Not many other "Bubbles" have survived 3 draw-downs of 80% or more in less than a 10 year stretch...

Bitcoin's no bubble and other people are finally starting to realize that

In a welcome article in Bloomberg today, I read a piece talking about how bitcoin may not actually be a bubble after all...

Gee, you think?!

I guess I can't be too mad at these people, they tend to try to fit everything into their basket and if it doesn't fit, well they make it fit.

I do applaud the author for finally coming to the realization that bitcoin may in fact not be a bubble after all but instead be a new asset class in price discovery mode pretty much since its inception.

Yep, that sounds like a much more accurate description to me.

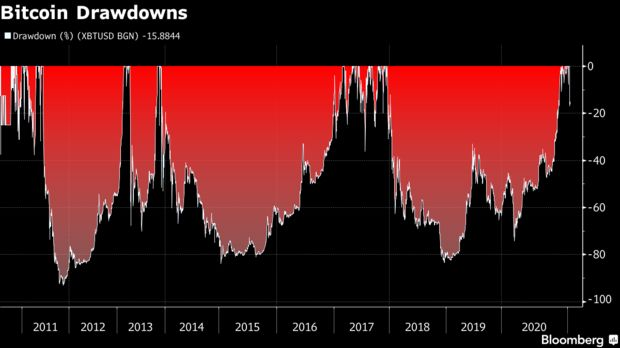

While we are on the topic of bubbles, bitcoin has had 3 draw-downs of 80% or more in less than a 10 year stretch, and it survived to tell the tale:

Not many other assets can make that claim, which is one major difference that separates bitcoin from other so-called bubbles.

But wait, there's more...

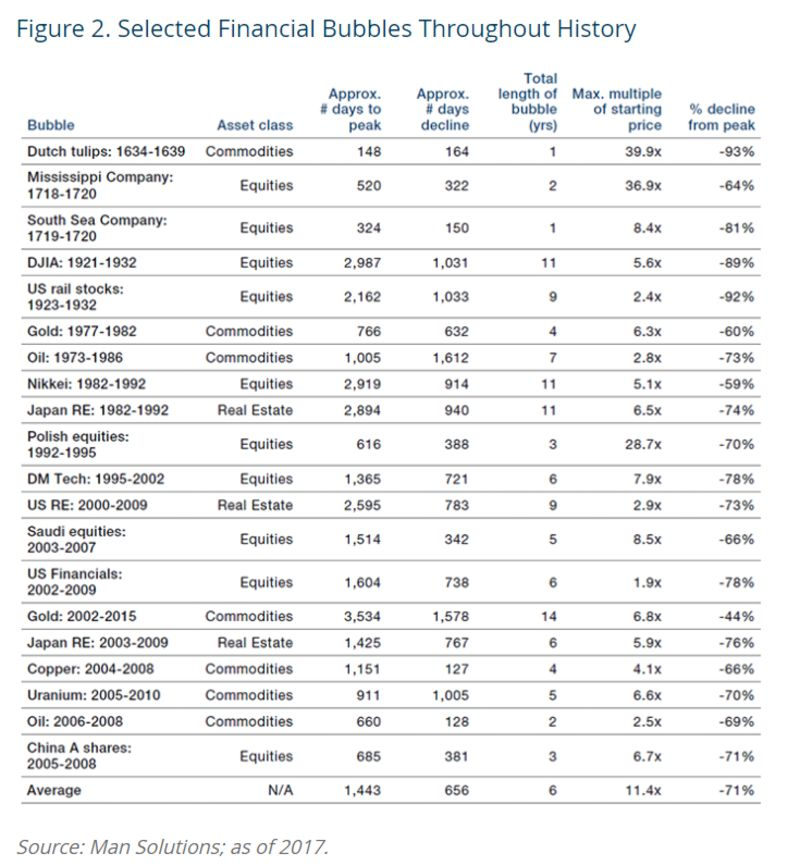

Man Group, which is one of the largest publicly traded hedge funds in the world (and also the main author of the Bloomberg article I referenced), complied a list of some of the characteristics of some of the more popular bubbles through history...

