Trade Journal - Shopify (05.19.20)

First of the trade was open on Monday and closed yesterday hence the post is dated 05.19. When I am referring though is the present day and looking back at the trade I made.

Two days ago I went and bough Puts on Shopify due to TA charts and news coming out from Facebook would have an announcement on their public market the following day. More competition with Shopify and weak buying into the trading session on Monday led me to hold Puts.

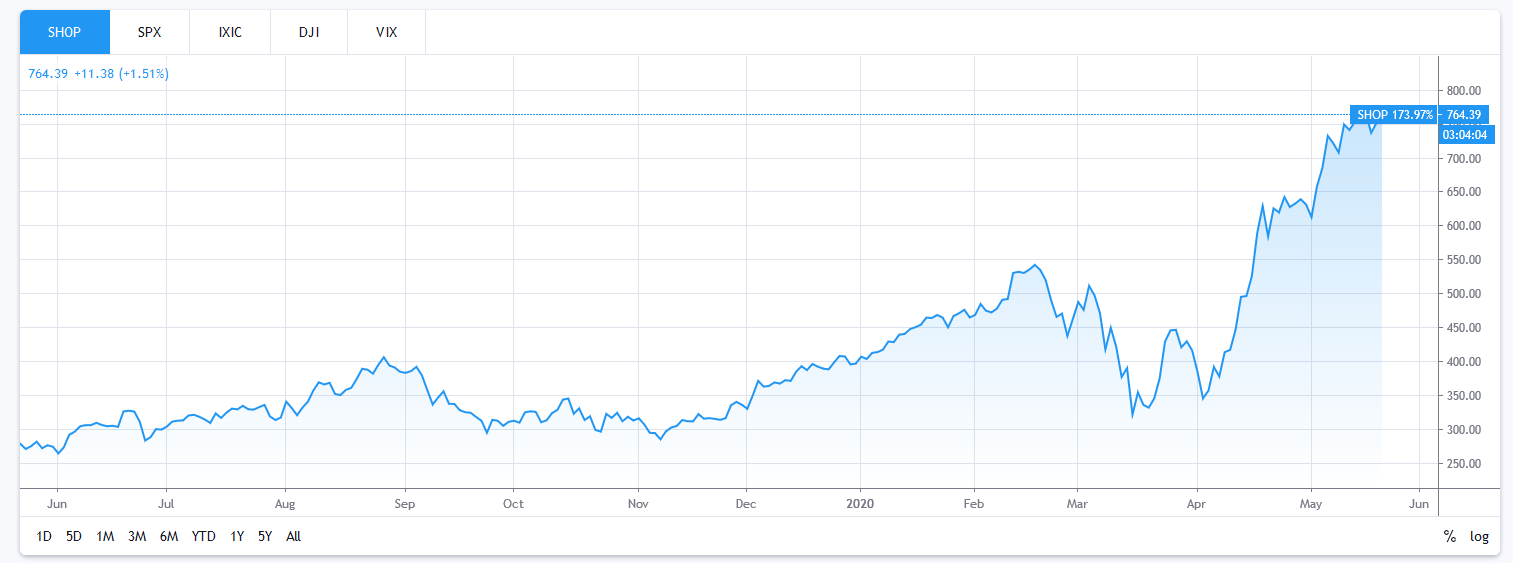

The up trend has been significant for high growth stocks in FANG and now ZM, W, ESTY, and SHOP. The tech industry is on fire since the virus news come out. People having to force to stay home has resulted in more reliance on tech companies to provide access to goods and services.

On the 18th price was dropping continuously from all time high of 775 and throughout the day it fell. In the middle of the trading session was when I bought puts. However once I bought my puts the trade turned against me as two things was occurring that I neglected to realize as risks.

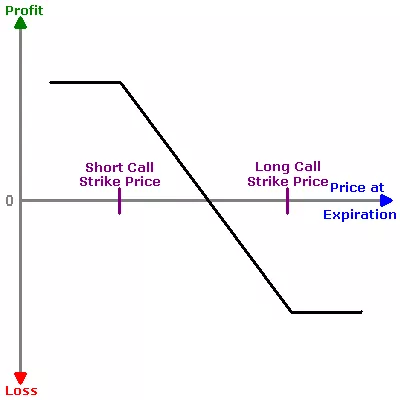

- Do to the quick price swing up since March lows the option premium on the stock was significantly higher than many other stocks. Going into the puts I was likely overpaying them. A quick movement in the wrong direction I would immediately be holding a loss. To mitigate this I should have used a spread such as short vertical calls or buy vertical puts.

(courtesy of Investopedia)

With a vertical put I limit the option premium but also cap my profits if SHOP indeed had a price drop.

