Bitcoin is working better than gold as a hedge against a depreciating dollar

Bitcoin is currently more inversely correlated to a falling dollar than gold

In times of dollar weakness, buy gold right? Well not so fast...

For centuries people have flocked to gold as a safe haven against depreciating currencies, however, bitcoin is currently doing that better than gold right now.

Since the "sell everything crash" in March where stocks bitcoin and gold all sold off hard as the pandemic fears were in full swing, bitcoin has been more inversely correlated to the dollar.

Being inversely correlated to the dollar means that whichever direction the dollar has gone, bitcoin has gone the opposite.

Specifically, when the dollar goes down, bitcoin has gone up.

This is normally gold's primary use-case, but recent data is showing that bitcoin is actually doing that even better than the shiny metal.

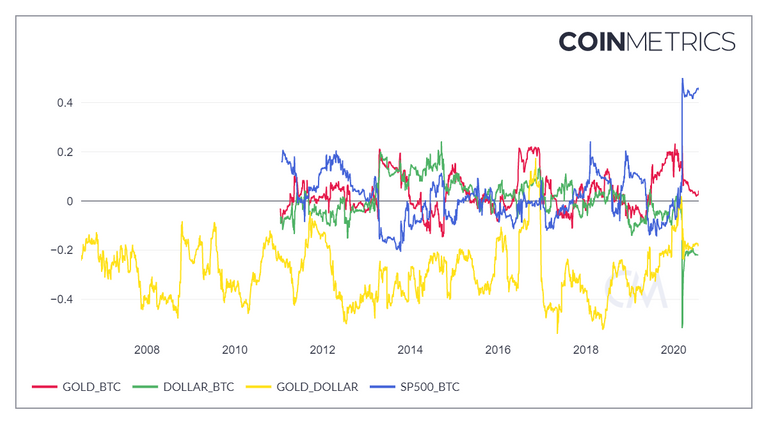

Check it out:

(Source: https://correlation-chart.coinmetrics.io/)

Bitcoin is currently a better hedge against a falling dollar than gold...

There is a lot going on in that chart posted above, so I will try to add some context for you.

Pay special attention that green line above.

The lower the line is on that chart, the more inversely correlated to the dollar the asset is.

As you can see, gold has predominately been the most negatively correlated to the dollar over the last decade, and really if you zoom out even more, gold would likely continue to be the most negatively correlated to the dollar.

However, pay special attention to the most recent activity... the activity on the far right side of the chart.

As you can see the green line is now lower than the the yellow line for the first time ever and it's been that way ever since March.

That means that bitcoin has been more negatively correlated to the dollar than gold has since the March lows.

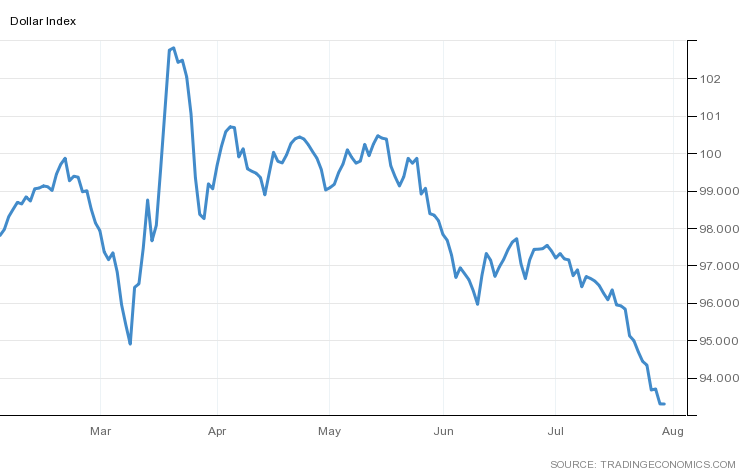

By the way, a chart of the dollar looks like this:

(Source: https://tradingeconomics.com/united-states/currency)

This is very interesting...

For years the biggest selling point for gold as an investment has been as schmuck insurance against excessive money printing by central banks.

There are other inflation investments out there, but gold has reined supreme in most investor's portfolios for decades and decades.

As well as in the hearts of financial advisors.

However, if we keep getting data like what we are seeing right now from bitcoin, it won't be long before financial advisors start recommending bitcoin as a hedge against excessive inflation.

I'm not sure about you, but this is one of those data points that really gets me excited as a bitcoin investor. This is the kind of stuff that the big boys pay attention to when doing asset allocations for a well diversified portfolio.

Hopefully it continues.

Stay informed my friends.

-Doc

Posted Using LeoFinance

Nice, I'm all in btc and eth. Maybe Gold as a hedge to btc once the bull run is over

Posted Using LeoFinance

Sure would be nice to see HIVE actually go up as well...

So happy I've got few dollars btc left. I find it totally unpredictable

I just wish it would stop messing around and make new highs already. :)

I hope so too 😂