Only 37% Of The Hive Supply Is Staked....Time To Reduce The Power Down Window Like LEO?

A few hours ago, I was going through the most recent statistics released by @penguinpablo and I chance upon some interesting things. To be specific, of uttermost shock and interest was the discovery that only approximately 37% of the circulating supply of Hive is staked.

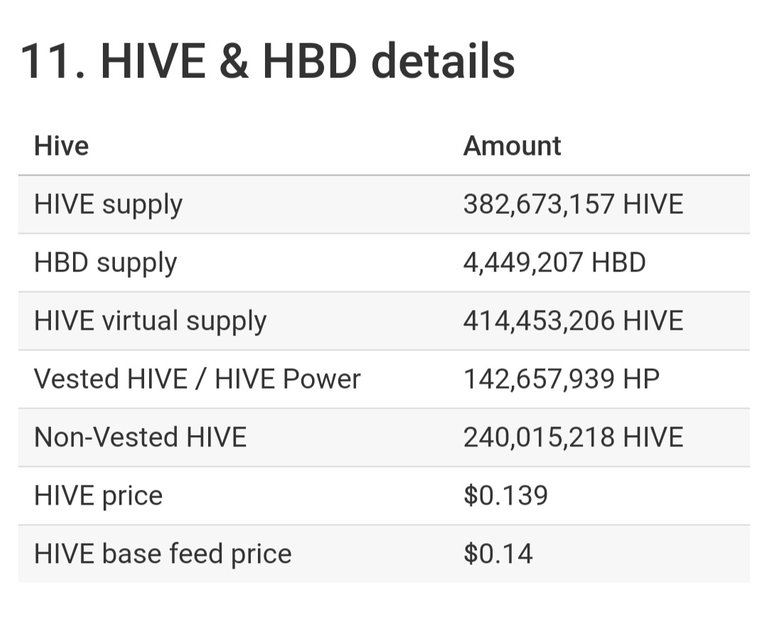

According to the aforementioned statistics, there are a total circulating supply of 382,673,157, out of which only 142,657,939 is staked. This means that we have more liquid Hive than those that are staked. There is a liquid Hive of 240,015,218, which is almost two times the size of the staked Hive. This is very disturbing, even if anyone tries to say otherwise.

A screenshot of @penguinpablo's report

Lately, the price of Hive has been remained almost docile, unresponsive to the brewing fire of an altseason. And one begins to wonder why the price of the token has remained dull for such a long time. Frankly, one finds some of the answers in the above statistics report -- too much liquid Hive ready to hit the market.

The next question would then be, why are investors or Hivers, permit me to use the latter name, finding it unattractive to power up their Hive tokens? While there might be no consensus in the available answers, one stands out I think - the power down window of 13 weeks is outdated and burdensome.

A tradition that can be traced back to the early days of Steem, now appears to be undesirable. Steem has reduced its power down window to 4 weeks. And Steem is not alone. LeoFinance also has a power down period of 4 weeks. Interestingly, there seem to be some evidence that these practices have had significant impact on the prices of both tokens.

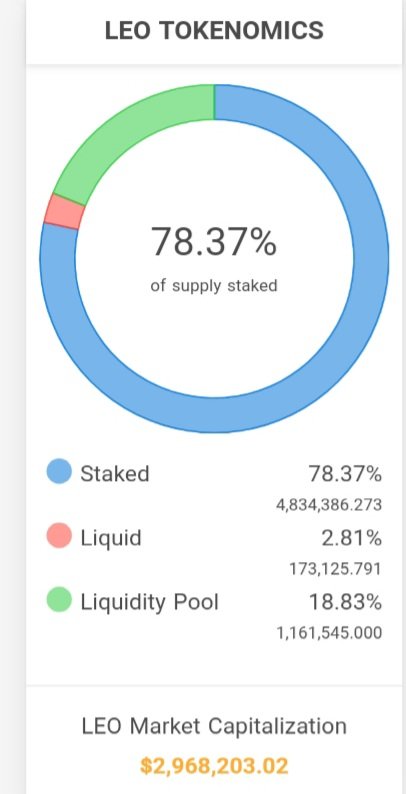

From trading below and then in close range with Hive for months, Steem is now trading at a price about 26% higher than Hive. The much talked about and second-layer wonder coin of the Hive blockchain, LEO, has an incredible 78.37% staked while there are less than 3% of liquid LEO in circulation. Little wonder, the price of the LEO token has continued to reach new all-time highs.

A screenshot of LeoFinance tokenomics page

A shorter power down window gives investors the much needed confidence and leverage that are needed if and when he or she has reasons to exit the market for whatever reason. On the other hand, an investor is scared to stake tokens that will take more than 3 months to eventually withdraw. That is such a long period of time in the world of cryptocurrencies.

Hive is known to be an innovative blockchain and, therefore, it ought to keep abreast of what is happening on other platforms and use such knowledge to improve and attract more investors. In a stake-based Hive economy, we certainly need more investors to power up. If the numbers are pointing us to a direction, then we should take it. If LEO did it and it succeeded, it might be time for us to do it too by the next fork.

Posted Using LeoFinance Beta

Your post has been voted as a part of Encouragement program. Keep up the good work!

Try https://ecency.com and Earn Points in every action (being online, posting, commenting, reblog, vote and more).

Boost your earnings, double reward, double fun! 😉

Support Ecency, in our mission:

Ecency: https://ecency.com/proposals/141

Hivesigner: Vote for Proposal

To start, that is not entirely accurate. Yes you are looking at the powered up numbers but the liquid supply is actually lower. The Hive in the DAO proposal system is not considered "powered up" yet is not truly liquid either.

As for the power down, people seem to think that will get people buying. If we go back a year and a half, people thought changing the reward system would end up getting investors in, it did not.

Leo did not explode in price because of the 4 week power down time. It exploded because of GROWTH. That is what Hive is lacking. Everyone wants to play games with the power down, the inflation, the this and the that instead of focusing upon basic growth principles.

If the active user base was growth at 50% per year, Hive would be mooning. Instead it is flat but that will soon change in a few months.

Posted Using LeoFinance Beta

This is a good observation that I admittedly omitted. However, don't you think that it is not too good to have almost the same amount of Hive in the DAO as the powered up number? 37% is not too far from one-third. At any rate, I get the points that you're trying to make.

Again, this is true. We cannot honestly tie the growth of LEO to the power down time. Yet, I don't think that we should ignore the fact that an average investor like myself and several others would likely power up LEO than I would Hive because of the 3 times shorter unstaking time. In a world of yield farming and liquidity provision, we can't continue to run with a system that was developed over 4 years ahead.

This is absolutely 💯 true. Growth will push price up to a very large extent. Let's growth and also work on our tokenomics. Thanks for stopping by, much respect.

Posted Using LeoFinance Beta