Layered Farming Explained - The Future Of CUB?

The CubFinance roadmap shows one very important thing, that is the latest hype in the DeFi world: Layered Farming, developed by Goose Finance, a clone of Pancake Swap - and CubFinance is a clone of both. But what exactly is it and how does it help to bring more value to the CUB token?

Keeping Up A High APR

The whole idea of CubFinance is, to create high returns for liquidity providers with mining the CUB token and use the vault revenue to burn CUB and LEO. We started with a very high inflation, which is lowered by 33% in the second week and another 33% in the third. This will bring down the APR, combined with more and more liquidity entering the farms and dens, competing for the CUB inflation. The burning from the revenue vault can only counter that to a certain degree.

Goose Incubators

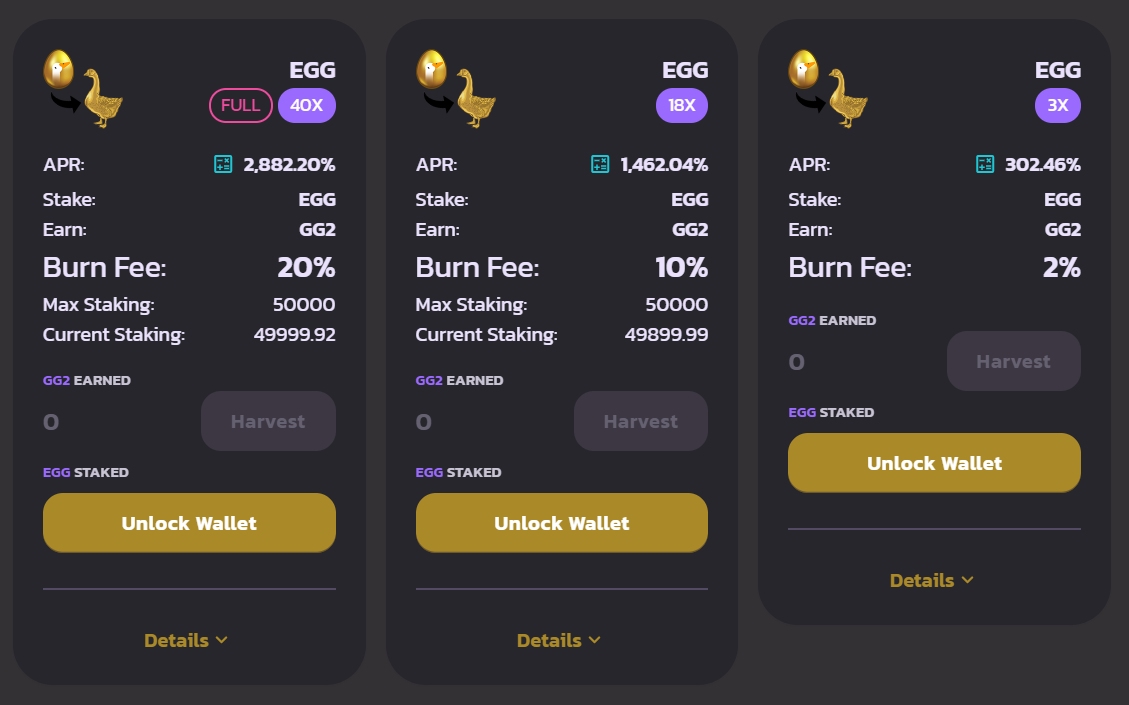

Goose Finance, a clone of PancakeSwap, introduced Layered Farming, as a method to provide more high APR farms and dens, to counter the inflation of their native EGG token. After the initial phase was over, they started the layered farming protocol, allowing everyone to stake their EGGs in so-called "incubators" (Goose Finance uses the term "Nests" for what we call "Dens" - "Incubators" are the same but exclusively for layered tokens) to earn a new token, that they call GGX (Golden Goose X, the X stands for the number of each layer). These new tokens are limited to 1 million GGX each and each week a new one is coming out (they are currently in week 2 with the GG2 token).

To enter these new incubators, a HUGE 20% burning fee has to be paid up front, for the most profitable one, followed by less profitable ones with 10% and one with 2%. The burning fee immediately burns the EGG tokens provided. The first and second incubator are limited to 50,000 max staking EGGs, while the least profitable one is unlimited.

In week 2, they introduced also two incubators using the GG1 token, to earn the GG2 token - one with 6% and one with 2% burning fees.

