Bitcoin's "slow knife cut" fall, DeFi and Polkadot present irrational prosperity

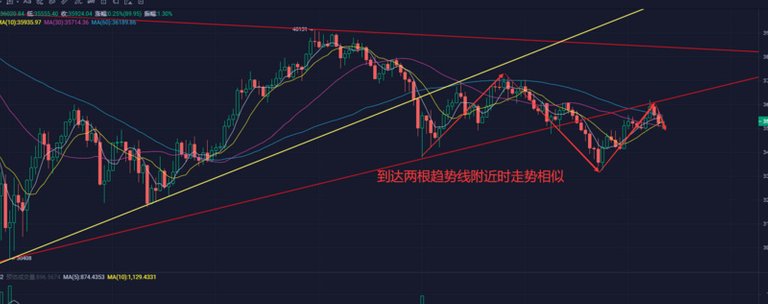

Yesterday’s market was a process of bottoming out in the day. Starting from 10 am, the market continued to fall from above 36,700 U.S. dollars, and received eight hour-level negative lines. By 18:00, the market reached the lowest level of 33,800 U.S. dollars in the day. The callback approached 3,000 US dollars, and then entered a rebound, and it was a regular oscillating rebound, and finally returned to above 36,000 US dollars. Bitcoin is still weak as a whole. Yesterday, if we only look at the market before the rebound, it was a very weak trend, and it was not a sharp drop in a short period of time, but a market that was slowly scraped by a blunt knife. The decline is relatively large, which can be regarded as the dealer in the market, but this kind of slow market is very damaging to the enthusiasm of the market. After all, you can expect a rebound after the sharp drop. After it is over, you can continue to rebound on the second bottom the next day. The slow knife market will give the market a weak sentiment as a whole, although it is true in the near term.

This is also the market atmosphere that everyone feels recently. Except for the different time periods in the day, the market on Sundays and weekends are still relatively consistent. After falling below the original trend line, they first bottom out and then rebound to near the original upward trend line. , Do not break, continue to test, the range of the test is not deep, or the same sentence, it is a blow to market enthusiasm. But this is good. In this kind of mood, you may not have to worry about the general direction. The market often collapses in a period of extreme excitement in the market atmosphere. When the current market sentiment is already down, there is no need to worry too much about this issue. Today’s daytime is the main time to look at the situation of the reversal. The support point for the reversal is not near yesterday’s intraday low of 33800. Today is Martin Luther King Jr. Day. The US financial market is closed today and still does not go to work at night, so today Still not too optimistic.

Regarding the US stock market, there are still issues to worry about in the next few days. Today is January 18, and January 20 is the inauguration of the new President Biden. By then, Biden will officially take the oath and become the President of the United States. However, according to the "learning from the past" the "domestic distress" incident triggered by Trump supporters on January 6, this time the presidential inauguration does not look so peaceful, and Trump has announced that he will not attend the inauguration of the new president. According to convention, current presidents generally attend the inauguration of new presidents. For example, Obama participated in Trump’s inauguration four years ago, and this time Biden’s inauguration has served as presidents, such as Obama, Clinton and Bush Jr. I will participate in the event, but Trump will not participate. This seems to mean that the chaos has been prepared. Just imagine if Trump is present, when a riot occurs, Trump will not come out and shout. These are all his support. Come out and talk, this is not what you want, so you just don't go and leave the troubles to the people present.

As long as there is no extreme situation (such as an assassination), Biden’s inauguration is a certainty, and what will greet Biden after taking office will be a series of plans that can exercise the presidential power, although Biden can only officially take office on January 20 And only after that can the presidential power be exercised, but before that, Biden’s ruling party has formulated a series of plans, which will be promulgated after taking office.

After Biden took office, a series of planning directions can be seen from previous studies, such as the most urgent new crown epidemic control, and the economic downturn stimulus plan, etc. The most important thing for the financial market is of course the economy. The stimulus plan determines how much money will flow into the financial market.

Regarding Bitcoin, in addition to the stimulus plan, there is another important point that everyone cannot ignore. Everyone knows that U.S. stocks and the U.S. dollar cannot have both in the face of a bad economy. If you want to ensure that the stock market can rise, then take A series of measures such as water releases and interest rate cuts by the Fed are devaluing the U.S. dollar, but if the U.S. dollar is guaranteed not to depreciate, the stock market crash will happen at any time. Before Trump, he was desperately protecting the stock market when he was in office, and the U.S. dollar continued to devalue .

