How Hive Distribution Stands Up Against The Major Cryptocurrencies

Yesterday, @heimindanger put up a post stating how many accounts controlled the majority of the HIVE tokens.

https://peakd.com/hive/@heimindanger/hive-power-distribution-may-2020

I will start by saying that I didn't double check his numbers and will use them as posted. These, evidently, were taken from steemitboard, so there is no reason to doubt them.

In the post, this statement was made:

Top 0.1% (272 accounts) currently control 67.1% of the total stake

We also have this:

Top 1% (2744 accounts) control 88% of the total stake.

The final parameter is that the accounts with less than 1 HP was eliminated from the discussion.

For this reason, I will also eliminate the smallest account holders for other tokens.

In the comments, this was issued. The idea is not to compare Hive to Steem, which has a worse distribution, but to the other cryptocurrencies. Unfortunately, the assertion that Hive is worse than them is not valid.

Let us take a look at how some other tokens break down.

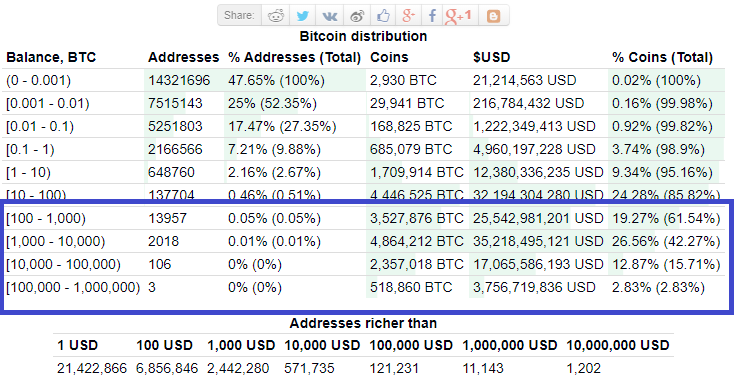

BITCOIN

There are 31, 341,620 wallets in total. Removing the smallest ones, gives us a total of 17,031,068.

16,071 wallets control 61.54% of the Bitcoin. This is a percentage of .09%.

153,779 wallets hold 85.82% of the Bitcoin, or .9%.

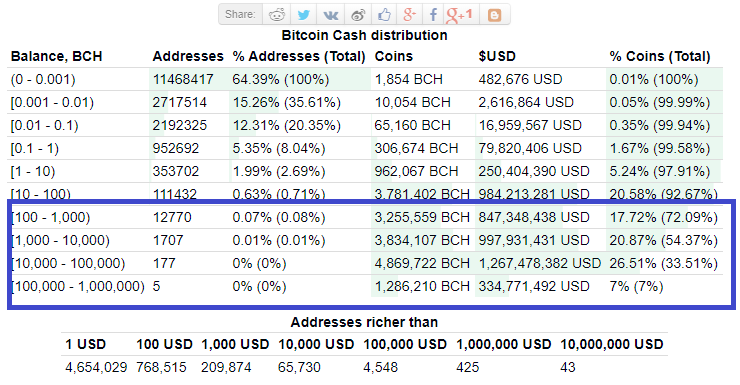

BCash

We have 6,342,324 wallets after the smallest accounts removed.

14,659 wallets control 72.09% of the BCash. This is a percentage of .23%.

126,091 wallets control 92.67 or 1.98% of the total.

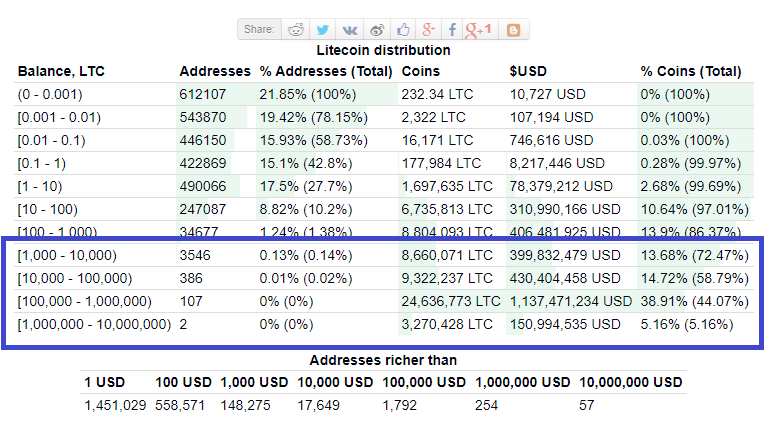

Litecoin

Once again, after removal of the smaller accounts, we see 2,188,760 wallets.

4,041 wallets control 72.47% of the Litecoin, or .18%.

38,718 wallets control 86.37% or a total of 1.77%.

These numbers came from https://bitinfocharts.com.

Ethereum

12,768,494 wallets in total after smaller accounts removed.

7,572 of those wallets control 80.98% of the stake. This amounts to .06%.

44,623 wallets control 91.88% of the total or .34%.

This is the Source for these numbers.*

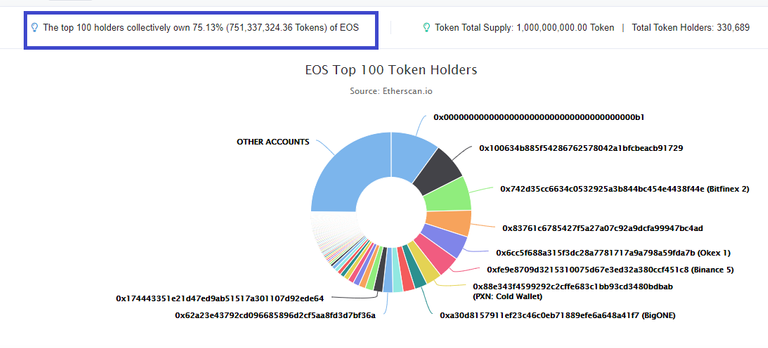

EOS

As we can see, according to Etherscan, the top 100 wallets control over 75% of the total EOS.

According to a post by @dalz, he put the total EOS wallets at roughly 1.9 million.

We will estimate that 1 million of them are smaller accounts, leaving us with 900K. Thus we get a percentage of .01% controlling 75.13%.

Tron

So what does this all tell us?

To me, it states that Hive stands up well in the token distribution compared to some of the other blockchains. Decentralization is not a point that is quickly achieved but a process. As time goes by, with a solid distribution plan, things spread out.

For more than two years, I followed the shifts in distribution on Steem. The same will be done on Hive. What took place is, because the reward pool, things changed over time. Smaller accounts, collectively, gained more power on a consistent basis. With Hive, there is a way for people to get their hands on tokens other than purchasing or mining them.

The difference between Hive and most of these other blockchains is Hive only started distributing tokens less than 4 years ago. Bitcoin is more than a decade old; Litecoin more than 8 years; BCash is a fork of BTC; Ethereum is 5 years old.

Only EOS is newer and that went through an ICO that was roughly a year long in an effort to achieve the best token distribution. We see how that worked out.

Hive is right there with all the major currencies. The difference is that there is a way for smaller accounts to keep getting more tokens, thus gaining more power as a collective unit.

The same cannot be said for the other blockchains.

If you found this article informative, please give an upvote and rehive.

Great analysis. Thank you

Great one!

I wanted to go trough something similar to this... and probably will do some time in the future.

The last 3 to 4 years, with 100 million of steem distributed did a great job in decentralization of the chain, although the start was very bad with a lot of centralization. 80% in on subject. Now days that subject has around 25% share, but on the old chain. Here its non existant. The largest stakeholder, freedom has around 5% share, the second one around 2%. For example block.one on eos also has around 5%, and the next close ones in the range 4 to 5%. But a lot od the coins overall are in few hands as you noted.

Not totaly sure about bitinfocharts, I use it as well but some numbers looks outdated.

Another great source of info is coinmetrics.io

Do not forget to add all of @blocktrades multi-accounts as showcased in this post : https://peakd.com/steem/@ayogom/who-is-the-owner-of-binance-s-101130147-wallet-darthknight-blocktrades-alpha

Can you do it again and tell me the %?

3% :)

Just funky math ... will look in closer at some point.

We should try to analyze all transfers to exchanges the same way @ayogom did for @blocktrades in the link. By using the exchanges memo. Luckily many exchanges don't support encrypted memo feature. Then we could do a pretty realistic distribution pie chart. I think I can gather this data.

I'm already downvoted every article/comment to 0$ anyway so what the hell :)

Have you seen this report?

https://steemit.com/steemit/@bitgeek/payout-stats-report-for-2nd-november-2017--part-i

I've been trying to get it reproduced since that guy stopped.

The key to me is that it keeps moving in that direction. It might take another 5 years before we see a major shift to a level where it can be said that the distribution is "decentralized" to a degree that most are happy with.

Over time, I watched more accounts achieve power. The number of accounts getting their first and 10th SP consistently grew. That was going to be the foundation for the future.

We will have to see how things evolved on Hive.

Ok for TRON and ETH (although probably not up to date as it's sourced).

But for others (BTC, BCash, LTC), the limit you set is way too high. My limit for Hive was 1 HIVE, so you should convert that to USD, and use that as the limit. It's 1500 satoshis for Bitcoin. And of course this goes in the favor of Hive/Steem again, making it look even better distributed.

BUT ... BTC, LTC, BCash or ETH are not DPOS chains, therefore stake is a bit irrelevant in these systems. What is interesting to chart would be the hashing power, because it's what controls the chain! Also important to note that Steem/Hive is a blockchain focused on improving distribution, through proof-of-brain, despite what all the powerful people on this chain say about it, it's working fair. The main issue on steem is that not 100% of the inflation goes to rewards, 10% goes to witnesses, and 15% to SPS I believe. This reduces the efficiency of the system.

Let's not talk about EOS, we all knew it was a scam. Let's just hope Dan Larimer comes back to reason and build decentralized social media again (VOICE ???)

If you want to properly analyze all the coins distributions, looking it as "Top X% controls Y%" is a bit weak. Instead, we should try to find the closest zipf law parameter. The lower this parameter is, the better the overall distribution. It honestly would deserve a small website, or maybe coin market cap could do it.

https://www.blockchain.com/pools

https://www.bloomberg.com/news/articles/2020-01-31/bitcoin-s-network-operations-are-controlled-by-five-companies

Bitcoin is controlled by few mining pools.

Yeah but also to point out pool don't equal miners.

There are some plans to phase out current pools with a pool system that will allow miner to control more of their action while still merging to be one pool.

Without a doubt this is not the best way to judge a blockchain. And yes, we do have POW blockchains in here which can be viewed differently.

I think the key is that it is often time that alters things. Steem in 2016 was a lot more centralized than it was in January of 2020. Where Hive stands today, things will be a lot different a year from now. My guess is it will follow trend and we will see more accounts holding more HP.

The flattening out is slow but it does happen.

Is there a better metric to create to analyze different blockchains? I would love to find one.

That is definitely something that makes me feel optimistic about HIVE in comparison to other tokens. Especially with 50/50 Author/Curator split, whales are motivated to support content creators that may have little "skin in the game"... at first. Many become hooked by the gamification present in the system here. At least, I have seen it happen in previous bull markets on STEEM. (2017) It's the catch-22, we need a bit of token value rise to attract new users, and we need new users continually so that the token value increases enough that it's worth people's time being active here.

I still believe that if we put more focus on gamification and UX in front-ends, people will want to use HIVE over traditional social media. Without that (it being a super-modern, aesthetically-pleasing and simple experience) people will mostly focus on the monetary aspects, even though it is the social interaction that creates value in the first place.

We will see if there is a preference over traditional media. That said, I do agree that utility is the most important aspect to any cryptocurrency.

It is the usage that provides the value.

Good point! Trend > Status.

The distribution of HIVE is good compared to other blockchains and it is getting better every day.

All the same, this disgusting distribution - the terrible distribution is a stone on the neck of HIVE - it will always be a problem.

How will it always be a problem?

THIS WILL BE A PROBLEM FOR SERIOUS INVESTORS

Nice comparisons.

A nice way to think about "flattening the curve" ... thank you!

Looks like I am pretty close to that 1%

Definitely in the top 5% even though you don't mention that number.

While it looks "bad" anyone who wants to put an extra $500 USD into this equation can easily be in those top numbers.

HIVE has among the best distribution in crypto and it will only get better as time goes by.

Heimin is just salty that Avalon is launching soon and his token price will be between 0.000001$ and 0.0000000001$

Very interesting that most of the crypto space is controlled by a relatively few people.

Hey I followed and upvoted you. And you?

You can learn Honey Hunters Community Page to subscribe.

https://esteem.app/hive-176028/@golden.future/honey-hunters-community-page-subscribe-for-membership

I appreciate his posting this information and I am curious to know why he is being downvoted so heavily (I hope everyone can refrain from downvoting people into oblivion just because we disagree with them), but the numbers themselves seems a bit misleading.

As I pointed out in a reply, most of the top 10 accounts are exchanges and have exponential amounts of hive and that seems unavoidable. As long as they are not participating in governance and voting, I think we need to count them differently when we look at the health of the ecosystem.

The chart looks awful but I suspect it will look much better when you adjust it this way

One thing you did not point out in your post is the difference in barrier to entry. There is a big difference between someone trying to acquire a lot of BTC versus trying to acquire hive. The higher point of entry is a big factor IMO. Saying that we stand up well against others is simply sugar coating that all coin distribution across the ecosystem is bad. We need a lot fo work

I like the comparison.

Some people think decentralization is a point when it's actually a spectrum.

You don't hear people like Hoskinson say he is trying to

achieve decentralization. He's trying to make his projectmore decentralizedthan other projects out there.Great post @taskmaster4450. Looking at cryptocurrencies from a distribution point of view is a new thing for me, so kudos to you.