The Deflation Supercycle: Important On Reading The Future

The is a great deal of fear about inflation. Unfortunately, this is akin to looking up when one should be looking down.

Motivating the inflation fears is the misguided viewpoint that money printing leads to inflation. This is untrue especially for the dominating currencies. Throughout history, the currency for the leading empires did not hyper-inflate. Certainly, money printing can be a part of inflation. However, this is not the only factor. Things such as supply, demand, technological innovation, sanctions, and a host of other variables can all impact the inflationary rate.

The truth of the matter is that inflation, or should be see runaway inflation, is the easiest thing for central banks to address. As the United States learned under Paul Vocker, runaway inflation can be immediately stamped out by increasing interest rates. What is ironic, since Volker took those actions, we witnessed a deflationary supercycle that has lasted for 4 decades.

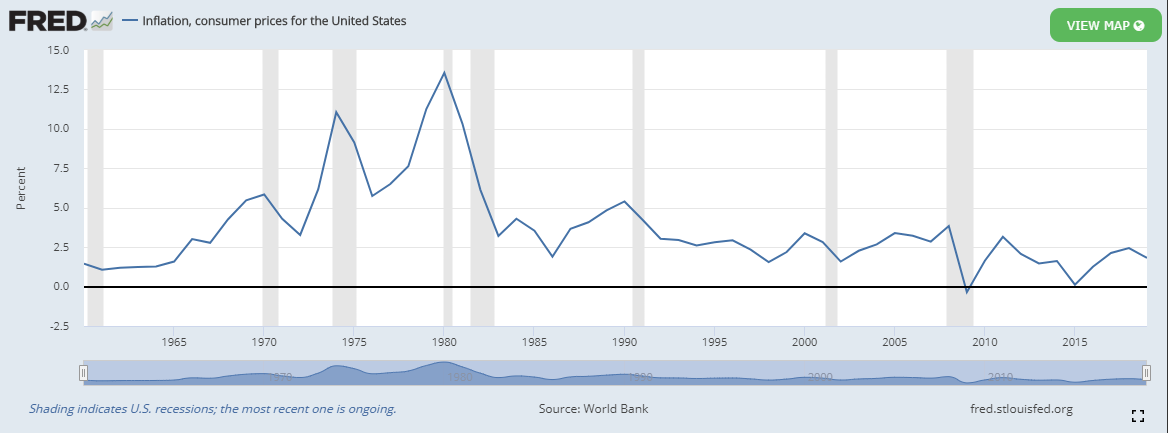

Here is the inflation rate over the last 40 years. Notice how it peaked over 13% in the early 1980s.

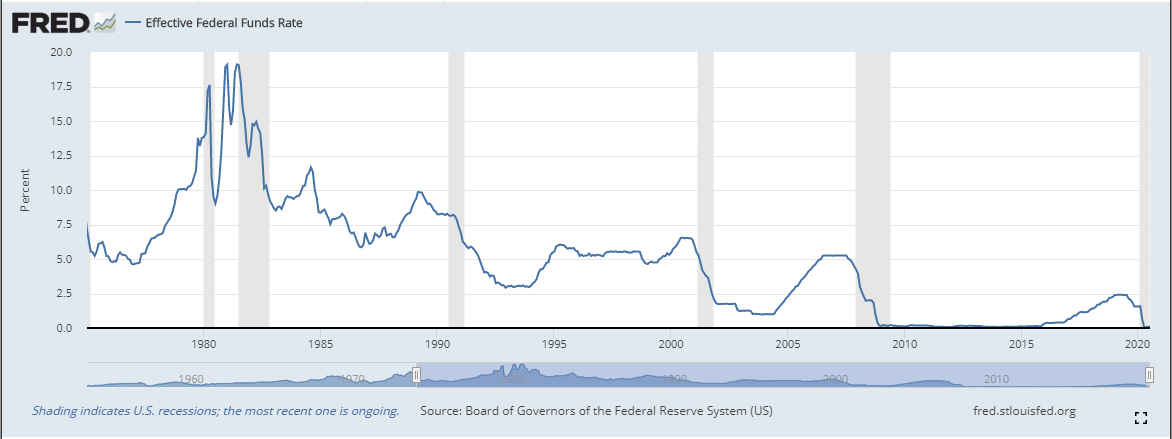

The trend over the decades is pretty obvious. This is mirrored in the Fed Funds Rate over the same time period.

Again, we saw interest rates pushed up through the roof in response to the inflationary pressures. After that, we saw a steady decline over the past few decades. If inflation was truly a problem, interest rates would not have steadily declined.

Of course, perhaps one does not believe government stats, feeling they lie. That is fair enough although the value of those statistics is long term trends. Over 4 decades, it is hard to manipulate the numbers.

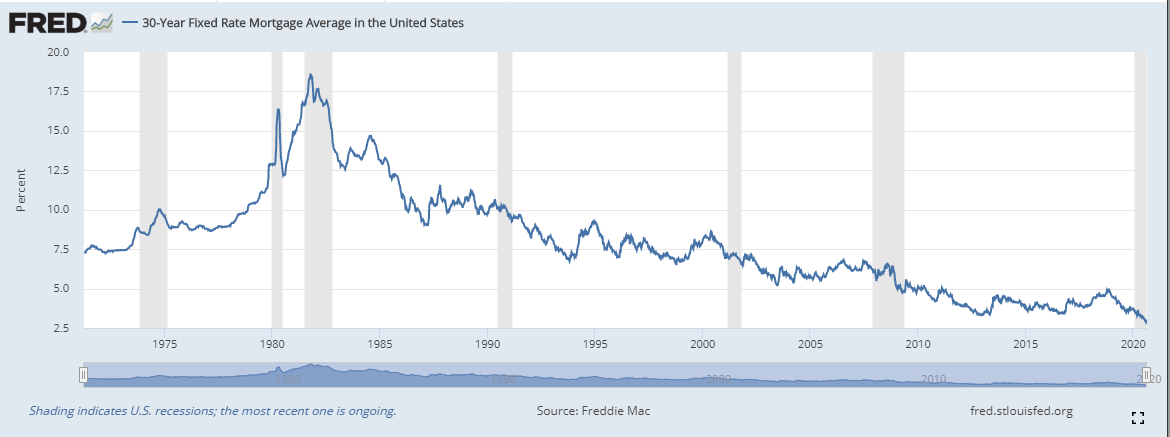

That said, let us ignore the actions of government or central banks. Let us focus upon what the market says. Look at the 30 year mortgage rate, we see clearly what is taking place.

It is hard to argue with the market especially considering it is so consistent. The 30 years is considered by many to be the benchmark when looking at interest rates. Simply put, the mortgage market is so large that it tells a great deal of the story.

Basically, the central banks are fearful of something far worse that inflation. They have shown their intention to try to inflate things at all costs. Unfortunately, as we see from the last decade, their ability to do this is diminishing. Instead, they are being overrun by inflation.

What could be causing this?

I believe this tells at least part of the story.

Soure

The bottom line is the Fed (in particular) is not in control of the economy. Contrary to their highly valued opinions of themselves, they really are in control of nothing. The Keynesian idea that central banks can manage the economy is completely false. We are seeing markets operating in direct opposition to what the Fed is trying to achieve.

This is an idea that will continue. Central banks will keep printing in an effort to stimulate things and produce some inflation. Their money printing is not what dictates markets. Other factors are more important. For example, we can expect inflation in food and energy over the next few years as the supply chain is gutted. At the same time, we will likely see interest rates increasing in many areas as confidence in debt, especially sovereign, falters.

Naturally, the forces that move us further away from 1980s guy will still be in effect. This is something central banks are completely powerless to fight against.

Thus we can expect the deflationary supercycle to continue going forward.

If you found this article informative, please give an upvote and rehive.

gif by @doze

Posted Using LeoFinance

Well I use to feel somehow mostly influence inflation, but then if they keep printing money like we've seen how little will their influence still be on inflation? How far do you think they can go to control it?

Posted Using LeoFinance

Inflation can be suppressed but can be diminished through reverse effects. HIVE POWER increases at an APR of approximately 3.35% to combat that, but I am not sure it is enough. It should take in consideration also other factors, maybe the market price, but being so volatile not sure if you can put it into math.

Posted Using LeoFinance