Applying the Tastytrade Approach to Options Trading: Selling into Strength

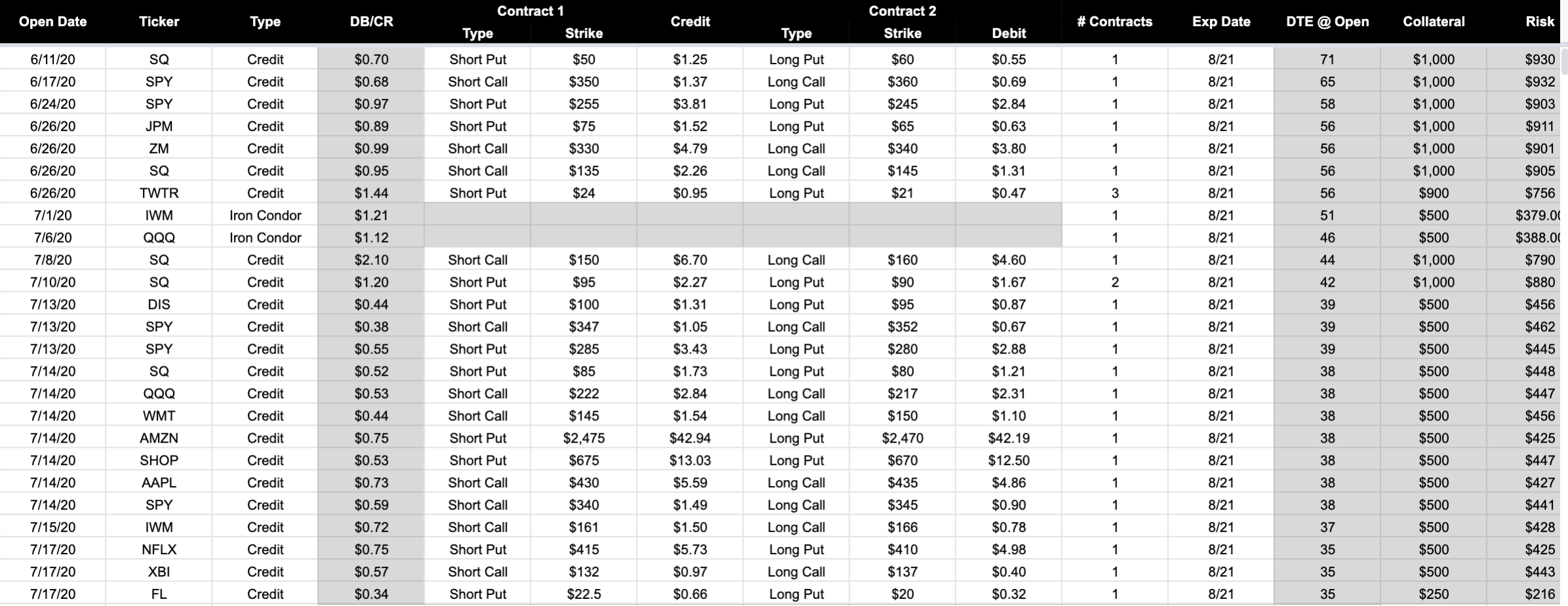

In my last post about trading options heavily, I analyzed a few of my trades and talked about the border portfolio that I was running. At the time (earlier last week) I had made about 20 trades. After the market closed on Friday, I’m now at 25 trades opened and 11 out of those 25 trades have been closed at a profit with 14 trades still open with an 8/21 expiration date.

On the latest LEO Roundtable, we talked about portfolio strategy and what I look for when I put on a trade. As of right now, I’m following many of the Tastytrade best practices. If you don’t know what Tastytrade is, I highly recommend checking them out. They are the epitome of options education in my opinion.

There are many core concepts that Tastytrade talks about frequently and they have done extensive research over the past decade to back up all of their claims. That is one thing that I particularly like about their approach — they don’t just talk about best practices and what they believe to be right, they actually back it up with real data that can be put into practice by you and I.

Selling Into Strength

When I’m finding an underlying stock/ETF to trade, one of the first things I look at is where the stock is trading on the day. Is it up or down? Is the move big or small?

If the stock is up, I’ll open the chart and check the IVR (I’ll talk about IVR in a future post). If the IVR is high and the stock is up over the past day/week, I will look to sell a call credit spread. This is called selling into strength and is one of the most important facets of the Tasty approach to options trading.

Keep in mind that the overarching tenant of trading options with the Tasty approach is to have a firm grasp of the mechanics that price options and dictate probabilities. When you put on a trade, you should understand what your probability of success is, how much you’re risking when you initiate the trade and also if your potential reward is high enough relative to the risk. In the chart above, look at the "DB/CR" and “Risk” columns to see how I am tracking these aspects.

I dug up this Tastytrade research video about selling into strength to backup my approach to selling call spreads when an underlying is high or selling put spreads when an underlying is trading low.

In this study, they analyzed 4 different bearish options trading strategies on the SPY. They used June 2010 to July 2013 as the sample set — which was an extremely bullish market. See the SPY Price column (SPY rose from $111 to $165 in this timeframe).

Without looking at the research, if you told someone that you traded bearish strategies during a crazy bull market like this time period, they would probably assume that you lost money. Selling into strength, thus seems like a bad idea… right?

Wrong.. and Tasty has done the leg work to prove why selling into strength is actually the best way to trade (from a statistical standpoint).

If you sold either ATM naked puts or 1STD puts (84% OTM) into strength from 2010 to 2013 (regardless of IV%), then you would have come out with a massive profit. With the ATM strategy, you would have made a ~75% ROI over this time frame.

Keep in mind: this is a bearish trading strategy in an incredibly bullish market. Most people would expect you to lose money by doing this.

Applying the Research

Going back to my spreadsheet (the first image) and showing how I am applying this research in my trading practice:

When I initiate a trade, whether I sell calls or puts is dependent entirely on whether the stock is trading up or down relative to today/the past week.

For example, look at this SQ spread that I traded:

On the day that I opened this trade, SQ was up for 3 straight days. The stock price had rallied well over 20% in that short time period which is clearly a strong move upwards.

When a stock is trading 20% up in 3 days, the premium on call contracts is much higher than usual. This lets us do two very important things:

- Collect more premium (because the premium is more expensive)

- Go further out (because the premium is more expensive)

When premium is more expensive, it’s easier to go further out on the short strike (in this case, my short strike was $150) and collect a decent return than if the premium is cheaper.

5 days later, SQ corrected from this massive rally upwards and dropped about 10-15%. I was able to quickly close the trade and walk away with a 15.95% ROC (return on capital).

The point of this post is to illustrate how you can take research like this Tastytrade video, apply it to your trading strategy and see the results unfold in real-time. Selling into strength/buying into weakness is something that I’ve always done naturally, but having the research to back it up (both from Tastytrade and now in the data that I’m collecting from my personal portfolio) is just as important.

LeoFinance is an online community for crypto & finance. We run several projects that are powered by Hive and the LEO token economy:

| Track Hive Data | Blog & Earn LEO | LEO FAQ |

|---|---|---|

| Hivestats | LeoFinance | Learn More |

|  |  |

| Trade Hive Tokens | Learn & Contribute | Hive Witness |

|---|---|---|

| LeoDex | LeoPedia | Vote |

|  |  |

Posted Using LeoFinance

Now I understand why you sell into strength vs. sell bull puts.

Posted Using LeoFinance

The data is there, I'm just trying my hardest to keep my monkey-brain out of it and focus on the mechanics

Posted Using LeoFinance

Man reading this makes me miss the days of transition where I could dedicate an hour a day to research a strategy, throw a few bucks around day trading to learn and test, and decide where it would fit in my strategy.

For now, I will leverage your wisdom gain and stack a little more fiat for a good entry point, buying into weakness.

Haha it's truly fun stuff. I'm just playing around with some spare time and learning the options game at a deeper level. I think we can all bring some takeaways from data like this and use it in stock accumulation, crypto accumulation, etc. It's all applicable

Posted Using LeoFinance

Dude, this posts humbles me. Props to you for your understanding of navigating these types of markets. There is money to be made all sorts of ways!

Posted Using LeoFinance

There definitely is money to be made in all sorts of ways! I'm doing my best to stay on top of that and continue to expand my toolkit ;)

Posted Using LeoFinance