As you will notice, bitcoin doesn't have a lot of similarities to many of them at this point...

As you can see, the average length of time for the entire bubbled period to last is roughly 6 years.

It takes on average 1,443 days to peak and 656 days to bottom.

Now, one could make the claim that bitcoin has smaller bubble periods with the broader context of an overall uptrend, but that is pretty much where the similarities end.

Bitcoin has basically gone from the lower left to the upper right ever since it was created and Man Group is finally starting to see the light as well, saying:

"Instead of considering each individual spike and fall as a discrete bubble, there may be more merit in the argument that this volatility is simply part of the price discovery in a new asset class, and that these are not bubbles, but part of a not-so-random walk that will eventually dwindle to give Bitcoin more stability, and ultimately, legitimacy.”

Hmm... you don't say.

We were way ahead of you Man Group, but it's nice to see you at the party. Better late than never. :)

Stay informed my friends.

-Doc

Posted Using LeoFinance Beta

What a "bubble." It's over a decade and it hadn't burst yet -- must be made out of titanium

That's my kind of bubble!

You made a very good point. BTC is sustainable just because even after all these massive draw downs it is still in high demand. Sustainable because it is always relevant.

You just reminded me that there are whiffs of this whole Dot Com bubble thing being brought back from 2018. Yeah, we already survived that? What? There's going to be a second Dot Com bubble now? And a third? Lol stop talking.

https://www.businessinsider.com/bitcoin-price-crypto-boom-internet-bubble-shark-tank-mark-cuban-2021-1

https://www.cnbc.com/2021/01/11/mark-cuban-cryptos-trade-is-like-the-internet-stock-bubble-but-thinks-bitcoin-can-survive.html

https://www.businessinsider.com/bitcoin-price-crash-bubble-warning-dotcom-trade-crypto-mark-cuban-2021-1

Yo! Mark Cuban, you don't know what you're talking about :D

We already did this.

https://peakd.com/bubble/@edicted/ridiculous-dot-com-bubble-comparison

Seriously I wrote that in Summer 2018... lol.

Did research on several Dot Com businesses that failed an why...

None of those reasons apply to crypto.

Yep exactly. A much more accurate description would be that there are boom and bust cycles with the context of broader adoption as a new industry and asset class matures. Higher highs and higher lows along the way.

For me the most annoying part is the timeline. If you look at to Dot Com bubble in that chart there would have been 3 Bitcoin bubbles during that time... lol. Literally would have gone x1000 even after crashing 3 times.

Also, the dotcom bubble didn't have massive money printing programs going on and it wasn't global. Bitcoin is global (can be bought in just about every country) and the money supply globally is increasing by tens of trillions of dollars.

amazing analysis! thanks for this. Bitcoin is actually quite resilient :) .coms have actually sort of survived the 2001 burst, after the clean-up of fake businesses it thrived since. Crypto market constantly needs wash outs of "bad" businesses, but granpas (BTC and ETH) will remain core and resilient

It's the Lemmings theory... As long as Bitcoin doesn't end in a disaster, it's a good thing... Everyone follows the first no matter where the road leads...

That's funny, because I was just reading an article from the UK the other day where the headline was something like "If you invest in Bitcoin, you will lose all of your money". I guess there are always going to be naysayers and supporters on both sides. It is nice to see that we are finally starting to get some supporters!

Posted Using LeoFinance Beta

Thaks for sharing information. Your blog is one of my favorite blogs

Posted Using LeoFinance Beta

Very interesting information as usual. Thank you

Posted Using LeoFinance Beta

I hate that people compare btc to the dot com bubble. They are not the same. My bet is people are just mad they did not get in early.

Posted Using LeoFinance Beta