Which coins will be allocated in 2021?

Hi everyone, I am @dejavumix , In fact, at this time in previous years, some predictive content should be published. I think crypto media especially leofinance have also reposted a lot of big V predictions, I also feel that forecasting isn't of much use. All of them still need the market to come out step by step. It may be more important to understand the core growth logic of today's market changes.

Just like the "top breakout indicators" we studied together in the previous issue, I think we've received a fair amount of feedback. It should be noted that this indicator can only reflect the current status of the market, whether they are relatively undervalued or overvalued, but also It follows market fluctuations, so it cannot be said that the top of the indicator is shown near 50,000, there will definitely be a "top" area in the future , note that it is not a predictive indicator.

So here we turn the forecast into a discussion: which crypto assets to buy and allocate in 2021.

I think everyone should have their own answer to this question, and there is no absolute standard answer. Today, I will treat it as a simple chat and a compilation of the current alt market.

A little ether

Bitcoin has made it out of the loop in 2020. There are also those that came out of the loop last year. When it comes to cryptocurrencies, the first thing that comes to mind is BTC . Ethereum has the largest crypto community. In fact, old wine and dishes abroad are coming out of Bitcoin. They are not small in number, and they are more concentrated in the ecology of ether and ether.

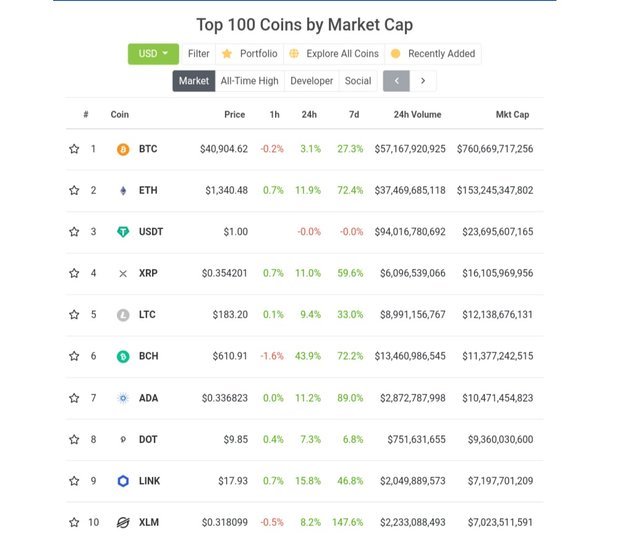

Currently, the market value of the BTCaccount is 69.1% and ETH is 12.8%. It must be said that BTC and ETH are the unquestionable targets of currency circles. From the current situation, the crypto world is more to cater to trading and speculation needs. The emergence of very popular applications, even if Ethereum has scalability issues, its first mover advantage can last a long time, so from a configuration perspective, as long as you are here for a long time, you should be more or less. Nothing can be said about configuring multiple positions.

According to personal circumstances, you can adjust several position ratios accordingly. For example, if we don't understand plain content, we may place 80 to 90% of our investable positions on btceth. If you are more knowledgeable, you will have more energy. To study various alts, or to have very promising targets or strategies, it is also possible to be more aggressive in allocating positions.

But also pay attention:

(1) Bit Ether has also doubled tenfold from last year's low. The craze of the market today is that there are lots of money looking to make money fast. It's hard to say where it went in the short term. According to BTC for 17 years The high point of ETH hasdoubled. If ETHincreased sharply, a large number of retail investors will not be able to transfer even basic transfers. So if you are a newcomer, or if you want to catch up, you have to be mentally prepared as old wine and food. I think there will be better times to enter the market. Of course, mad cows are unpredictable. Old wine and food may be more suitable for preserving life, than making quick cash.

(2) In today's domestic and foreign financial markets, there are several phenomena of constant force and two-level differentiation. For example, the domestic liquor drum market and the new energy sector have always been strong, while many small market value stocks have performed flatly. This is also due to the fact that the Fund Group.

The crypto world now looks like it has this trend. It is stronger than Bitcoin and has a certain level of liquidity. Not only saw an increase, but also a loss. It doesn't seem like much, and needs to be maintained in the future. One of the reasons for strong asset allocation.

However, for cryptocurrencies, it is more complicated than traditional financial markets. This is a global market. For some targets, I don't know which corner there is a group of people who see something that doesn't make sense, and might appear. Waves, and take a look at the 7 day gain ranking on coingecko:

It can be said that the pie and ether did not only rise at this stage. . So, let's sort alts from a few relatively hot markets in the last two years to see which one to choose too:

1. Ethereum's ecological currency

The copycat outbreak that began in the second half of 2020 is primarily concentrated in the ether's ecological currency, the erc20 token. Here we also break down:

(1) defi coin

Defi should be rotten by most of the media, what we need to pay attention to here are those that have relatively large leveraged mortgages, namely in lending platforms such as compound / aave it can be used as mortgage chips to lend stablecoins. The target, because such a target is equivalent to having a large mortgage in the network, the sales will be reduced, and the U borrowed can also be leveraged.

There are a few here:

link / aave / snx / yfi

Second, uniswap is the largest and most active DEX on ether. Its union currency platform has also received considerable attention from the market. There is also sushi and community popularity, but the fundamentals are still some distance from uniswap.

The other is defi mining coins, the two big comp and crv, the smaller one is not mentioned. Long-term selling pressure like this will be lower than the first two. I've always felt that the point of defi is not It's not about mining.