But Yellen, the next nominee for the U.S. Treasury secretary, may break the previous high rise of U.S. stocks. Everyone may not know Yellen. Yellen was also the chairman of the Federal Reserve during Obama’s tenure. According to Yellen’s past style, A U.S. dollar supremacist, the market expects that if he is elected U.S. Treasury Secretary, Mahjong reaffirms its commitment to the market to determine the exchange rate, making it clear that the United States will not seek a weaker dollar to gain a competitive advantage. The policy outlined by Yellen will represent the return of the traditional posture of the United States towards the dollar. This is what the American people expect of the new government or the Biden administration for Yellen.

But new problems will also arise. What about US stocks? If the strength of the U.S. dollar is to be guaranteed, the first thing is probably to raise interest rates. When the economy has not recovered, the decline of U.S. stocks is a certainty, and it may even trigger a butterfly effect. Will the "312" incident be repeated then? Of course, this is a very extreme situation. It will not happen unless necessary. It’s just that Yellen’s coming to power means the strength of the US dollar, which is not a good thing for Bitcoin and gold. The US dollar is strong when the economy is in good condition. It is the icing on the cake for US stocks, but not for 2021.

Mainstream currency

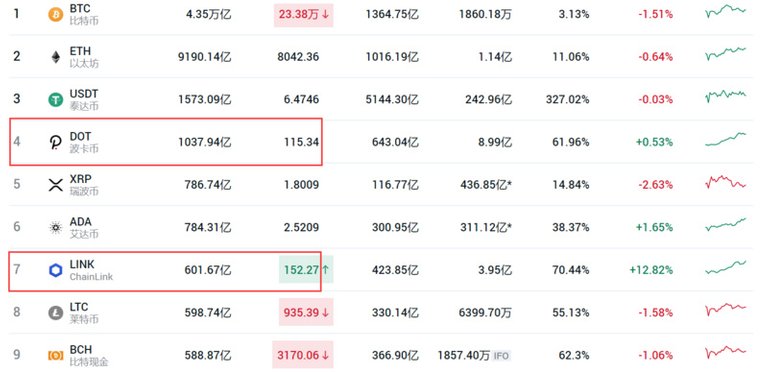

Investors who hold mainstream currencies recently complained repeatedly. Seeing that DeFi currencies continue to rise, breaking new highs one after another, the mainstream currencies that are set off are extremely shabby. Not only that, but DOT is currently basically ranked fourth in market value, excluding stable currencies USDT is only behind BTC and ETH, ranking third.

And LINK’s top ten yesterday also squeezed LTC and BCH down by one position. LINK currently ranks seventh in market value. It seems that it has entered a period of survival of the fittest. The old currencies that have not contributed have gone down, and the new currencies began to rise. Times began to change.

However, when some old currencies have indeed come to abdicate, huge problems like XRP have been investigated and can still stay in the fifth place. I can only sigh the power of the original dealer and enough coins issued, and EOS has already been counted. It’s not surprising that the currency that was eliminated by the market fell out of the top ten in 2017. The same is true for BSV, and ADA, which was previously only able to "MLM in the countryside", can still stay in the top ten. 6. I can only lament that investors' requirements are really not high.

The top ten rankings will be shuffled sooner or later, and it is not surprising that DOT and LINK are "upper". One is the boss of the Polkadot, the other is the leader of the oracle, and ETH is the facade of the Ethereum public chain, plus Bitcoin These four are nailed down, and others are like stable coins. This should not be the case. USDT currently accounts for too high a share. It should be re-segmented with other stable coins. The market value should also go down. An old currency such as LTC and BCH, or the leading currency in DeFi should be in the upper position, such as UNI, such as AAVE, such as SUSHI, but due to the current overall market value of DeFi is still too small, so the currency impact is limited In the future, when DeFi gradually grows decentralized exchanges to share the share of centralized exchanges, the market value of DeFi currencies will have a chance to hit the top ten, and the time for mainstream currencies to pay for their money is getting shorter and shorter.

In terms of market conditions, other mainstream currencies have similar trends with Bitcoin, but ETH has been suppressed very strongly. The day before yesterday, when Bitcoin was so weak, it was necessary to try to reach the top. Just imagine that ETH was currently out of stock. On the other hand, DeFi on the public chain has become the market leader. ETH really wants to be low-key and can't get up.

So if there is a hot reincarnation, for example, if Bitcoin and mainstream currencies begin to explode, then ETH may lead the rise. After all, ETH is currently stagnating, and sooner or later there will be a chance to vent.

Platform currency

Unexpectedly, the current platform currency is not weak. Although it is not very strong, it is very different if it can maintain a positive upward trend. From the disk, it can be seen that the current platform currency and mainstream currency have gone out A completely different trend is generally related to the flow of hot money. Anyway, funds flow everywhere except mainstream coins and Bitcoin.

