How Can You Earn a Much Higher APR on Your CRO Than on the Crypto.com App or Exchange?

For anyone clinging to the old financial system, this needs to get through to them: defi is the future.

Out of the crypto-related cefi that I use, two already understood that and plunged into the defi territory. One is Binance, the other is Crypto.com. There might be others I haven't remarked yet or that I don't use.

Both released their own public chains. Binance has their Binance Smart Chain, a copy of Ethereum except fees and governance. So they chose the tried and tested option.

Crypto.com went with the new tech and implemented a chain based on Cosmos SDK, a newer blockchain hub which attempts to interlink the partner blockchains via a protocol called IBC (Inter-Blockchain Communication). I'm not going into details about IBC because it's not the aim of this post, but enjoy researching if you want to.

Being linked to the Cosmos Hub, Crypto.org chain (.org, not .com, same as Binance) is now linked to any other blockchain in the ecosystem. That includes the Osmosis AMM interface and defi platform.

Where am I going with this?

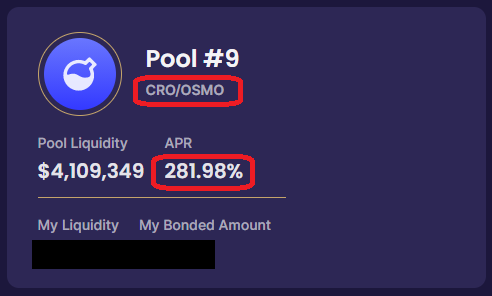

Let me show you a screenshot.

Here's a breakdown:

What you see above is the kind of returns liquidity providers receive on the CRO/OSMO pool on Osmosis currently. It has been around those values for a while now.

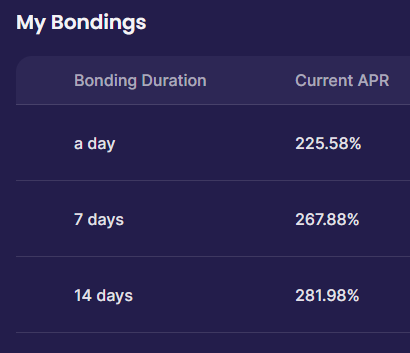

So 225% APR for a one-day bonding and even 281% APR for a 14-day bonding.

Compare this with the 10% staking reward yearly I think it is for CRO on the Crypto.com exchange (at least that was the rate for me before I unstaked), and the 180-day lock period. Even compare with the ~15% APR one would seem to receive on the Crypto.org defi app, if you stake there.

That's 10-19x more currently.

There are more risks too, to justify the high APR:

- impermanent loss, since this is a dual-asset pool (CRO/OSMO), compared to only CRO

- new tech, new platform risk

- no customer support to fix things in case the beginners make mistakes in the defi environment

- probably no stable coin yet on Cosmos Hub, but they are coming

That being said, I still moved all my CRO besides what I have staked for the Visa Card benefits on the app to Osmosis and into the CRO/OSMO pool.

If you don't like to take a little bit of risk, this is probably not for you. Same if you don't want to go through a pretty complicated process for the average person, that involves installing new things and moving funds multiple times.

Otherwise, this might be a good way to speed up the accruing of CRO. In my case, I thought it's the best way to reach the necessary amount to upgrade my card (thus the benefits), without investing more to buy CRO.

But you decide for yourself if that's what you'd like to do.

Here's the process you should go through, assuming you start from scratch, only with your crypto.com account and some available CRO in it. Of course, you can choose to start using the crypto.com app* at any time if you decide so, if you are currently not a user.

(*) That's my referral link, both of us will receive a bonus if you join, under certain conditions.

Let's go:

- If you never used Cosmos before, @jk6276 created a very easy to follow guide at the end of this post.

- To transfer CRO from Crypto.com exchange or app to Crypto.org Chain - where you need it - you have to create a Crypto.org Chain wallet. I used Crypto.org Chain Desktop Wallet, but I suppose you can go a different route, as long as you end up on your wallet on the Crypto.org Chain.

- From the exchange or the app - where you have the CRO to move - you need to initiate a withdrawal to an external address, and add the deposit address of your Crypto.org chain wallet as the address to withdraw to. Fees will be insignificant, if I remember correctly the number of zeros, it's 0.0001 CRO per transaction on chain. Anyway, insignificant. Pay attention to move funds via the CRO chain, not as an ERC-20 token!

