The COMP Effect: How Compound Has Led the Charge in a DeFi Boom

Following the emerging DeFi industry has been a passion of mine lately. It's been interesting to see the evolution of longer standing protocols like MakerDAO against the contrast of newer platforms that are rising like Compound.

The crypto industry itself is still nascent. There are colossal voids and gaps in the architecture of crypto in terms of UI/UX and many other areas that still need a lot of work.

With this said, we now have other layers being built like DeFi which are even more nascent. For all the gaps in the broader crypto space, there are many many more in a space like DeFi that is built on top of it.

The core mission of DeFi is to bring financial tools and services to the entire world. Whether you're an American looking to leverage up some of your crypto holdings or you're living in Africa and want access to a loan product to start a business, the long-term goal of DeFi is to provide services that are valuable to everyone regardless of the "standard" institutional practices.

Compound Making a Dent on the Industry

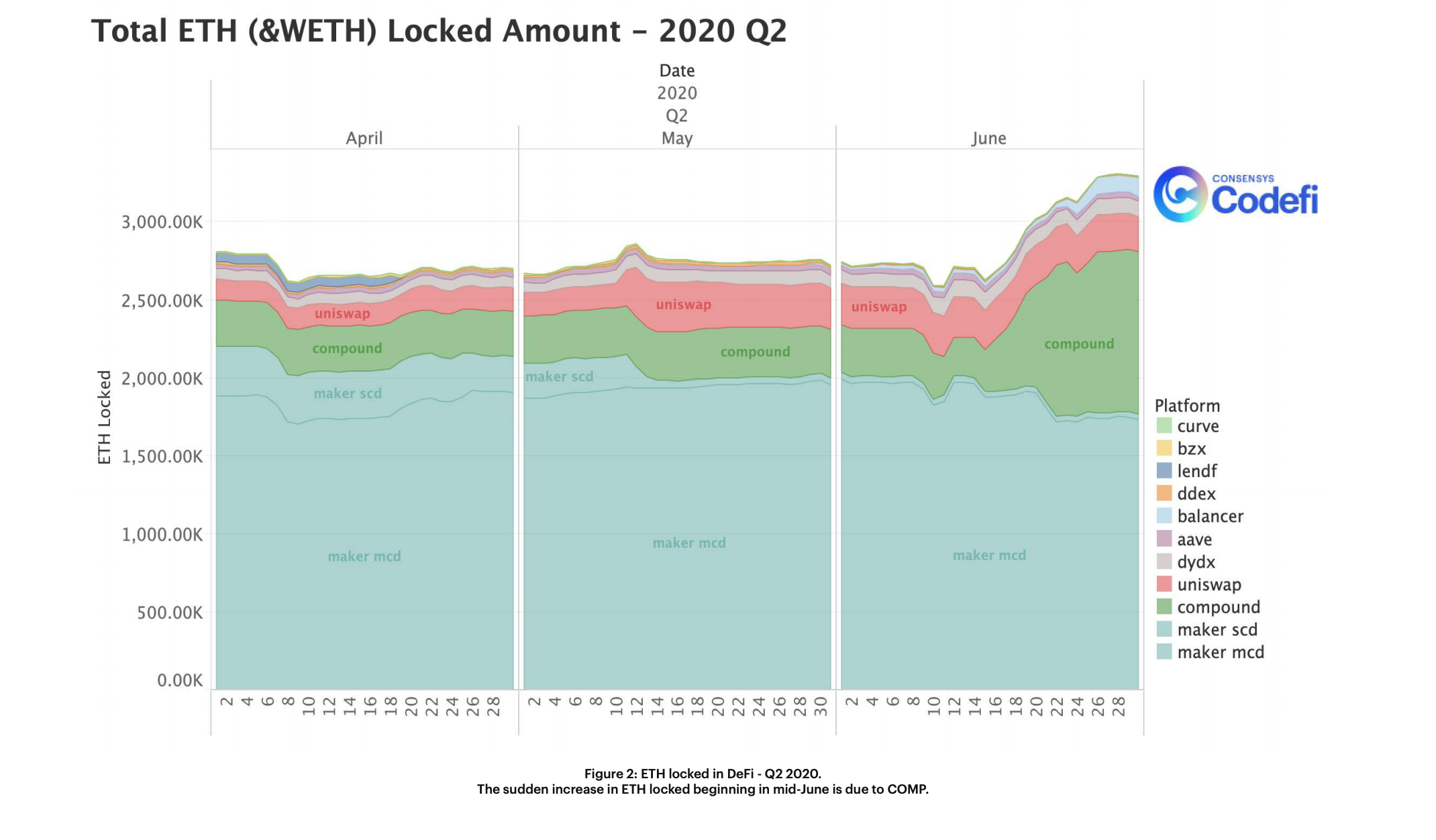

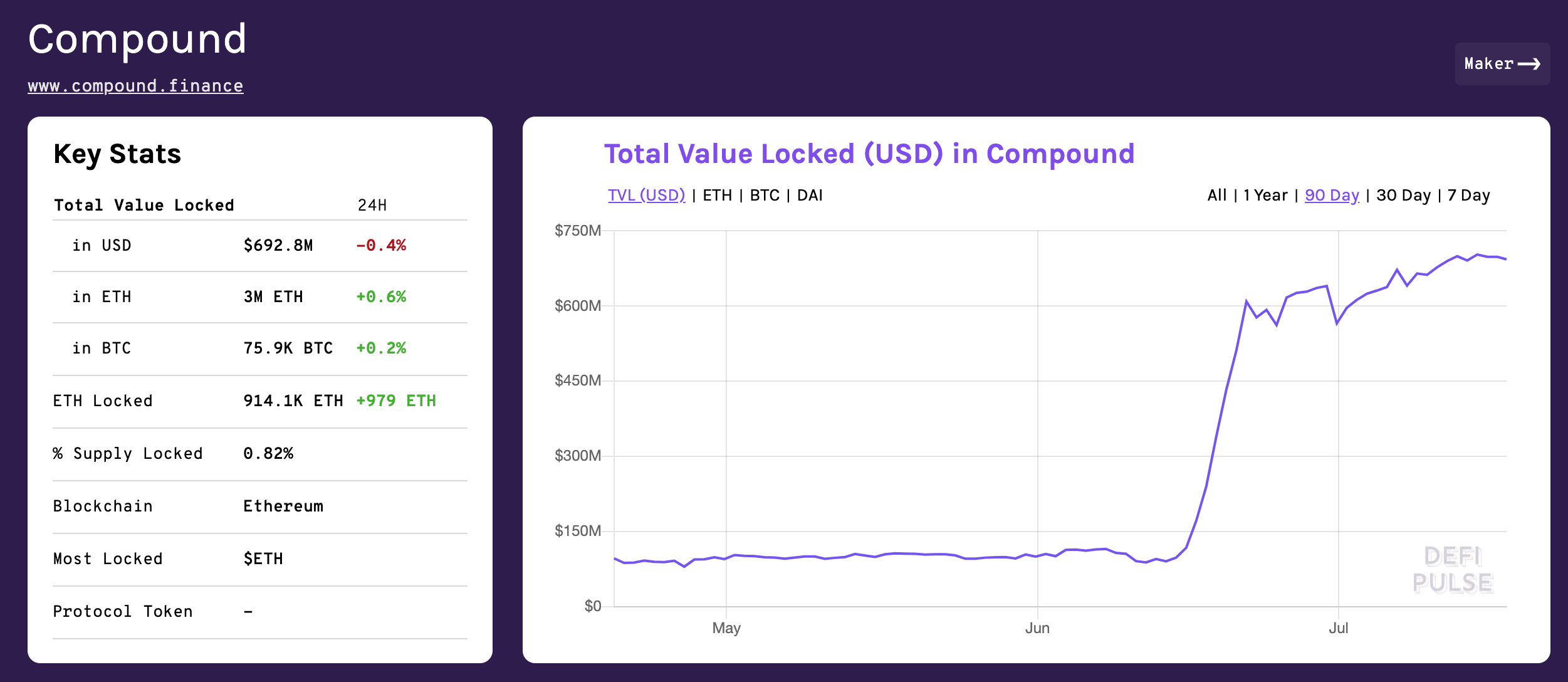

The COMP governance token was launched recently and the platform saw an incredible surge in TVL - total value locked. This TVL metric is one of the most used in DeFi as it gives us a measure on all the assets locked in a protocol. When we look at the rise of the TVL in the COMP platform, you can see just how big of an impact it had on the larger DeFi space:

Above is the TVL in Compound.. rising by over half a billion USD in less than a month.

The first chart in this post shows the total ETH (and wrapped ETH) locked in the entire DeFi space. Not surprisingly, this major increase in the TVL on Compound also attributed a major spike to the entire value locked on DeFi more broadly.

What About Actual Users?