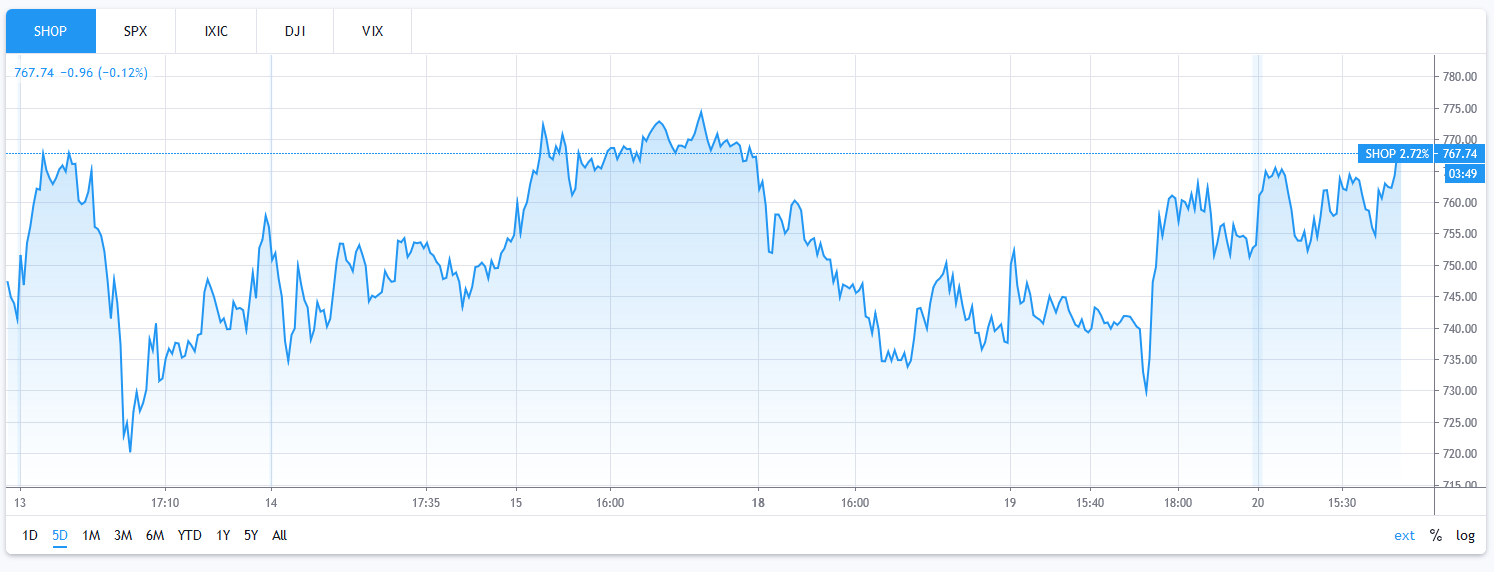

- The stock volume is low relatively speaking as it averages 3.6 million a share a day. Yet Monday lack of buying and a good chunk of it was selling lead me to believe in being bearish. The fact that there was a low quantity of shares did not let me be able to sell out of my puts early to capture a decent size gain. I have to play into the volume and glad I did not have an oversize position on even if I have conviction that prices would go the way I thought.

I was very right and very wrong at the same time!

During yesterday's trading session the initial opening had SHOP pop over $8 on literally 300 shares before markets opened. Through the trading sessions the price gradually went lower but never manage to get below 740 and hold. At that price my puts were in the red but the Facebook news once just hours away. This is where I experience the limited amount of shares traded meant limited amount of options being traded.

At the initial start of the Facebook news the stock quickly dropped $10 in a matter of seconds. I immediately try to set a limit order. By the time order was set the stock price drop another $10 and stock was close to $720. However my limit order was not getting filled and when I started to see prices move up back to $730 I knew I had to get out as best I could without a lose. The bounce was swift and I had no time to check on the Facebook news other than I knew they had something to do with the SHOP price. I lowered my limit order and luckily got filled with a 10% profit. I say luckily because moments after my order was filled the stock was back to green and eventually go on to close near $750. My puts if I had held would have been in the red for -40% loss, and as of today SHOP is still gaining at close to $765.

Relying on News not ideal?

The charts looked to have SHOP price stalling but never confirmed a follow thru drop. I had hope the Facebook news would be catalyst for things to come, but I had no control of what that news was. Basically Facebook came out with an enhanced market place system, but would partner with other sites such as Shopify to help customers. So in essence make Shopify an even better product! No news was necessary to hear anymore as it was clear Shopify would benefit from this. I was very lucky in this trade as that the initial fear in the stock allowed me to escape with a profit. If Facebook had came out from the get go that their hews was to help Shopify I would have taken a significant lose.

Disclaimer:

I am not a financial advisor and all this post information is for entertainment purposes only.

Posted Using LeoFinance