than 1 billion USD per day. Yet again the increase of the trading volume is mostly because of the increase of the ETH price. In terms of ETH equivalent the trading volume is also stagnant with around 1M ETH per day.

Top pairs

Here are the top trading pairs on Uniswap on a weekly basis.

These four pools were incentives from the start, and they remained at the top since then.

Out of the top four, three are ETH against a stablecoin. The USDC-ETH is on the top with 1.2B volume in the week, followed by ETH-USDT, and then DAI. The Bitcoin – Ethereum pool is on the fourth place.

Interesting to see that USDC as a stablecoin has the most volume, and not the decentralized equivalent DAI. USDC seems to enjoy some trust in the space.

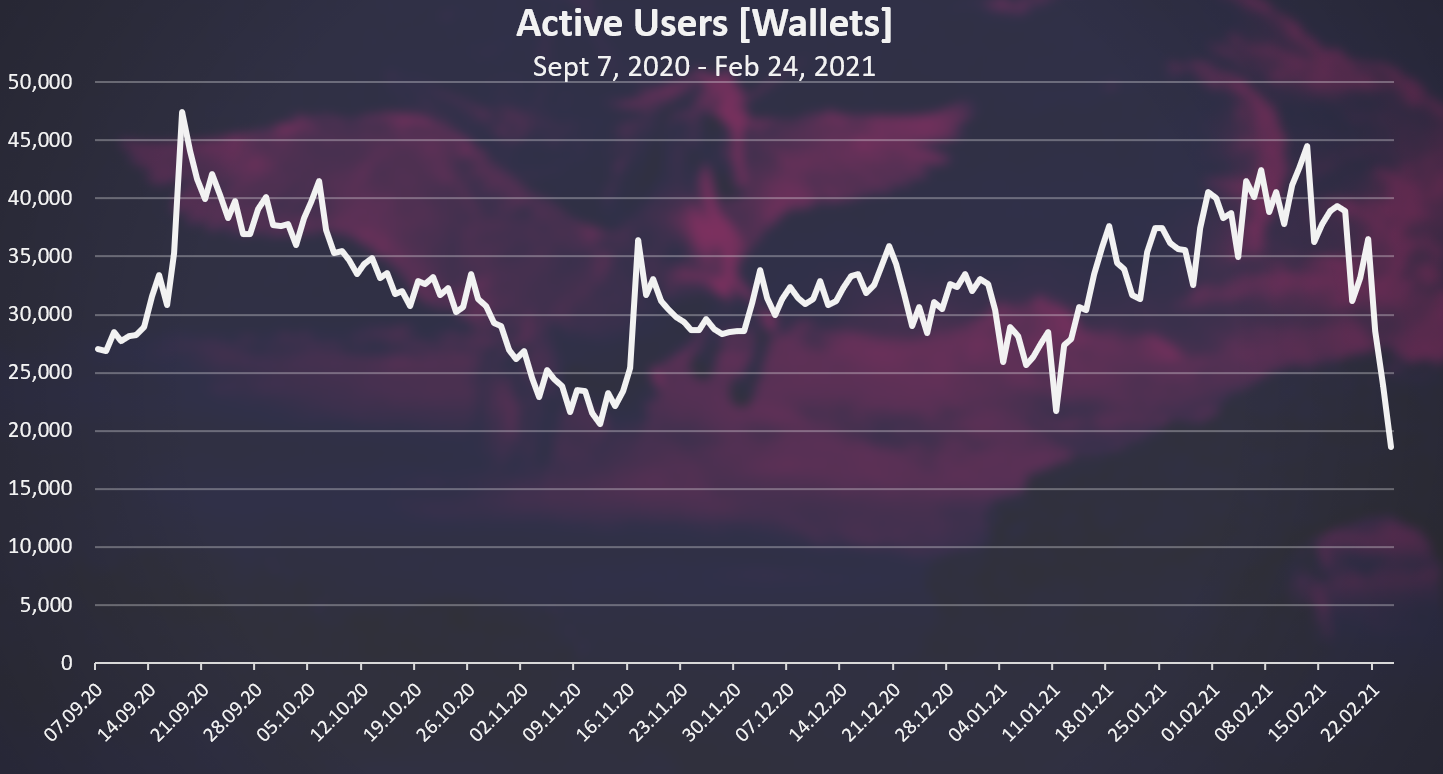

Active Users [Wallets]

How about the number of users? Here is the chart.

When we look at the chart of the number of users/wallets we can see a drastic decline in the last week. From 45k to under 20k active wallets. This might be because of the ETH fees in the period that are reaching ATH levels. But overall the chart for active wallets is looking stagnant for the whole period with some ups and downs, and a sharp drop in the last week.

This is showing that not a lot of users can afford the high ETH fees and basically the same number of users or even lower are transacting on Uniswap.

Fees are real issue for the ETH blockchain. It keeps small players out. Obviously the number of wallets that can afford these fees is limited.

The overall sentiment is that Uniswap and Ethereum have reached a ceiling in terms of users. Yes there is an increase in the total value locked and in the trading volume but mostly because of the increase of the ETH price. There is actually no new capital entering the platform. In terms of users the numbers are declining. The centralized equivalent like PancakeSwap have given a feeless option and a lot of users and capital seems to be flowing there.

The DeFi movement seems to have outgrown the ETH capacity at this moment and its spreading in other directions now.

