Uniswap V3 Is Out For More Than A Month | Uniswap Data On TVL V2 and V3, trading volume

The Uniswap V3 version went live at the start of May 2021. It’s been more than a month for this version and the V3 has already accumulated some liquidity and trading volume. Lets take a look how are the numbers for V2 and V3 in the period.

May has been a rough month for crypto, with Bitcoin correction for more than a 50%. Still the Uniswap protocol and defi in general keeps going and trading on DEXs is running smoothly.

Here we will be looking at:

- Total value locked

- Trading Volume

- Uniswap V2 VS V3 in trading volume

- Top Pairs

The period that we will be looking at is September 2020 to June 2021, with a closer focus on the last two months.

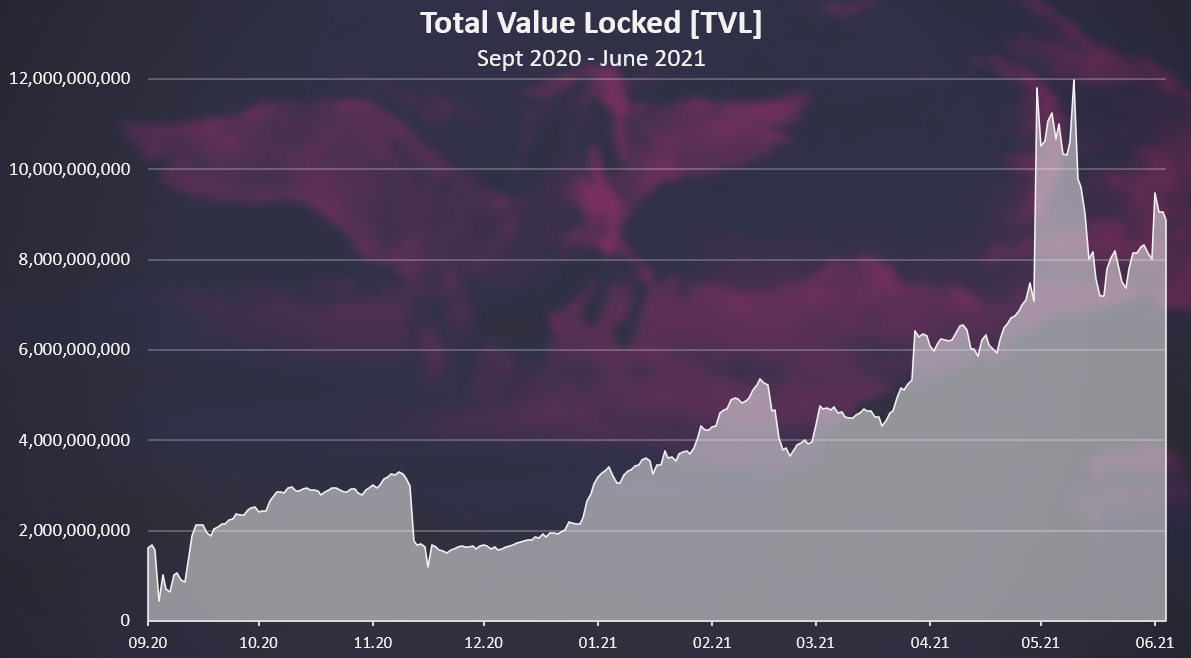

Total Value Locked

Here is the chart for the TVL on Uniswap starting from September 2020.

Overall an uptrend for the total value locked with some bumps.

There were incentives with the UNI token at first and when they finished there was a drop in the TVL in November 2020. Afterwards the TVL started increasing again reaching, with a peak in May 2021 with almost 12B in liquidity. Then a drop to 8B, after the correction.