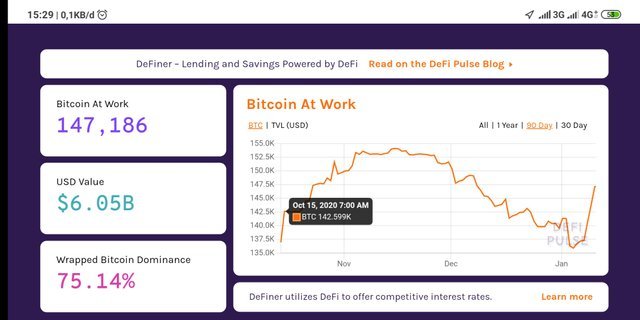

Regarding the future direction of the defi currency, one of the basic things you can refer to is the data on the defipulse:

At present, lock-up funds in defi have increased rapidly and have exceeded 22 billion US dollars. You should know that in June last year, this value only crossed 1 billion, which increased 20-fold in half a year. If there is exponential growth this year, the market value deficit of these top projects will still grow.

However, there are a number of things that need attention. First, the value above seems to have increased quite a lot. In fact, a large part of it comes from the increase in the market value of Bit Ether. Lately, the volume of locking up BTC and ETH has decreased.

Second, we mentioned earlier that leverage can bring prosperity, but it can also be a collapse fuse. The most feared thing about mortgage tokens is the centralized liquidation caused by the sudden drop in price of tens of points. This bitwave is hardly a decent callback along the way. It seems that the maximum time is 17%. For now, we are still very safe, and a rise in market value also means more money that can be borrowed (eight).

Another good aspect is that I have observed several large accounts before. The bigger the tens of millions of dollars, the more conservative the leveraged mortgage is, so for now, liquidation collapse is still a very small probability event.

(2) Tool token

Represented here is LINK , which serves as a bridge between off-chain data and smart contracts, and the other is api3, released late last year, which is also a third-party service for on-chain api.

There is also Graph (grt) which was turned on some time ago to provide data indexing services for on-chain applications.

It seems that the last tool tokens serving the ether ecosystem will also be a trend, especially compared to the era when the concept of technology was king in 17 years, the current trend seems more pragmatic.

But for now, this type of token is still more speculative. Like LINK, I personally think its growth has come more from mortgages than from the oracle itself. Like grt, it depends on short-term project dynamics. Can not be configured for a long time, I am here to make a question mark.

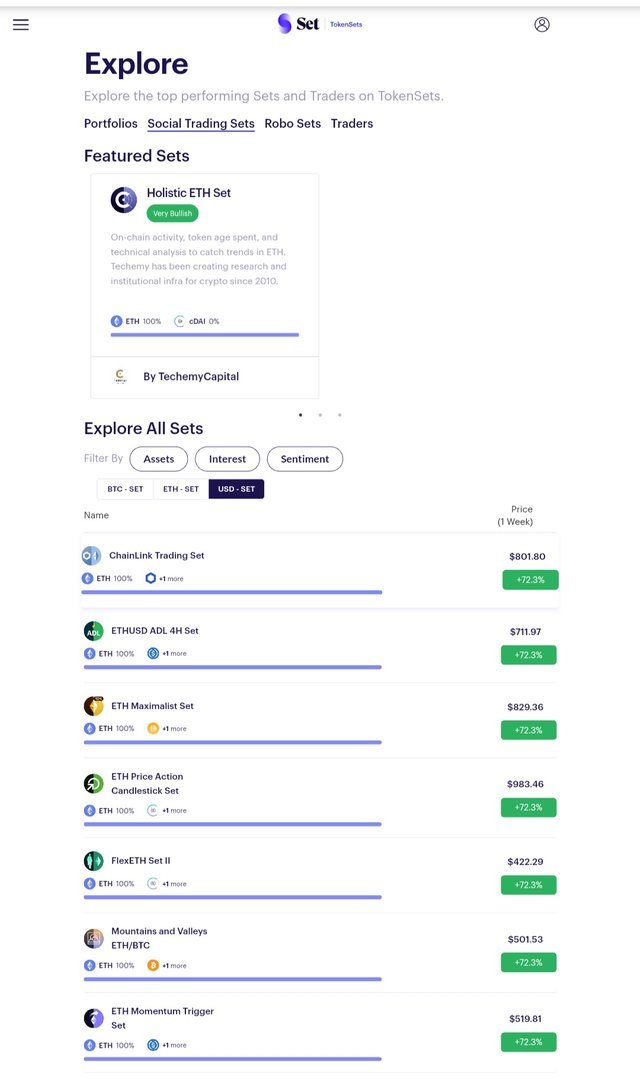

(3) Fund token index

I think this category may become a trend in the future, as the market becomes more mature, and more financial products have to come out. We not only have trusts like Grayscale, but also fund products that are similar to traditional markets in the chain. Develop multiple profit strategies and the like.

One ether ecosystem that can be seen today is tokenset, which has several holding strategies to follow up with:

At the same time, his family also issued a DPI defi index, buying DPI tokens is the same as holding a basket of defi tokens.

The other is DuckDaoDime, a decentralized VC angel investment community that has been introduced in small currencies before. Through the power of the community to invest in and incubate several small encrypted projects and then together seek a profit, tokens can be understood as a barrier to entry into this community of costs.

Of course, these two things are still quite relevant today. To mention here, I also want to say that I hope to see more such "group benefit" projects emerge in the future.

(4) The currency of the second level network concept

Layer 2 network expansion will be a stiff demand this year. For this you can view the previous content:

ETH has taken off with gas, and the second tier grid concept will be the prettiest boy in 2021?

This same concept coin also feels that there is an element of hype to a large extent. The speculative perspective will be a point to look at in 2021, but in the end, we still have to see who really can be widely used. I feel it might be implemented in traffic portals like uniswap. More advantages, than little-known new little DEX .