Entering Spinvest's SPEW Pool - Getting in on the WLEO Liquidity Pool Bounty for Small Investors

Back in Cyberspace

Whenever I return to civilization, after having spent months on end in some remote location without any WiFi and barely any network connection, I tend to stumble over the most awesome and exciting opportunities unfolding on the blockchain. Take Splinterlands for example. When I came back from my three-month bike trip down the US West Coast two years ago, I saw that Steemmonsters (as it was called back then) was all the rage. Seized by a burning curiosity, a desire to check out this Magic the Gathering-like blockchain game, and a fair portion of FOMO, I bought my first starter pack. Best decision ever! Though I haven't actually played the game for more than a year, I've been renting out my cards, and leveling them up slowly from the earnings.

Wrapped LEO, Uniswap, and Liquidity Pool Reward Bounty

Once again, I returned from an exciting project in the desert less than a week ago. And of course I had to scratch that burning itch to find out what I've been missing out on the blockchain... or rather what I haven't missed out on YET.

Looking around on Leo Finance, I noticed a lot of buzz around one particular topic: the expected launch of WLEO, and corresponding reward bounty for the liquidity pool on Uniswap. At first all these terms were as foreign to me as they would be to anyone who hasn't been on top of what's going on. So I started digging around, reading posts and watching videos of round-table talks on Leo Finance. Eventually I got to the point where I think I've wrapped my head around the story.

Let Me Explain It In My Own Words:

LEO has been probably the strongest performing token on the Hive blockchain, but by its nature it can't be traded on other chains, such as Ethereum. In order to change that, a "wrapped LEO" token would be able to create a WLEO - ETH pair on Uniswap, and thus open up trading between the Hive and the Ethereum blockchains. Great! But one possible impediment to this is liquidity (or rather lack thereof). There must be sufficient amount of both WLEO and ETH present in order to enable trading. In other words, somebody must put their WLEO and ETH into this liquidity pool. But why would they do it? Merely earning the fees apparently is not enough. So a reward bounty has been offered, to be shared proportionally among all participants in the liquidity pool:

300,000 LEO Over 12 Weeks!!!

Now this sounded good enough to keep me excited about finding out more. I realized that in order to join, I needed to put in as much ETH as my included LEO was worth, that in order to qualify for the bounty it had to equal at least a hundred USD in total, and that I had to wait for the launch of WLEO before I could do it.

I was still enthusiastic. That meant I was not too late for the party, and I remembered having about a third of an ETH in my wallet, from years ago. I know, it wasn't worth as much as it once used to be, but then again, years of HODLing didn't help much either in bringing its value back. So I might as well do something with it, right?

Beware of the GAS Fees!

That's when I got the cautionary advise: If your contribution to the pool is minimal (as it was gonna be in my case) the GAS fees might eat up your earnings. So what could small investors like me do to minimize them? Create a pre-pool pool, of course! And that's exactly what Spinvest is doing. Introduced in their original post, it has been updated with more favorable terms (20% instead of 25% commission), and finally given an extended deadline as a result of the delayed WLEO launch.

Jumping Into the SPEW Pool

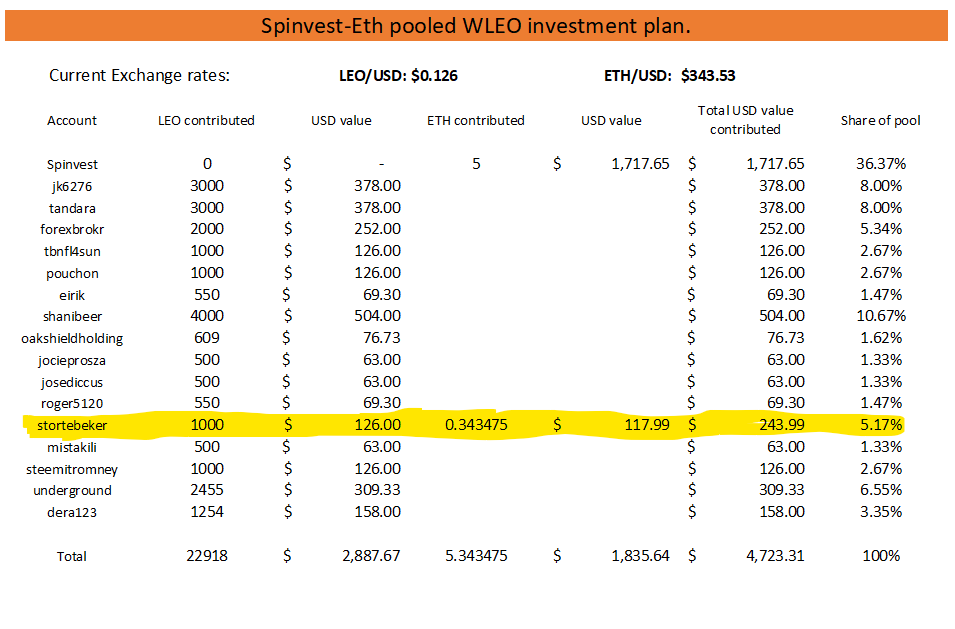

This seemed to play right into my hands. I had time to contact @jk6276, a member of Spinvest, who's organizing the SPEW pool. (Admittedly, the acronym for Spinvest Pooled ETH WLEO may not appeal to all tastes. I think it's funny enough though.) He assured me that not only was the pool still open for participation, but if I wanted to send in my ETH, it would come in quite handy. As it turns out, their proposed SPEW pool has been a lot more successful than they'd anticipated, and the 5 ETH they've added to cover the incoming LEO has proved to be a bit short. At the moment 17 participants have pooled together almost 23K LEO, and with the additional 5.34 ETH the total pool is worth over $4700 USD.

Still Some Time to Join

Does this sound like the kind of opportunity you could see yourself taking up? Do you think that linking the Hive with the Ethereum chain could be lucrative? But maybe you don't have thousands of LEOs (plus the corresponding ETH) to lay down at once? Why don't you join the SPEW pool too? The doors are still open till the launch of WLEO, which I just noticed is scheduled for tomorrow!

But Be Careful!

You will have to lay down your money. So make sure you read the posts by @spinvest-leo very carefully, and I would also contact @jk6276 to make sure it's all still up. (We're getting very close here!) Most of all, please be advised that I'm not a financial advisor, so this little report of my dabblings should be taken as such, and NOT as any financial advise by any means! Do your own research, and do not invest any more than you are willing to lose. But should you decide to join, I'm looking forward to seeing you in our SPEW pool! May it become as lucrative as joining Splinterlands was in its early days!

Posted Using LeoFinance

excellent article, I also made my investment in spew pool, let's see how all this develops during the week

Posted Using LeoFinance

I'm glad you liked my post. As you can see, I'm neither a financial nor a tech expert. But I'm sure there are many other users like me out there, and I enjoy sharing my journey, hoping others can relate to it. It's also exciting to get to know others from the SPEW pool. Two people I've already had contact with previously. Goes to show how small this blockchain is, hehehe.