Cub Finance: Learning about Impermanent Loss and Liquidity Pools

I learned a few things during my first experience in liquidity pools in Cub Finance. Before this I only staked my CUB airdrop into the DEN so it was really simple so long as you had some BNB in your Metamask Wallet.

I decided to look into various things on Cub Finance because I believe in doing your own research. So I was surprised to see that there were things that I figured out but others did not in @leomarkettalk. The topic was about impermanent loss and it was about a post by @revisesociology. @revisesociology mentioned that he did not want to be any more liquidity pools with BNB because of impermanent loss and the high chance of him losing BNB.

This lead to a discussion between me and @finguru where he thought we would not get any fees back for being in a liquidity pool in Cub Finance. You can find the chat here.

Impermanent Loss

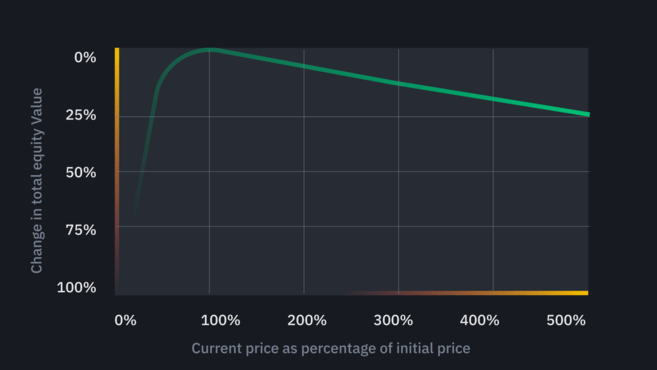

In this article about impermanent loss by Binance, they mention a few things about how you can lose money compared to just holding the tokens. The first way you lose money can be simply explained by the chart below from that article.

Impermanent loss happens no matter which direction the price changes. The only thing impermanent loss cares about is the price ratio relative to the time of deposit.

So as they stated in the article, impermanent loss will always occur. So we will gain the most profit in a liquidity pool if the exchange rate stays constant. As for how much you lose, the article by Binance stated the following about the losses you can receive.

1.25x price change = 0.6% loss

1.50x price change = 2.0% loss

1.75x price change = 3.8% loss

2x price change = 5.7% loss

3x price change = 13.4% loss

4x price change = 20.0% loss

5x price change = 25.5% loss

Liquidity Provider fees

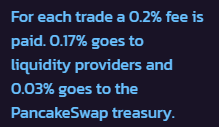

Whenever someone trades on the exchange, the trader pays a 0.3% fee which is added to the liquidity pool. Since no new liquidity tokens are minted, this has the effect of splitting the transaction fee proportionally between all existing liquidity providers.

An article about Uniswap mentioned by Binance talks about how Uniswap has a 0.3% transaction fee that is given to the liquidity providers.

So this means on top of the APR you get from a farm, you also get liquidity fees added to your liquidity staked. When I checked the exchange link on Cub Finance, I see that the liquidity provider fee is 0.2%. So of the 0.2% fees you pay, 0.17% goes to the liquidity providers in the farms and 0.03% goes towards the treasury. I think the treasury means that it will be used by Cub Finance to burn LEO and CUB tokens.

Swap Example

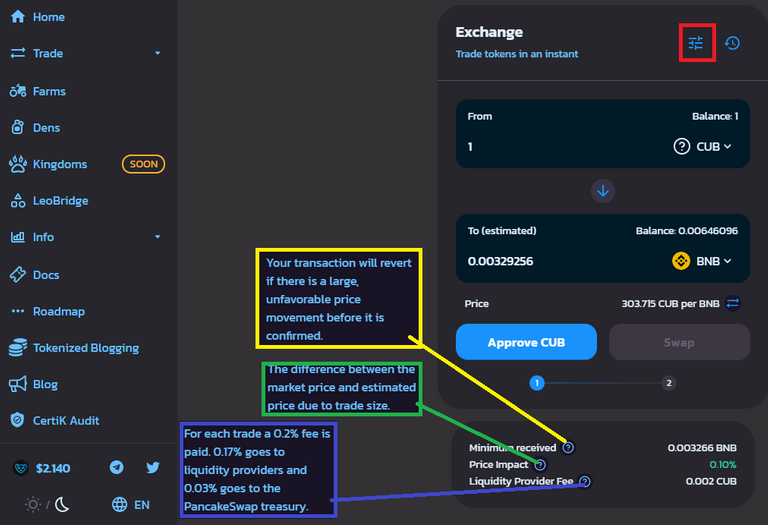

In the above example, you can see the exchange on Cub Finance. I have put 1 CUB and I want to receive BNB in return. As you can see in the example, you can see the minimum amount received, the the estimated price difference and the liquidity provider fee.

So for a transaction of 1 CUB, I would pay 0.0017 CUB to the liquidity providers and then this is spread out to all the liquidity providers so the portion you may receive may be small. But every transactions adds more to your stake inside the liquidity pool. This will help alleviate part of your losses by impermanent loss.

Settings

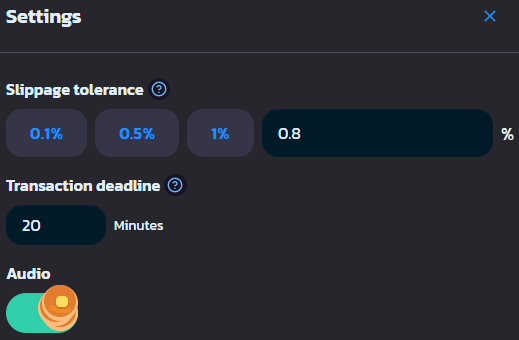

One thing to note about transactions here is that there is a minimum amount you are willing to accept otherwise you will reject the transaction. In the previous picture, the red box shows where you can change this setting.

The settings allow you to set how much of a price difference and how long you are willing to wait for the transaction to go through.

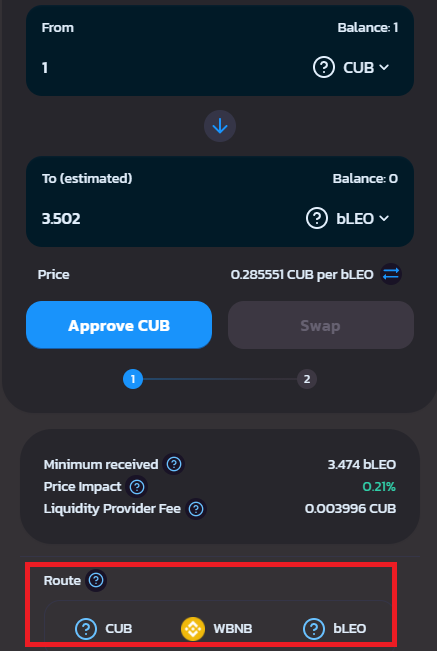

Routes

If your exchange on Cub Finance does have not a direct swap on Cub Finance farms, then you may have to pay more in fees. This means you will have to go through multiple swaps to get your desired token.

In the above example, I wanted to change CUB into bLEO but there is no CUB/bLEO pool. So in order for this exchange to happen, it must first exchange CUB into WBNB then exchange WBNB into bLEO. Since it requires two exchanges, the fees will account for both swaps.

Conclusion

I am still learning about Cub Finance and Defi in general so I may be mistaken about some of the information. If I am, please let me know so I can learn more about Defi systems. Cub Finance is my first Defi system and I trust the Leo Finance team behind it. Even though I am red from my first investment in a farm, I have learned a lot about Defi and I believe that it will work out based on a long term view.

Please feel free to leave a comment if you have any questions or feedback.

Posted Using LeoFinance Beta

Your current Rank (34) in the battle Arena of Holybread has granted you an Upvote of 23%

Learning is an endless process and the more I read, the more I learn. Thanks @jfang003 for sharing your knowledge and tips. I couldn't properly understand "Slippage Tolerance" settings before and used to set it for a minimum. Now I got it. And I think it's better if we pool two tokens which are not as volatile as BNB. Or go for the stable coin pair. But many people would do the same and that would lower the APR. So low risk low returns.

Btw, no. of transactions should grow so that we get substantial amount of FEE split in the future. 😁

Posted Using LeoFinance Beta

Yea the learning is endless and I learned quite a bit with hands on experience. Playing around with the token pairs and the numbers made me question why they change. So I looked more into the different fees. And the best part is that if we can get tons of transactions happening, then we can extra tokens on top of the APRs.

Posted Using LeoFinance Beta

That's cool. You get to learn more while experimenting a bit by bit every day. Once we get a hang of this particular system, we will be able to use other DeFi platforms with ease.

The learning curve will shorten automatically for the next one.

Posted Using LeoFinance Beta

Lol experimenting with other systems will have to wait until I get use to everything in Cub Finance. Besides I think I might wait till I generate a bit more in Cub and roll some profits to test other systems. So Cub will probably be my biggest holding.

Posted Using LeoFinance Beta

Same here J. Diversifying will come later when I get comfortable with Cub Finance.

Posted Using LeoFinance Beta

!ENGAGE 20

!LUV

Posted Using LeoFinance Beta

ENGAGEtokens.Hi @finguru, you were just shared some LUV thanks to @jfang003. Holding 10 LUV in your wallet enables you to give up to 3 LUV per day, for free. See the LUV in your wallet at https://hive-engine.com or learn about LUV at https://peakd.com/@luvshares

Your post was promoted by @finguru

Excellent article colleague. Could you upload a tutorial with screenshots of the process that is done to enter money in Cubfinance farms? I need this information and I think many people here in Leofinance also, since we do not have everything very clear with these processes of buying tokens and how to invest them in the farms.

Posted Using LeoFinance Beta

Yes I can in a few days. I am waiting for some more LEO to come in so I can do my 2nd add to my LP and it would satisfy one of my goals for the month. I'll make sure to document everything with screen shots so you can see what happens on my end.

Do you want me to tag you?

!ENGAGE 20

Posted Using LeoFinance Beta

Perfect buddy. Yes, please tag me when you upload it. Thanks in advance!

Posted Using LeoFinance Beta

ENGAGEtokens.good article that points everything out. Good job!!!

Posted Using LeoFinance Beta

Thank you. I decided to just put in all the stuff regarding exchange that I saw for people because I don't know if they ever mentioned it in the Docs. It was definitely an experience figuring out more about how everything works.

!ENGAGE 20

Posted Using LeoFinance Beta

ENGAGEtokens.Just FYI for the future. You can trade CUB directly to bLEO right on Metamask. Just pay one low fee that way.

BTW - great article.

Posted Using LeoFinance Beta

Oh I didn't know that. So even if there is no direct exchange for CUB-bLEO, it will find a way to do so? I don't think you can avoid both swaps and I looked online too. It basically said that it will find the cheapest way to exchange the tokens into the one you need.

Posted Using LeoFinance Beta

!ENGAGE 20

Posted Using LeoFinance Beta

ENGAGEtokens.There actually is, it just has no liquidity in it. I know the pool exists because I created it. I used to have some liquidity in it, and I think an order or two got routed through it. I might put some back in there in the future.

Posted Using LeoFinance Beta

I was mainly putting it as an example because I know some people only want to participate in the CUB Den so they exchange their bLEO into CUB. I don't think I will do that right now since I am more interested in putting it to work in the LP. The harvested CUB can go to my DEN afterwards.

I was basing the double swap on what I found in the Cub Finance farms and I am unsure whether or not a CUB/bLEO was ever listed on their site. But I do think it would be nice for people to change it directly without paying as much in fees.

One of the other commenters also talked about MetaMask's direct swap allowing you to skip fees but I haven't really tried. I think it might be possible that your order got routed through it based on that.

As a final question, this pool is not related to Cub Finance right? So even if we invested, we would not get the extra staking rewards.

Posted Using LeoFinance Beta

Nope you wouldn't. But in the case that many trades got routed through that pool and it became insanely volatile, you could make off with some nice LP rewards. Thats why I decided to bite the fee to create it and went for it. Thought, hey maybe I can get enough $ in here that if this gets used widely enough it'll make a nice amount with Leobridge. But sadly it hasn't.

Yea I didn't see the big changes that I hoped for after the Bridge went live. I do hope the Kingdoms do bring in some more people who aren't second guessing their investments.

Posted Using LeoFinance Beta

!ENGAGE 20

Posted Using LeoFinance Beta

ENGAGEtoday.Excellent article and well explained. I like how you took a complicated article and dropped it down into a simple easy to understand bite sized article that makes sense to new people. I might just use it as a reference in the training I'm building for CUB at the moment if you don't mind and I have your permission to do so?

Posted Using LeoFinance Beta

Feel free to use it as you like and you have my permission to do so. I just read your article earlier and would be glad to that this will help you on your Cub Finance onboarding efforts.

!ENGAGE 20

Posted Using LeoFinance Beta

Thank you!

ENGAGEtoday.Learning never exhausts the mind but open new doors. Nice sum up of cub defi and associated risks.

Posted Using LeoFinance Beta

Thank you and yes learning is something we have no choice but to do as technology improves.

!ENGAGE 20

Posted Using LeoFinance Beta

ENGAGEtoday.Excellent little guide on impermanent loss and liquidity pools from a CubFinance perspective.

Thanks for sharing :)

Posted Using LeoFinance Beta

Thanks. I got the idea from commenting and engaging with others. It's weird how we all see different things so I decided to make this post.

!ENGAGE 20

Posted Using LeoFinance Beta

ENGAGEtoday.I'll need to watch my account with BSCscan because last time I withdrawn my LP, It was worth +$5. I placed it at around $20 and withdrawn it 1 month later and it was $5..

I may just remember it really bad so I'll check ! Thanks a lot for your post !

!PIZZA

Posted Using LeoFinance Beta

@jfang003! I sent you a slice of $PIZZA on behalf of @ykretz.

Learn more about $PIZZA Token at hive.pizza

Thank you for dropping by and I tend to check my Cub LP using the following tool. At least it keeps track of how much you have staked and how much it is worth.

https://mycublp.holdings/

!ENGAGE 20

Posted Using LeoFinance Beta

ENGAGEtokens.Thanks @jfang003 for your post and your time. I am really newbie to DeFis and my really first Farming I am doing it's with CUB. What is convincing me is the power of Composed Interest. I am harvesting around 5~10 USD every two days. Of course I am aware that the coin is down, so the original value of my different buys are lower, but it's question to wait. Fortunately for me I didn't find out how to do farming until CUB was coming back to almost 3 USD. And I discovered by accident as sometimes I asked how to do and the little answers I got was not clear to me... I am a slow learner; in addition, English is second language, so still more slowing my learning process.

The part of the table with prices and percentage is illustrative, it is still making me to thing about the process. But maybe it could be more illustrative if those percentages are illustrated with a real example of amount of coins Add Liquidity and how it affect the amount withdrawn in certain period of time. I know it is kind of difficult, and I just taking note of my lates buy and Staking-Farming on CUB. But I did not diligently took note of a couple of buys. But anyway it could give an idea of my actual earning once I stop the farming. Anyway I am not thinking to withdraw in a short time.

Thank you again for sharing. I think with most and most readings on the subject and with our actual Doing we learn much more.

Posted Using LeoFinance Beta

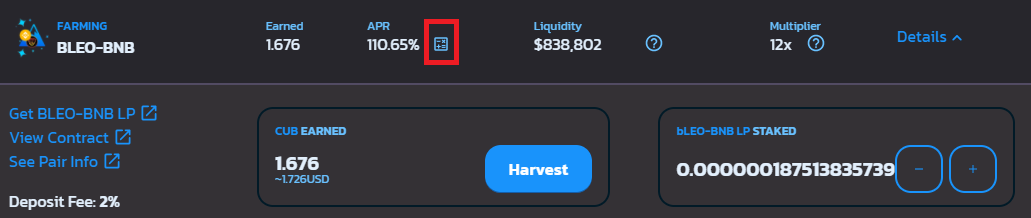

Oh there is a way to check. Click the little table sign in the image below

It will show you the current return on investment on the left side and returns based on $1,000 on the right side. At least this way, you can guess roughly how much you earn. This value can change depending on CUB price and how much liquidity is in the pool.

Posted Using LeoFinance Beta

Oh, thank you so much! It is an approximate of what I was computing I input in total, some +1000 USD and it is accurate with what I am getting in Harvest. Of course we need to wait for the price to come back. It will be very stupid to withdraw now.

I have checked it. I can see what you are mentioning in Day/Week/Month/Year.

Thank you again!