The Mets Weren't Really What Steven Cohen Wanted To Buy

After graduating from Wharton in 1978, Steven Cohen headed straight to Wall Street and got a job as a junior trader. Steven was a natural, he made $8k on his first day and in due time was making the his firm, Gruntal & Co., about $100k a day, and eventually managed a $75 million portfolio and six traders. Six short years later, Steven started his own company called SAC in 1984. As they say the rest is history because over a span of 30 years, Steven amassed a net worth north of $10 billion. However, in 2012 Steven was implicated in an alleged insider trading scandal.

In 2013 Steven settled with the SEC and started a new hedge fund called Point72 Asset Management which manages $75 billion in assets under management.

With a net worth of $14.6 billion, Cohen became the wealthiest individual majority owner in the major league baseball when he reached a deal to buy the New York Mets for $2.42 billion. Cohen later said that he’s excited to have reached an agreement with the Wilpon and Katz families to purchase the New York Mets. But that’s not the purchase he was really after.

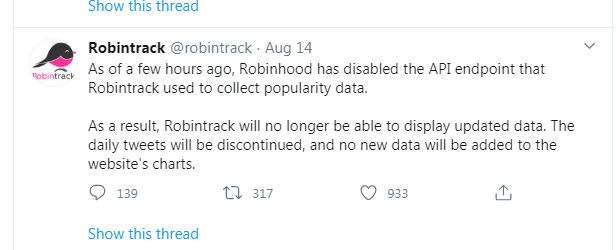

Last month, Robinhood said it would no longer provide data that shows which stocks are popular among its users in an attempt to get away from the stigma that they cater mainly to day traders. This was a blow to Casey Primozic, who created Robintrack which was receiving over 300,000 visitors a month. But it was also a blow to the Smart Money, such as Steven Cohen.

Point72 is among the hedge funds scrambling to find alternative data sources after the day-trading app Robinhood decided to stop providing data on which stocks are most popular on its platform, according to people with direct knowledge of its outreach.

Point72 isn't alone among hedge funds reaching out to other data providers, according to one of the people. Within hours yesterday of a Bloomberg story announcing the closing of robintrack.net, a website founded by Casey Primozic to track Robinhood users' favorite stocks, hedge funds began reaching out, the person said.

So why are these partnerships with the Hedge Funds so important...quite simply the Smart Money is always on the side of the retail investors' trade. Quite simply trading is a zero sum game in which the Dumb Money always transfers their money to the Smart Money.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Posted Using LeoFinance