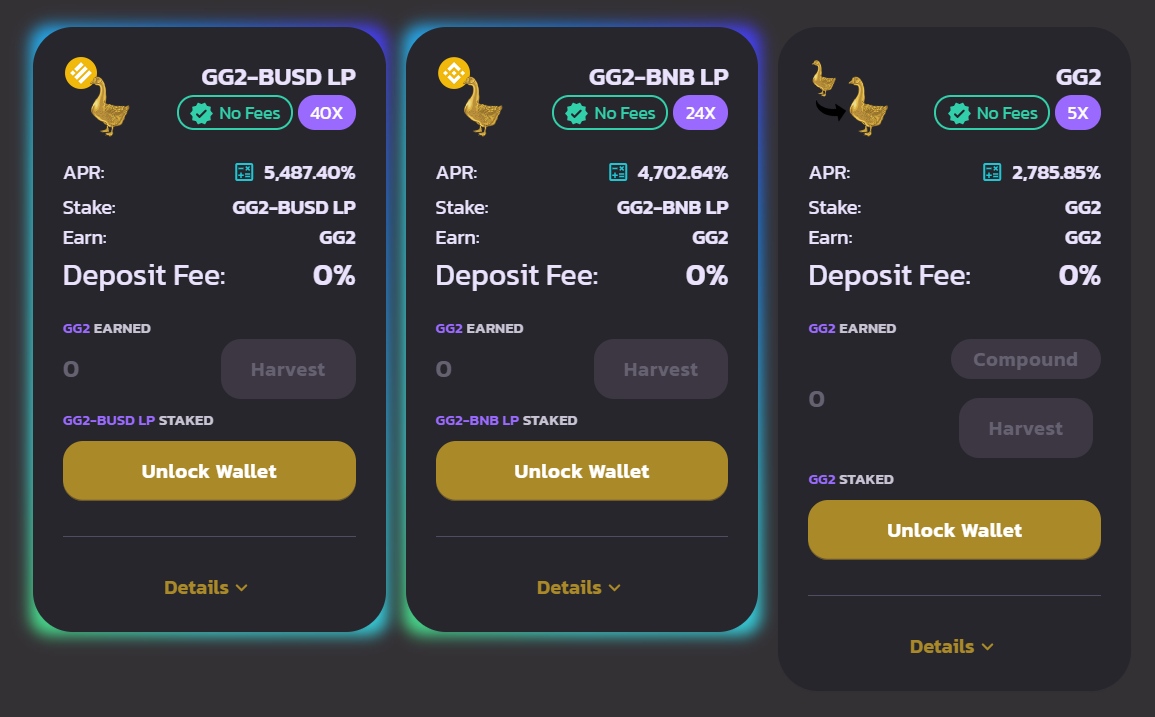

Goose Farms

Just like the normal Farms, that produce on Goose Finance the native EGG token (or on CubFinance the CUB token), by pooling two tokens with each other in a liquidity pool, you can pool your earned GGX with other tokens as well. This is limited to GG1-BUSD and GG1-BNB farms, though. Additionally, there are Nests (under the layered Farms, sigh for all that confusing terminology), where you can just stake a single token like GG1 itself, BTCB, ETH, DAI and so on to earn GG1 with them, for a 4% deposit fee (which is used to buy and burn EGG and GG1 AND pay the devs - something that will likely not be the case on CubFinance). Another part of the deposit fees goes into the HOUSE (see next point).

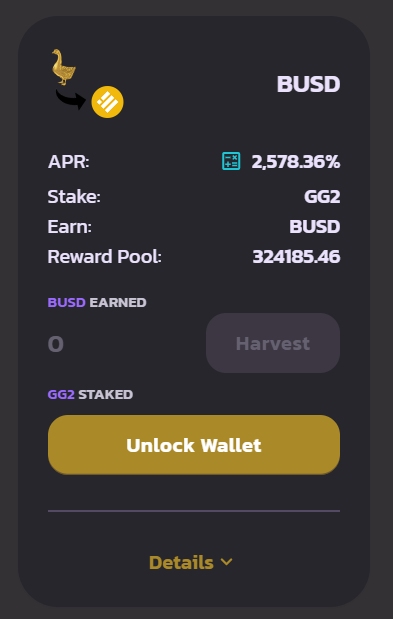

Goose House

Finally, we get the House, where BUSD is being bought with parts of the deposit fees from the Goose Farms and provided as a reward instead of EGG or GG1. Here you can stake GG1 to earn BUSD directly, which is a pretty interesting one itself, allowing to farm a stable coin. This Nest Incubator Den Stake House (sigh) has no burn fee, similar to all the pools and stakes that work directly with the native assets of the platform.

