When will Avalanche reach $100?

After Avalanche (AVAX) hit a new all time high during a market-wide correction, traders are now watching the $100 psychological level.

How good is the feeling you get when your altcoin bags actually go up during a crypto market-wide dump.

It’s not something we get to experience all that often, but for those of us in Avalanche (AVAX) this week, you know exactly the vibe I’m talking about.

In this quick supplement to our guide to Avalanche (AVAX), we take a look at what’s behind this latest price rip and discuss whether $100 is truly now on the cards.

Avalanche (AVAX) hits new ATH

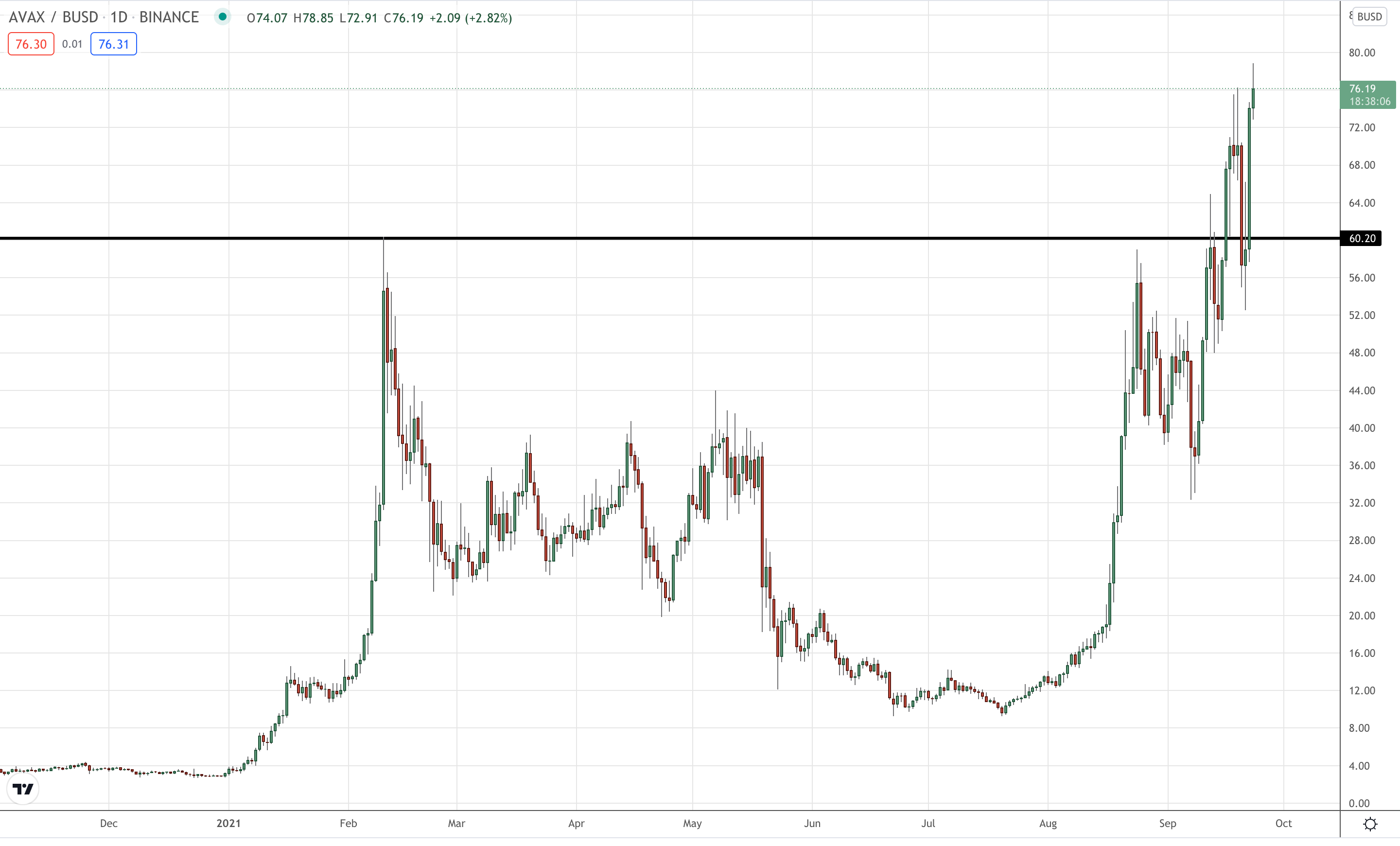

Let’s head on over to TradingView and bring up an Avalanche daily chart.

AVAX/USD Daily:

In today’s context, the only price zone that matters is the $60 level that I’ve drawn on the chart above.

You can see that this level acted as resistance back in February during the early 2021 pump, and has now been respected on both sides since.

But its the restest of previous resistance as support this week that I really wanted to highlight here.

In a market wide dump, for the AVAX price to only pullback as far as the first support level before bouncing hard, shows some serious strength.

There’s no doubt the bulls are large and in charge here.

What’s driving the bullish momentum in AVAX?

We’re seeing heavy inflows enter the protocol through its cross-chain bridge, while institutional investors such as Polychain Capital, Three Arrows Capital and Dragonfly capital, have come together to pledge a total of $230 million in funding for the network.

If you doubted Avalanche’s position as a true challenger to Ethereum’s position as the dominant smart contract platform, then this sort of backing should have you taking notice.

Corporate support and institutional investment can only get you so far (I mean just ask EOS…), so the fact that we’re seeing an actual migration of funds into Avalanche based DeFi platforms such as the Pangolin DEX is great to see.

Evidence of the asset migration can be found in the total value locked (TVL) data showin in the following Defi Llama chart:

As you can see, the TVL on Avalanche has been climbing rapidly since mid August and continues to hit ATHs alongside price.

So when $100 Avalanche (AVAX)?

If a market wide dump couldn’t shake the Avalanche price to break even a single support/resistance zone, then I can’t stress how strong the bulls are right now.

Combine this with the TVL data following price higher and corporate dollars backing developement within the ecosystem, $100 Avalanche (AVAX) won’t take long.

Avalanche is now a major player in the smart contracts game and a proper repricing of the AVAX token won’t be far away.

Best of probabilities to you.

Direct from the desk of Dane Williams.

Why not leave a comment and share your thoughts on when Avalanche will reach $100 within the comments section below? All comments that add something to the discussion will be upvoted.

This Avalanche crypto blog is exclusive to leofinance.io.

Posted Using LeoFinance Beta

Wow!

Definitely missed the rocket ship on this moon shot!

I will have to look into it now.

So much is happening in the cryptosphere it's hard to keep up.

Now I must contemplate finding another avalanche or investing in the real Avalanche...

Posted Using LeoFinance Beta

You could buy Avalanche's AVAX token.

If you think you've missed the boat however, you could simply use some of Avalanche's DeFi apps like Pangolin?

Cheaper and higher yields on offer than some of those on Ethereum.

Posted Using LeoFinance Beta

Good point, I like investing in defi more then buying and holding only, as it gives me daily income and appreciation.

Posted Using LeoFinance Beta

If that trade break high high,we will expect the bull market to continue but if it didn't break the higher high we will expect selling

Posted Using LeoFinance Beta

Truly insightful technical analysis, William!

Posted Using LeoFinance Beta

Thank you

Posted Using LeoFinance Beta

And, the TVL wars begin. It will be amazing to witness the rise of all these platforms. I wonder about the future of DeFi and think how disruptive it will be in the next five years :)

Posted Using LeoFinance Beta

Do you think the SEC or other government actors could kill it? I hear they are making bold moves against DeFi.

Posted Using LeoFinance Beta

The SEC (or any other backward state regulator) can't kill DeFi.

Their regulatory oversight only extends to centralised companies within the United States.

Not the globally decentralised protocols that DeFi platforms run on.

What we're seeing with UniSwap Labs being forced to remove tokens is a great example.

The privately-owned UniSwap Labs runs the domain that points to an IPFS hosted instance of the Uniswap Interface.

As a US company, they're the SEC's bitch.

But they can't touch the Uniswap Protocol which is the back-end where the DeFi magic happens.

DeFi is unkillable by any one, backward or selfish nation-state :)

Posted Using LeoFinance Beta

I'm a huge proponent of cross-chain interoperability and think the maxi arguments are so dumb.

While the major platforms are definitely competing for capital, I do think that the best will be able to co-exist.

For now it looks like Avalanche is going to be a part of that conversation.

Posted Using LeoFinance Beta

I'm so embarrassed that I've ignored Avalanche until just now. I'm FOMOing on in! Wheeee!

Posted Using LeoFinance Beta

What could possibly go wrong?! ;)

Posted Using LeoFinance Beta