Cryptocurrency's Rapid Expansion: Use Cases

Sometimes progress is seen by looking at the second layer. What do I mean by this?

There are many organizations out there that are trying to size up how big the cryptocurrency market is and how rapidly it is progressing. Since we do not know the number of individuals involved, there is a great deal of speculation.

Nevertheless, there are some ways to monitor what is taking place. One is to witness where tokens are starting to appear. With the expansion of the cryptocurrency industry in general, this is going to assist all of humanity down the road.

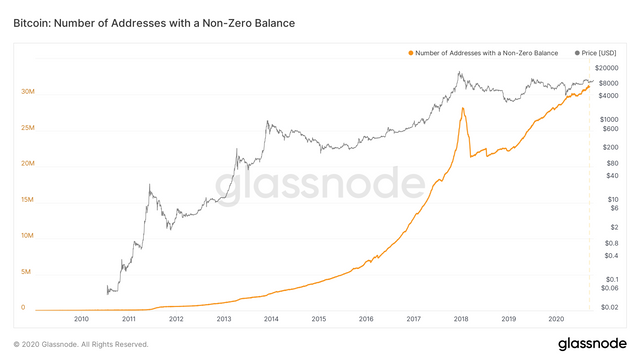

To start, let us look at the biggest one of them all, Bitcoin. This chart comes from an article posted by @globalcurrencies yesterday which shows how many Bitcoin wallets have a non-zero balance.

Source

As we can see, there are 31 million wallets now with a non-zero balance of Bitcoin. The chart shows that, after a big drop during the 2018 collapse, the number of wallets has grown significantly over the past two years.

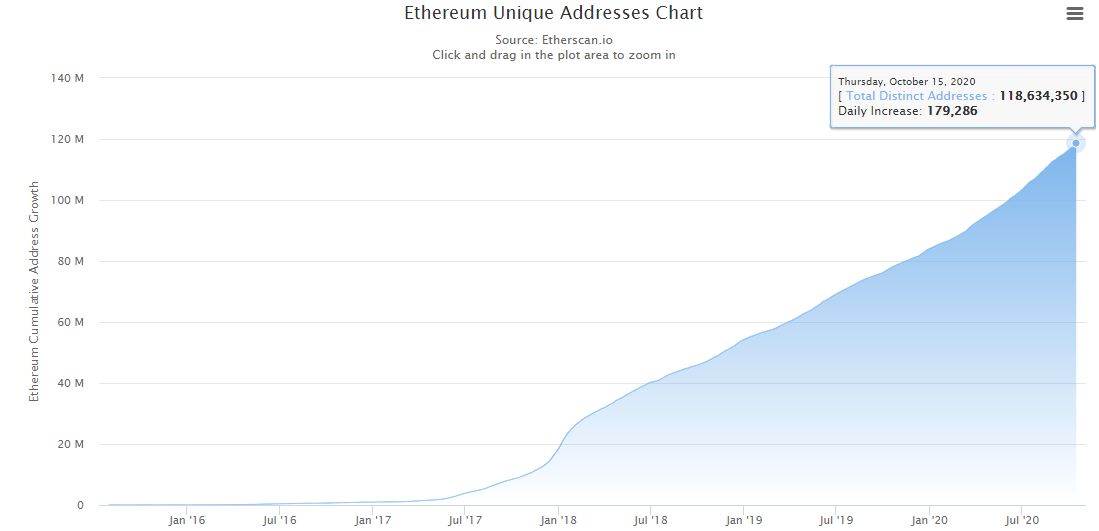

Another chart that shows similar, if not more exciting progress, is Ethereum. Here is what it looks like according to Etherscan.io.

As we can see, there is a tremendous growth in the number of wallets on Ethereum as well.

How Does This Benefit The Average Person?

Here is where things get very interesting.

We know that Bitcoin and Ethereum are the two most popular cryptocurrencies, at least as judged by their marketcap. That said, we know there are thousands of other currencies that are out there, all putting tokens in people's wallets. As time passes, people are seeing their holdings increase, in number terms.

The idea is to provide people with a basis in cryptocurrency from which they can build. DeFi is obviously offering something to people who are willing to get involved in that market. However, it is a bit shady as well as being risky. Many will not opt for this path.

So what is an individual to do?

This is where the maturation of the market is starting to provide legitimate options to people. Last week we saw a story about how a whisky distiller on the Faroe Islands was going to create an ERC-20 token to allow investors to get involved in ownership.

https://decrypt.co/44566/proposed-whisky-distillery-first-in-world-funded-by-crypto

It is a project that comes on the heels of another whiskey based idea where money was raised from investors to buy 1,000 barrels of Kentucky whiskey. This was done through a financial entity, thus going to "accredited investors" whereas the one on Faroe Islands does not appear to be that way. It does utilize KYC and AML, but appears to be open to anyone willing to provide that information.

https://www.coindesk.com/wave-financial-investement-whiskey

Another interesting project is set to go live next month is in the gaming world. Atari, one of the biggest names in gaming is creating a token that allows for individuals to make purchases in game. The company is set to dole out $1 million in tokens which can be utilized on their newest gaming console. It appears this will only be for purchases with no word given if the token can be earned by playing the games.

https://u.today/leading-game-maker-atari-will-let-gamers-spend-atari-tokens-while-playing

The final project that I want to point is out an idea that really excites me. The subject matter isn't what is important at this moment. Rather, it is the concept that can open doors for millions of people.

There is a film being produced called "Roe V. Wade" that is now going to be tokenized. It will allow individuals who are interested to invest in the film for a share of the potential profits.

It is an exciting step in a move towards decentralization and breaking up the monopoly that the present financial players have.

Here is what the producer had to say:

Tokenization via blockchain technology is democratizing investing and will revolutionize how Hollywood will engage with their audience.

https://eng.ambcrypto.com/hollywood-film-roe-v-wade-to-be-tokenised/

Certainly feature films can make a lot of money. They can also lose money too. This is where the risk comes in. However, tokenization opens up the doors for millions of people to be financially involved in an industry that has generated enormous wealth.

While we are only seeing a handful of projects at this time, what happens when there are dozens in each industry? An individual could spread his or her "movie" investment across 6 or 9 projects, putting a bit into each in an effort to seek a return.

At the same time, the amounts from each do not have to be great. Consider having to raise $50 million for a film. If there were 20 million crypto holders willing to invest, that is an average of $2.50 apiece.

This is the power of fractional ownership.

Source

It is also one of the reasons why I believe Hive will become an extremely successful blockchain. One thing that Hive excels at is the distribution of tokens. In addition to the base layer, we are now seeing second layer tokens getting some attention. The success of LEO has stimulated the community to take another look at the value of this layer.

Ultimately, with growth, people will be receiving tokens for their actions. The one drawback to Bitcoin and Ethereum is they, for the most part, require people to spend money to acquire them. Since most of the world does not have any excess capital, this cuts them off from participating.

Yet on Hive, everyone has the opportunity to see their wallets grow. As more activity takes place, one receives more rewards. Certainly, there will be some variety as to which tokens are received, but the option exists to convert them.

Now we are starting to see other options appearing that people can take advantage of. Over the next few years, as development keeps rolling out, we should see all numbers growing. This means that more people will have some money to invest in things that interest them.

It only makes sense that those looking to raise funds will target crypto holders. If the entire industry starts getting into the trillions of dollars, that will be too much to overlook. Thousands of different projects will have the opportunity at funding while presenting everyday Johns and Janes with the chance to get involved in something profitable.

Eventually the use cases will be such that they rival the existing system. Just like one does not have to search very much to find a use for the USD, we are rapidly approaching the point where the same holds true for some of the tokens (like BTC and ETH). Over time, this should spread.

At some point, investing will not only be something for the wealthy but, basically, everyone who operates online.

If you found this article informative, please give an upvote and rehive.

gif by @doze

Posted Using LeoFinance Beta

Your current Rank (25) in the battle Arena of Holybread has granted you an Upvote of 20%

View or trade

BEER.Hey @taskmaster4450, here is a little bit of

BEERfrom @pixresteemer for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.It really doesn't matter whether it's tokenized digital assets or non-digital assets, which rely on a legal system to enforce their backing by an underlying asset. The main thing is that if crypto tokens end up in the hands of the average Internet user, it will be impossible for governments to shut the crypto space down.

Posted Using LeoFinance Beta

That is key. We are in a race to get enough tokens in people's hands to prevent an sort of "shut down". While they cant really do that, they can use their guns and jails to make examples out of a few key people and scare the rest.

Posted Using LeoFinance Beta

What I find interesting about the BEOS blockchain is the ability to pick and choose which jurisdiction you run your smart contracts in. That way, you can avoid certain legal pitfalls.

That and decentralizing everything possible are key to keeping governments at bay. It is also important to create a market for digital as well as analogue goods to make avoiding KYC possible. While I don't think cash will be phased out any time soon, Bitcoin ATMs tend to have KYC nowadays and so has LocalBitcoins. The KYC shit is highly annoying as it in actual fact does little to prevent money laundering as it is done by regular banks at a whole another scale but the little guy is made to put up with it at every turn.

Interesting times are coming, and this is just starting.

There is a lot more of things, business structures and services to create, so this is the time to make something that will last for a long time and if not, well we learned and know how to make something better later.

A lot of experimentation taking place, that is for sure. Yet there are going to be a lot of successful ideas that come out of all of this.

It is exciting to think about the possibilities when there are hundreds of millions, if not billions, of crypto users, all being rewarded in different tokens. Then, they can opt to put them into projects they are excited about.

Posted Using LeoFinance Beta

That will truly give a lot of quality of life to the people in general, this will probably take more than a decade to see really big improvement, but we can enjoy a lot while we wait.

There is a lot going on in crypto, we only need people to see what is going on and that this is openned for everybody

Posted Using LeoFinance Beta

Happy to see you again Mr legend

you are the Shine of HiveBlog

one other thing i see hive could be good to use are microtransactions. free transactions make it easy to send small amounts of value to a lot of people.

biggest problem to solve and probably the hardest (kinda for all crypto) is the ease of people buying it.

You are correct on that one @bil.prag. Micro transactions do offer a lot of opportunities although I dont think many have experimented enough to really come up with use cases outside of tipping.

Since most chains dont allow for that due to the transaction fees, few are toying with the potential. Hive does offer that yet it has not come up with a major use case that appeals to a large number.

It is something to ponder.

Posted Using LeoFinance Beta

I do believe that the usage and transaction of Crypto will even grow the more especially if people notices some particular features about it that can't even be gotten anywhere. In my own way I believe there's no limitation, Crypto is better than what our centralised financial systems has to offer

All valid points. Only thing that I will add is - mass education. The value of tokenization has to be realized by individuals. Mass awareness on how you can and should do it relative to the traditional economy is something that should be prioritized. As you said, Hive is a real use case where you distribute ownership tokens to the masses. The step forward is to educate.

A very good point. Education is truly key. Along with that, ease of use has to enter the picture.

We are looking at a learning curve.

Hopefully the resources will be available soon.

Posted Using LeoFinance Beta

In the near future, things would drastically change in an upward direction as per crypto adoption. I'm hoping to see the education, transportation sectors adopt crypto soonest.

Posted Using LeoFinance Beta