We're Being Put To The Test

This year is like a roller coaster ride regarding what's happening in the crypto world. I'm not entirely sure but I think it's safe to say that there has never been a similar year before. One surprise coming after the other, the year is far from being over.

We're about to witness another huge surprise, which (kind of) had been expected but no one knew when it's going to happen. We're heading to a new low as I am writing this post.

Facts

#BTC has lost the 2021 Higher Low, the multi-week Higher Low, the 50 week EMA as support and so on.

If you're a crypto hodler, you know how things stand. However, what you see on social media platform is people are fighting about if we're in a bull market or bear market. This is their biggest concern, to define what type of market we're in right now.

I personally couldn't care less how you call the market. There are more important things to do, one of which is to restructure your portfolio, in case it is needed.

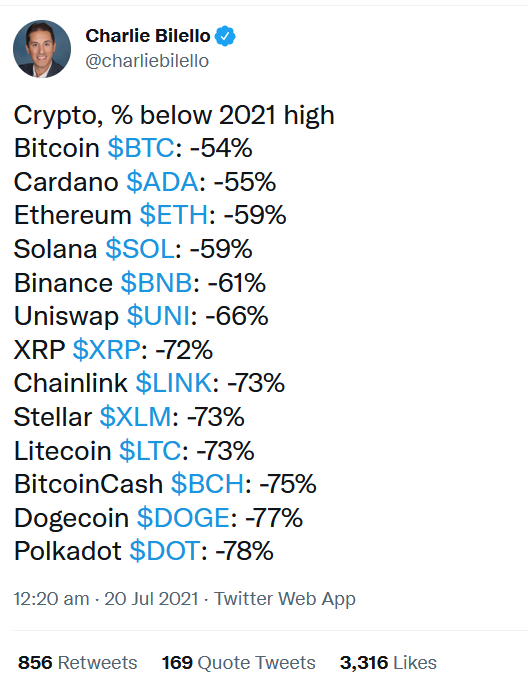

I've found this list on Twitter. If it's accurate (and I don't have any reason to doubt it is, it can be checked easily), then we have to think about which can asset hold long term.

One of the golden rules in investment is to diversify your portfolio. This is key if you want to avoid getting badly hurt by putting all your eggs in one basket.

Over the years we've learnt that there are a few cryptocurrency projects that are safer than the others, but the latest events have not spared any of them and a few of those so called safe coins got hurt, got hit more than the others.

Just to be clear, I'm not talking about Shiba Inu, Doge and other related coins. I'm not going to waste my time or capital, not even from my trading portfolio.

If you look at the list you can see that some of the coins with good fundamentals are not as high on the list as they should be, which is quite surprising.

Cardano (ADA)

One of the biggest surprise (in a very good way) has been produced by Cardano (ADA), which took second position by sitting before ETH. ADA has surprised a lot of people by holding its ground better than the other coins. They say don't fall in love with your trading coins, which is a very good advice but ADA for me is both for long term holding and for trading as well. It has passed the test with flying colors. ADA hodlers are not joking!

Binance Coin (BNB)

Unfortunately BNB is not doing so well and the reason for that 61% drop from the 2021's high is not just the market. The latest problems Binance is facing has also contributed to the correction. I still trust the project and think this is a temporary setback, which will be sorted soon. Am I too optimistic? It's possible.

Chainlink (LINK)

Compared to ADA, LINK took a bigger hit, being at -73% below 2021's high. The difference between the two is -18%, which is quite a lot, no matter how you look at it. I've been expecting more from LINK to be honest.

Polkadot (DOT)

DOT is even worth as it's down -78% this year and below DOGE, can you believe it?

Bottom Line

Portfolios are structured based on certain criteria and can and should be changed, reorganized anytime the portfolio owner thinks it's necessary. It's recommended to hodl good coins, whatever that means to you.

Spot wallets are easy to manage as you don't fall in love with your coins, you see an opportunity, jump in, then when it's time to take profits, you sell. Then look for the next opportunity.

Long term portfolios however work differently. You buy and hold, till time comes, which means months, years.