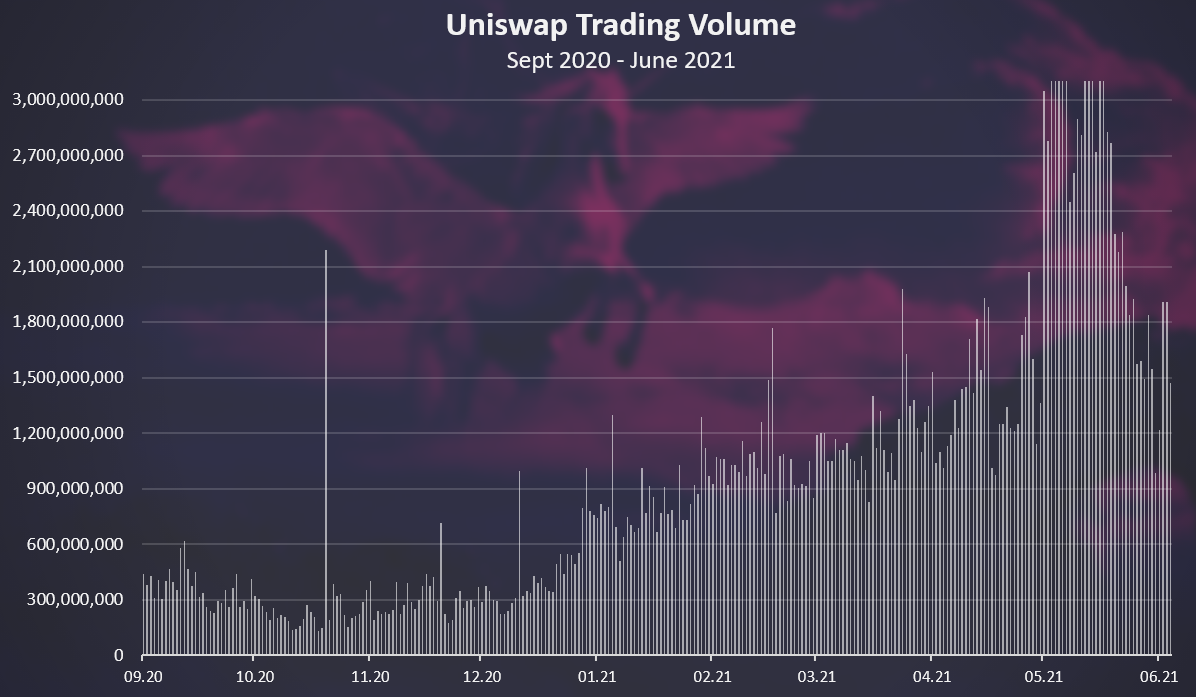

Trading Volume

The chart for the trading volume looks like this.

This is quite similar with the locked liquidity. A peak at the beginning of May 2021 with more than 4B volume per day, and then a drop to around 2B.

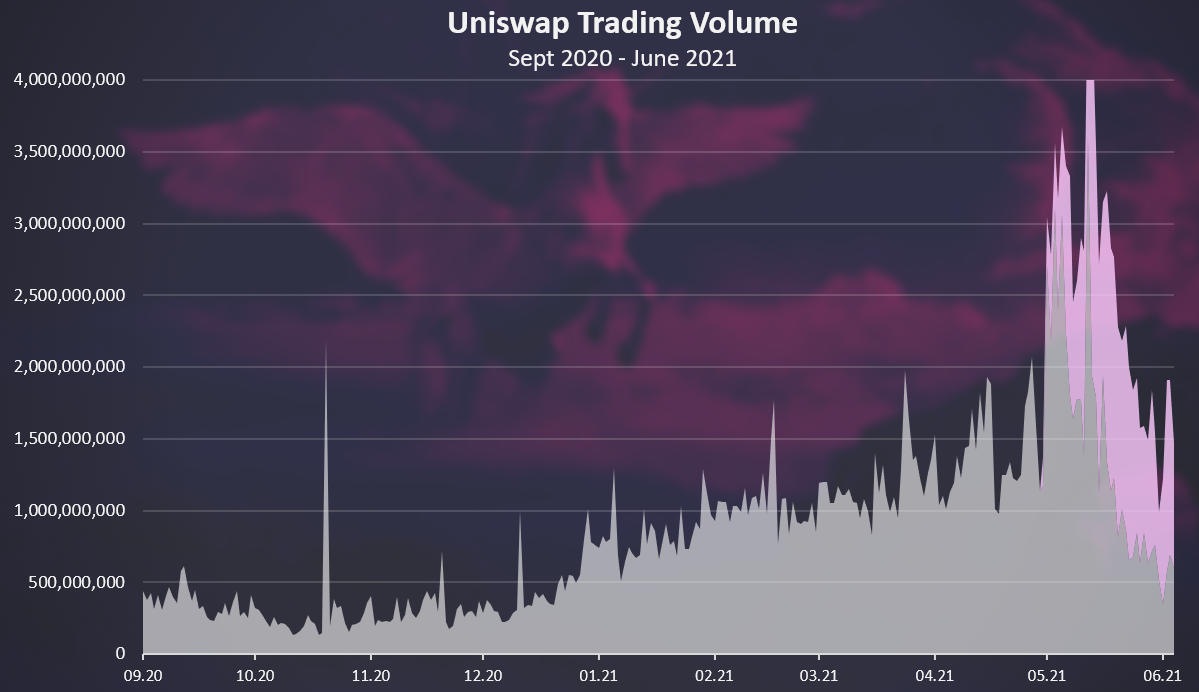

Uniswap V2 and V3

When we breakdown the chart for the trading volume to V2 and V3 we get this.

