Bitcoin is Vying for a piece of the $280 Trillion Store of Value Market

Some knock bitcoin because it doesn't have great utility, but there is plenty of runway for it regardless...

There are numerous people out there that seem to think that bitcoin has failed in its intended purpose, and maybe it has depending on how you interpret its original white paper.

After all that is basically the argument put forth by both the BCH and BSV camps.

However, I would argue that even if bitcoin has failed as an every day payment option, it's future is as bright as ever.

In my opinion, in bitcoin's current iteration, it works much better as a non-correlated digital store of value that guards against excessive money printing by central banks.

Can you buy coffee with it as easily as the current system or as easy as many other cryptocurrencies?

Nope, but that is honestly possibly a good thing.

Here's why...

On the one hand we have the fact that governments around the world are very powerful entities and while they cannot kill something like bitcoin they can certainly make it very difficult and uneconomical to use.

However, the United States for example, has mostly left bitcoin alone...

Now why is that?

Because it's not a competitor to the dollar!

Had it been a real legitimate competitor to the dollar it would have been banned long ago in my opinion. And as I mentioned above, a ban would not kill bitcoin, but a ban with saying that anyone caught holding or transacting in bitcoin will be put in jail would be a major blow that would be difficult to overcome.

It's much more of a competitor to gold than it is to the US dollar.

And that is a good thing.

The gold market is currently worth around $9 trillion while bitcoin is worth less than $200 billion. So, even if bitcoin never is widely used for every day payments and really only works as a store of value, it still has tons of runway left just taking a portion of the current gold market.

However, the store of value market is so much bigger than just the gold market...

How much bigger you may be wondering?

Well, check this out:

(Source: https://twitter.com/DTAPCAP/status/1281112212141211650/photo/1)

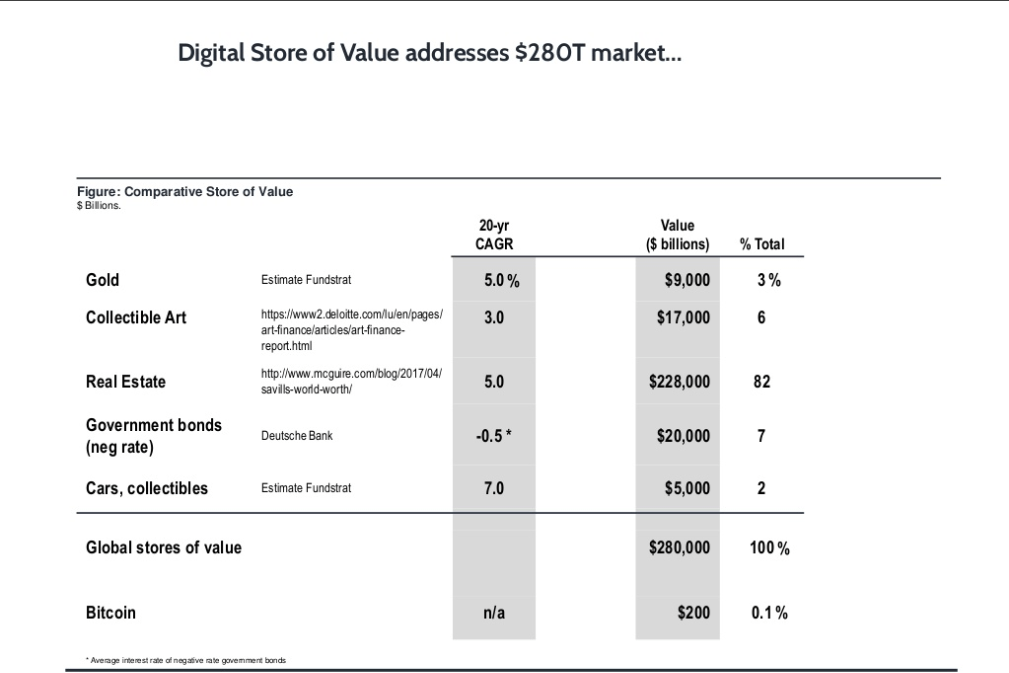

When factoring in the gold market, the real estate market, the collectible art market, the neg. interest bond market, and the collectible market we are talking about a $280 trillion dollar store of value market!

When taken into that context it looks like bitcoin certainly has quite a bit of runway ahead of it and that is with bitcoin only ever succeeding at being a store of value.

So, the next time someone tells you that bitcoin will never catch on as a widely used method of payment, you can tell em, "yep that is probably true, but it doesn't really matter, it's got a ton of runway in the store of value market"

There was recently a report put out that speculated that if the majority of institutions took just a 1% allocation to bitcoin the price of bitcoin would be worth north of $50k:

Now imagine it bitcoin takes just 1% of the total store of value market...

That would be more than 14x the current price.

What happens if it takes 2-3% of the total store of value market?

Well, you do the math...

Stay informed my friends.

-Doc

Posted Using LeoFinance

$280T market... That potential for growth looks very good.

Yea I had no idea it was that high. The number was come up with by Fundstrat Global Advisors. I could easily see bitcoin pulling a percentage from all the categories.

Wow, bitcoin is the best possible collectible art and the best ROI online real estate. lol.

Gotta get something from all of them. Guess we will get 10% from each of them!

That is my guess as well. We will pull dollars from every category as bitcoin's market gap gains.