SPDR Sector Relative Strength Analysis Report For Week Starting 3/15/21

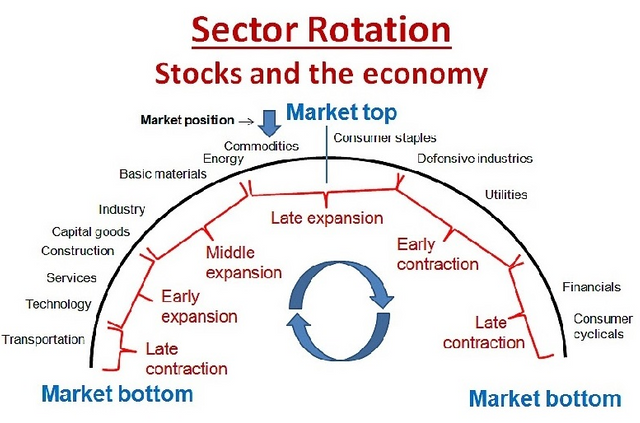

Sector rotation is the action of shifting investment assets from one sector to another to take advantage of cyclical trends in the overall economy in an attempt to beat the market. Sector rotation seeks to capitalize on the theory that not all sectors of the economy perform well at the same time because sectors of the stock market perform differently during the phases of the economic and market cycle.

For example, defensive sectors such as consumer staples, utility and health care stocks tend to outperform during a recessionary phase, while consumer discretionary and tech stocks tend to fare well during early expansions.

When you trade, you want the strongest stocks in the strongest sectors, which is why you should monitor sector performance carefully. With that said, lets determine the relative strength of the sectors relative to the S&P 500 ETF, SPY for the upcoming week.

Communication Services (XLC)

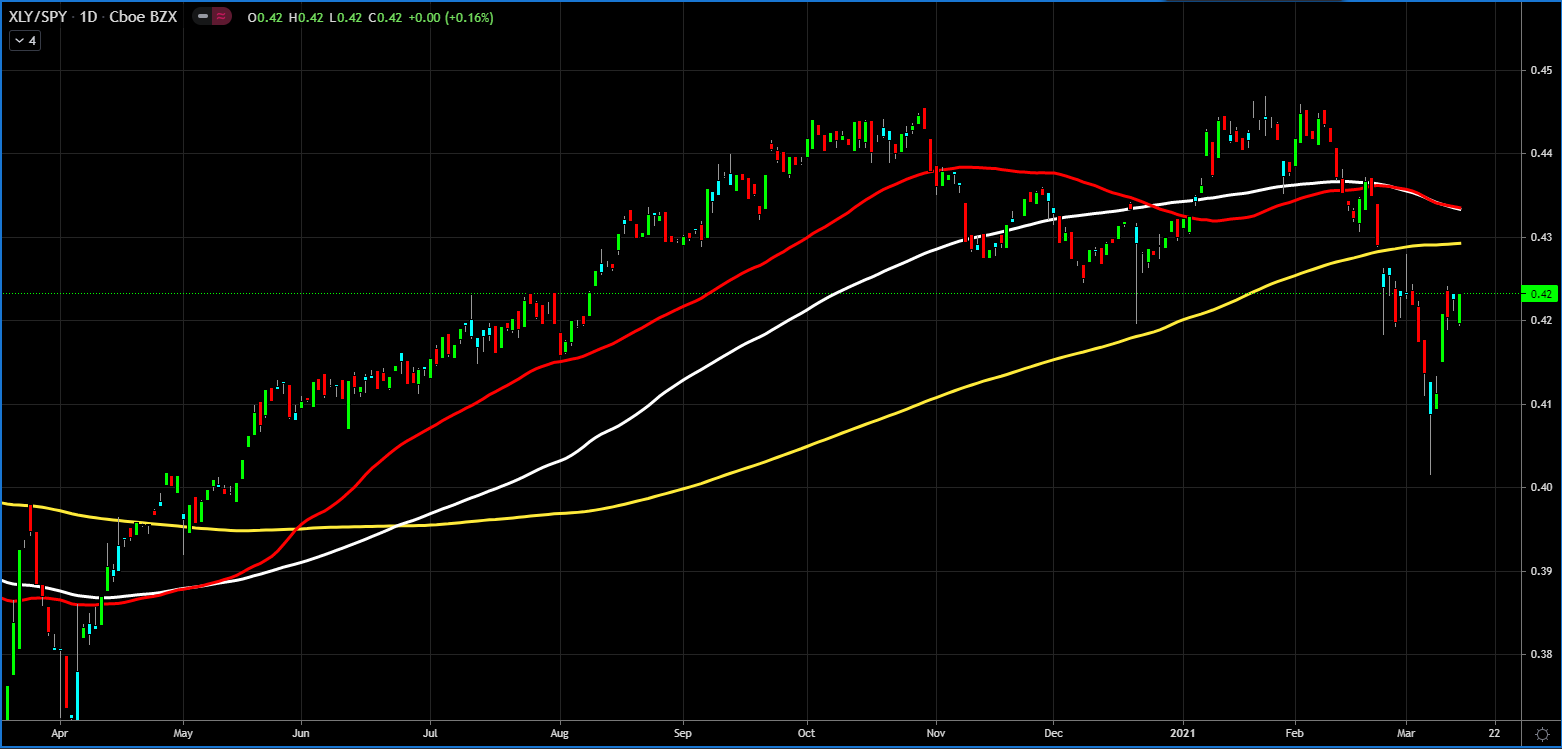

Consumer Discretionary (XLY)

Consumer Staples (XLP)

Energy (XLE)

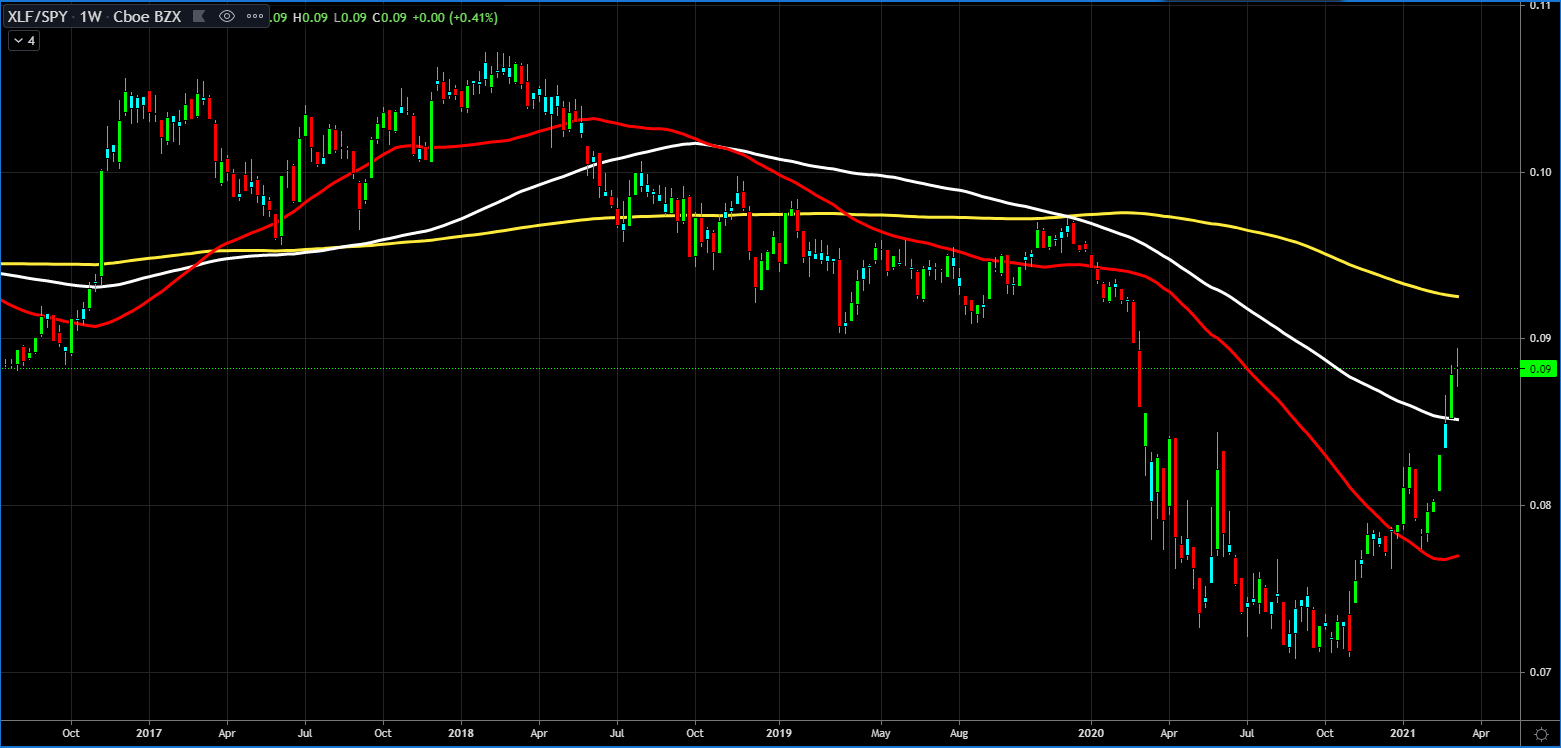

Financials (XLF)

Health Care (XLV)

Industrials (XLI)

Materials (XLB)

Real Estate (XLRE)

Technology (XLK)

Utilities (XLU)

