Ethereum Flippens Bitcoin In Daily Settlement Volume

Bitcoin's volatility isn't the only thing tanking as of late. Settlement values on the BTC network have been dropping as well - coinciding with a major spike in the usage of the ETH network, thanks to DeFi and Stablecoins.

Over the past several weeks, we've seen a great deal of consolidation for Bitcoin. It's price is not really moving and the on-chain activity reflects a market of Hodl'ers who are sitting on their coins and waiting to see what happens post-halving as we close out 2020 and look to 2021 for those coveted "$100k" price targets.

Looking at my personal BTC holdings, I reflect the broader market. I'm neither a buyer nor a seller at a $9k Bitcoin price. If we drop to $7500, I'll become a buyer. If we jump to $12k, I'll sell a small portion of my holdings and wait to buy the dip. The entire market seems to reflect this sentiment as every time BTC drops just a few %, the market scoops up the loose tokens and we come right back to ~$9200 - same goes for the upside.

The main question here though is not about price but rather, on-chain volumes. Messari just came out with a report about transaction volumes, stablecoins and the DeFi boom cycle.

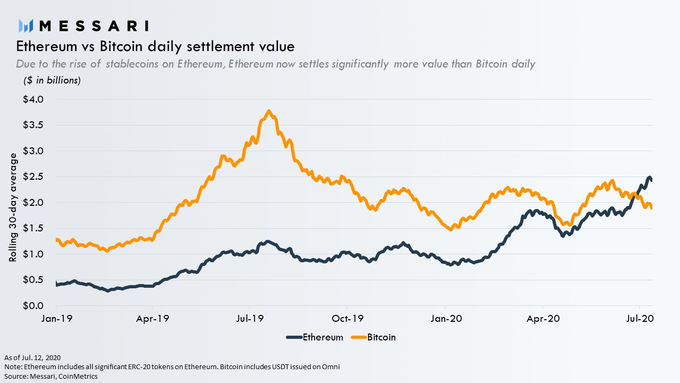

As we see a tightening on many levels for BTC and the Bitcoin network, we're seeing an explosion on the Ethereum network. In their report, Messari showed the following chart which displays a "flippening" in settlement value:

https://messari.io/article/q2-20-review-stablecoins-at-the-heart-of-defi-boom

Daily settlement value is simply the USD value of transactions on a network. Ethereum's incredible rise over the past several months is largely due to stablecoins and the DeFi movement. Stablecoin transactions are set to at least quadruple in volume this year - with the current 2020 figure sitting at $508 billion (last year was $253 billion).

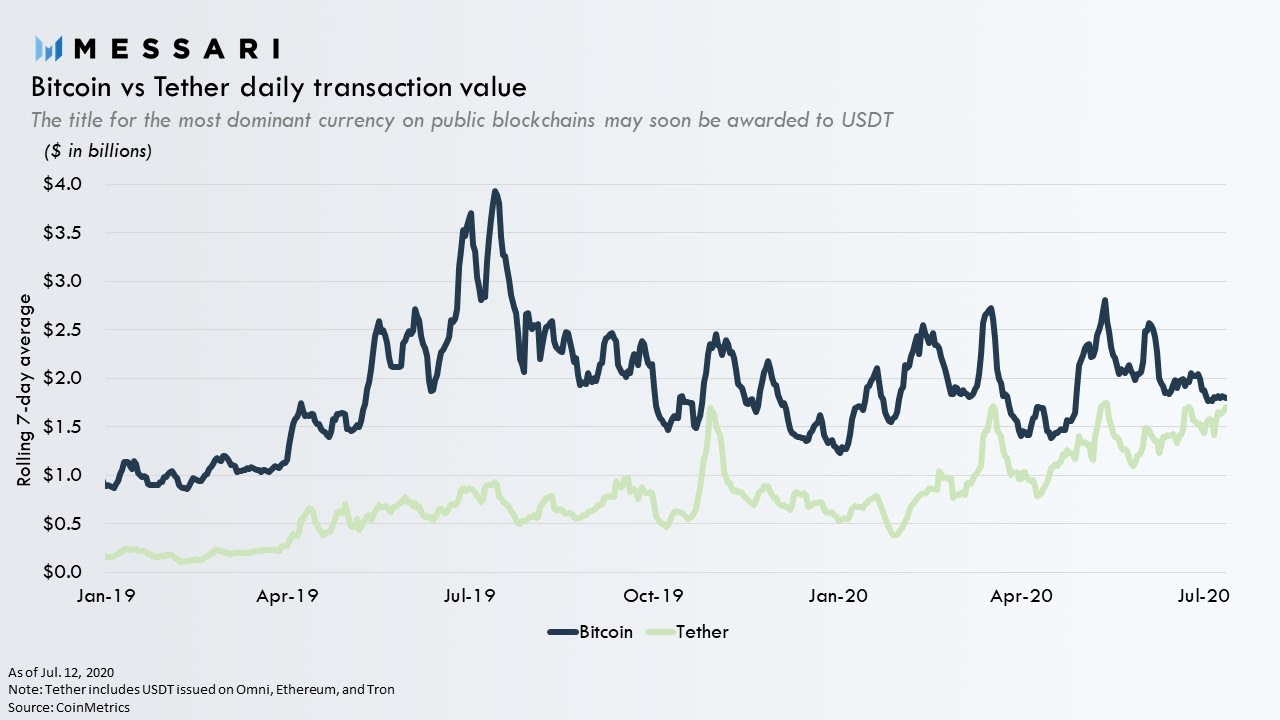

If you want to see something really crazy, look no further than the growth of USDT transactions, which accounts for most of this parabolic rise:

The ETH network has already surpassed BTC in daily settlement volume, within the next 30-60 days, USDT alone will likely surpass BTC daily tx volume as well. This is an incredibly important metric to pay attention to. The world of crypto is dynamic and anyone who thinks that focusing on just 1 asset is smart, misses the broader picture.

Granted, when I say focus on 1 asset, I don't mean invest in one asset. I mean pay attention to the space from a macro perspective rather than just looking at it in an echo chamber.

I hold almost no Tether. I utilize it occasionally when I'm sitting in cash for less than 30 days and I only do it with small amounts of $ that I know are at risk. I don't look at Tether as being a safe way to store value but rather, a way to temporarily store value while I wait for a particular opportunity or payment.

Around the world, however, other people look at Tether as a safe-haven. Bitcoin is a great long-term value storage mechanism.. but we have no idea what it will do in the short term. For all we know, BTC could get cut in half. As a world citizen who has a poorly managed local fiat currency, holding some of your wealth in BTC makes a ton of sense over these long-term time horizons. Holding USDT on the other hand may be a great way to store short-term payments that you will spend regularly.

I look at the entire stablecoin industry and see a lot of potential. While we've seen an explosion in the usage of DeFi services and stablecoins on a global scale, we are just at the nascent stages of what is possible.

Since the start of 2020, the entire stablecoin market cap has grown from $2.4 Billion to over $12 billion USD. While the industry booms, we're also experiencing a lot of network load on Ethereum. ETH is not capable of handling this level of activity, so many (like me) are also waiting on ETH2 to make our lives a whole lot easier - and more importantly: our transactions a whole lot cheaper.

LeoFinance is an online community for crypto & finance. We run several projects that are powered by Hive and the LEO token economy:

| Track Hive Data | Blog & Earn LEO | LEO FAQ |

|---|---|---|

| Hivestats | LeoFinance | Learn More |

|  |  |

| Trade Hive Tokens | Learn & Contribute | Hive Witness |

|---|---|---|

| LeoDex | LeoPedia | Vote |

|  |  |

Posted Using LeoFinance

I am also neither buying or selling at this stage. Either way it goes I will be reacting to movements between 8k to 9.7k

Posted Using LeoFinance

That's essentially the same approach I am taking.. I think that's the best way to look at this market

Posted Using LeoFinance

Absolutely!

Good strategy; helps reduce your risks.

But at the same time, those practicing futures trading are still trading at this current level.

Posted Using LeoFinance

If I was a more active trader, I definitely would be playing these little BTC swings of a few hundred $. For me, it's about the long-term because I can trade elsewhere and make better (and more secure) returns.

Posted Using LeoFinance

And where is that?

Posted Using LeoFinance

It seems HiVE needs to develop a stable coin to handle some of the traffic. 😁

Posted Using LeoFinance

Lol if only someone would develop some DeFi/stablecoin solutions for Hive!

Posted Using LeoFinance

ETH has more use cases than Bitcoin

Hive can bring crypto mass adoption

We need more users and demand for our Hive

Posted Using LeoFinance