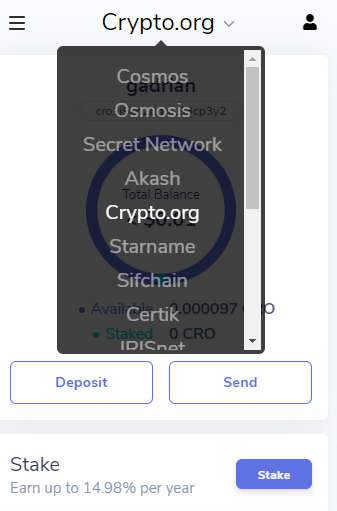

- Now from your Crypto.org chain wallet (in my case the desktop wallet), you have to move funds to the Keplr extension. You just send what you want from the wallet to the Crypto.org wallet on the Keplr extension. Make sure Crypto.org chain is selected when you copy the wallet to send to, like in the image below:

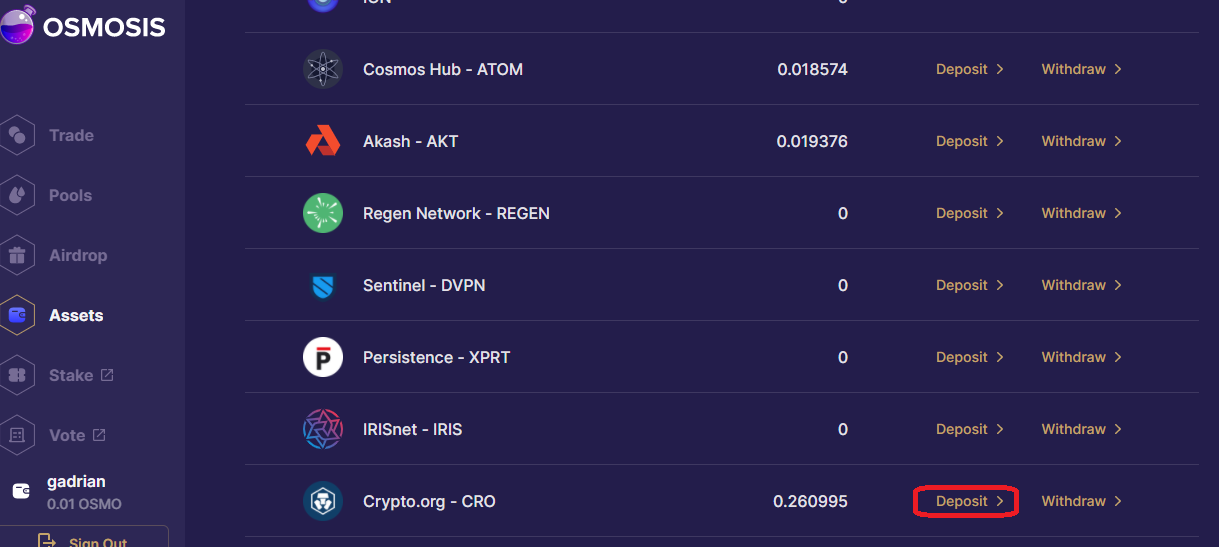

- Ok, after the transaction completes and CRO is on your Crypto.org wallet on Keplr extension, now how do you move it to Osmosis? Normally you'd have to use 'IBC Transfer' on the Keplr extension for such inter-chain transactions, but in this case you don't, because Osmosis helps you a lot. You go to the Osmosis interface and from the Assets page you go to the CRO asset and choose to 'Deposit' it to Osmosis (which behind the scene leads to an IBC transfer).

Once you approve this transfer and it's completed, you'll have your CRO on the Osmosis blockchain.

Once you approve this transfer and it's completed, you'll have your CRO on the Osmosis blockchain. - Now it's time to pool it with OSMO (pool 9). If you don't have a matching amount of OSMO in USD terms, you'll need to trade half of your CRO (or whatever you need till CRO/OSMO you want to pool together are 50:50). Then, choose 'Add/Remove liquidity' from the CRO/OSMO pool.

- After you've added the liquidity, remember to bond it to earn rewards. You have the option to bond it for 1, 7 or 14 days, with increasing APRs. What happens is that if you want to unbond liquidity after a while, it will take the bond duration before it becomes available to you (much like staking and unstaking in the Hive ecosystem). You also can only unbond all liquidity for a certain bond duration, not a fraction of it. That's something I don't like.

- Osmosis reward distribution works in 'epochs', where an epoch means 24 hours. Every epoch you have your rewards and you can compound them (manually) to existing pools then. Since the 'low fee' option for transfers is 0 OSMO, the chain can be considered fee-less at this time.

That's it! I'm not an expert in Cosmos or Osmosis. That would be JK. But if you have questions let me know and I'll see if I know to answer them.

Posted Using LeoFinance Beta

Electronic-terrorism, voice to skull and neuro monitoring on Hive and Steem. You can ignore this, but your going to wish you didnt soon. This is happening whether you believe it or not. https://ecency.com/fyrstikken/@fairandbalanced/i-am-the-only-motherfucker-on-the-internet-pointing-to-a-direct-source-for-voice-to-skull-electronic-terrorism

Great post mate, nice details and walk through. Osmosis is fantastic, and I've been using it since launch day. The APR's have really held up well, still way over 200% on the OSMO pools.

One little tip is that you can start without needing any OSMO, always select "Low Fee" option whatever you are doing on chain. Low fee = zero!!. If you are swapping, there is of course the pool swap fee, but you can do everything with no gas fees.

Thanks for the post, will tweet it out.

Posted Using LeoFinance Beta

Thanks JK, it means a lot coming from you! I really became very fond of Osmosis too. You are right, I didn't make this very clear in my post, but one can start on Osmosis with no OSMO, since the low fee is zero.

Posted Using LeoFinance Beta

Congratulations @gadrian! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 5750 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz: