According to the realized market value, Bitcoin actually only accounts for 2% of the gold market value

Earlier, there was a widely circulated argument on the Internet that Bitcoin (BTC) is about to exceed the old data forecast and may occupy more than 10% of the gold market value . However, the CEO of CryptoQuant, Ki Young Ju, tweeted on January 12 that if Bitcoin's current realized market value is used , its share of gold market value is much lower than the rumored proportion.

The price of Bitcoin has risen all the way at the end of 2020 and hit a record high of $42,000 last week. Some experts believe that investors are exchanging gold for Bitcoin. The current market value of gold is 10 trillion U.S. dollars, and Bitcoin has already occupied 7 %about. But Ki said that if we use a more precise way to calculate the realized market value, the actual "transfer" of gold is only 2%.

Ki Young Ju's tweet, image source: Twitter

"People think that Bitcoin accounts for 7% of the gold market value. In fact, they are not. Many Bitcoins are unclaimed, unavailable, and even lost forever. According to the current realized market value, Bitcoin only occupies the gold market value. 2%", Ki said on Twitter: "If digital gold replaces 10% of the current market value of spot gold in the financial market, the price of Bitcoin will be $154,000."

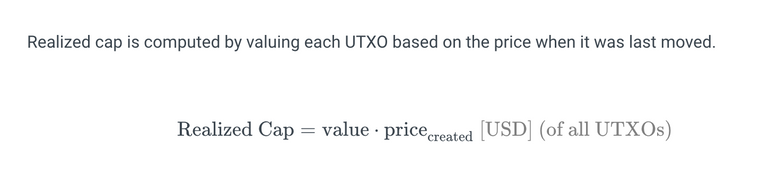

Realized Cap (Realized Cap) is an indicator created by Coin Metrics. This indicator is calculated by calculating the price of each bitcoin at its most recent move, and excluding central escrow exchanges in the calculation process Of coins, thereby precluding speculative behavior. This is in sharp contrast with the traditional standard market capitalization indicator.

Realized market value calculation formula: Image source: Glassnode Academy

The traditional market value is estimated by multiplying the current market price by the liquidity . For example, if the current price of BTC is 10,000 U.S. dollars, then the traditional market value estimation method will treat the cost of each coin as 10,000 U.S. dollars (even if the cost of many old coins is only a few dollars or even lower), this leads to Bitcoin The circulating market value of the coin is calculated to be 178.981 billion U.S. dollars (circulation volume 17898125 BTC * 10,000 U.S. dollars unit price). Realized market value is estimated based on the price of the currency when it was last transferred . Therefore, if someone transferred 1 BTC in 2017, and the market price at that time was US$2500, the cost price of the coin would be US$2500 instead of the current market price of US$10,000.

The economic significance of the realized market value of a cryptocurrency provides a more realistic measure. We can approximate the realized market value (Realized Cap) as a measure of the average cost of a coin holder. According to calculations, the realized market value of Bitcoin on Wednesday was $227 billion, while its standard market value was $645 billion.

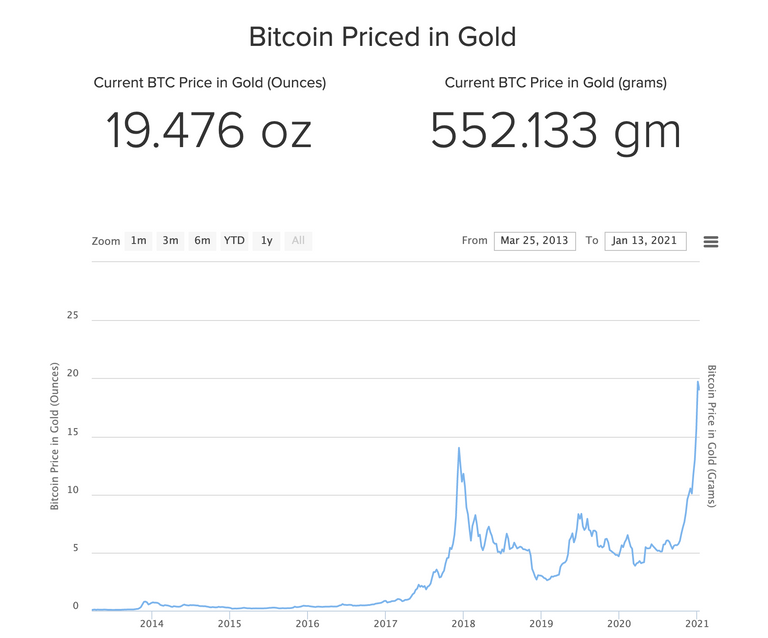

Bitcoin/gold price, picture source Buy Bitcoin Worldwide

But Bitcoin does continue to dominate the gold market. Even if Bitcoin fell to about $30,000 on Monday, gold could not recover the market share occupied by Bitcoin. According to data from Buy Bitcoin Worldwide, as of press time, 1 Bitcoin can currently buy 19.476 ounces of gold.

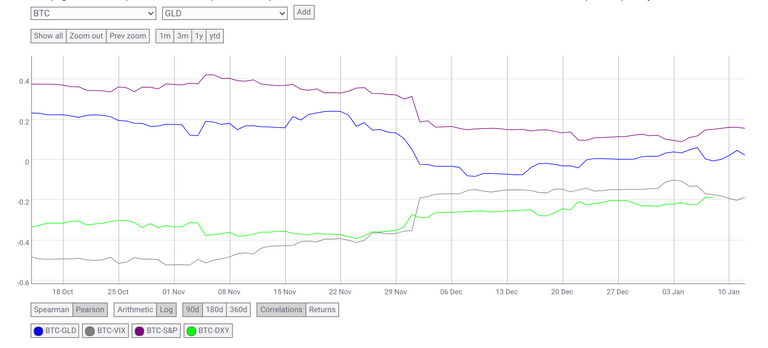

The 90-day chart of the correlation between Bitcoin and gold/VIX/S&P/US Dollar Index, source: Coin Metrics

According to data from Coin Metrics, the correlation between Bitcoin and gold this week tended to zero, significantly lower than the October high. Previously, V Documenting Bitcoin tweeted on Twitter that Bitcoin has transferred the entire market value of $10 trillion in gold in its 12-year history. However, gold investors have different views. Gold expert Peter Schiff has doubts about the value of Bitcoin as a safe-haven asset and the interest of institutional investors in Bitcoin.

Peter Schiff's tweet, image source: Twitter

"Last Friday, the transaction price of Bitcoin was close to 42,000, while on Monday it fell to 30,000. Assets that fell 28% in a single weekend are neither safe-haven assets, nor hedge assets, nor a viable way to hedge against inflation. "He said on Twitter this week: "If you want to gamble, please buy bitcoin. But if you want to hedge against inflation, please buy gold."

Innovative automated World-class crypto trading bot platform

https://www.phptrader.com/invite/ADD4249

Thanks for sharing the report, @hyubei. Yes, the daily fluctuation in Bitcoin prices can be measured in Troy ounces of Gold.

Source of plagiarism

Direct translation without giving credit to the original author is Plagiarism.

Repeated plagiarism is considered fraud. Fraud is discouraged by the community and may result in the account being Blacklisted.

If you believe this comment is in error, please contact us in #appeals in Discord.

Please note that direct translations including attribution or source with no original content are considered spam.