Most of Bitcoin addresses have unrealized gains, and the realized market capitalization exceeds the virtual currency bubble

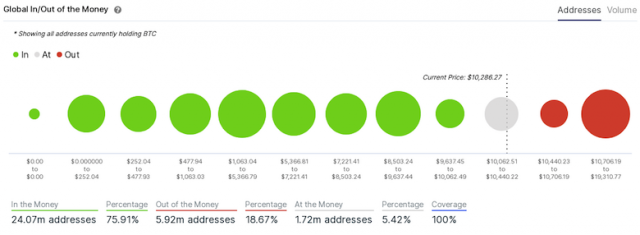

In the account information of crypto assets (virtual currency) Bitcoin, it was found that addresses with unrealized gains account for about 76% (24 million addresses in total). The latest data from IntoTheBlock showed.

Source: IntoTheBlock

A virtual currency address is like an "account number" in a bank. Of the addresses with unrealized gains, the most common were Bitcoin addresses purchased in the $ 1,040-5,285 and $ 8,450-9,560 range, with data aggregated just before the half-life in May this year, "85% of the total." The ratio is lower than "Unrealized gain".

On the other hand, the number of unrealized loss addresses is 5.92 million, which is about 19%, which is higher than the 11% just before the half-life.

The "average break-even point" where the surplus and the deficit switch is $ 10,440.

At the moment, it seems that there are many investors who have purchased in the course of 1 BTC = $ 20,000 recorded in the cryptocurrency bubble in 2017 and are salted with unrealized losses.

Realized market capitalization

In addition to unrealized gains, the latest data on so-called "realized market capitalization" was also revealed.

The realized market capitalization measured by Glassnode, which provides cryptocurrency market data, is said to have increased by more than 60% compared to the time of 1 BTC = $ 20,000 at the end of 2017. The "realized market capitalization" measures the price of each brand (coin) as "the value when it was last moved (when it moved between different addresses)".

As a point to keep in mind, since it is a measurement with on-chain data and coins on the virtual currency exchange are not counted, it is highly likely that it reflects the trend of long-term investors rather than traders who buy and sell in the short term.

Currently, Bitcoin's market capitalization has reached $ 115 billion, which is said to be more than $ 43 billion from its 17-year high, and its market capitalization has steadily increased since its half-life (May 12). I'm doing it.

glassnode (@glassnode) menge-Tweet: #Bitcoin Realized Cap at ATH.  )

)

Ethereum

Ethereum (ETH) has not yet made a sufficient recovery from its realized market capitalization in January 2018 compared to its peak. The market capitalization realized in January 2018 was $ 35 billion, but now it is 26.3 billion, which is 25% lower. Looking at the realized market capitalization graph of Ethereum, the downtrend continued longer than Bitcoin.

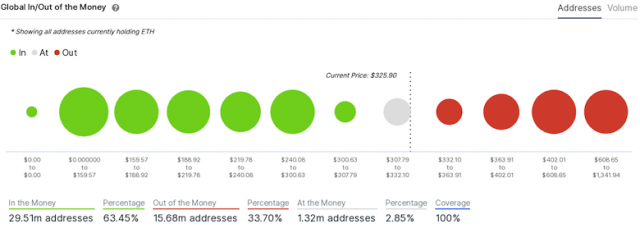

According to IntoTheBlock, 63% of Ethereum addresses were in unrealized gains, with purchase prices ranging from $ 240 to $ 300 and $ 160 or less.

Source: Glassnode

Source: IntoTheBlock