Now that we've witnessed these swings and can compare results, it's time to rethink our portfolio structure. I will certainly do! The changes I make may bring me more benefits in the future.

The only thing that remains unchanged is my investment on Hive, Leofinance and CUBDeFi.

I've been in CUBDeFi since the beginning, the USD value of my portfolio has been going up and down ever since, but that's how DeFi works. I trust the project and know it needs time to grow and I'm patient.

I haven't sold a single CUB and have no intention to sell till it's time. Right now I'm enjoying watching my stake grow day by day. This is the time to accumulate and enjoy those APY's.

What about you? Are you going to change anything in your long term portfolio?

Posted Using LeoFinance Beta

Not really. I am just/only collecting Hive, Hive Dollars (HBD) and other Hive related currencies/coins/tokens. And maybe some NFTs. Mainly Splinterlands cards. Nowadays I rarely play Splinterlands, but I still receive reward cards from time to time.

Sometimes I also give Hive related currencies/coins/tokens to others.

Like now. Have some !LUV and !PIZZA.

@erikah, you've been given LUV from @xplosive.

Check the LUV in your H-E wallet. Daily limits change soon, check @LUVshares for info. (1/3)

@erikah! I sent you a slice of $PIZZA on behalf of @xplosive.

Learn more about $PIZZA Token at hive.pizza (1/10)

I've got my CUB, all the way back to the first few tokens that were airdropped to LEO HODLers; I keep adding bits and pieces to it because I believe it's a worthy project. That belief stands independently of whether or not the markets are up or down.

I have a bit of (very old) BTC that I am just hanging onto because I have no particular reason to sell it. Since I paid less than $1000 per BTC for it, I'm not really losing sleep.

The rest of my crypto is really just "small play money," and that means I'll keep staking LEO and it means I have a small stake in POB as a sort of "wild card."

I'm a long term part of this market, and since I don't think cryptos will outright go away I'm not too worried.

=^..^=

Posted Using LeoFinance Beta

It's MORE Bitcoin for me ATM.

Well, some more, and more stables to pile in if we dip lower.

No more alts for me, I think I'm growing up.

Posted Using LeoFinance Beta

I'm kind of leanings this way myself lol. I’ve got good ETH but I want to maximize bitcoin more until I get to a comfortable spot with it. Maybe more litecoin but not much else.

Awe - I have an irrational soft spot for more LiteCoin too!

Posted Using LeoFinance Beta

Lol, this was funny. I'm not against ALTs, but statistics show which got hurt more, so I think I should take this list into consideration when deciding to diversify.

Plus with BTC you can never go wrong.

Posted Using LeoFinance Beta

Well until people start asking 'why BTC exactly'?

Posted Using LeoFinance Beta

I am waiting for ADA to launch smart contracts. Once that happens then I'll decide whether I should continue to hold or move into a better asset.

I'm thinking of holding but diversifying is also important.

Posted Using LeoFinance Beta

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for Proposal

Delegate HP and earn more

Diversity is a good thing to have in any portfolio but it’s helpful to have it in crypto right now. Trading isn’t something that’s easy to do living in America but we can still buy some of the things we get access to just to hold it for a while. I’ve been trying to buy a little bit of something each week for the past several weeks instead of just dumping a few hundred dollars at a bad time like I was preciously. It should hopefully work out as a better strategy for me, I know others use it well!

I know Binance is not available in the US, but there are other exchanges, I'm sure you can find a decent one.

Buying little by little is a good strategy, that's what I'm doing too.

Good luck in buying the dip 🙂 💰

Posted Using LeoFinance Beta

I've got access to a pretty good amount of coins but what gets me is the selling aspect. They tax anything we sell unless we buy back at a lower price. I'm not looking forward to what mistakes I made earlier this year, and the tax implications of that lol. I'm hoping my buying back has reduced that but I don't know how it will go. I'll take a look at it in a few weeks! lol

I'm lucky in that regard. As long as I don't withdraw my money, I'm not subject to taxing.

I hope things will change worldwide soon (although I don't think so) and taxing crypto will be softened.

Posted Using LeoFinance Beta