The Rising Tide

Ready to jump?

The Reserve Bank of Australia finally broken their promise of not raising interest rates until 2023 and lifted them by a quarter percent, 25 basis points. This is the first rise in 11 years in Australia, but it isn't going to be the last in the near term and, the big banks have followed suit and passed it onto their customers, as they do.

All those people who over the last two years have been swept up into the FOMO of buying a house at a premium, pushing their mortgages to the max, taking loans from parents and injecting all they have and more in - must be getting a little nervous.

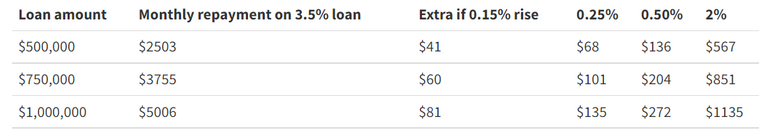

As you can see, the monthly extra can stack up pretty fast and if you think that a million dollar loan amount is massive (it is) it is also the average house price in the Sydney area, so not uncommon at all. A 0.15% interest rate is bearable, but even at 2% that is looking at becoming 2 months average salary before tax and, this is before factoring in that it isn't only loans going up, the cost of everything is going up.

Just remember, negative interest rates are awesome and printing money doesn't cause inflation.

Feeling rich?

It is interesting to think though, that while so many people are so scared of loss that they can't put a few dollars into crypto, the same people are also quite happy to drop 15 years of salary into a house, after it has already increased 25% in the last year. That is a difference of 3 and a half years of full salary - insanity?

Well, we all need a place to live, but it still raises the question of what is considered valuable, what we need to live, what we think is going to be worth our time, money and potential to lose it all.

As I was saying the other day about my friend who dropped 1000€ on BTC and watches it daily, that amount represents around 0.2% of the value of his house - which he has a loan on. The ceiling hanging from the vaulted ceilings is worth more, yet there he is, watching the price of Bitcoin fluctuate, worrying about whether he is up 200 euros or down 500.

So, what is valuable?

Is it where we spend our money, where we spend our time, or the things that hold our attention and make us worry?

I don't know and for each of us, the profile is likely different, but I do think that we each need to reflect on what we as an individual feels is worth paying a price for. For many at this point, the wise play might be to put a small percentage of earnings into crypto just in case, but a small percentage of what? Just think, someone buying a million dollar house in Sydney today, is paying 200 thousand more than they would have a year ago - that is an incredible amount of money if thinking about it in terms of an investment and it is almost half of what a retiree would need to have at 65 in their superannuation. But, spending that extra in the space of a year seems justified somehow.

Interestingly, the expectation on house prices could see them drop 30% in value over the next couple years, which means that not only did people pay 200K extra in the space of 12 months, but if it happens, they will end up paying another 100K extra on top due to the loss on their property value, plus interest.

But hey, they have a house!

We each make our decisions in this life, but it is interesting to contrast our decisions against other decisions we make, buy & sell, love & hate, happy & sad - and each choice we make, is going to take other choices off our table and we hope that at the end of the day - we have a better life than bad.

In my estimation, it is important to talk about these things, but at the same time, we shouldn't get so caught up in them that we get lost, no longer able to tell what is valuable to fight for, and what just isn't worth it. A house and a home are two different things, yet they'd have you believe that buying the first, gives you the second.

People are often overpaying for a house, at the cost of owning a home.

Taraz

[ Gen1: Hive ]

Posted Using LeoFinance Beta

Bingo.

The first place I bought (31 years ago, ouch) was for 59k USD. A 2 BR, 1 BA fixer-upper in move-in condition. The furnace was iffy, the air-conditioning non-existent, the insulation marginal. But even then, the bank had authorized a 130k loan. Rather than taking chances, went with the starter home.

It seems that the younger generations are impatient, they want their "dream home" as their first home - it is insanity, as they go in with very little collateral, but are buying the top of the market.

I had to start again in Finland, so my second home was bought in 2008, a little apartment that I made 30% on, then scaled down to a larger full reno apartment for half the price of the last, that we (now with wife) added more to our collateral on and then, bought this fixer-upper house, which we hope to be in for a while but if not, we can sell for another gain after the work we have done.

What was interesting was, the bank would have given us a loan for around 400K, but wouldn't give us a loan to spend 230K + 70 for a renovation, to increase the value of the house to 380. They don't want people making gains with sweat equity.

when you buy property, arent you always buying at the top of the market?

Depends on the property and how desperate they are to sell fast. But technically when you are buying anything you are buying at the top, right?

Measured in Fiat, that's usually the case IMO. There can be exceptions of course.

As a general rule of thumb, fiat usually halves every 7 years. So after 15 years your "debt" should be halved.

It is funny to see people micro-managing a 1 or 2% portion of their portfolio instead of the part that is doing the heavy lifting.

I have a fixed for 15 years mortgage. hopefully, I will be ok.

Yeah, it is crazy. It shows the emotional disconnection from the rational decisions.

Mine is collared for another 9. 10 was the longest available from the banks.

You should be ok, it looks like we are going to get some large inflation numbers compared to what we've been used to. When this tsunami hits the crypto market, I hope I've stacked enough for the big jump up!

I think that there will be no ideal recipe for happiness, everything has its drawbacks. As for the hive, the ideal option is to be patient and go forward without starting capital, then you will fully understand the joy of earning a crypt. But, also for investments, the hive is much safer than most banks, for example, the bank of Moldova, from which a billion dollars were stolen and could not be found).

Posted Using LeoFinance Beta

a billion dollars lost from a bank? It is like the Pentagon in the US where 21 trillion has been unaccounted for over the last 2 decades. that is insane!

Comparing with the Pentagon is like comparing an elephant with a fly, military projects are a place where you can hide a whole planet, and within the borders of a small, agrarian country like Moldova, a billion vanished into thin air looks cooler than any Houdini trick)

Posted Using LeoFinance Beta

Yes it is - it is an incredible amount, considering it is almost the size of the entire US national debt (at the time it was made public).

Is Moldova feeling the affects of the billion loss a bit?

To be honest, I thought that this would be a complete collapse for the country, but, somehow, thanks to the injections of the IMF, FISM and EBRD, Moldova keeps afloat, and the search for a billion for many years looks like a crane trying to eat semolina from a flat dishes.

Posted Using LeoFinance Beta

Good point, even though I think you can have a home without owning a house.

With that being said, I'm considering buying one at some point in my life. Some years ago I wouldn't even consider that but now this idea is growing on me

Posted Using LeoFinance Beta

you can have a home anywhere really - it is more a mindset than a thing.

A house is still a decent store of value, if bought at an appropriate time.

I actually had this exact conversation with a friend who had a lightbulb moment after rates went up yesterday.

Watch this space...

Posted Using LeoFinance Beta

Yeah - it is going to be very painful as that lightbulb is forced on in people's lives.

What will happen to the sale price and the market, will people pay more or less? to buy or will they stop buying.

Comes down to fear and greed yet again.

Of houses? I think that as there are defaults, people will have to panic sell in the hope to get out and back in lower.

It's great to hear something from an Aussie perspective! Maybe not the current generation, but all of us oldies were programmed to see a house as the #1 asset to strive for throughout our lives. It'll take a while for that conditioning to disappear, especially as so many organizations have a lot staked on keeping it around.

Posted Using LeoFinance Beta

I am only slightly "Aussie perspective" as I live in Finland now, but I try to stay connected still :)

And yeah, the #1 asset of a house is strong in me too - even though at the moment, I likely have more tied up in crypto! :D

The more I learn about how I have been conditioned to value certain things, the more it makes me cringe!

Your friend must be stressed out keeping track and worrying about his 1k investment on BTC and especially now that the price is going down.

It is fascinating how we make certain decisions and look at things differently.

Posted Using LeoFinance Beta

He seems a bit stressed, even though 1000€ for him is much less than the cost of the tires on his car.

Quite an irony but I used to be like that, lol! Was just glad I learned to shift a bit of my mindset.

Posted Using LeoFinance Beta

This. Not wanting to put anything significant in the space yet hoping for massive returns. Some people just want to make profit no matter how little to feel smart.

Yeah, it is common. I also know people who have dropped a lot more in - but barely look at the markets because they are so far down the road.

We are in that bind right now, I personally feel that I need to get the fuck out of where we are living for several reasons, one being we desperately need outdoor space for the little man lol. Regardless though, I'm sure that we are going to pay a bit of a premium which sucks and is annoying but there are added benefits for the region we want to move that I am having to focus on instead of the added price tag of what the shit is at now. Sort of thankfully the rates have gone up which brings the housing cost down so we have thankfully waited for maybe the right time to do it compared to 6 months or 12 months ago. Still sucks that we were about to pull the trigger on a house in February 2021 before prices spiked but it fell through. Damn! lol

I keep an eye on the markets for sure but I'm trying not to focus on them. I'm more focused on building and expanding more than anything! I'm maximizing my bitcoin and other Hive related assets and not getting caught in the fluctuations and noise going on until I'm at a point I want to be. Where that point is I don't know specifically but I think I'll have a better inclination as time goes on lol

In the US, I get the sense that people are scared to let their kids play outdoors, unless it is their own property, is that the case? We do have a yard now, but when in an apartment, we had tiny playgrounds and forests around that the kids could play in safely.

We were lucky - we got our place signed the week before lockdowns started.

When it comes to building and expanding, if the ability to increase the finances is faster than the increase in the house prices, doesn't it make sense to keep building?

Spending spare money in house holding is quite a big bet. Sometimes loan and the interests really mix up and causing relatively high or low loss at certain points.

Like you said, people are reluctant to spend a few dollars in crypto anticipating they might lose em, but ready to lose the one -thirds in the housing plans.

I would say- its upto their choice.They prioritise one and leaves another.But dont notice that,where low risk profit is available.

That creates variety and diversity and we should accept that.

And, a house is only one of the costs - people will drop 100K on a car, but struggle with losing a couple hundred on crypto :D

Housing is expensive and I remember hearing about a few people who deposited their stable coins into places like Nexo or Celcius for the interest so they can pay off their mortgage. So I think it just depends on the priorities that a person has.

In any case, I am hoping that 3D printing drops the price for construction and housing prices to be more reasonable in the future.

Posted Using LeoFinance Beta

3-D printing is going to be interesting for housing for sure. I would love to have a hybrid 3-D printed and container home on the beach :)