Feeless Transactions Called Into Question: Hive As A Social Media Network

We often discuss that fast and feeless transactions are one of the things that separates Hive from other blockchains. The fact that we utilize the resource credit system as compared to direct transaction fees is a game changer.

As noted in the past, interaction with the network with transaction fees is an expense. On Hive, one makes the investment because access is granted through the use of Hive Power. This is what correlates into resource credits, a non-tradeable token that quantifies each activity on-chain.

This has some of use excited about the future. Of course, there are people who call into question the viability of it. Are some of us off our rocker because we believe the long term potential? Do those people who believe that Hive cannot scale due to rising RC costs have a point.

It is what we will discuss in this article.

Social Media On Hive

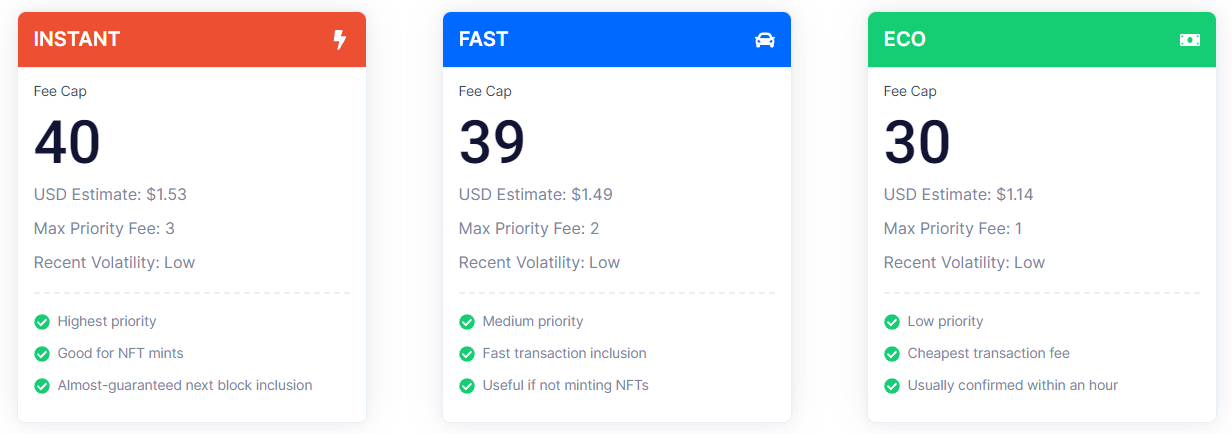

The image above is the most recent gas fees on Ethereum according to gasprice.io. As we can see, paying over a dollar for each social media activity is a non-starter. In fact, I maintain that even half a cent on other networks makes it impossible long term.

Simply put, people are not going to pay tx fees each time they upvote or comment.

That said, social media networks do have costs. This is true whether we are discussing Hive or Facebook. Hardware costs money and servers are not free. For this reason, we have to attribute the costs in some manner.

We all are aware of how traditional social media operates. What we often do not think about is how powerful their model is. The network effect is what pushes the value up exponentially. However, since their cost are computer-related, those tend to decrease over time.

Here is the golden nugget. Storage (and processing) get less expensive with each new generation. At the same time, we see performance increase. Basically, this is a more for less model.

This is one piece of the pie for Hive.

Cost Per Transaction

At this moment, there is a cost to the system. For our example we will use $1M. This is a nice round number. We will also start with 100K transactions.

The presumption is that RC cost for each activity has to go up. Is this reflected in the numbers?

With our example, if the cost is $1M and we have 100K transactions, obviously we are looking at $10 apiece. In other words, the cost/tx is $10.

What if the volume jumps to 1M? Under this scenario, the cost is $1. Here we see how the number of transactions went up yet the cost for each decreased.

It is a fact that is often overlooked.

Naturally, this is only possible when excess capacity resides within the system. As long as the present hardware can process the 1 million transactions, there is no problem. If, however, the mast is 250K, then something has to give.

Under this scenario, we have to either upgrade the network, experiencing further cost increases or see a backlog transactions, causing prices to go up as we often see with Bitcoin and Ethereum.

So what is the solution?

Scaling The Network

Hardware advancement is not the only area. We see progress being made with compression, data architecture and software design. All of this factors in.

Since Hive came into existence, one of the main areas of focus is scaling of the network. This not only applies to total transactions that can be processed. It also applies to the cost of running the operations.

