A More Recent Hyperinflation

In this next case study, we will look at the hyperinflation that happened in Germany during the early 1900s. World War One took place between 28th July 1914 – 11th November 1918. Germany’s war efforts would need a lot of money to fund. As this was money that they did not have, they would need to get that money from somewhere. The way that this works is that the German government take out a loan from their own national bank.

If you were to take out a loan today, you would need some collateral, an asset that would be taken if the debt cannot be paid. This is the equivalent of taking a mortgage loan for your house from the bank, and if you cannot pay back that loan the bank will repossess the house. The assets that the German National Bank was using as collateral was the promise that after Germany had won the war, they would sell off newly acquired land and assets.

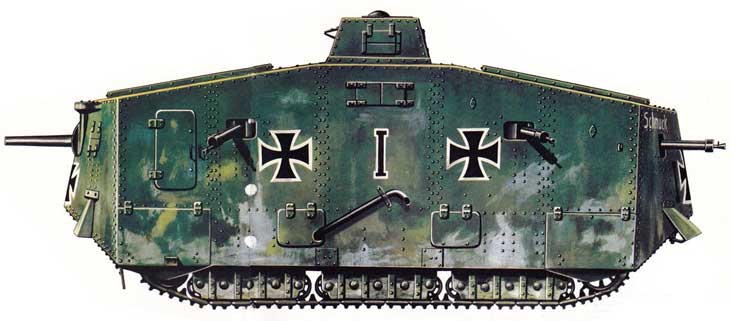

The money that they needed was to purchase everything needed for the war: tanks, ammunitions, rations and training. Over the course of a 4 year period, the size of Germany’s debt was monumental. Given that Germany had lost the war, the promise of being able to pay back their debts was looking close to impossible. So, the German government was faced with two options when it came to paying back their debt:

Default on their debt. The German government come out and say, “We know that we promised that we could pay you back, but we can’t”. This would be the equivalent of you or me not being able to make mortgage payments and declaring bankruptcy.

Print new currency to pay off the old currency. At this point, Germany has a large number of debt infront of them which they need to pay back. What they have the ability to do, though, is to set up printing presses and print new currency to pay off the debt that they owe.

So, which one do you think they went for?

Posted Using LeoFinance Beta