Volatility=Uncertainty=Risk Reigns Supreme

Although we saw a remarkable 20% bump in the stock market last week, the risk to investors likely remains. Why? Volatility.

In finance, uncertainty leads to volatility and volatility is literally how risk is defined on Wall Street. In short, we have no idea what is going to happen with this COVID-19 crisis. Two days ago, America was supposed to be "opened up and raring to go by Easter." That was the context that lead us upward last week. It's not there any more.

Now Trump is extending social distancing guidelines until April 30 and this Fauci guy, not sure exactly where he fits in this Administration but he's obviously become very important, he has now gone on record stating that he thinks that the US will see between 100,000 and 200,000 deaths from this virus before all is said and done.

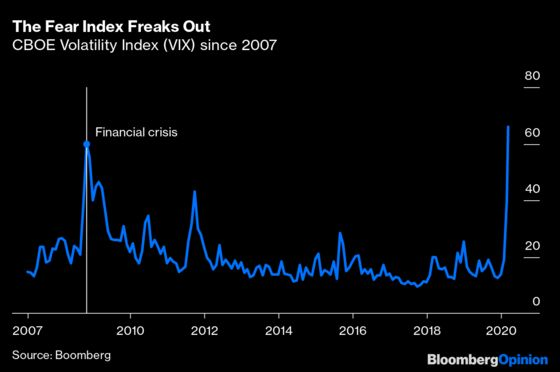

For perspective, that's somewhere in the ballpark of how many soldiers that the US lost during World War I. In that same press conference, Fauci said he fully expects for the US to have "millions of cases." Besides that being just an utterly reprehensible fumble of the public health policy football, that kind of wide breadth of possibility in the number of cases spells uncertainty with a capital U. That unquantified risk is being played out in the volatility indices. Just take a look at the 6-month chart of the VXX, an ETF that roughly tracks volatility.

As you can see, the normal range for volatility is in the 15-20 range. Currently, we are firmly in the 50 range even though we have just seen a 20% up week. That's extremely irregular for the volatility index to remain elevated like that. It normally just spikes after some event and then returns to the 15-20 range. That's how it has worked for the past 13 years, at least.

My takeaway for today is don't commit fresh capital at these interim highs. The chances that it is a bull trap are just too high. Take solace in the fact that the markets are going up on pretty weak volume despite massive stimulus from the Fed, which means that when they do fall, they'll fall harder. My personal opinion, and of course this is not financial advice, is to raise cash and wait for a good shorting opportunity.

Keep your eyes trained on the VXX.

LOL... it's stupid, but I had read the plots... and was wondering why there were date jumps! Weekends... right, I forgot that they had those in traditional markets!

PS: Fauci is the Allergies and Infectious Diseases Head... he has been there for decades!

Yeah, but associated with what department. And where the heck is the Surgeon General? When I was a kid, that was the dude that we were supposed to listen to about this kinda stuff!

The volatility is part of the game in any market right now. It is like a good western movie in the far west!

The Westerns I watched as a kid were a whole lot better than that!