Weekly Market Recap.....Bitcoin, Precious Metals & US Dollar Index

Morning everyone....

I’m going to try something new today and maybe make it a regular thing. Depending on the feedback from you fine folks.

With the overwhelming volatility of the markets these days. I thought it’d be a nice idea to do a weekly recap.

So here it goes....

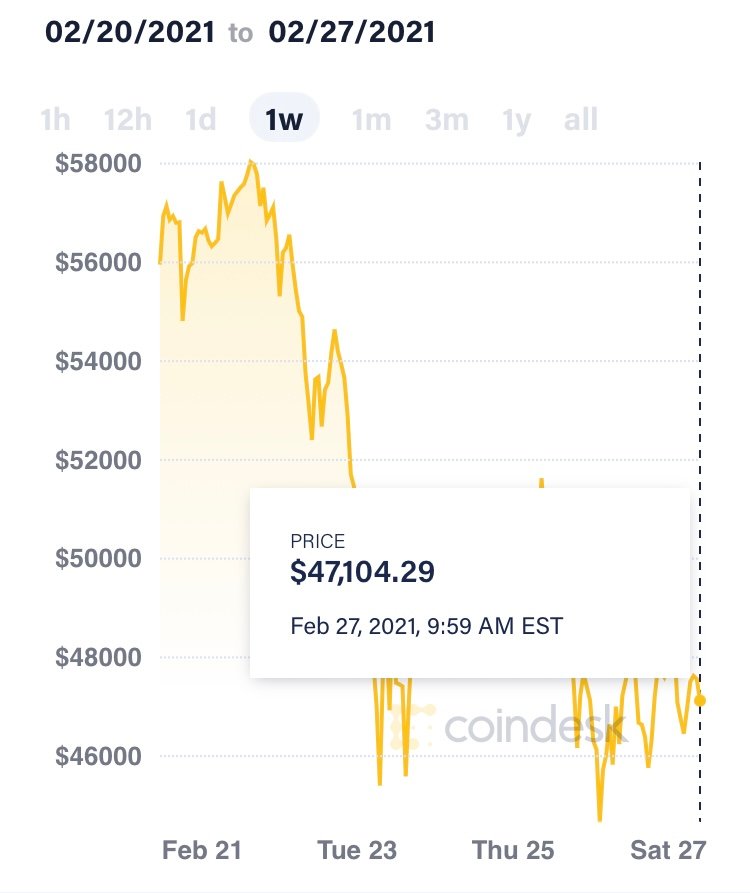

Bitcoin

As you can see from the charts below. Bitcoin started the week at $55,945 and had a nice run all the way up to a record high of $58012. Before taking a complete nosedive ending the week at $47,104. That’s a 16% drop for the week, and a 19% drop from its weekly high.

Here are the charts.

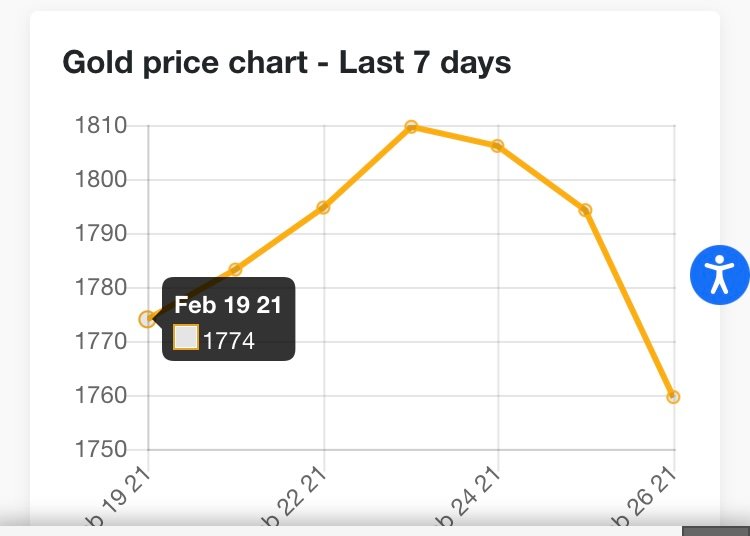

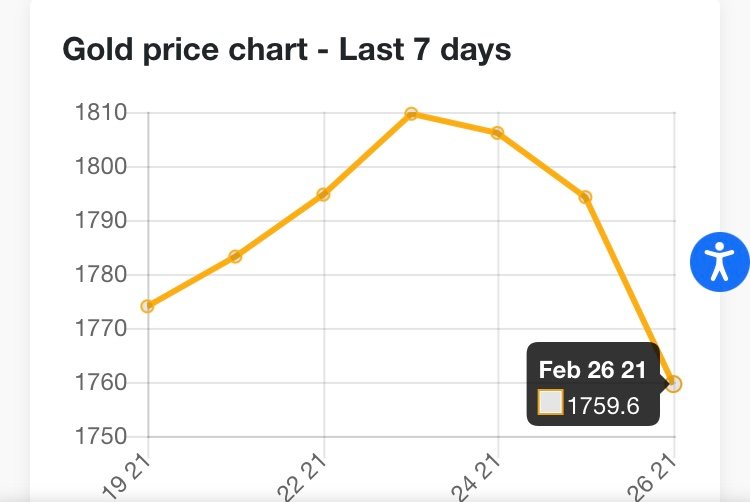

Gold

Gold started the week at $1774, and had a nice run over the the $1800 support line. With a high of $1812, before getting destroyed on Thursday and Friday. Leaving it to close for the week at $1759.60. Which is technically only a 1% drop for the week. But a 2.1% drop from the high for the week.

Here are the gold charts.

Silver

Silver started the week at $26.94, and had a nice three day run all the way up to $28.16. Then Thursday came and began the complete destruction, which grew worse on Friday. The closing price for the week was $26.84, which is only a $.10 loss. But it’s nearly a 5% loss from the high on Wednesday, which is very disturbing.

The reason for this being disturbing is that there is no physical silver available for mints to produce their products. How can a commodity decrease in value when the demand is extremely high, and the availability is so minuscule?

All you silver holders, be prepared for something big.

The roof is about to explode

Here are the charts.

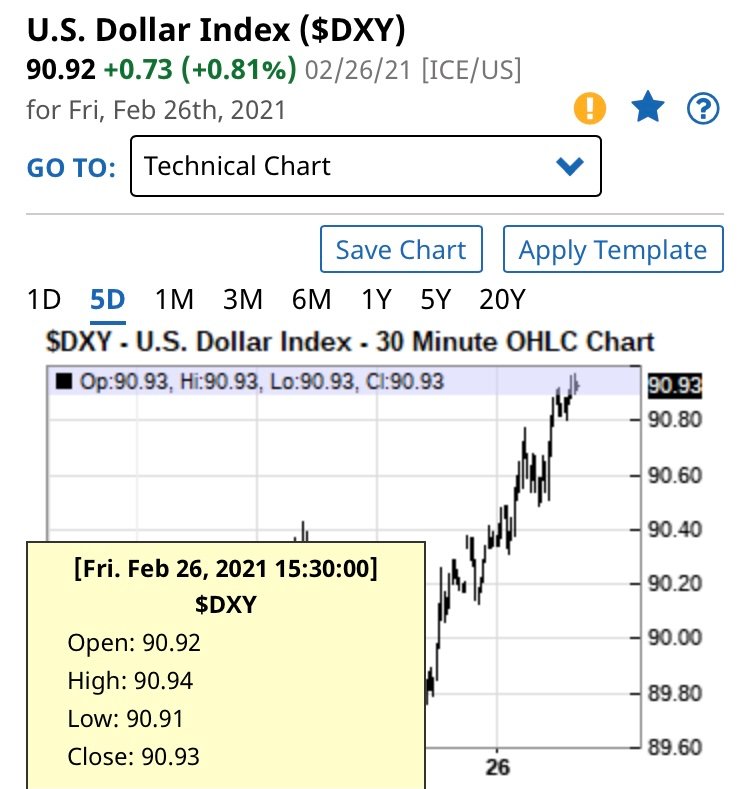

US Dollar Index

While these charts might not be of interest to some. They are very telling in many ways. This tells how much buying power the US dollar has worldwide. With all the talks about the next stimulus check coming soon. The dollar has had a pretty significant increase this week.

I find this very peculiar in so many ways. One we are in the worst debt in the history of the US, and after the next round of stimulus will be even further in debt. Yet the dollar has strengthened nearly a full point this week.

The US dollar index opened at 90.29, it hit a bump on Tuesday and Wednesday dropping below the 90 level. Yet had a massive not only recovering from its early week dip, but having a marked increase for the week. Closing at 90.92, which is a .81% increase for the week.

Here are the charts.

I am by no means a financial advisor

But the dollar is way inflated, and the three assets above are undervalued in my personal opinion.

Got silver and gold?

Hell yeah I do.....

Posted Using LeoFinance Beta

We are on our way to superinflation...

I'm glad that week is over, at least my cash stack held up. If this keeps up I may have to buy some more miners.

Posted Using LeoFinance Beta

Charts all in the red @silverd510, I agree all three undervalued not sure which one is a better buy at the moment my friend....

Thanks again for the report, @silverd510. The Local Coin Shop had hardly any Gold, no Platinum. Nice, BU American Silver Eagles were $39 and up. Mishandled, but decent, Silver ASEs, Canadian Maples, and Philharmonics are turning up in Junk & Generic Box for $32. The Dealer said he sold 400 mishandled Eagles to one customer. I picked out some 1996s, and other rarer '90s ASE. Tons of graded ASEs. They were breaking open modern, 90% Silver proof Sets, rolling up the Silver and selling for melt, junk price, but higher, new-normal, premium, than usual. And giving proof nickels & cents as change. He let me have about 50 proof Presidential (copper) Dollars, still in original mint packaging, for face value. Storage, space issue. LCS crowded & hectic, now has security guard.

Good info, thanks for following up with me. Those are some stiff premiums. There’s a guy on YouTube that bought 150 proof sets for under spot. He broke them open in the video. He paid $7 per proof set. He got 55 ounces of silver for $1050. That’s under $20 an ounce.