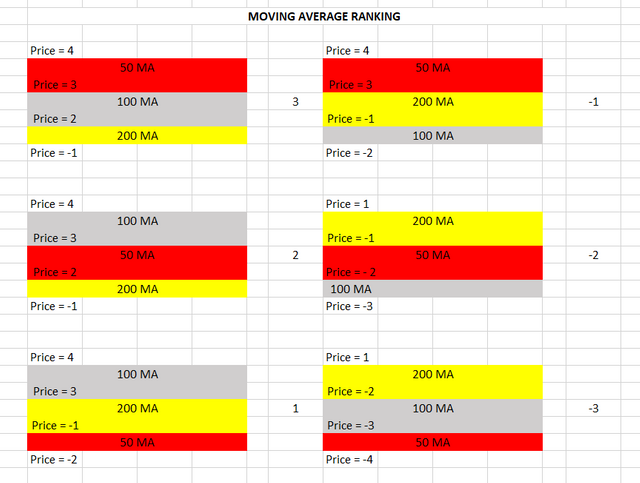

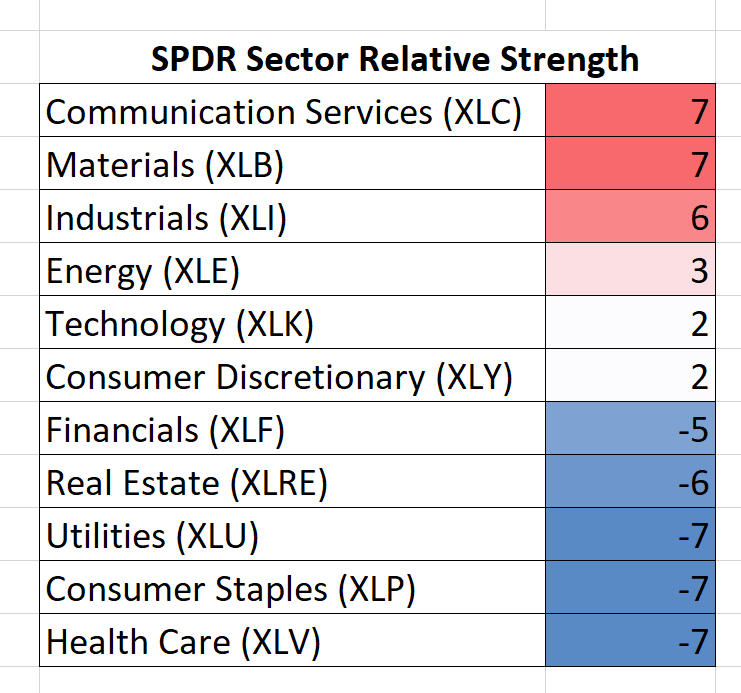

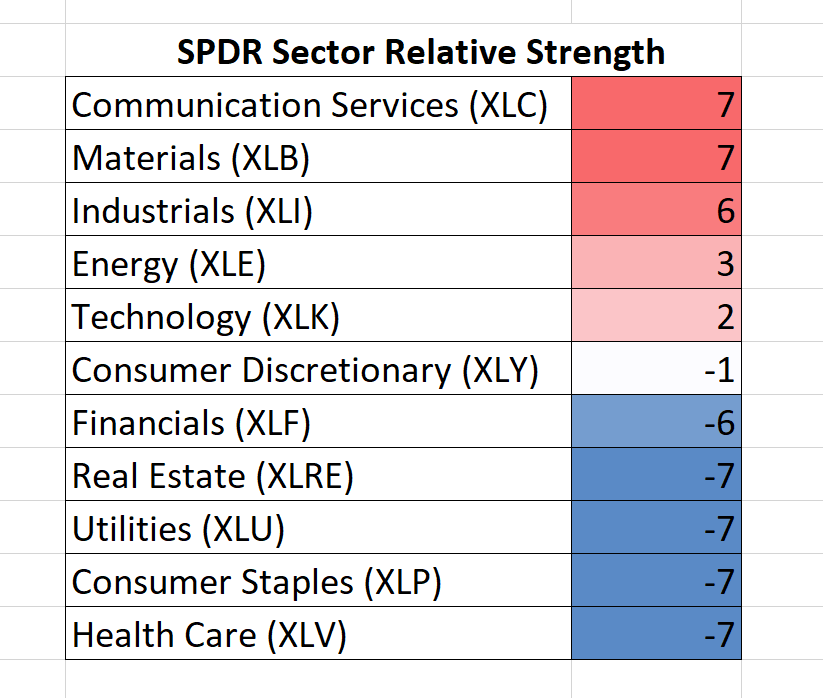

Based on the moving averages and the last daily closing price, relative to the moving averages,

the SPDR sectors' relative strength, relative to the SPY are the following:

Two Weeks Ago

LeoFinance is a blockchain-based social media community for Crypto & Finance content creators. Our tokenized app allows users and creators to engage and share content on the blockchain while earning cryptocurrency rewards.

| Track Hive Data | New Interface! | About Us |

|---|---|---|

| Hivestats | LeoFinance Beta | Learn More |

|  |  |

| Trade Hive Tokens | Hive Witness | |

|---|---|---|

| LeoDex | @financeleo | Vote |

|  |  |

Posted Using LeoFinance Beta

Have seen this series of the post before from you, but today I spend more than a bit of time reading it and trying to understand. A wealth of information you provide for someone who never jumped in understanding the stock markets. Based on the SPDR per sector, we are on the left side of the rotation circle, somewhere between bottom and top, depending on the sector. In average this indicated the stock market is not at its tops yet. Is that also what you conclude, in case you can draw any conclusion?

Posted Using LeoFinance Beta

I'm glad that I could add value to you. Yes, I think your analysis is spot on, we might be in another expansion phase with all the stimulus. Also if you look at the consumer staples and health care, they are declining, meaning we are in a risk on environment still.

Posted Using LeoFinance Beta

What I find interesting, is Real Estate. In my country, the Netherlands, real estate is crazy positive. Last so many years an enormous increase in property value. Offices maybe follow a different pattern, but homes are going through the roof. Investment money from China and Russia buying Amsterdam and other surrounding cities. The talk is: London and Paris became too expensive. Not sure if that is the reason. With super-low mortgage rates for the last 5yrs or so, it's easy to bid a lot to purchase the dream home. A sellers market for sure :)