The premium in GBTC is quickly approaching its NAV

Grayscale has been soaking up all the bitcoin, but that may start to slow with the premium in GBTC getting close to zero

One of the biggest stories in crypto and bitcoin specifically over the last several months has been the number of bitcoin being soaked up by the Grayscale Bitcoin Trust.

The trust has routinely been adding multiples of the amount of new bitcoin created each day.

This has caused there to be dwindling supplies of bitcoin on exchanges and have lead some to believe there is likely to be a supply crunch on exchanges in the near future, if there isn't one already.

However, with the premium in GBTC quickly approaching zero, the influx of bitcoin is likely to slow, at least in my opinion.

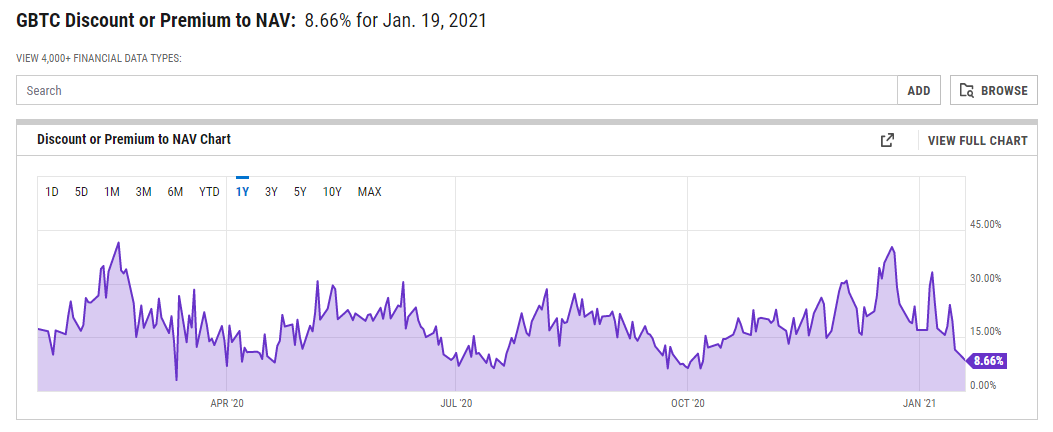

After getting as high 40% a month ago, the premium in GBTC has dropped all the way to 8% as of yesterday:

(Source: https://ycharts.com/companies/GBTC/discount_or_premium_to_nav)

And when you look at the data from today, the premium has dropped all the way down near 1-2%.

The price of bitcoin is down slightly on the day, while the GBTC bitcoin trust is down significantly...

This is what I mean when I say the premium is being sucked out of GBTC.

(Source: https://stockcharts.com/h-sc/ui)

What this means going forward...

In my opinion this is going to me that bitcoin stops flowing into Grayscale at the same pace it had been recently.

The premium was the main driver for people to send bitcoin to Grayscale.

Grayscale as a like-kind exchange where accredited investors can exchange their bitcoin for shares of the GBTC trust.

These shares were priced at their NAV, and had a lock up period of 6 months, but once those 6 months pass, the investor was able to sell them in the secondary market, where they were routinely trading with a 20% premium or more.

Now that the premium is gone, or almost gone, I suspect the inflows of bitcoin to slow down substantially.

Time will tell, but I have a strong feeling that is why so many bitcoin had been flowing into Grayscale over the last several months.

In the long run this won't matter much and is probably a good thing as the trust should be trading very close to its NAV, however, in the short run it probably means less bitcoin is going to be leaving exchanges.

Stay informed my friends.

-Doc

Posted Using LeoFinance Beta

Yeah, totally. It seems like people would just want to hold onto their own BTC so they can easily flip it if the premium is gone. Without that incentive why would you want it to be locked up for six months! I think all of us know how quickly things can change in the crypto market.

Posted Using LeoFinance Beta

Yep exactly. I suspect the inflow of bitcoin into Grayscale over the coming days/weeks is likely to drop dramatically...

The question is what that will mean for the price action. Will BTC finally correct more substantially than it already has?

Posted Using LeoFinance Beta

We will see. I bought some today on the dip.

Congratulations @jrcornel! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPThank for sharing information about blockchain