Unusual Options Activity In Netflix

Walt Disney recently announced that its Disneyland Paris theme park won't be reopened on Feb. 13 due to COVID-19 and pushed the date back to April 2. Now keep in mind, Disney makes most of their revenue from their theme parks. In November, Disney had announced that plans to lay off about 32,000 employees in the first half of 2021. But that seems to be OK, with Wall Street because Disney blew away expectations with its Disney+ streaming service, both its own expectations and Wall Street expectations. The numbers announced were projected in the years to come, but now the company has their sights on catching Netflix…next year.

Netflix has been quite as of late. I personally don’t hear much about Netflix on the financial media outlets. The last time Netflix reported, Netflix added just 2.2 million global subscribers in the third quarter of 2020, much lower than both Wall Street’s estimates of 3.4 million and its own company forecast.

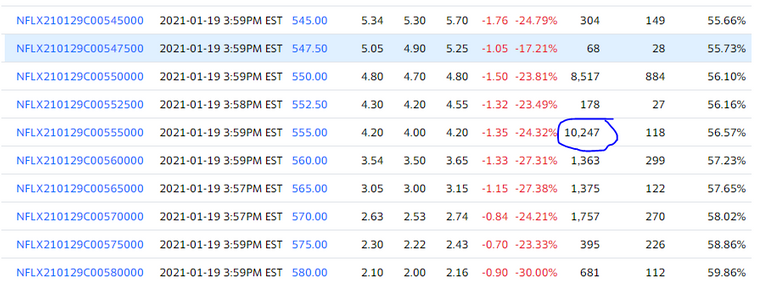

But recently, they made a bold announcement and told Disney they were here to stay. The company announced that they are releasing one original film every week in 2021. Today, Netflix announced their earnings, but it wasn’t until after the Market closed that I noticed unusual options activity as the Smart Money bought over 10,000 call options at the $550 strike price that expire on 1/29.

After the bell, Netflix blow out the numbers.

Netflix Inc. topped 200 million streaming subscribers for the first time at the end of 2020, as sign-ups surged yet again despite higher prices in the U.S. and Canada.

On Tuesday afternoon, Netflix NFLX, +0.76% reported 8.5 million net new subscribers in its fourth quarter, a dramatic uptick from the 2.2 million reported in the previous quarter and well ahead of Netflix and analyst estimates. Netflix lured 25.9 million new subscribers in the first half of the year, as shelter-in-place orders related to the COVID-19 pandemic spread globally, for an annual net gain of 36.6 million subscribers to 203.7 million total.

That performance led to Netflix revenue rising to $25 billion for the first time, and profit increasing 48% for the full year.

After years and years of debt and negative cash flow, the company also announced they are now making money to cover operational expenses and even mentioned potentially buy back shares.

After hours, the stock is up $60, another win for the Smart Money. And this is why I follow the Smart Money.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Posted Using LeoFinance Beta

Congratulations @rollandthomas! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Interesting, do you know what % of the revenue is?

Posted Using LeoFinance Beta

I wrote a post about this sometime ago, I believe it like 40-45%.

Posted Using LeoFinance Beta