I personally I’m a great fan of ETH. You must respect the chain and the developers there because most of the innovations in the space have come from ETH. The DeFi movement, landing, borrowing, swapping it all came from Ethereum, and BSC is basically coping all of this with some tweaks. But once you have a feeless option its hard to go back to fees. ETH2 will take probably two more years to be fully implemented and that is a long time.

One more thing worth mentioning at the end is that Uniswap doesn’t have incentives at the moment. No UNI tokens are given out to liquidity providers. At some point another round of incentives will be voted in and that might push the numbers on the platform.

All the best

@dalz

Posted Using LeoFinance Beta

https://twitter.com/Dalz19631657/status/1364696638963535873

The Gas is really so high especially on uniswap

We need the eth 2.0 update soon

Posted Using LeoFinance Beta

A year or two down the road!

Posted Using LeoFinance Beta

The insane transaction fees is a big factor. It is also a whales game, anything less than $5,000 gets stomped by the transaction fees. Version 3 is suppose to be a big help in this regard as well as slippage reduction, but will have to see how they do it.

Yep fees are just ridiculous, especially for an Uniswap operation.

ETH=WhaleFi :)

Posted Using LeoFinance Beta

Just goes to show that decentralization is a luxury crypto-heads are willing to do without.

Posted Using LeoFinance Beta

What decentralization :)

Posted Using LeoFinance Beta

Binance smart chain makes everything so easy and attractive. Pancakeswap has recently been seeing new competitors like apeswap, gooseswap etc. I think more users will naturally gravitate towards bsc

Yeah, fees are crazy and that's why I also switched to BSC to play my degen games.

Posted Using LeoFinance Beta

I see you :)

Posted Using LeoFinance Beta

Yeah, I sometimes wonder if Eth is going to miss the boat if it takes till the end of the year (or later) to roll out Eth 2.0. On the other hand there are so many projects build upon.

Posted Using LeoFinance Beta

ETH will always be around, but nothing is for granted, and things can change in crypto fast ... a lot more serious competitors this time around.

Posted Using LeoFinance Beta

Gas fees are the true Ehtereum killer.

Posted Using LeoFinance Beta

Nice data, as ive said that the gas fees are the undoing of Ethereum

Posted Using LeoFinance Beta

I stopped using Uniswap since 2020. The fees are too painful. I might just use it again when I'll get my ERC-20 tokens that I earned.

Posted Using LeoFinance Beta

Reveiling data!

1-2 years in crypto space is very long. Defi on Ethereum is in trouble, imo.

Posted Using LeoFinance Beta

While Ethereum is ridden with fees, it offers the kind of security that other present competitors lack, specifically BSc, in terms of decentralization.

the data provided us here shows that people are willing to sacrifice decentralization of which is the most vital part of security for functionality and there are those who would never.

While I totally understand why that is so, is this not the part where polkadot and rune come in? Whereby both offer decentralization, hence security and cheap defi functionalities?

Posted Using LeoFinance Beta

First of all great analysis. Congratulations on your job. The great problem about that is... one or two years of development and no one has the guarantee that this chronogram will be effective. This time is so long for projects in the blockchain.

Consider that as BSC is coming up... Polkadot, ADA Cardano too.

The fact that they made a great innovation about DEFI doesn't mean that the others can't follow them and make it better.

From my point of view, this situation put "fire on the whole"... let's see what the next.

Posted Using LeoFinance Beta

Really doesn't surprise me at all. Stories like this:

https://cointelegraph.com/news/defi-user-pays-36k-for-one-uniswap-transaction-as-eip-1559-draws-closer

are becoming more and more common lately. Sure, most of the time it's smaller amounts, but it's just not worth it to pay these fees. With the emergence of the corresponding alternatives - see Binance - the market is becoming more and more competitive. I expect the volume to continue to move away from UniSwap.

Posted Using LeoFinance Beta

I really want to use uniswap, if only to get rid of some of my shitcoins. But the fees would make it not worthwhile so it is just unusable at the moment.

I guess I will just hang in there for a couple of few years. With my small $WLEO🦁 investment on Uniswap🦄, I really don't have any alternative! 😉

Posted Using LeoFinance Beta

Great information! Intuitively, you knew it had to happen. As much as ETH is portrayed as the 2nd blue chip in the crypto world, they just don't have a use-case cornered like bitcoin does with it's store of value. Inflation and high fees mean that competition can innovate and outpace them. As much as they were the building block on which a lot of this innovation was built, at some point the students will outpace the master. I'm not saying it's going away. But people with $5k, $10k, even $50 price targets I think are engaged in wishful thinking. Ethereum has been, is, and will always be an alt coin. And alt coins main usecase, in my opinion, is to try to make bigger returns faster so you can buy more bitcoin.

Posted Using LeoFinance Beta

Let's face it, ETH became unusable for most transactions below $10K (DeFi, complex Smart Contracts, Uniswap). One single popular DApp like CryptoKitties can clog the entire network. ETH is however still good for decentralized, secure, high-value transactions like high-value DeFi, crowd investing and NFTs (above $10K).

Posted Using LeoFinance Beta

Today I used BSC and pancakeSwap, it is really nice also graphically, as well as being extremely cheap

Posted Using LeoFinance Beta

Very interesting to see the stats for Uniswap. I have avoided any situation where such high gas fees are required. Much appreciated.

Posted Using LeoFinance Beta

So, what is a good option for Uni holders? I do not have much but still. Is this project worth sticking with?

Posted Using LeoFinance Beta

it will still take a long time to see Ethereum 2.0 up and running. DeFi projects on other blockchains will take advantage of this situation

Posted Using LeoFinance Beta

Congratulations @dalz! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 72000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz: