What if you had a tool that reliably told you Bitcoin was going to drop just before it actually happened?

While not quite a crystal ball, this metric may be as close as you are going to get...

What if you were able to spot a trend that happens in the bitcoin markets that often showed up right before major drops in the market?

Would that be helpful to you?

I think the answer to that question is an obvious YES!

Well, there is sort of one such measure and it's called the Bitcoin Miner Outflow Multiple.

In laymen terms it basically measures the amount of bitcoin sent from miners to cryptocurrency exchanges.

And as you might have guesses, that metric tends to spike bigly just before major drops in the crypto markets.

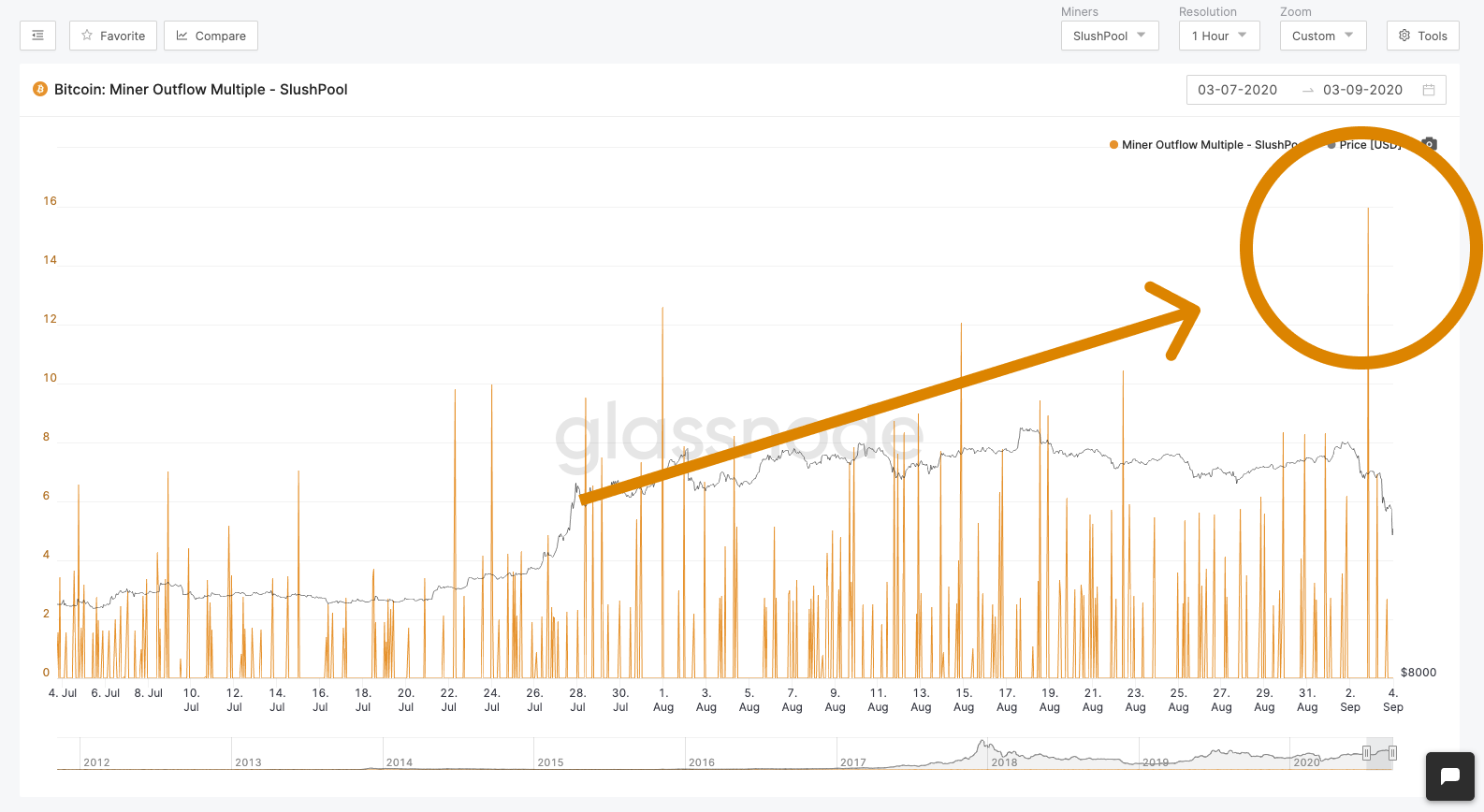

Here's what we saw a couple hours before our most recent drop several days back:

(Source: https://twitter.com/ColeGarnerBTC/status/1301985117473103872/photo/1)

As you can see there was a major spike in the multiple right before the price of bitcoin started heading south.

Likely indicating that miners were largely responsible for the sell off as they send large amounts of bitcoin to exchanges just prior to the dip.

But that is just a one-off event right?

Not exactly.

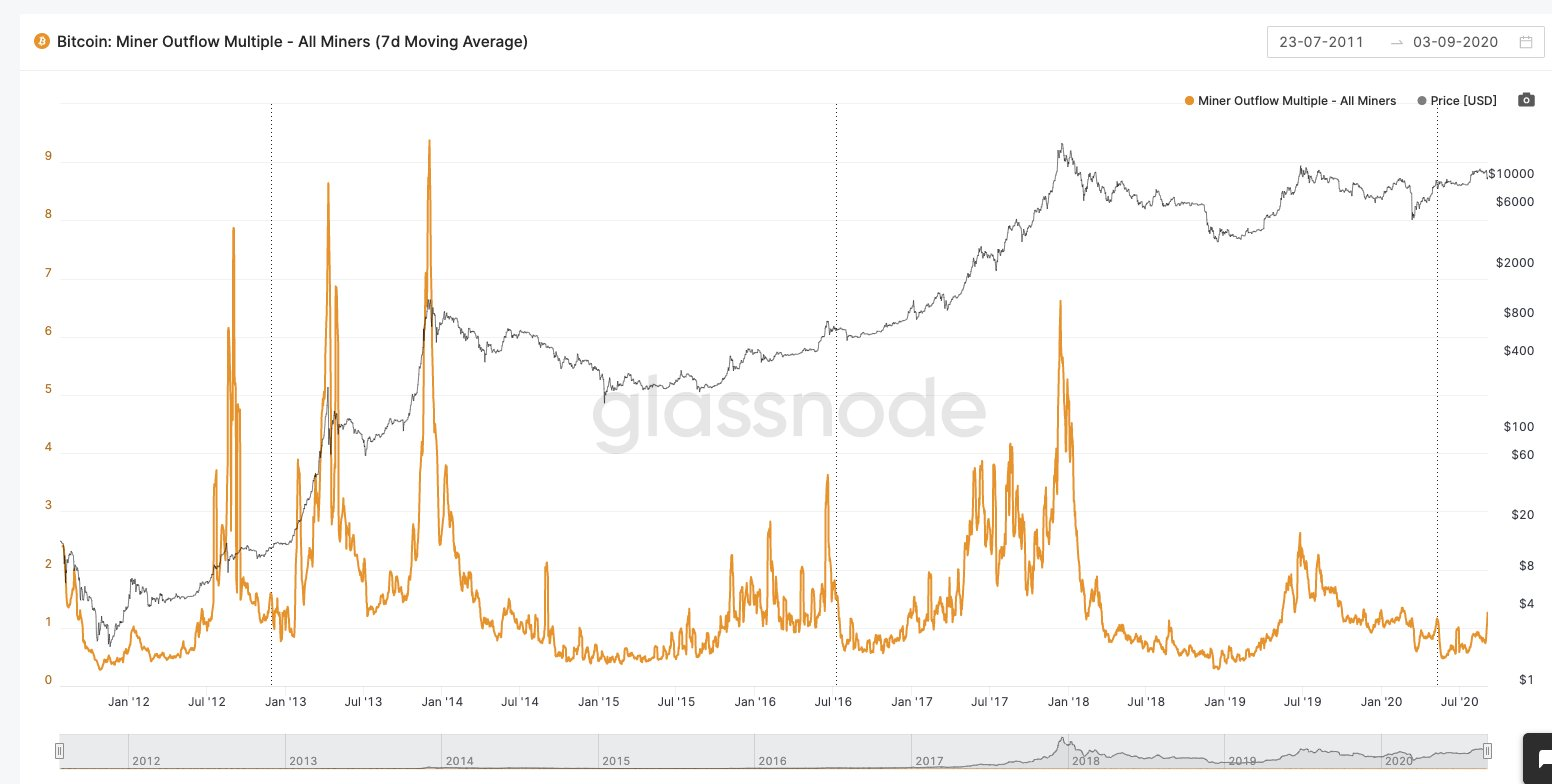

If we backtest the data and zoom out, we can see that this multiple tends to spike quite often before major drops.

In fact, based on the below chart, we can see that this multiple spiked bigly before just about every single local high or cycle high on a weekly timeframe...

Check it out:

(Source: https://twitter.com/ColeGarnerBTC/status/1302395657500598273/photo/1)

Based on the above data, it seems like a good indicator to pay attention when trying to figure out if we are near a top during a bull market cycle.

It has done pretty well predicting them in the past.

Nowhere near a top yet...

A major takeaway from our current position on that chart as how relatively low that multiple is compared to previous tops...

Based on that, it would like indicate we are probably nowhere near a cycle high at this point.

Which also jives with several other patterns/cycles like the stock to flow model and previous post halving bull market cycles.

Overall, this metric is likely far from a crystal ball as there appears to be some subjectivity as to what exactly constitutes a "high" multiple, but it looks like a nice piece that someone could add to their overall trading plan.

Stay informed my friends.

-Doc

Posted Using LeoFinance

If i had a tool like that i would not be on Hive. I would be chilling in the Bahamas :-D

doesnt mater unles u also have a tool showing u when its gona pump

Doesn't matter? Ok, feel free to ignore it then. :)

This is probably the single most sensible article about the price of Bitcoin I have ever read! Usually there's nonsense about triangles and support lines and all that rubbish, to actually have a real world event to link price to is what I've been saying for years.

Like you say, it's not a crystal ball, but at least it's a real world event that is clearly affecting the price.

well done!

Thank you. And yes it is pretty intuitive as well. When miners send large amounts of bitcoin to exchanges, the price tends to fall short after, which makes sense. The only thing I found difficult as far as using it for a trading indicator is how high does this multiple need to spike before it is considered "high". If you look at the above charts there were plenty of times where the multiple spiked but the price continued to climb higher, which means it evidently spike high enough...

I do believe that BTC will going to touch the $9,222 per BTC soon enough @jrcornel :D

But the USA elections is another factor for it to ether slump or Pump too.

Posted Using LeoFinance

Why do you believe that?

Congratulations @jrcornel! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

Thanks.

530000 is an impressive number @jrcornel! And still, the badges keep coming! Well done my friend!😉🐝🐝🐝

I dont see a corelation here. If you didnt know the future result you wouldnt be able to know if a spike would had casued price rise or a drop so it's useless imo. Or I didn't get the sense of it.

The correlation is that when miners send a large amount of bitcoin to exchanges, the price falls shortly after.

Ah, this is a pretty interesting way to gauge Bitcoin's potential movements. I'd also like to add the CME Futures Gap to this list, given how accurate it has been, and how BTC has a habit of wanting to fill them eventually. There was a time when I thought it was silly to base it off that... 😐

Yep that has been a very good one as well. The problem with that one is that the gaps can fill within days, weeks, or even months. Bitcoin can move quite a bit in between those times...

Ah, that's a very good point. I guess its good when taken into consideration with other metrics and data points.

Yep exactly. If the market is starting to look topy and there is a large CME gap 10-20% below that is yet to be filled, I think that might be a good time to be cautious. Which is pretty much the exact setup we just had.

Aye, I wish I could've followed that before it actually happened. I thankfully didn't buy any BTC that high up, although it was still rather painful. Plus, I could've sold a bit, and bought into the dip. I guess it's worthy for consideration next time, eh? 🙃

I flipped out of some over $12k and picked em back up, plus a little more at $11k. Looked good at the time as bitcoin went back over $12k again, but now not so good. :)

Lol, quite true 🙃. I guess we'll just have to wait for another big push from Bitcoin once more, and hopefully this time it'll conquer that dreaded $12k resistance. Once that happens, it could be a straight shot to $20k, maybe even more.

We have to run in front of the selling miners.

Ha yep, there you go. Front run those dumpers!

!BEER

View or trade

BEER.Hey @droida, here is a little bit of

BEERfrom @eii for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.