ChainLink Will Be Bigger Than Bitcoin

ChainLink is a platform which attempts to bridge the gap between smart contracts on the blockchain and real-world applications, which often tend to be off the blockchain. The cryptocurrency uses “oracles”, which find and verify real-world data and bring it on-chain to be integrated into smart contracts.

Smart Contracts are considered secure and reliable. In order to maintain a contract's overall reliability, the inputs and outputs for the contract must be secure and reliability too. Chainlink’s decentralized oracle network provides the same security guarantees as smart contracts themselves. By allowing multiple Chainlinks to evaluate the same data before it becomes a trigger, we eliminate any one point of failure and maintain the overall value of a smart contract that is highly secure, reliable, and trustworthy.

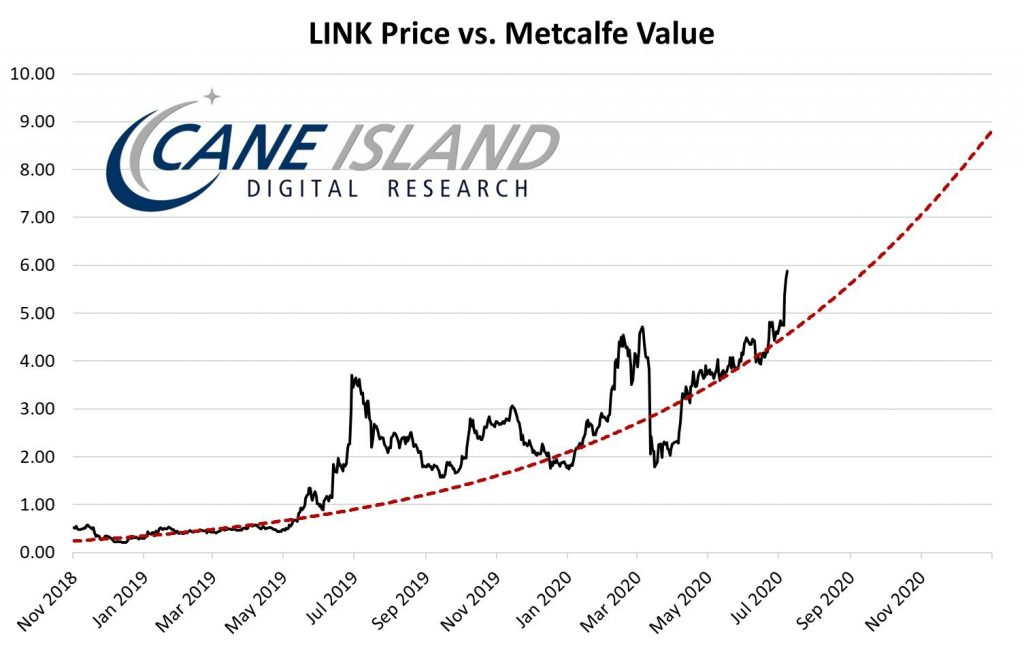

This past week, Chainlink broke above $5 for the first time ever. Since the March lows, price has been steadily climbing, but Timothy Peterson, a crypto analyst and an Investment Manager at Cane Island Alternative Advisors, Chainlink is just gettting started to the point where he's moving his excess money out of his Chase Bank account and into Chainlink and thinks the next target is $8 by the end of the year.

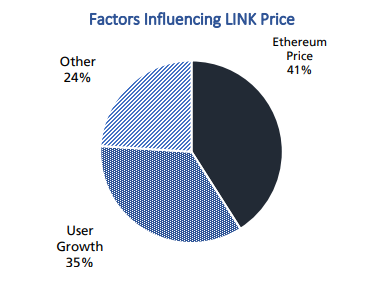

Unlike most other cryptocurrencies and tokens, LINK was not materially influenced by Bitcoin’s price movements. The merit to this finding lies not only in an investment diversification benefit, but in that almost none of the popular naysay arguments against Bitcoin would have much weight or applicability to LINK.

Additionally, the fate of LINK in the crypto markets was highly dependant on Chainlink user growth that stands at 17% per month.

We found that LINK’s user growth rate has been an astonishing 17% per month. Our opinion is that ChainLink has viable real-world business application. LINK does not simply serve as a speculative store of value or medium of exchange.

According to Cane Island’s research paper, as part of Blockchain 3.0, ChainLink will be right in the middle as the physical world interact with the internet and blockchains. In the case of ChainLink, ChainLink will take real-world live data and catalog it on the blockchain.

Blockchain 3.0 and/or Internet 3.0 also known as the internet of things is already upon us. Smart homes, wearables and connected cars are all examples of Internet 3.0. According to IDC, they estimates that there will be 42 billion connected IoT devices, or generating 79.4 zettabytes (ZB) of data in 2025.

So I can see how Chainlink will be a benefactor, but according to the Research Paper, nearly 41% of the price of Chainlink will be influenced by Ethereum's price.

Nevertheless, the chart suggest to buy ChainLink on a pull back to the weekly demand at $4.50.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Posted Using LeoFinance