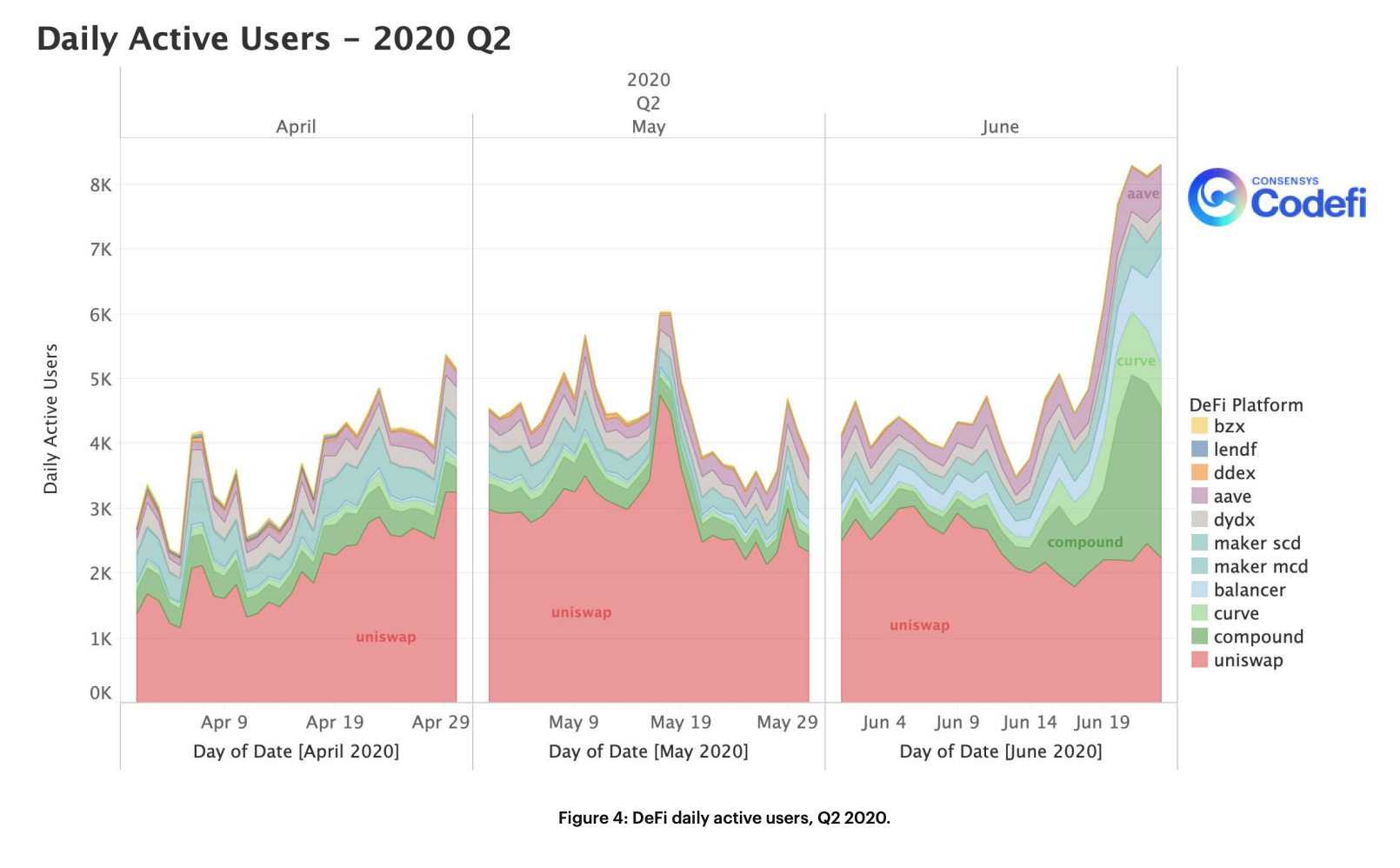

A lot of people are questioning just how accessible DeFi is for the "masses" - or at least the masses who use crypto (which is obviously a small subset of the global population). When we look at the unique addresses and analyze the protocols for users, these are the numbers we get:

There's been a major rise in active users on DeFi protocols, but this is still a tiny industry. To further put this into perspective, the daily active users on DeFi and the DAU on Hive are almost identical.

Hive is a small blockchain and DeFi is clearly a small industry. In terms of market cap, there's way more money over on DeFi than there is on Hive.

To me, this is just another signal of the nascency of DeFi and the broader crypto space around it. We have a long ways to go before these products are actually "usable" by average folk and we clearly need a lot more innovation on the UI/UX of these tools.

The Hive maximalist in me also wants to slide in a comment saying that the # of users on Hive is very impressive. While many would say having ~10k users is meaningless, let's just take a moment to look at the # of users over on DeFi and also compare the $$ in DeFi versus Hive. Interesting potential on both sides, if you ask me.

Join The LEO Community!

LeoFinance is an online community for crypto & finance. We run several projects that are powered by Hive and the LEO token economy:

| Track Hive Data | Blog & Earn LEO | LEO FAQ |

|---|---|---|

| Hivestats | LeoFinance | Learn More |

|  |  |

| Trade Hive Tokens | Learn & Contribute | Hive Witness |

|---|---|---|

| LeoDex | LeoPedia | Vote |

|  |  |

Posted Using LeoFinance

If I have a paperclip I can turn it into a house. I heard this on american news. Is this compound interest? I have a paperclip and would LOVE a house one day

Posted Using LeoFinance

haha that is the American way, essentially.. Wishful thinking at it's finest :)

Posted Using LeoFinance

I'm waiting for the day when you will add a defi app in the leo portfolio 😀

sooooooon

Posted Using LeoFinance

that's helped lots can I aks question in future

Glad to help and sure, ask any time ;)

Posted Using LeoFinance