In the last hard fork, we saw a reduction in the size of the blockchain data. It was almost halved in what it was before. Here is where we see a drop in the cost for storage. If the size goes from 750GB to 400 GB, this can be housed on a smaller server.

This equates to less cost.

We also saw a redesign in how the data is shared. Now, the block producers compresses the data before sending it to the other nodes. This removes the necessity for each node to compress every block, an obvious waste of resources.

Here we have an ongoing quest. Scaling never stops either in technological advancement or programming on Hive. It all ties to efficiency. We know that, based upon the past 40 years, the hardware we will be dealing with in 3-5 years will be more advanced than today. It will also likely be cheaper, at least form a cost/performance standpoint.

Resource Credits

Resources Credits are designed to capture these costs and quantify them on a transaction basis. There is no doubt that as more transactions occur, the cost of running the network increases. In raw numbers, this is unavoidable.

That said, there is no guarantee the costs go up at a rate faster than the growth capabilities of the network. In fact, the sustainability of these types of systems relies upon it. After all, this is the wave that Google and Facebook rode.

Recourse Credits basically allocate the cost of the network to each activity based upon the resources used. This is why account creation is more expensive than a comment. For the former, more network resources are used.

Again, this is only for on-chain activity. There is a reason why we are looking at the development of sidechains, especially when it comes to smart contracts and Hive Application Framework (HAF). The idea is to keep the base layer tight in terms of functionality.

Even Vitalik Buterin echoed similar sentiments about Ethereum recently. He noted that expanding the core functionality of the network would come at a cost and a minimalist approach was better.

This is the approach Hive always took.

Resource Credits are tied to cost. They are set by the witnesses based upon the allocation of resources along with the overall operations. For years, the trend was for rising costs as the database grew. This was reversed over the last couple years as focus started to pay out. Even though it is larger, the cost of the total chain is less expensive today than it was 3 years ago.

Reason For Optimism

Why should we believe this will continue?

The answer lies in the fact that everyone is in the same boat. It doesn't matter whether it is Hive, Facebook, or Goldman Sachs. All entities are facing the problem of every increasing data. It is growing exponentially with no signs of slowing down.

This means that the entire industry is going to be focusing upon different packet architecture, laying optimization, and sharding techniques. Data distribution and storage will also be altered. Maybe the database is broken down and a subset node system is created. Instead of every node having the entire blockchain, it is divided among groups of Witness nodes, with each housing a portion of the database.

People consistently underestimate the scaling potential of the industry. Data is something that gets a lot of attention. Hive is not the only network with this problem. That means solutions will come about that Hive can incorporate that affect the total cost of operation.

In the end, that means we could see RC pricing staying the same or potentially even going down. If the scalability of the network increases yet costs remain fairly constant, then we can how this works out on a per transaction basis.

Not only is there internal measures that are being taken, we have an entire industry focused upon being able to house and process more data for less money.

This is what is going to allow Hive to keep operating as a social media network.

After all, scaling does not mean handling more transactions at any cost. It means doing so in a cost efficient manner.

In the end, the progress made there is reflected in the costs of RC.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Alpha

@keenyetheunusual @stewardofwordds @daisi

Thanks for tagging me 😊

Hive Scalling and increasing active users two are most important areas to focus in order to get mainstream adoption, we have everything in place all we need few thousands active users in the start which will lead us to few millions then we need to scale hive blockchain to handle that much activities

Scaling is a focus of the community, especially on the core development.

So this is a positive.

Posted Using LeoFinance Alpha

I'm interested to see how Hive scales. I'm sure the developers have stress-tested their code, so I hope we have spare capacity. As it stands many witnesses will be subsidising their nodes, but a higher price would help them. As you say, falling hardware costs and code efficiency also help.

If the network gets really busy then I assume the RC costs would need to go up. I can see a couple of scenarios for this. If we gain many thousands of users who all want to post then those with no HP may not be able to do much. That could cause frustration. Alternatively, if someone tried to launch a massive spam campaign they would soon run out of RC unless they also invested. That would protect Hive. We know there are people out there with thousands of accounts and there may be concerns about their reasons, but lack of HP could prevent some abuse.

I'm probably missing some of the intricacies of this, but I'm up for learning more.

Ultimately, applications are going to have to develop ways to ensure their users have RCs, especially newer ones. This is where RC delegation comes in. They will have to automate it. I know Leofinance has plans on that.

Scaling is multi-faceted as I am learning. There is core stuff but also other areas. For example, Leofinance found out it will have to open its own API to handle its traffic. This is expected in the next few months.

So there is another area of focus on scaling, albeit not base layer stuff.

A lot of things to concentrate on growing it seems. But this is a problem the entire online world has: handling more data while trying to lower costs.

Posted Using LeoFinance Alpha

Yes, RC delegation will be much needed. We may be lucky that we have not gone viral so far. Others have crumbled when it happened.

When HIVE goes mainstream and the blockchain is over capacity, would it become impossible to move HIVE or HBD around without increasing HP?

Which means increasingly more and more HP needed to be locked to use the chain without going through side chains even for the basic function of moving value.

With high level of activity the most probable scenario is that Hive will start routinely hitting block size limit for prolonged periods of time creating backlog of transactions that will start expiring before getting included in the blocks. In such case more HP won't help you since there is no mechanism to prioritize transactions of people with more stake (such mechanism could be individually introduced by some witnesses without breaking rules of consensus, but I doubt anyone with proper knowledge would waste their time on it). Note that such thing already happened in the past, but only because witnesses vote to keep max block size at a minimum, which is 64kB. They can change it at any moment for up to 2MB - a 32 times increase.

With increased block size and constant high activity we would indeed see RC costs going up as resource pools get consumed faster than they refill. Then you would need to increase your HP to be able to afford unchanged level of on chain activity. Even in such scenario you will first see people having problems posting large articles or creating accounts. Transfers are one of the cheapest operations, so Hive would become completely unusable as a social media platform months before RC costs could make transfers prohibitively expensive.

It doesn't mean you could not exhaust your RC mana on transfers alone. I've seen even orca level accounts with so much activity that they are constantly running on fumes, so a free account with no HP can run dry pretty easily even at current costs.

Interesting! Thanks!

You are talking two different things.

Overcapacity is something we hopefully never reach. Blocktrades has been focused upon that since day 1.

As for the need for HP, yes that is the case. Regardless of the usage of the network, we are seeing the need for RCs to engage. Those with under 10 HP have an issue so more needs to be powered up.

Hence the ultimately buy demand on HIVE.

Posted Using LeoFinance Alpha

The utilization of the resource credits for enabling fast and feeless transactions sets Hive apart from other blockchains. While the cost of running the network may increase with more transactions, the scalability potential and ongoing optimizations, simply allows for Hive to operate as a cost-efficient social media network.

That is what is always comes down to.

More transactions are going to increase cost. However, technological developments and improvements to the system can offset that.

The question which is going faster? It tends to be a game of cat and mouse. As more improvements are made, cost per tx can decrease since overall capability expands with prices staying relative the same.

But massive expansion outpaces development or technology.

As I stated, all in the digital world are dealing with it. Data and activity tied to it are not decreasing. So how do we handle it all.

Posted Using LeoFinance Alpha

https://leofinance.io/threads/edgar-alive/re-leothreads-fzrpn6mn

The rewards earned on this comment will go directly to the people ( edgar-alive ) sharing the post on LeoThreads,LikeTu,dBuzz.

I think that will make sure a network is able to scale without any issues. Creating flexible hardware and software that can accommodate the increasing load of data and process them efficiently. The main benefit is that we also usually end up doing more with less.

I wouldnt say "without any issues". There are always challenges. But having people focusing upon it is a good way to ensure problems get solves.

How do you scale Hive? That is being addressed with each new update. Much of it is not exciting but does grow the potential. It is an ongoing battle that never stops.

Posted Using LeoFinance Alpha

Right. Issues will always be there. What counts is figuring out ways to solve effectively solve these issues when they happen.

Resource Credit feels just right. Indirect “fee” that replenishes itself.

Yes. There are no direct tx fees.

I like to think of Hive "fees" as an investment. On most other blockchains, they are an expense.

Posted Using LeoFinance Alpha

I find it hilarious that even in 2023, there are still people who believe that Ethereum is viable for P2P transactions, micropayments, and social networking. It isn't. All the supposed "upgrades" and network updates that have been pushed through on Ethereum in the past few years have done NOTHING to address the gas fee issue, nor has any of it alleviated the bottlenecks in transactional throughput.

I think that the more people realize that everything has a cost - the better. Facebook makes over $64B per quarter from selling user data, alone. Google makes more than that. People need to realize that their online activity is monetized by these centralized entities and sold for profit at their expense.