We can see that V3 launched at the peak and gained liquidity.

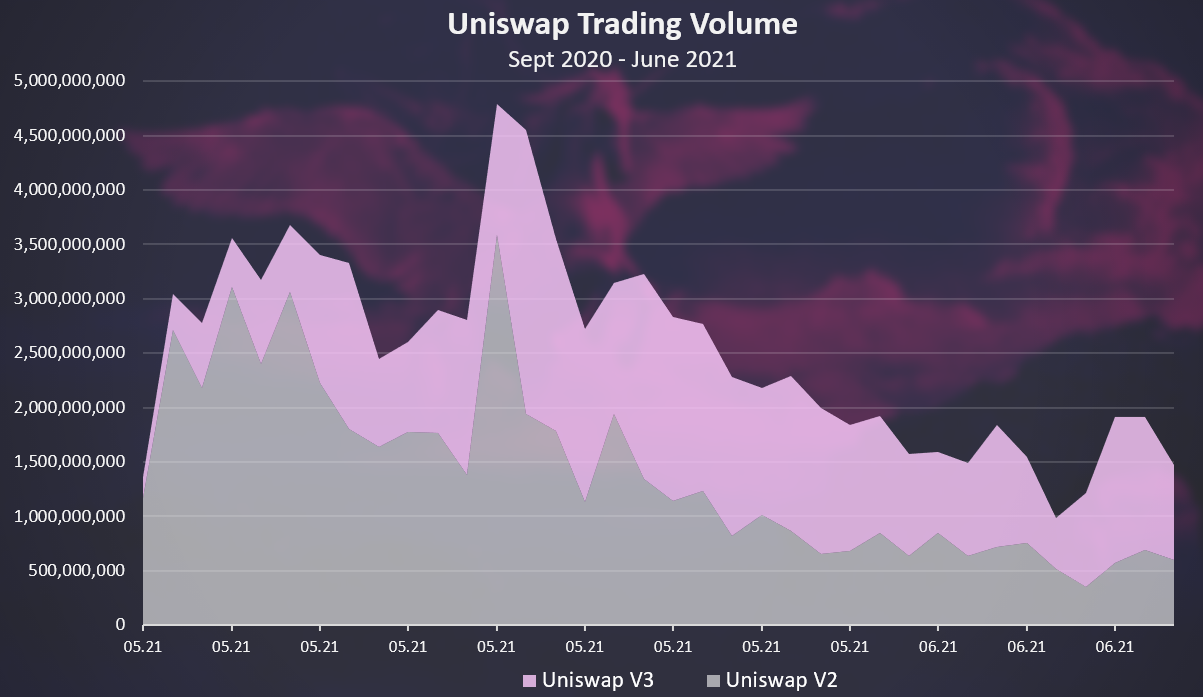

If we zoom in just for the period when V3 is live we get this.

In terms of trading volume Uniswap V3 has grown fast, and now it has around 50% share, and higher in the last days. For example on June 8, Uniswap V3 has 1.3B in trading volume, while Uniswap V2 has 0.57B, or V3 is leading almost double on that day.

The cumulative trading volume in the period when V3 is live looks like this.

In terms of cumulative trading volume Uniswap V2 is still leading in the period, but the trend is obviously on V3 side.

Top Pairs in TVL

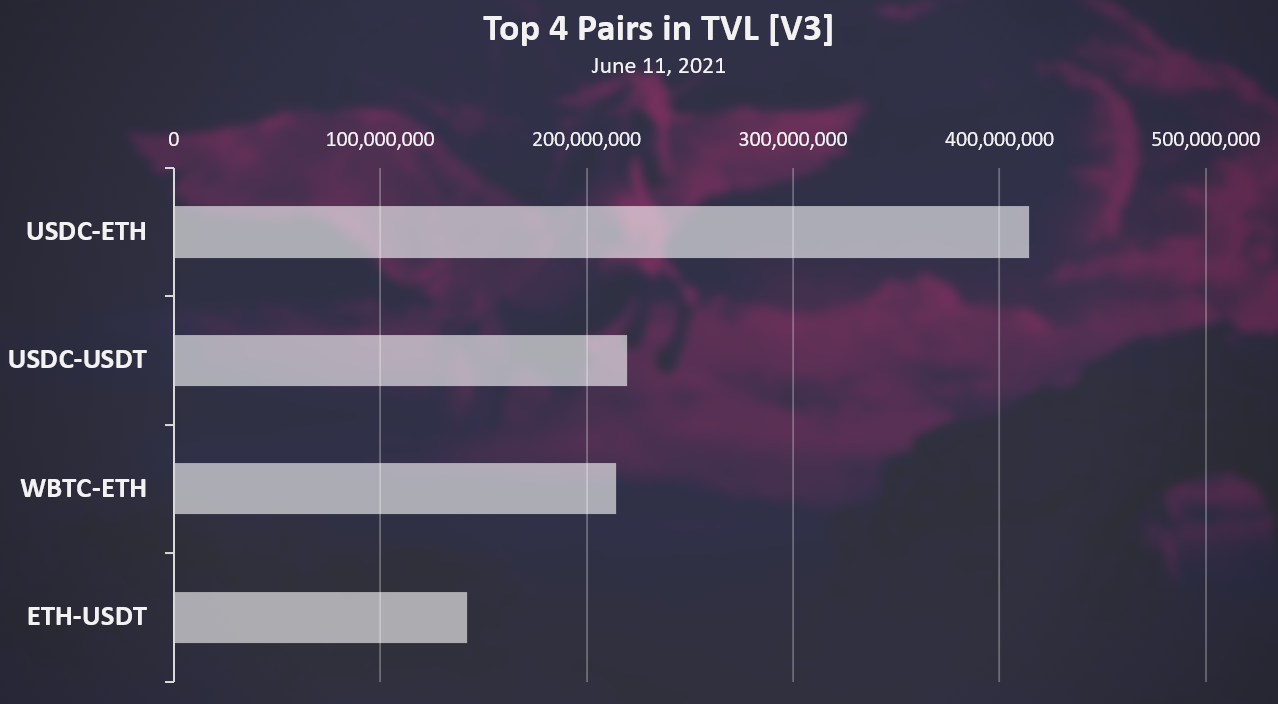

The top pairs in TVL on Uniswap V3 are:

The USDC-ETH is on the top with more than 400M in TVL.

The interesting thing is that the stablecoins pair USDC-USDT is on the second spot with more than 200M. This is as a result of the Uniswap concentrated liquidity feature, where LPs deploy the liquidity in a tight range for a much better efficiency.