BNB rose by more than 10% in two days over the weekend and has once again set a new record high. HT can also see that it has already stepped out of a strong trend of 5 consecutive positives. OKB is slightly weaker but it is an upward trend. In addition to the flow of hot money, it is expected to be related to the strength of DeFi. After all, major platforms also have mining projects as key strategies. This step is really curious. Previously, major platforms launched mining projects and the central platform DeFi were roughly In September, it was also when DeFi was about to die, but it was just preparations. The next DeFi outbreak is an opportunity. This also shows the foresight of these platforms. When it is time to bet, they are not merciless and can see DeFi at a glance. What position will it occupy in the market in the future?

But I don’t know if this is a good thing for the market. The meaning of DeFi itself is to depart from centralized trading and centralized exchanges. However, with the intervention of centralized exchanges, DeFi seems to be on the way of developing and competing against centralized exchanges. Many difficulties have been added.

DeFi

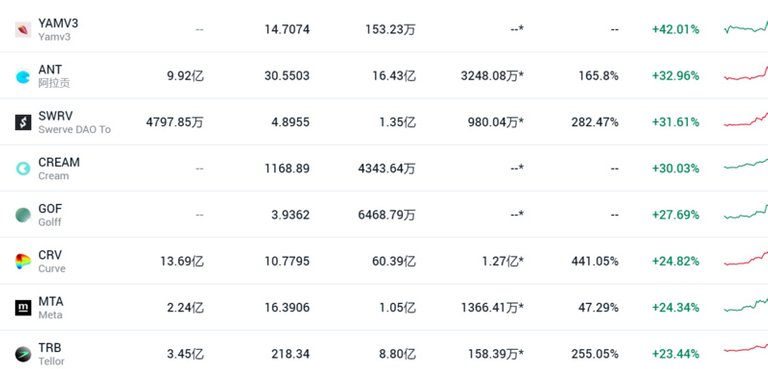

The DeFi concept currency deeply reflects the liquidity of funds. The top-ranked currency that rose the day before yesterday is completely different from yesterday's currency. There is roughly only one CRV still in it, but the AAVE, UNI, and SNX that rose the day before yesterday are all Going to the bottom of the list, currencies like YAMV3, SWRV, and CREAM began to appear.

It can be further confirmed that the current hot money of Bitcoin and mainstream currencies has come to the DeFi market. It is really rare to say that the same rise in rotation is really rare, but it should be noted that the reasons for this increase in currencies and July to August seem to be different. Too much the same. After all, what decentralized lending, liquidity mining, the first currency issuance and other concepts to promote the rise before, but this time seems to be an unreasonable rise, and it may also be silent for the two months of DeFi. It is a reward for development, but the duration of this situation is very uncertain. It is very likely that it will come and go quickly. This is called "irrational prosperity", so you still need to pay more attention and be cautious. Drop the bag for safety.

Polka

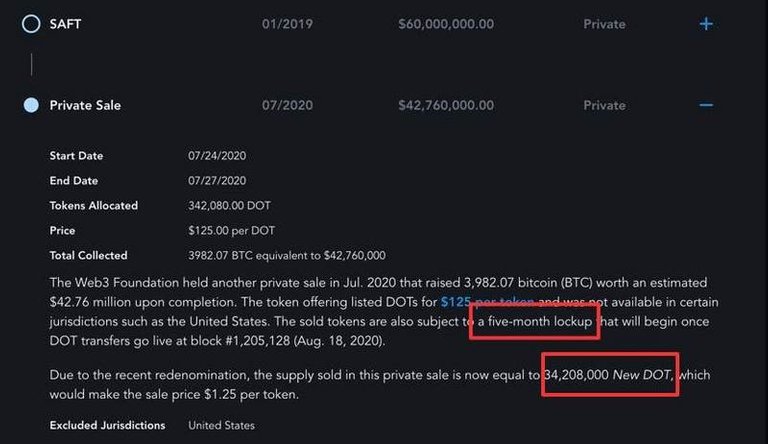

Although DOT did not continue to set new highs in the past two days, there was a callback yesterday, but it is still at a high level. It seems that it has chosen to rebound first. However, today DOT has factors that need to be paid attention to. Earlier news said that Polkadot (DOT ) Will unlock 34.208 million tokens today. This unlocked share comes from a private placement round of financing in 2020. The investor cost is 1.25 USD/DOT (after the split), except for the 300 million DOT held by the Web3 Foundation. In addition, approximately 116 million DOTs will be used for future financing and flow into the market.

But after confirmation, the third round of private equity share held last year was unlocked on January 10 this year, so there is no need to worry about the crisis of unlocking in the short term, but the problem is that the irrational prosperity of DOT is also very serious. The current situation Just wait to see who is more unlucky and become the last batch of takers. The price rises and falls are uncertain, but there will be a period of return to rationality, and you still need to pay attention.

Congratulations @filoso! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP