In a World of Uncertainty, HBD is Proving to Be The #1 Stablecoin

We're living in a world of bank runs, crypto companies collapsing and overall uncertainty about... well, everything. The world is in a state of constantly questioning things. I think this is healthy in a lot of ways, but it also can be detrimental.

COVID kicked off a state of massive distrust with the establishment. As people in crypto, we've spent a significant amount of time already on this spectrum but now it seems that the masses are coming around to a new way of thinking.

Maybe everything isn't as okay as we are told it is. Maybe we are told things to just keep us quiet and moving forward and consuming the next iPhone or that package from Amazon or pay that student loan bill. Keep quiet and march on.

Stablecoins

Stablecoins in crypto have always been a fascinating concept to me. I've been in crypto since before Ethereum gained adoption - so that means I've been around when things were just BTC.

If you were in crypto, it meant that you held Bitcoin. There wasn't a whole lot else to do in this industry other than to keep calm and stack sats.

Then Ethereum started promising us the virtual computing model. We started to get excited about the premise of decentralized applications (dApps) and how they could change the world.

And slowly, a whole new world unfolded. Ethereum delivered a dApp revolution and also a revolution in altcoins and spin-off blockchains.

We also managed to get really amazing developments like Steem Hive and all of the incredible technology that comes along with it.

Stablecoins were a natural development. When crypto was just crypto (BTC, ETH, etc.) then we were forced to endure massive volatility all the time. The only "safehaven" was if you went back to fiat and saved yourself some of the volatility by taking some profits into USD.

Stablecoins originally offered that safehaven. We could move from BTC or ETH into USDT and have a little safety net.

Slowly, stablecoins gained more and more adoption. Suddenly, we could also lend out stablecoins and earn interest. It became a whole new way to remove yourself from the fiat system, hold crypto but also have some "cash" in the form of safe stablecoin in one of your wallets.

Then we saw UST collapse. Slowly, people started to question every other stablecoin. This is not new, people have been questioning USDT and the reality of their reserves since the beginning of USDT.

The Promise of a Hard Peg

Well this title could be read in two very different contexts. Get your head out of the gutter and keep it focused on stablecoins.

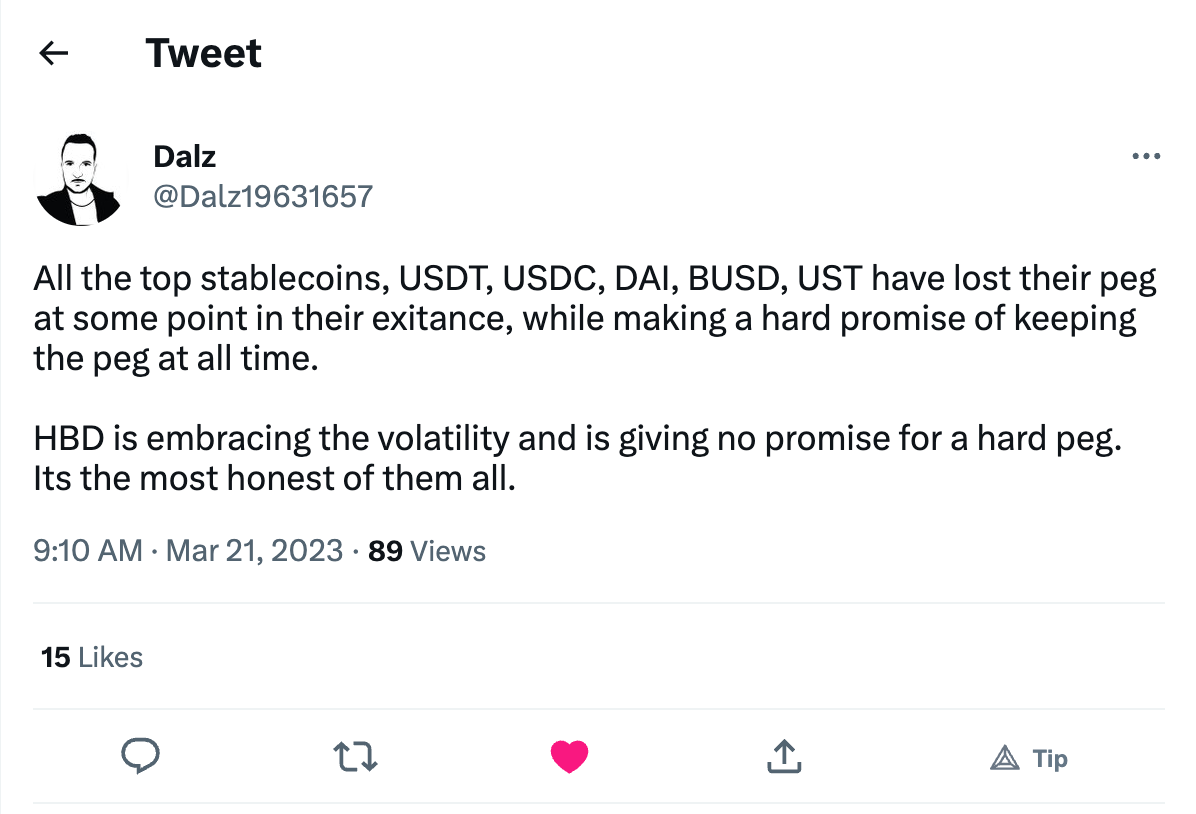

Dalz put out this tweet and it resonated with me: Stablecoins like USDT, USDC, BUSD, UST, etc. offer hard pegs. They MUST be worth $1, always. If they aren't, then something is wrong.

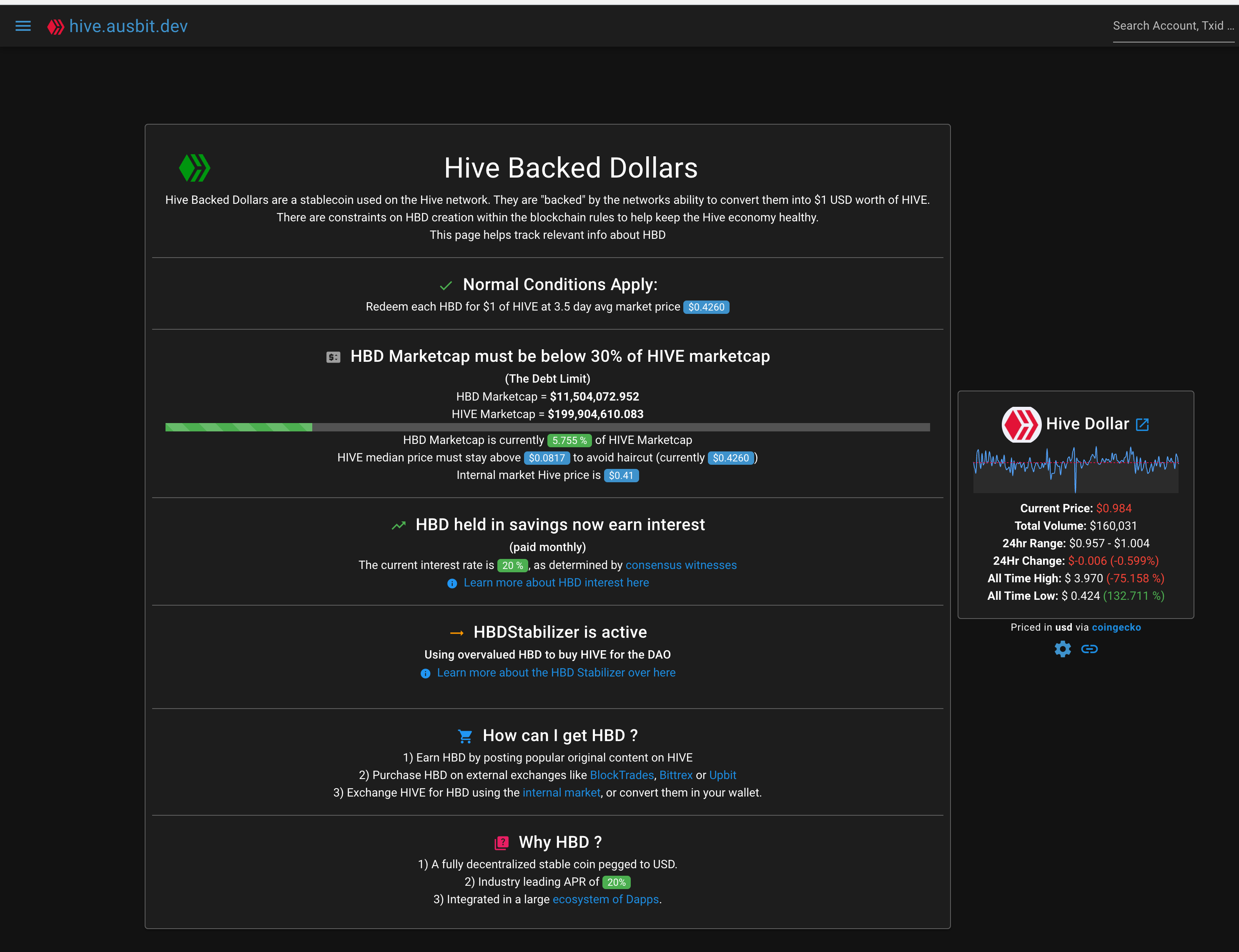

HBD does not fool anyone. It offers a soft peg. Instead of promising to always be worth $1, it promises to always be worth roughly $1 worth of HIVE - UNLESS certain conditions are met. This is where the debt limit, haircut rule and other variables come into play.

HBD Can't Collapse

Yes, HBD could in theory become worth $0.60, but it can't death spiral like UST. We all understand that it is soft-pegged.

If HIVE were to crash below $0.0817, then we all know what happens. HBD loses its peg temporarily.

On the other hand, we all know that if HIVE crashes down that low, it will also recover. This blockchain has an insane amount of development relative to the size of its market cap. An insane amount of usage as well.

Combine that with the economics that drive this chain and the newly updated HBD model and I believe that HIVE is severely undervalued.

Now, this shouldn't be a factor for a stablecoin. It should always be worth as close to $1 as possible, right?

Well, that's the goal but the volatility in between isn't necessarily a bad thing.

Other stablecoins are inflexible. HBD is flexible. If USDC drops to $0.92 overnight, then people start losing their shit and wondering if the whole USDC economy is going to break and go to $0 like UST did.

If HBD drops to $0.92, we all say "well, it is a soft-peg" and many of us will look at the numbers behind the scenes: the debt limit, HBD market cap, HIVE market cap, etc.. It's all on-chain.

When shit gets windy, HBD sways in the wind while other stablecoins start to shatter at their base. They MUST hold their peg to keep confidence - kinda like how a bank run in TradFi works. HBD doesn't play the confidence game, it works how it works and we all know it.

Unique Opportunity for HBD Adoption

I think the 20% APR is a genius move by Hive as an ecosystem. We're giving people a reason to look our way. The reason is far too large to not give it a fair look.

HBD offers one of the most unique opportunities in crypto. 20% APR on a stablecoin with a soft peg, amazing economics and a community that has been around longer than 99% of other crypto projects and even the top stablecoins out there.

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage & share micro and long-form content on the blockchain while earning cryptocurrency rewards.

Our mission is to democratize financial knowledge and access with Web3.

Twitter: https://twitter.com/FinanceLeo

Discord: https://discord.gg/E4jePHe

Whitepaper: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3: https://leofinance.io/

Microblog on Hive: https://leofinance.io/threads

LeoMobile (IOS): https://testflight.apple.com/join/cskYPK1a

LeoMobile (Android): https://play.google.com/store/apps/details?id=io.leofi.mobile

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 2.8M HP

Hivestats: https://hivestats.io

LeoDex: https://leodex.io

LeoFi: https://leofi.io

BSC HBD (bHBD): https://wleo.io/hbd-bsc/

BSC HIVE (bHIVE): https://wleo.io/hive-bsc/

Earn 50%+ APR on HIVE/HBD: https://cubdefi.com/farms

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC): https://cubdefi.com

PolyCUB (Polygon): https://polycub.com

Multi-Token Bridge (Bridge HIVE, HBD, LEO): https://wleo.io

Posted Using LeoFinance Beta

https://twitter.com/2429520006/status/1638214748394102788

https://twitter.com/67965788/status/1638224291362746370

https://twitter.com/1472693700933345286/status/1638491780801871872

https://twitter.com/1415155663131402240/status/1638544006186700802

https://twitter.com/1884771912/status/1638555374079950848

https://twitter.com/1021896104118341632/status/1644051733604343808

The rewards earned on this comment will go directly to the people( @atma.love, @kalibudz23, @rzc24-nftbbg, @shiftrox, @shortsegments ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

One thing I'd love to see is a kind of "Haircut reversal" rule. That way, if there is a haircut, there would be a set of rules that mean everyone who lost out gets repaid their losses once things are back on a stable footing again. Not too early, just eventually.

But I'm still a huge fan of HBD 😀

As long as you hold long enough for it to restabilize, you're fully compensated by the time you convert. It's only if you want out during the storm specifically that you get a haircut. In the meantime, you are compensated with a high rate of APR for holding through the storm.

Ah, thank you ! I guess I just assumed it was the kind of haircut used by the legacy banks, where they just take your deposits or issue worthless vouchers, and that's that. I plan to hold HBD in the very long term, so that's all good 😀

(As long as HIVE retains some value.)

An interesting perspective

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

The flexibility is just like the way the wings on an airplane first lift up as the plane speeds down the runway before they drag the rest of the plane into the air.

And if we hit turbulence they'll move up and down a bit but we'll fly right through it.

Absolute pegs, where public markets are concerned, seem to be setting ones self up to fail every time.

Posted Using LeoFinance Beta

Great analogy.

Great read @khaleelkazi!

You've given me a new appreciation of #HBD in the light of soft pegging.

It would interest me to hear any thoughts you may have about how #HBD may be affected by the SEC's obsession with staked cryptos being securities. They appear, to me, to be creating a one occupant regulatory safe zone for POW's BTC. Although the dust shall likely settle the next number of years should see more industry slowing litigations if the SEC continues down the road of CBDC introduction.

My feeling is that the semi-centralized and individualized witness system of #HIVE may offer an attack vector for the SEC which POS ETH, for example, does not share.

The 'individualized' witness system on Hive is actually more resistant to state pressure than the system on ETH. Stake pooling does not in itself improve the resistance to state pressure - it's ultimately the node operators that the state can apply pressure to alter block production and enforce a censorship regime. Pooling doesn't change things because most of the stakers are not running a node, but merely pooling along with a person or institution which is.

Indeed, the fact that so many institutions are involved is the problem at ETH. Institutions are often the ones running the pools and the key nodes, and institutions find it much more difficult to move and leave a hostile jurisdiction than individuals do. Institutions are much more likely to be inclined to ultimately comply with state demands, which is indeed what we have seen with exchanges over the years in the crypto ecosystem.

Is your suggestion that 20 individual witnesses are less centralized/individualized than the untold amount of folks holding 36 (?) ETH or more? Even should the large ETH pools be targetted a system seems in place where anonymous individuals can pick up the slack. This seems not the case, to me, with #HIVE.

It doesn't take "untold" amounts of validators to make a majority and thus alter consensus on Ethereum. What matters is the number of institutions and/or individuals operating nodes (the number of nodes they operate is irrelevant when they're operated by the same people or institutions) with sufficient stake to have over 50%. And the fact that such a large amount of staked Ethereum is held and operated by institutions (exchanges) particularly makes it vulnerable to state pressure. 3 of the top 5 entities in Ethereum staking have already bowed to state pressure in the past. If there is any weakness in the decentralization of LIDO (itself having a small number of people who own more than 50%), then those 3 along with LIDO would have the 50% required to implement a censorship regime.

Thanks for your replies. Your insights are most welcome to me at this time.

HBD is my masterplan for the next bear market. It should have been the case for the past one as well, but greed pushed me into the dirt once again... This time is different :)

Yes HBD really proved it is a stable coin, can you tell me if I want delegate to leo so how to delegate?

Posted Using LeoFinance Beta

Good work in explaining this to us. I will be getting mine as soon as all my withdraws from all the sites I quit pay me. I am hoping to get a lot of HBD with my earnings.

Posted Using LeoFinance Beta

That's quite true and I like that HBD is not aimed for hard peg, but rather to repeg through solid mechanics. This means stability and sustainability against market uncertainty and blind sheep reactions.

Posted Using LeoFinance Beta

Opportunity that comes with hbd is life-changing and we must build gradually with it.

Posted Using LeoFinance Beta

im going to be staking hbd, for now, it's stable now

This is more or less the analogy I made about it last year.

Aside from the confidence aspect of allowing minor depeggings to be normal for HBD, there is also the fact that allowing minor depeggings also means better use of capital by our stabilization mechanisms. The HBDstabilizer using the equivalent of $1000 to stablize the peg goes a little further when the internal market price is at $0.95 (buying 1052 HBD) rather than $0.99 (buying 1010 HBD). The network effectively profits from fixing a depegging event, but moreso if it doesn't try to maintain a tight peg. That said, there is still a trade off because allowing a depeg intentionally would likely still undermine confidence.

It's just so unique the way HBD is, we know 1$ is Inevitability when it losses that soft peg. The world's only true decentralized stablecoin. It might be a blessing in disguise that stablecoins are losing their shit and HBD is like .....

Posted Using LeoFinance Beta

HBD remains the best at the moment when it comes to stability and it's always a great privileged for people who are saving the coin. its value is incredible compared to other coins.

Posted Using LeoFinance Beta

Thank you for this post comparing HBD to other stablecoins. There is some very important information in this post. After the UST crash I had lost some faith in stablecoins. This post made me regain some of that lost confidence !BEER

Posted Using LeoFinance Beta

View or trade

BEER.Hey @khaleelkazi, here is a little bit of

BEERfrom @stefano.massari for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER."This blockchain has an insane amount of development relative to the size of its market cap. An insane amount of usage as well."

I completely agree with you that Hive has insane potential. However, being a blockchain-based platform, Hive requires a transitional period for users to adapt to the new technology. It can be daunting for some users to make the shift from the familiar Web 2.0 to the more decentralized and secure (read complex) blockchain technology.

To put it bluntly, I think Hive needs more centralized applications that will take care of UX and onboarding processes. On contrary, what I've learned so far is that money and incentives change how people behave, making it harder for the app to function as a soc media.

This is by far the biggest issue I can see.

What I'm hoping to see is businesses accepting HBD as a form of payment . Although our target audience isn't exactly crypto-savvy, we believe that pushing the narrative forward will make a difference in the long run.

It turns out that HBD was my best investment ever. ♦️

https://leofinance.io/threads/@seckorama/re-leothreads-wcy33pu

The rewards earned on this comment will go directly to the people ( seckorama ) sharing the post on LeoThreads,LikeTu,dBuzz.

The 20% APR matched UST yield on Anchor before the death spiral. It was an ingenious move. I will continue to stack $HIVE & $HBD, powering up for yield and delegating out $HP for further yield, utilizing $POSH & $GOSH to further compound interest for more passive income.

Posted Using LeoFinance Beta

At this moment, nothing seems to be more faith keeping on when nit comes to investing than #HBD , but regardless of that, I still so much believe that other tokens too will definitely do well in future

Posted Using LeoFinance Beta

All you mention are great reasons to continue to believe in and support Hive and for us to use HBD as our preferred stablecoin. From everything you have explained, I have a feeling that HBD will end up outperforming all the stablecoins in the market sooner rather than later.

Posted Using LeoFinance Beta

Many of us will even buy the dip

Your confidence in Hive is reassuring. I have only been here 4-5 years, or 60 moons in April, but I felt an intrinsic trust for Steem backed dollars when I first joined as more reliable then USDT, which people have seemingly always been suspicious of, but seemingly always used as thee ubiquitous stablecoin.

There is so much to learn and understand in crypto, one is constantly rereading and rethinking things here to fully understand.

thank you.

p.s.

I am trying out the alpha interface with this account first, and I will write a post about it in a few days.

Posted Using LeoFinance Beta

Tagging

#shortsegments

#cryptowendyo

Posted Using LeoFinance Beta