The most important companies and projects in 2020: who is profoundly influencing the encrypted digital asset market?

2020 is a year of rapid development of the blockchain industry and also the year with the fastest changes. This year, important companies have a significant impact on the entire industry. Of course, there are also important products and agreements that will revitalize the entire industry. , Exclamation is the future. Let's take a look at which companies and products have had an impact on the industry in 2020.

PayPal

On October 21, payment giant PayPal announced that it would open its newly launched cryptocurrency service to all eligible US users. This is considered a watershed in the entire encrypted digital asset industry.

PayPal began providing encrypted asset services to US users in November last year. This digital payment giant has 346 million active users worldwide. A survey shows that more than one in five people have traded cryptocurrencies on Paypal. PayPal plans to expand its encryption service to other parts of the world in 2021.

However, PayPal’s support for cryptocurrencies has not been widely praised in the crypto community; many people pointed out that the crypto assets they purchased on PayPal cannot be transferred to other crypto asset accounts, which is in line with Bitcoin’s ethos of “owning its own money” Go in the opposite direction.

After Paypal's high-profile announcement of the integration of encrypted asset services, the daily Bitcoin purchases on the platform once accounted for 100% of the daily output of miners. The price of Bitcoin began to jump up.

Grayscale

This year, Grayscale's performance set a record. It is currently the world's largest encrypted digital asset management company, managing investor encrypted assets worth more than 18 billion U.S. dollars, mainly Bitcoin. Grayscale allows qualified investors to obtain exposure to Bitcoin, Ethereum and various other digital assets through multiple trust funds and funds.

After Grayscale, companies such as Microstrategy, Galaxy Digital, and BlockFi also bought bitcoin on a large scale. Statistics show that currently 29 large companies around the world hold 5.48% of the total supply of bitcoins, holding a total of 1.15 million bitcoins.

Polkadot

As a much-anticipated cross-chain superstar, Polkadot's mainnet finally went live this year after many years. Since Polkadot's mainnet went live, DOT has directly dropped to the top ten in the market value rankings, triggering a wave of Polkadot. In addition, the parachain auction is under intense preparations and is expected to officially start early next year. Many DeFi projects are also eager to try on the Polkadot network. Not only are they supported by many venture capital institutions, but exchanges are also establishing Polkadot ecological funds to support project development.

In addition, Gavin Wood pointed out in the "Polkadot Summary in 2020" that the next major version of Substrate 3.0 may be released in the first half of 2021, which will bring compatibility to Ethereum, as well as new improvements and more customary Frames. Pallet API and a faster database backend and end-to-end weighting system.

Filecoin

The distributed storage star project, which has lasted for many years, finally went live on the mainnet in October this year. As a project endorsed by many top venture capitalists, the entire secondary market is also living a mess, with hot mining machines and currency prices. However, the ensuing fork disputes and the dilemma of miners' lack of currency pledge have also placed Filecoin on the cusp of the storm many times.

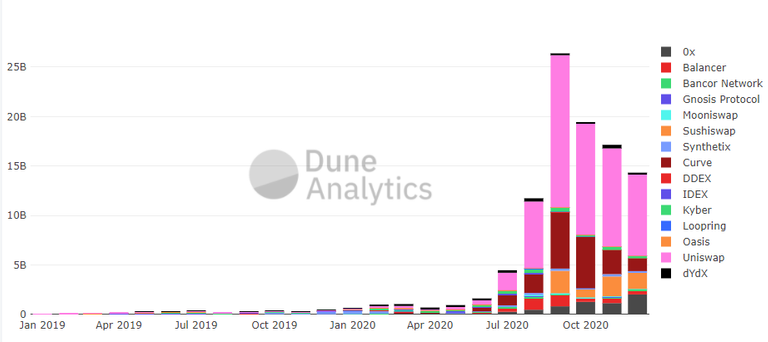

Uniswap

Uniswap is the most widely used DEX on Ethereum, and its total lock-up volume far exceeds that of its opponents. On August 31, Uniswap's trading volume hit a record high, with a 24-hour trading volume exceeding 441 million U.S. dollars, exceeding the 373 million U.S. dollars of Coinbase Pro during the same period.

Uniswap v2 went live in May, allowing anyone with access to the Internet, Ethereum wallet and ETH (or ERC20 tokens) to seamlessly exchange assets without permission. It uses an open source structure of a set of on-chain smart contracts, eliminating the need for intermediaries. Its automatic market maker (AMM) model is called the "constant product market maker model" (CPMM), which allows anyone to provide liquidity quickly and easily in exchange for a 0.3% fee per transaction.

Uniswap v2 is very popular. With the rapid increase of liquidity mining and "income farming" platforms, it has become a platform for making money by issuing new tokens and supplementing market liquidity for tokens.

In September 2020, Uniswap also launched the governance token UNI, and airdrops rewarded long-term users of the platform. Up to now, the total locked position has exceeded 2 billion US dollars.

Yearn.finance

Yearn.finance is a milestone innovative product of DeFi (although its model is very common in the classical Internet).

