#AskLeo: Where are the money coming in CUB Finance?

Hi everyone,

I was trying to understand the model behind yield farming platforms, but I have to say it...

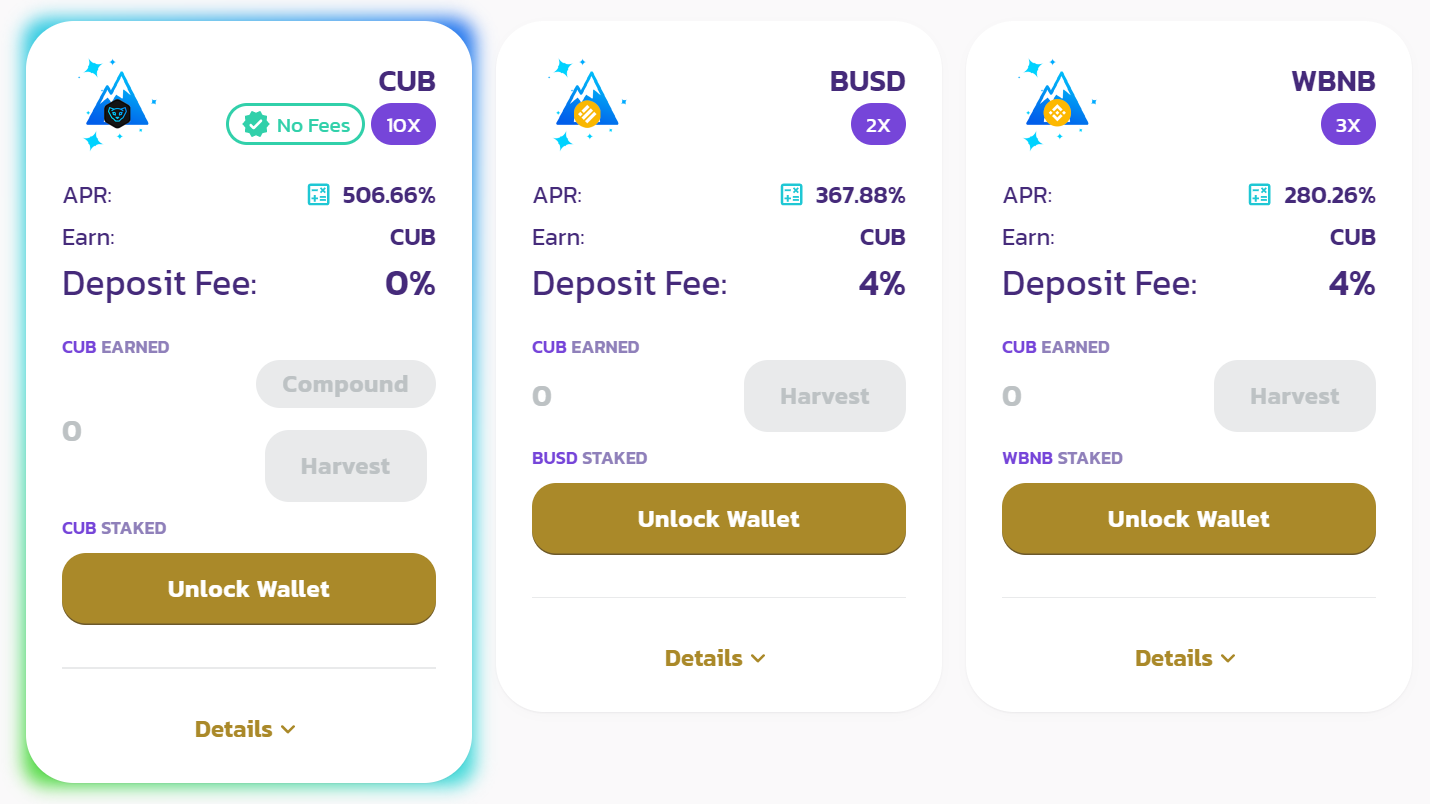

I don't understand it! Especially the huge yields on CUB Finance for various coins. For example, at the moment when I'm posting this question, the yield for various forms of USD (BUSD, USDT, USDC) is in the range of 365% APR:

Can anyone add more clarity here on how CUB Finance can cover all these huge yields?

Posted Using LeoFinance Beta

0

0

0.000

No idea

Posted Using LeoFinance Beta

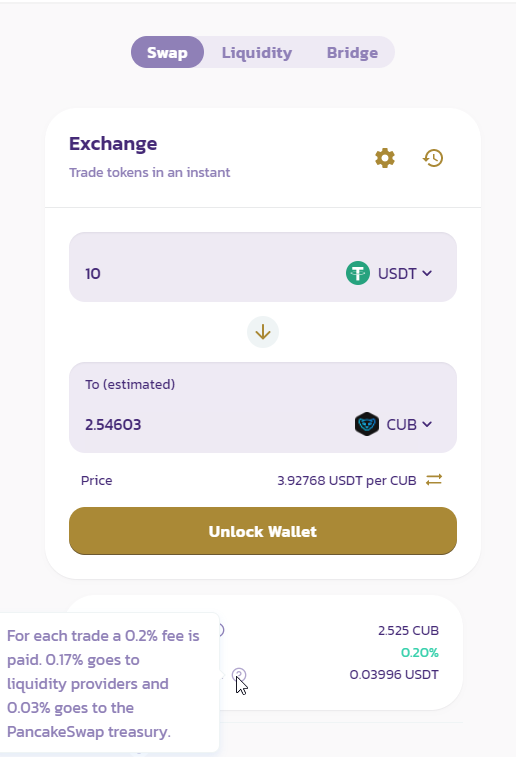

there's fees paid for trading between different currencies.

As you can see here, the fees paid for that trade would be about 4 cents, 85% of which goes to liquidity providers. The more liquidity there is added, the lower the APR, as it just launched, the liquidity is fairly low. There's also a promotion running atm increasing APR by a multiplier to promote adding liquidity. The normal APR yield atm for CUB should be 50.66%, BUSD 183.94% and WBNB 93.42%.

Edit: based on your screenshot, not time of commenting.