Fed Seeking Inflation: What Makes Them Think They Can Achieve It After A Decade Of Missing It?

The United States Federal Reserve is so cute. They are like children. When we look at the world around us, they are in fantasyland.

Tonight there was an article posted that explained how the Fed, after a year of study, is now intent on hitting the 2% mandate for inflation and will do what it takes (i.e. keeping interest rates low) to achieve this.

It was one of those articles that made me laugh. I mean, honestly, these bankers really do not have any idea what is going on.

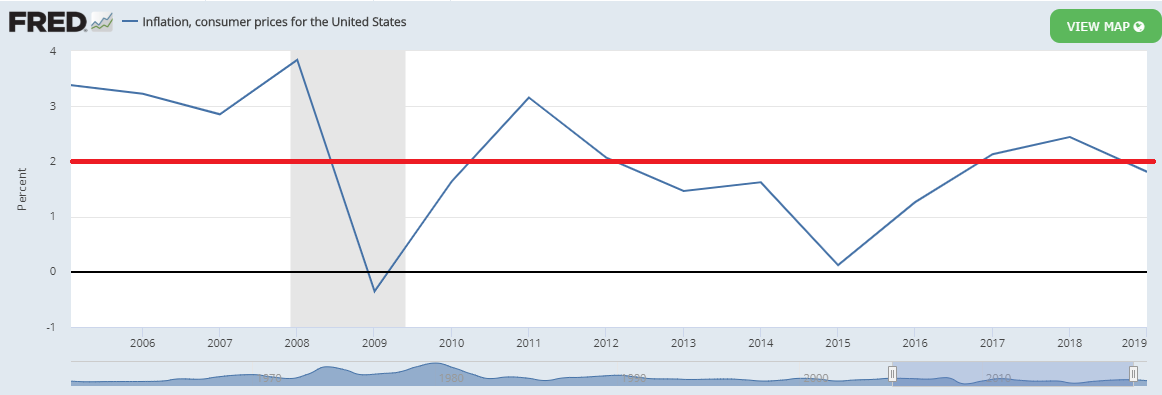

To start, let us look at the inflation rate over the last decade.

The red line is the 2% mandate. If you look from 2010-2019, the Fed missed their targeted rate in 6 of those years. The inflation rate is as follows:

2010 1.64%

2011 3.15%

2012 2.06%

2013 1.46%

2014 1.62%

2015 .11%

2016 1.26%

2017 2.13%

2018 2.44%

2019 1.81%

Here is how interest rates looked over the last 40 years.

Since the early 1980s, we are in a deflationary supercycle. Notice how this coincides with major advancements of technology.

That said, the last decade is worthy of note. Look at the interest rates. Most of the time was spent near zero with the interest rates. There was one burst where they were able to get above 2%.

This is from the article cited above:

The Fed and other global central banks have been trying to gin up inflation for years under the reasoning that a low level of price appreciation is healthy for a growing economy. They also worry that low inflation is a problem that feeds on itself, keeping interest rates low and giving policymakers little wiggle room to ease policy during downturns.

In the latest shot at getting inflation going, the Fed would commit to enhanced “forward guidance,” or a commitment not to raise rates until its benchmarks are hit and, in the case of inflation, perhaps exceeded.

Is this for real?

The Fed has been under a mandate from the United States Congress for decades of hitting 2% inflation. It appears they are getting serious now. Which brings to mind, were they just playing around for the last decade? Did they not take the mandate seriously?

Essentially, this is pure foolishness. The Fed, contrary to their own self-image, do not control the economy or what happens. They are completely incapable of stimulating demand, one of the major premises they operate upon. Finally, they are completely disconnected from the effects of technology upon the inflation/deflation equation.

So we now we led to believe they are going to get the targeted level of inflation and they will do everything they can to get there? After a decade of complete ineptitude, we are suddenly suppose to believe them?

Ultimately, the Fed is going to have to print money like never before and they still will not hit their targeted level. The world of the bankers is changing because the underlying value in the economy is shifting. Unfortunately for them, those at the Fed and the economists they listen to are completely oblivious to what is taking place.

The simple reality is that too many give the Fed a "god-complex"; assigning the belief that they can impact things in the economy. We saw since the last financial collapse the Fed could do very little of impact. Look at the inflation rate from 2011-2014, how it declined when the Fed was still engaging in full-fledged easing.

In other words they printed and inflation dropped.

One way to really screw up a bankers mind.

Once again, why should we believe them this time?

If you found this article informative, please give an upvote and rehive.

gif by @doze

Posted Using LeoFinance