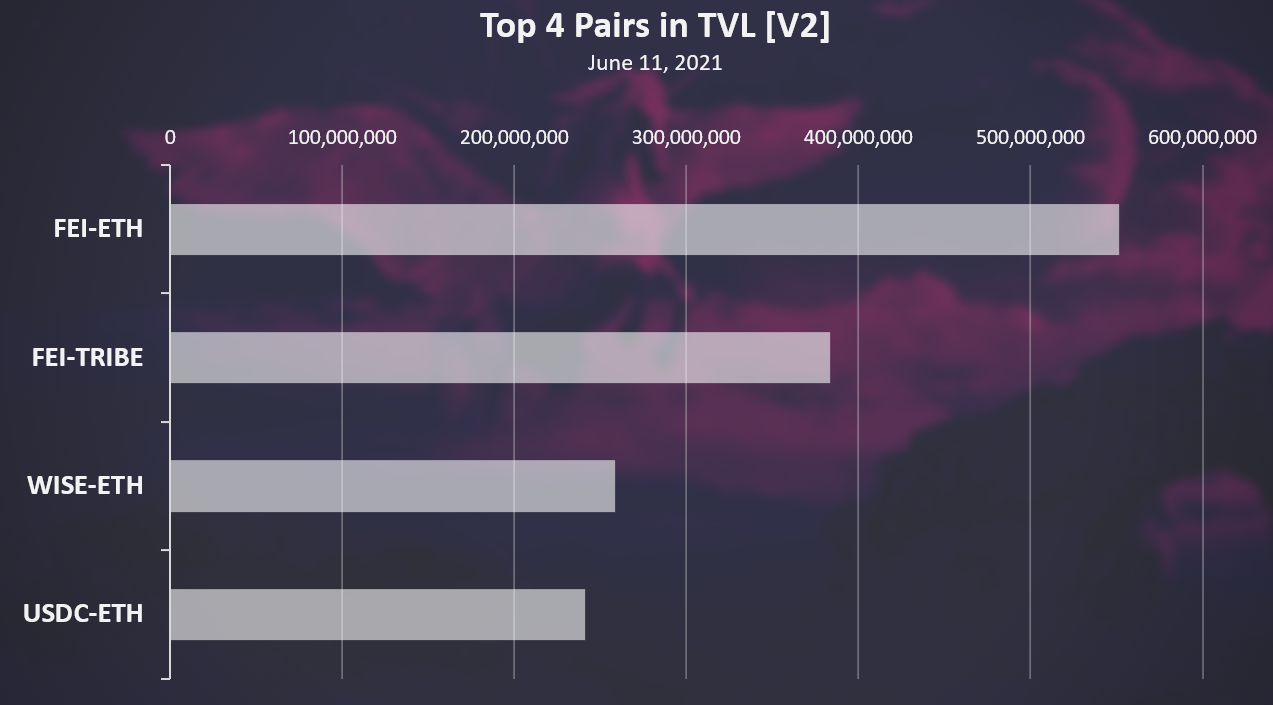

For the Uniswap V2 the top pairs are:

The FEI-ETH pair is on the top here, while FEI-TRIBE is second. Both of these are FEI related projects, that is a new type of stablecoin. I have posted about this project here.

The WISE token is yet another asset pegged token, where all the tokens sales ends in the liquidity pool.

Monthly Active Users

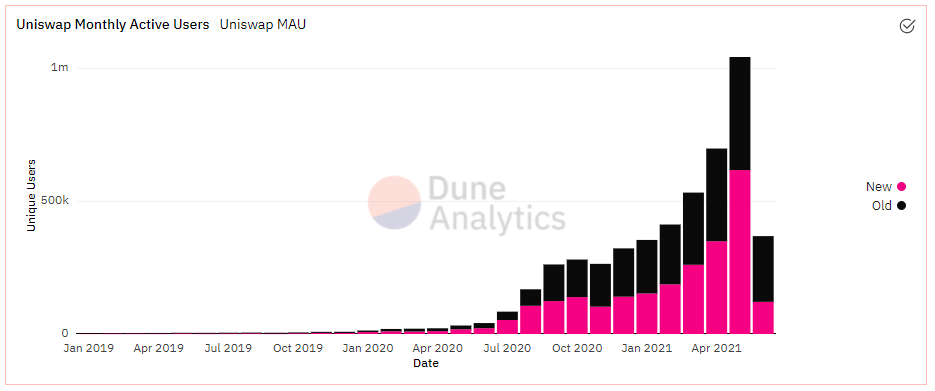

The chart for the MAUs look like this.

source

This is a chart from Dune Analytics, and we can see the peak in May 2021 with more than 1M unique wallets for that month. June is not over yet, so the last column is not relevant.

What is interesting here is the number of new wallets interacting with Uniswap in May 2021 has been bigger than the number of old wallets.

Overall, the numbers for Uniswap have been going up, with some downtrend with the recent correction.

Uniswap V3 is slowly but surely taking over with the liquidity, reaching more than double of the trading volume from V2 in the last days.

On V3 the ETH-USDC is no.1 but also the stablecoins pair taking advantage of the concentrated liquidity. On V2 the “pegged” tokens are dominating now, like FEI and WISE. Once they move to V3 the overall liquidity on V2 will drop a lot.

The number of users has been increasing on a monthly basis, with more new users/wallets in May 2021 then the old ones.

All the best

@dalz

Posted Using LeoFinance Beta

oh big drop in volume!

Yep ... everything is down with the correction.

https://twitter.com/Dalz19631657/status/1403310393297092611

In the long run that 12 billion LTV number will reach 100 billion, we will see that very soon.

Posted Using LeoFinance Beta

I think VOLUME/TVL for uniswap V2 and V3 would be interesting to see how much more capital effiencient V3 is. Maybe taking account the different fee pairs too.

Yea that one is a nice indicator.... overall v3 has a better efficiency

USDC-USDT is such a unique thing. I get why someone would get into it. I didn't expect something like that to be so high. It's really awesome to see FEI being popular too :)

!PIZZA

Posted Using LeoFinance Beta

@dalz! I sent you a slice of $PIZZA on behalf of @d-zero.

Learn more about $PIZZA Token at hive.pizza (3/10)