Its Official: We Are Heading Back Into Recession

The Fed confirmed it: We will enter another recession, likely in 2022.

No, we will not blame the Fed although they are not helping matters any. They do not deserve credit. To do so would be giving them too much power. In fact, they are basically impotent when it comes to all of this.

On the day when the Fed announced they are going to accelerate their taper and might raise interest rates as many as 3 times in 2022, we are getting confirmation of what was discussed both in these articles along with the videos: a double dip recession is on tap.

The decisions that were announced today are only going to accelerate what is already in motion. We knew the warning signs are there, something the Fed is missing.

That said, I will have to defend Powell on this matter. It is likely he knows what is going on. He was hammered for the "inflation is transitory" comment. Hell, he probably got it from Biden before being re-nominated by the President. Everyone from members of Congress, the media, markets, and anyone else who has an opinion is screaming about inflation. Powell understands the game so he is playing it. When inflation plummets, the Fed will take the credit. Of course, it will also be blamed for tanking the economy.

The reality is the Fed will do neither but so much for people understanding the lack of power of the Fed.

All The Signs Are There

The economy sucks. There is no way to sugarcoat it. Despite what the media want to claim, it is tanking.

Here is how screwed up things are. Remember the discussion between the US and China about releasing oil reserves. Oil prices are out of control and people are fed up. OPEC basically told Biden to pound sand when he urged them to pump more oil. Thus, reserves have to be tapped into to help with a shortage of supply. This was only a few weeks ago.

The Brent Crude spread traded briefly on Tuesday at a contango – the market structure in which front-month prices are lower than prices out in the future months, signaling an oversupply. The prompt spread in the Brent futures contract flipped on Tuesday from backwardation to contango for the first time since March 2020, excluding the days on which contracts expire.

All analysts and estimates expect the oil market balance to start shifting to oversupply as soon as this month and see supply exceeding demand in the first quarter of 2022.

Oversupply? What the hell? How did we get to oversupply? Weren't we told that we have too little oil? Wasn't the President urging OPEC to pump more?

Oops. Seems demand might not be as strong as people thought (something we have been saying for months).

Speaking of demand, here is the latest retail sales numbers for the month of November.

Again, we were told about a hot shopping season and that people were going to begin early. It seems, according to the November numbers, that the holiday season is off to a lackluster start. This is in keeping with the analysis of the traffic and online activity during the Black Friday/Cyber Monday time period.

Once again, it appears that demand is not quite as strong as stated.

Jobs

This is another area that, if we know how to read it, screams problems.

We know the unemployment rate is heading down. This is a good thing. However, we have to understand that the absolute numbers are pretty useless since it omits a great many people. For example, we know employers are not hiring. Sure the government stats tell us there are plenty of jobs out there. Yet when people go for them, they are not being hired. Why is that?

The answer is because these companies can figure out what we did here. It is not hard to put the pieces together. They see their employment numbers up yet productivity is down. We should not be surprised to see more layoffs come after the start of the year as companies realize they were misled into believing things were going to get better.

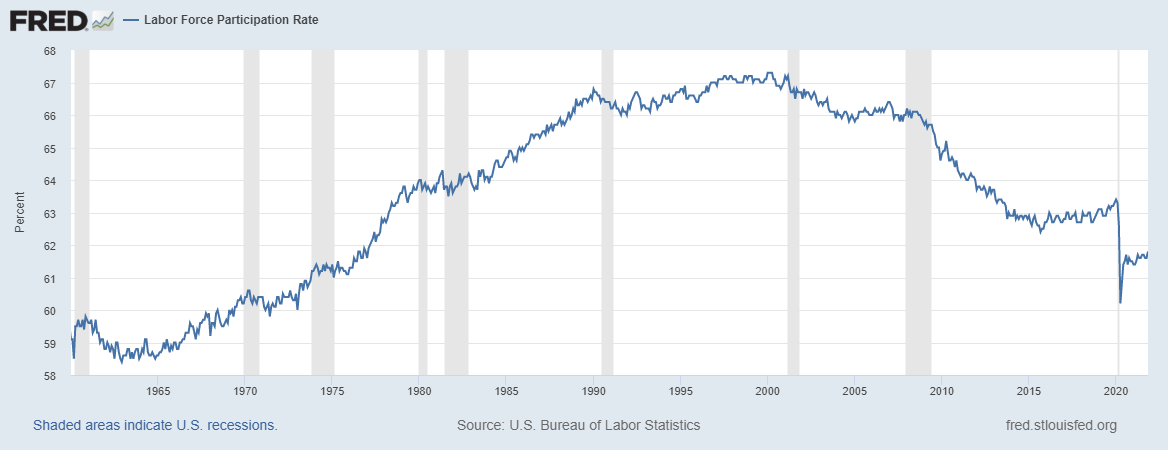

Where the reality smacks us in the face is with a chart like this. Here is the participation rate:

How can we consider the economy on strong footing when the participation rate is so far below the pre-pandemic level? Remember when we were told that the reason there we so many job openings is because people were milking off the government and if the payments would just stop everyone would have to return to work. So much for that. Those ran out 6 months ago in some states and all by the beginning of September. Here we are 3 months later with a record number of jobs.

The reality is we have a labor participation rate that rivals the mid-1970s. Something else is going on, much more than just people sitting home collecting a check. Perhaps things are not as rosy as we are told.

History Repeating Itself

We have to keep in mind the ability to forecast this is due to the fact that many factors tell us exactly what is happening.

For example, we know what every recession since the late 1960s ended up experiencing a double-dip simply due to the fact the same playbook is run. We have a recession, every organization says we have to fix it so stimulus starts flowing. This helps to improve things, especially on a YoY basis. Suddenly, whether ideological or otherwise, people start screaming about too much and it needs to stop. This causes the money to stop flowing to people, causing spending to decline.

Ultimately, we head back into a recession.

Then we have the words of Larry Summers. Like most economists from the education arena, he is pretty worthless. However, one area they can be helpful is in research. He had this to say:

“The Fed will have a very difficult time organizing a soft landing,” he said, noting the long and variable lags between monetary-policy actions and their impact on the economy. “All the efforts at disinflation that we have had historically, where it was clearly established that inflation was too high and the Fed acted, have ended in recession.”

Well it seems that we are heading down this path. With supply chains still bottled up, we are going to see demand seriously altered as prices remain high. Of course, the potential cracking of oil will end up really putting a damper on the hyper-inflation crowd.

As I said a few weeks ago, if you are looking at buying a new car, June or July of next year should be a great time. By then the supply should be improved and demand is so overstated in that market that they will have cars coming out their ears. Dealerships will be cutting deals all over the place to move cars.

We will see how these theories pan out over the next half year or so. Thus far, the path appears to be followed.

The Fed is the latest entry to jump on board in trying to drive this train into the recession wall.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

View or trade

BEER.Hey @taskmaster4450le, here is a little bit of

BEERfrom @pixresteemer for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.This is for real boss

It's not a surprise for anyone knowing the underlying numbers and fundamentals. It reminds me of how things played out in the 1970s. Politicians said they would do something but didn't. Then they just keep doing more things that don't solve the issue at all.

Posted Using LeoFinance Beta

Because they're not realizing that they're the problem and that they need to get the hell out of the way if there's any hope of improving the situation.

The baseline metrics arent very solid. Be careful about the comparisons to the 1970s. I understand what you are saying but so many are led astray in the belief that there is a repeat of that.

Two totally different worlds.

Posted Using LeoFinance Beta

I feel bad for the every day working person trapped in the endless work cycle that just gets them further and further in debt. I think everyone here tries to spread the word about how Crypto can help them get ahead and hedge themselves against inflation. The working stiffs are in for some more pain !

Posted Using LeoFinance Beta

Each 1 teach 1

Your articles are always extremely interesting. If there is a recession for the US, there will also be for Europe. I have to be careful, I'm Italian.

Europe is further down the "we're screwed" rabbit hole than the US. It is running about a decade ahead in terms of the impact of debt and the declining growth rate.

But yes, the disinflationary numbers coming out of the EU are already showing up. It is only a matter of time before it hits the US.

After all, China is sucking wind. How does anyone think that wont impact things.

Posted Using LeoFinance Beta

Thanks for reply, after years of pandemic this will make matters even worse

Government are not helping matters and that is why we all need crypto to get more stability in our day to day life

Posted Using LeoFinance Beta

As a kid, I worked at my Father's Service Station weekends and summers. Even as a youngster whose vehicle had two wheels and pedals, the games being played with oil prices were ridiculous.

Wouldn't things be easier if the Government just played it straight with the people when it comes to the economy so we can work as a country to a common goal?

Things have been bad here for a while and suggest we are already in a deep recession. Economy is worse than screwed as there is just no money being spent as there is none to go around. We live in the real world unlike most politicians and know when things become tougher to get by. I see more jobs being cut as companies have to find savings somewhere.

Posted Using LeoFinance Beta