There is a limit to the rewards though, which are fed out of the deposit fees. Goose Finance writes in their Docs, that they are still experimenting with this feature.

Funny, because the entire Layered Farming is a huge experiment, that nobody has done before them.

Layer 2

After one week, the entire layer 1 doesn't stop. There is enough inflation for about a month of farming. However, APRs are going down and the next layer starts. In week 2 we got GG2, which I have already shown on all the screenshots above (in case you wondered). Everything that was introduced in week 1 of the Layered Farming, is now cloned again on the second layer, where you can farm GG2, with fresh and high APRs in all Nests, Farms and the House. The only difference is, that you cannot use the native EGG token anymore. Here, you can only continue using the GG1 token - or any other asset for which are Farms available and for which you are ready to pay the deposit fees. Also, the deposit fees from here are now used to also buy back and burn the GG1 token as well.

Ideally, this is now to be continued, week after week after week, until we hit GG52 after one year, and so on and so forth...

Bot Problems

This all sounds pretty weird and complicated at first but is actually pretty straight-forward. The whole system is designed to bring more value to the EGG token and keep liquidity providers on the platform, instead of moving on to the next clone with high APRs.

However, they did not anticipate the power of clever developers with deep pockets (or deep pockets with clever developers):

The max staking in the Incubators worked well in week 1 but already in week 2, this system ran into a bot problem, whereby bots managed to fill the max stake before anyone else. This lead to a massive wave of disappointment among the Goose Finance farmers, who, rightfully so, felt left out.

Layered Farming On CubFinance

There is nothing really known about how this will work with CUB. All we know is that CubFinance is a clone of Goose Finance and has already announced in the roadmap that Layered Farming will come. Leo OG @khaleelkazi is watching very closely what is happening on Goose and how the community, the money, the bots and the public code is developing. If Goose will find a solution for the bots, we will fork their code, if not, we will get our own solutions.

It is pretty helpful that Goose is frontrunning us, clearing the way for CubFinance to make it as good or better. Afterall, 100% of the depost fees on CubFinance is used to burn CUB and LEO. That alone is already an advantage, plus the diamond paws of the LEO community, hodling their CUBs and the two-year track record of LeoFinance, one of the most respected communities on the Hive blockchain.

If this experiment doesn't end in a total disaster on Goose Finance, it will probably not take long, before Layered Farming is rolled out on CubFinance as well. I suspect one or two weeks after week 3 brought down the CUB inflation to 28,800 CUBs per day. Then we will know more and get back crazy APRs.

Posted Using LeoFinance Beta

Another excellent explainer. You're killing it with these lately.

I was trying to Google and YouTube how layered farming works to be ready for the CubFi addition, but ended up giving up.

Complex!

Posted Using LeoFinance Beta

Cub was Prince Charming, kissing me out of my sleep. It's been a while since I was on fire like that.

100%! The videos on YouTube are really not doing a good job explaining it all. That's why I did the research myself and wrote this article.

Appreciate this man...I'm being a sponge with all this stuff, and while some of it is way over my head, posts like this help keep things easier to understand.

What a write up @flauwy, thanks for the detailed explanation on the topic. You are on fire, keep such posts coming because it's difficult to understand such concepts on our own. I could not understand the whole thing at one, might have to re-read a couple of times to fully understand it. Bookmarked! Thanks a lot man.

Posted Using LeoFinance Beta

I have to say thank you again for explaining these things to us. We're learning every day and posts like yours can help a lot. Keep up the good work!

Posted Using LeoFinance Beta

One question I have is how is the APR so high? Who's paying these high APR's for us to earn?

Posted Using LeoFinance Beta

Basically the base token inflation. And both layer 1 and 2 are also created from fresh air. Is not much more than a glorified ponzi, as there is not a single dollar coming from outside other than the one deposited in farms by yield farmers, so the result for the commoner is pretty bleak.

The only reason I know CUB is different is because its going to be used in all kinds of defi use cases by the team, effectively brining value from the outside to CUB holders. For example, the ETH and BNB bridge will make that any crypto holder moving to Leo Finance suit of apps will leave value for CUB holders in the form of deposit or exchange fees. That would be pure value generation.

But this layered thing is a pleb's trap. My 2 cents, ofc.

Posted Using LeoFinance Beta

Congratulations @flauwy! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next payout target is 22000 HP.

The unit is Hive Power equivalent because your rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPlet's see where it goes. I see some things on the horizon that will make cub token really useful :)

Posted Using LeoFinance Beta