As a revenue aggregation product, yearn.finance provides many different fund pools for DeFi users to choose from. Each fund pool has different basic assets and exclusive strategies to achieve investment returns. Later, people called the pool of funds that included strategies to maximize return on assets as the "machine gun pool"-this is the most interesting (no one) gameplay in the DeFi field this year.

The yearn.finance machine gun pool strategy is much more active than the Yearn standard protocol, which can only lend coins.

yearn.finance has made its founder Andre Cronje (AC) famous. In July of this year, AC created the governance token YFI for Yearn Finance. Although he repeatedly emphasized that YFI is worthless, the price of YFI has risen up to four times that of Bitcoin. Subsequently, AC launched a series of new products (such as Eminence, Keep3r, etc.) and led a series of eye-catching project mergers.

Although some projects have mixed reputations, AC-based DeFi projects will undoubtedly promote one of DeFi's most powerful features-the boundaries of composability, and bring more innovative financial products and services.

Compound

Compound is an algorithm-based mortgage lending protocol that provides users with current floating rate deposit and lending services. The interest rate of the token borrowed by the user on the platform is determined by the algorithm of the amount of borrowing and deposit of the token in the platform. The platform will reserve 10% of the borrowing interest as platform income, and divide the remaining interest equally among the The depositor of the token. As a representative DeFi project for decentralized lending. Since June this year, liquidity mining has completely detonated the DeFi circle.

In addition, on December 18, the Compound development team announced the release of Compound Chain and initially introduced the details of Compound Chain. Therefore, Compound Chain aims to be a distributed ledger that is independent of Compound and can transfer value and liquidity between peer-to-peer distributed ledgers, so as to solve the above-mentioned limitations of Compound and actively welcome various blocks from ETH, Polkadot, and CDBC. The rapid explosion of chain digital assets.

Aave

The loan agreement has made significant progress in 2020. Switzerland-based Aave has achieved amazing success in this field this year. Like other lending protocols, such as Maker and Compound, Aave allows users to borrow cryptocurrencies instantly, creating a "flash loan", which is an unsecured credit:

The transaction of loan issuance and repayment must be completed in the same block on Ethereum. According to the current block rate of Ethereum, which is 13 seconds, that is, the repayment is completed within 13 seconds after the loan. As long as the above conditions are met, the borrower can borrow without collateralizing assets.

In 2020, Aave has widely promoted "flash loans" in DeFi. Through flash loans, users can obtain tens of millions of funds with only a small fee.

At present, Aave has received US$25 million in investment from Blockchain Capital, Standard Crypto and other institutions, and these funds will be used for the next step of innovation and expansion. These developments have also been reflected in the price of the agreement token AAVE. The data shows that its increase this year has exceeded 4000%-one of the biggest dark horses this year.

Chainlink

The leading project of the oracle. When the DeFi sector soared in June this year, the oracle sector soared, and the leader of the oracle, ChainLink, surpassed many mainstream coins to become the fifth largest in the world by market value. As one of the strongest altcoins in 2020, LINK has repeatedly let short investors break their thighs.

LINK is the abbreviation of Chainlink token. It is a decentralized oracle network designed to enable smart contracts to securely access data sources outside the chain. In the blockchain, the oracle is a bridge that connects the smart contract with the outside world, and is one of the infrastructure of the blockchain, mainly used to provide data information for the smart contract. It uses node reputation and mortgage tokens to ensure the security of data, and evaluates the reputation of nodes. Nodes with higher ratings are more likely to get the choice of the data demander. When there are malicious nodes, the pledged LINK tokens will be confiscated as punishment.

In addition, since its inception, Chainlink has been well-known for continuously cooperating with major technology manufacturers outside the circle.

Synthetix

Synthetix does not need these intermediaries, but still allows traders to do business with people they do not know and trust each other-without fear of being deceived. This is because the blockchain automatically ensures the integrity of each transaction, and the cost is only a small part of the army of traditional middlemen. Because of this, traditional asset brokers, banks, and other intermediaries are increasingly facing an existential threat to their business models. You can trade almost all assets on Synthetix, including gold, fiat currencies, various encrypted assets, and theoretically even real estate.

Synthetx saw an increase of several tens of times last year, and this year it has also soared. After a sharp correction, it has set a new record high. V3 version will be released next year.

Rarible

Rarible is unknown in the Chinese world, but it builds a bridge between NFT and DeFi. If you are optimistic about NFT, then you must understand Rarible. Since the launch of Rarible in November 2019, about 40,000 artworks have been collected on its community platform, with a total transaction value of nearly US$10 million.

Rarible enables anyone to create a non-fungible token (NFT) that represents a tradable digital collectible, and can provide proof of provenance, and allows works to be sold on its market at almost zero cost. Although other encrypted art markets such as SuperRare, Nifty Gateway, MakersPlace and OpenSea are also booming, Rarible is still in the leading position, with more than $1 million in weekly transactions.

In July, Rarible has officially become the first NFT project to launch the governance token $RARI that can be used on its platform. Recently, yInsure can be traded as an NFT on the Rarible platform, and recently, it can be used as an NFT on the Rarible platform. YInsure, which is traded by NFT, has also proved to be popular with users, who can earn RARI through trading.

Now, click to enter the world of Rarible: https://rarible.com/

Congratulations @dejavumix! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz: