Jack Dorsey Is Wrong: Bitcoin Will Not Be The Native Currency Of The Internet

Sometimes some very smart people get things completely wrong.

Jack Dorsey is certainly a proponent of cryptocurrency and Bitcoin in particular. Herein can lie the problem with how things are viewed. Overall, Dorsey does appear to be a bit of a maximalist when it comes to the potential of Bitcoin.

While we can debate price forecasts all we want, what is clear is that, for the last decade, Bitcoin was one of the best performers in the world for the return provided. Many believe this trend will continue. On this point, I will not debate. Markets can do some interesting things and a big Bitcoin price is, in my opinion, not to be ignored.

The Market Decided

The challenge that people who are making assertions like Dorsey is they are omitting what is taking place. Watching markets tells us all we need to know. This tends to move things from opinion to fact.

Bitcoin is known for its hodlers. This right here tells us how people view it. The idea of transacting in it really does not appeal to most people.

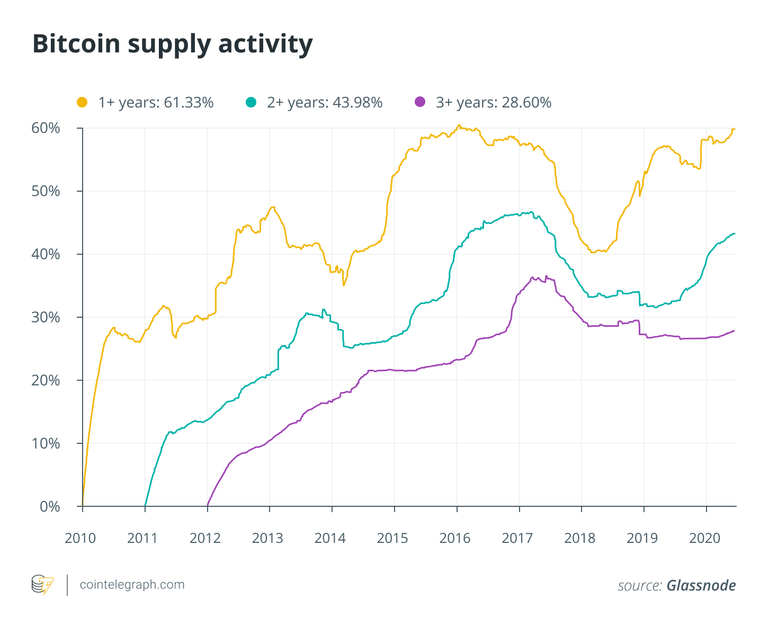

Consider this chart:

Do you think you can find these rates in any other currency that is used for payments? Imagine 60% of the USD, JPY, or EUR not moving in over a year? Talk about the velocity of money coming to a screeching halt.

Of course, if you are a holder of Bitcoin, go through this scenario yourself:

You are in desperate need of a car, so you head to the local dealership to look at an Accord. The car is $25,000, something that you cannot afford to buy since you have no money. There is also the problem that your identity was stolen, thus your credit is shot.

Fortunately, the dealership works with a bank that will subprime you for a whopping 11% interest rate. While the rate is awful, you can afford the payment.

Suddenly, you see a sign that says "We accept Bitcoin". This could be your lucky day. You just so happen to have 2.5 BTC, worth the price of the car in your wallet.

Do you take the financing for 7 years at the onerous rate or give up your Bitcoin?

Most would opt for the loan on the car for a simple reason: the history of Bitcoin shows that the price will be higher in 5 years. Let us, for a moment, presume, $20K BTC over that time. Certainly, this is not an outrageous forecast.

After 5 years, the Accord is worth, probably $10,000 (if that) while the 2.5 BTC will be $50,000. Even with the high interest rate, the BTC still provides a better return.

And here is where we go one step further. If you do decide to sell your 2.5 BTC in 5 years, do you think the person buying it is doing that to go out and purchase an Audi? Or do you think they have the idea that it will be worth $75K or $100K further down the line?

Obviously, it is the later.

Hyperdeflationary

Bitcoin has a fixed limit of 21 million coins. Many feel this is a good thing, the sound money thing after all. Of course, what they do not realize is this is awful for an economy. Money is required for transactions and the velocity of money is vital to economic growth.

Consider the above example. If the Honda Accord at $25,000 will not get you to give up your Bitcoin, what price will? Would you pay 1 BTC for the car? Thus, paying $10,000 instead of the previous price? Perhaps if you only thought that BTC would double in price.

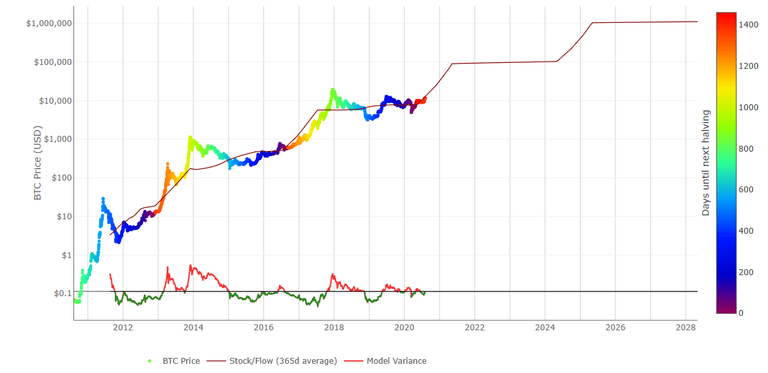

However, this is a conservative estimate compared to the Stock-To-Flow model.

This model, which thus far, has proven remarkably accurate, has Bitcoin on its way from $100K to $1M by 2025. Just think about that for a second and how it changes the appeal of using it to buy a car.

I would forecast that people would need a huge discount to fork over their BTC. Thus, prices for everything would collapse 70% or more.

Old Technology

Bitcoin is now 11 years old. The network, while a revolutionary idea, is outdated. When it comes to transferring value, there are much better options out there today. Bitcoin is slow and expensive. Of course, compared to the SWIFT network, it is still amazingly fast. However, when we look at other options, we see much faster and less expensive choices.

Most of the development being done on the Bitcoin network is simply trying to make it a more efficient transfer of value system. They realize it cannot compete when it comes to sending money from point A to point B.

I think Vitalik also had it correct when he said people will get tired of Bitcoin. If I am reading his view correctly, the interesting development is not taking place on Bitcoin. There are many other blockchains with more interesting projects that will attract users. Bitcoin simply is not in that category.

We Are Tribal

People are tribal in their nature. We tend to assemble based upon different needs. For most of human history, this was based upon geography. Since our world was mostly physical, that was the realm we operated on.

The last few decades saw that change. With the introduction of the Internet, we moved into the virtual world. Now people can assemble based upon topics, likes, and a host of other parameters. The physical closeness is not required.

With cryptocurrency, the assembly is compounded by the ability to create an economy. Whatever the reason for getting together, that can be tokenized and individuals can interact in a financial capacity with each other.

As we keep decentralizing our interactions, why would we have just one native currency? The truth is we are already seeing a different mindset forming. For example, those who operate on Hive see what everything is priced in. When dealing with other tokens tied to that chain, it is all priced in the native token to that group (blockchain).

Over time, we will see the main users on Ethereum, EOS, Tron, and Cardano do the same thing. Their transactions will be based upon the tokens they are familiar with.

In fact, we see that in the world today. The USD is the reserve currency and can be traded for any other major currency. That said, do you think that the average person in the EU knows, or cares, what the EUR/USD rate is. Unless they are looking to travel, they have no clue. There is a simple reason for this: their daily lives are priced in EUR.

Advancements in crypto wallets will also make this a moot point. As wallets start to instantly swap one token for another, the joining of what is held versus what is needed to pay is bridged. There will be no need to go to a standardized currency to be able to interact. The wallets will seamlessly do this in a peer-to-peer manner.

Digital Gold

All the reasons that work against Bitcoin as a means of a payment system actually work for it as "digital gold". With us entering a more digitized world, it only makes sense that stores of value will start to operate in that realm.

Once again, the Stock-To-Flow model tells the story. Bitcoin has a built in scarcity. While this is a drawback to economic growth, it is an asset for value appreciation. Even if the model misses by 50%, we still will see some terrific gains over the rest of the decade.

We also have the Millennials. They are, according to the few surveys I read, preferring BTC to gold by a margin of 9-1. This is a group that is forecast to inherit roughly $70 trillion over the next 10-15 years.

The Baby Boomers are many of your gold advocates. With the Millennials starting to take over, as they enter their prime earning years, we can see where the shift is going to take place. With the passing of each Boomer, we see their customer base shrinking.

For this reason, I cannot contest the idea that everyone should be holding at least some Bitcoin. The historic returns are outstanding while the forecasts going forward, even on the conservative end, will provide stellar returns.

As bullish as I am on BTC from a pricing perspective, I simply do not see it as the native currency of the Internet. That idea makes little sense as we move into an automated, decentralized, and digital world.

What are your thoughts?

If you found this article informative, please give an upvote and rehive.

gif by @doze

Posted Using LeoFinance Beta

https://twitter.com/IamAtmaLove/status/1304778336573566976

Great writing. Thanks for sharing. I struggle to keep 1 Bitcoin as I keep swapping some for HIVE LEO and other Alts. I will buy more, just waiting for a dip :-)

#POSH https://twitter.com/IamAtmaLove/status/1304778336573566976

Posted Using LeoFinance

Well I am far from a bitcoin maximalist so buying alt coins could be as profitable, if not more so in the long run.

There are a lot of opportunities. That said, having some BTC in your portfolio is probably not a bad idea.

Posted Using LeoFinance Beta

I'm looking into another, what looks very promising project at the moment. It's called Verus. I'll post about it when I'm done, but I think I'll buy some VRSC today. Just downloaded the Verus wallet (so I can stake and mine and create a digital ID). Next open an account in yet another exchange! Man, so many wallets, exchanges, password, keys, seed phrases!

Posted using Dapplr

LOL yes @atma.love. There is a lot.

Many ways to put ourselves in position to really benefit financially. Not going to hit on everything, but the more we spread things around, the greater our chances.

It is going to be exciting when a lot of this stuff starts hitting for people. Then there will be a lot of resources available.

Posted Using LeoFinance Beta

It is not like he is an expert.

The flaw of Bitcoin lies within its supply cap.

Few understand.

Great article BTW.

It is only a flaw if you are using it as the basis for an economic realm that needs to expand.

As a value creator, the cap actually is an asset.

Agreed. It is one of the most misunderstood concepts there is.

Posted Using LeoFinance Beta

Have you had a chance to study the SNX model of staking. They're basically the OGs of modern day passive yield farming?

-In a non-dilutive way.

No I have not looked at their system too closely. I liked that project from the early days.

Want to give the cliff note version?

Posted Using LeoFinance Beta

Synthetix in 2019 decided to revamp their tokenomics model in a big way. As you may know they are a synthetic asset exchange using on-chain collateral to mint any synthetic including their own stable sUSD.

In a nutshell what they did was start inflating the SNX token get investors to stake SNX while offsetting the new inflation with protocol fees generated by the exchange.

Synthetix created a sleek app called mintr to manage it all. SNX stakers can claim weekly rewards that go into escrow for year until they can be transfer out. SNX rewards that don't claim go back into the general weekly pool & get redistributed new SNX claims.

They created a good product but the tokenomics were just as important. SNX staked skyrocketed from around 20% staked to in the high 80's. Needless to say it was great for their token appreciation.

I thought this is what it makes it different unlimited fiat supply of central banks...?

A small but steady rate of inflation is needed to ensure longevity and stability of any currency. Over time currency will be lost and you need a certain amount of inflation to counteract that loss.

Just as cash is lost or destroyed over time, people will lose bitcoin wallets or send coins into the void.

We know that around 4 million bitcoin is already lost, 2.9 million if Satoshi never lost their early keys, which means bitcoin's functional cap has already been reduced to ~17 million.

Optimal inflation is equal to or a hair higher than loss so that your real inflation rate is near zero. Bitcoin may end up needing to hard fork at some point to remove the hard cap to keep a small amount of inflation. If they don't than the currency is doomed to fail.

Since future demand is unknown it puts the entire security model at risk as block rewards halve every 4 years. The way to fix this is minimum necessary issuance model then burning the supply based on demand (fees).

A superior economic model emerges this way.

decreasing supply > fix supply

It's not a flaw, it's a feature. Bitcoin works as digital store of value that can also be used as a currency. It doesn't work for every day payments.

Fixed supply puts the entire security model at risk, since future transactional demand is unknown. The cap will need to be lifted to subside the reduction of block rewards. Also, POW needs a much higher issuance than POS models to be fend itself from double spend attacks. e.g. ETC has nearly almost been attacked out of existence.

I believe we'll see Cryptos that will run any application including very low cost payments rails with reducing supplies based on extremely high demand (fee burns). Not so different than what BNB is doing or what EIP-1559 has planned.

Moreover, there will most likely be an elastic gold "stable" currency as well where the supply adjust without dilution.

Bitcoin can still exist but it will need to survive a major evolution if it is to thrive imo.

I agree with your viewpoint. And, hope Hive becomes the chosen chain to transact on. Now, to get 5 billion ppl on board!! Nbd right!? LOLz

Piece of cake.

We can knock that out by Halloween.

Posted Using LeoFinance Beta

Personally never been a fan of the digital gold narrative. Bitcoin is not fungible, and that will prove to be an increasingly bigger problem over the next decade.

Bitcoin was supposed to be a "Peer to Peer electronic cash system", but now it has strayed far from that original vision. As more and more people realize they are being tracked and traced, there will be a shift towards private coins.

Zcash in particular stands out to me because of the team behind it and the underlying technology. It offers the best privacy when compared to any other coin. Also the team behind it is doing some ground breaking work for scalability that could have positive implications for many other blockchains besides Zcash. I encourage you to take a look at their recent developments with Halo, also ZK-Starks are something to keep an eye on..

Interesting to note: Hal Finney(@halfin) followed 17 twitter accounts before he passed away. One of these accounts is the @zerocoinproject which is twitter account for the Zero Coin Protocol, which is what $zec is built with.

Better privacy than what XMR offers?

When used correctly yes. It really comes down to the anonymity set. Zcash anonymity set for users is much larger than XMRs. The mixing strategies that other cryptocurrencies use for anonymity provide a rather small [anonymity set] in comparison to Zcash. Zcash has a distinct advantage in terms of transaction privacy. With ZEC the more people that use the shielded feature the stronger the shielded pool grows. So right now, not many are using the shielded feature on ZEC, but its about to change soon. With the most recent update ZEC miners are now able to mine straight into a shielded address, before we had to mine into a transparent address and transfer to shielded from there. So this will also strengthen the shielded pool eco system. The problem right now with ZEC is that most people dont know how to even access the shielded address feature, the only official wallet is on Linux. There are some others now for android such as NightHawk wallet, but would not trust it yet with large amount of ZEC. Also Ledger devices recently got an update to the ZEC app to get ready to support the Zcash Shielded address feature, so you should expect it to come to ledger live within the next few months. This will be the first time shielded address are easily accessible to the "average joe" and could make a big difference in terms of ZEC adoption. Like I said earlier, the more people that use the Zcash shielded eco system, the stronger it grows. The anonymity set for users spending with shielded coins is in fact all generated coins. Where as with XMR, its a certain number of mixins and the anonymity set is limited to that.

The developers behind Zcash are world class, and the project deserves much more attention than its getting now. Satoshi (and Hal Finney, Nick Szabo, and the other fathers of Bitcoin) tried to devise other ways to guarantee fungibility but at that time we didn't yet have the necessary cryptographic science) -- Satoshi himself spoke on Zero Knowledge Proofs a few times but at the time it was not possible to implement in Bitcoin as no one had discovered proofs efficient enough yet. Satoshi wrote that he didn't see how to use zero knowledge proofs to prove single-spend. But this was later solved by Miers, Garman, Green, Rubin. They are now working for Zcash and it launched in 2016 making crypto history in my opinion.

Quote from Satoshi:

"This is a very interesting topic. If a solution was found, a much better, easier, more convenient implementation of Bitcoin would be possible.

Originally, a coin can be just a chain of signatures. With a timestamp service, the old ones could be dropped eventually before there's too much backtrace fan-out, or coins could be kept individually or in denominations. It's the need to check for the absence of double-spends that requires global knowledge of all transactions.

The challenge is, how do you prove that no other spends exist? It seems a node must know about all transactions to be able to verify that. If it only knows the hash of the in/outpoints, it can't check the signatures to see if an outpoint has been spent before. Do you have any ideas on this?

It's hard to think of how to apply zero-knowledge-proofs in this case.

We're trying to prove the absence of something, which seems to require knowing about all and checking that the something isn't included."

Source: https://bitcointalk.org/index.php?topic=770.msg9074#msg9074

Thanks for the link, will check it out.

Posted Using LeoFinance Beta

Did you read about the IRS offering $620k as bounty to anyone who can crack Monero and other privacy coins?

https://decrypt.co/41411/the-irs-is-offering-you-625000-to-crack-monero?amp=1

Any thoughts?

Like someone wrote on Twitter, if one could hack Monero, do you really think they would do it for $620K?

And even if it is hacked, the community would likely respond very quickly and fix whatever patches were exposed.

I am sure there are many who have been trying to hack it over the years.

Posted Using LeoFinance Beta

That all could be true. I wonder, @encrypt3dbr0k3r, how the ability to potentially integrate cross chain transactions could affect things. For example, if a Monero or Zcash could tie into a token like Bitcoin, then people could lose the tracking that is taking place.

Charlie Lee was supposedly trying to provide the privacy feature to Litecoin. Based upon news about it, this appears to not have gone anywhere.

Posted Using LeoFinance Beta

When it comes to cryptocurrencies, Bitcoin is still a very strong reference... But it will definitely not be the only one.

Yep, I agree. Bitcoin likely will either be a store of value or it will be used for every day payments, but it can't really be both...

This is what I have been telling the world since 2017. I have often compared Bitcoin to dial up internet. It proved a concept and provided many groundwork only to be killed y much better technologies that ushered in better possibilities to the world.

Good point but it has to be bitcoin or it can't be anything else. If not bitcoin, what possible other coin can be "native internet money"? BCH, DASH, LITECOIN? No, Bitcoin have to succeed first at being internet money before any other coin even get a chance to be accepted. Bitcoin is the proof of concept.

Again, I love the amount of value you drive in every post...

Every time I enter one, I learn time and time again, I simply can't go wrong. :)

I am in total agreement with this narrative. Personally, when I want to move money from one exchange to another I use XLM (Stellar) because the transaction cost is INCREDIBLY low. This really drives your point in a personal way for me. I rarely trade XLM, except to move money and then buy the currency I want to trade with, but it is SO useful for that!

I would never pay the high gas fees or 'proof-of-work' fees on the Bitcoin network to do this. I would think coins like XLM would rise, but I think the fact that people often use it just to move money from place to place - then selling it - is probably why the price sticks around at such a low point (among other factors of course).

Anyway, that is why I agree from a personal perspective with your point that 'Bitcoin will not become the standard internet money.' It simply isn't sustainable. It makes no sense to pay more for the same service, which is classic 'blockchain capitalism.' :P

Thanks again! :)

I don't see BTC as the native token but the anchor for value, it sets the floor for other coins to do the work it could be a utility token, it could be a satoshi. It doesn't really matter to me how people want to exchange value that's up to the parties involved. I Just think BTC has a bigger role to play in making sure we always have value and be a bridge between all fiat and all crypto

Posted Using LeoFinance Beta

I'm not fully immersed with using bitcoin for transacting anything, however I have purchased items online using bitcoin and I can say it's been relatively easy to do so. I also use my visa and paypal at times however in terms of delays or anything along those lines. There is no marked difference on when I get my product purchased.

So for me personally i have not come across delays in transactions even using the smallest and slowest to save on the fees.

Old Technology

Listen to this carefully.

PRIVACY = FREEDOM