Currency Analysis Report 9/24/20 – Is It Time To Finally Go Short NZD/USD???

Several months ago, the Reserve Bank of New Zealand (RBNZ) left its interest rates at 0.25%, as expected, but said it was prepared to use additional tools "if and when needed" including further cuts and expanding its quantitative easing program to include foreign assets. The teasing continued today as the RBNZ left rates on hold.

New Zealand's central bank held its official cash rate at a record low on Wednesday but hinted at further easing and warned the economy may need support for a long time as the world grapples with the coronavirus pandemic.

However, the RBNZ's warning of job losses and business closures in its commentary cemented expectations that it would move to negative rates, which sent the New Zealand dollar down 0.3%.

The RBNZ said the ongoing virus-led activity restrictions, especially during a second wave of infections in Auckland, continued to dampen economic activity, and business and consumer confidence.

A resurgent dollar held on to overnight gains on Tuesday after virus fears and worries about U.S. stimulus drove a wave of selling in just about everything else.

Meanwhile, the U.S. dollar rose against the New Zealand dollar on Wednesday, supported by positive U.S. economic data and concerns about a second wave of COVID in Europe. This is also on the heels of data showing U.S. home sales at their highest level in nearly 14 years in August.

So the question becomes can the US dollar continue to gain against the New Zealand dollar, lets go to the charts to find out?

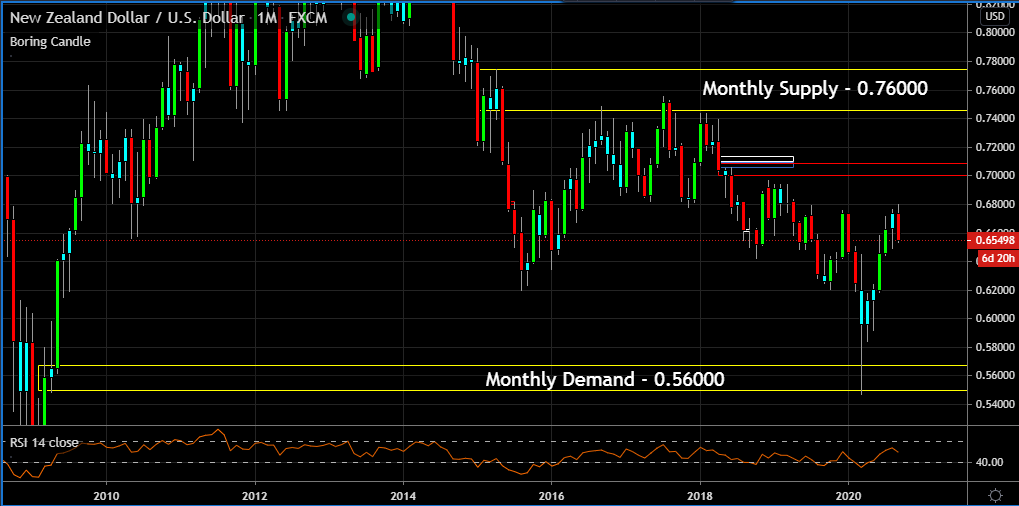

Monthly Chart (Curve Time Frame) - monthly supply is 0.76000 and monthly demand is 0.56000.

Weekly Chart (Trend Time Frame) – the trend is sideways with upside momentum.

Daily Chart (Entry Time Frame) – price is in an odd spot, having reacted to the weekly supply, but based on the monthly chart, price is in the middle with more upside potential. However, aggressive can take a stab and go long at the daily demand at 0.64600.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Posted Using LeoFinance