Looking into precious metals

I've been considering investing in precious metals a lot lately to hedge my assets. I have never purchased precious metals in my life for investing purposes so I am still doing some research.

There are four popular precious metals you can easily acquire.

- Gold

- Silver

- Platinum

- Palladium

Gold and silver are obviously the most popular but platinum seems the most interesting to me followed by silver. Here is what I am thinking, and remember I am just now looking at the precious metals industry for the first time.

The first thing I did was look at the 10 year charts for each

I am no expert, but the first thing I noticed was gold and palladium is sitting pretty high in the 10 year period. Silver is kind of in the middle, it's up there but not as much as gold & palladium. Platinum though is pretty low over the last 10 years. This can be interpreted in a few ways, on one hand if you believe these metals go through patterns that they may repeat and platinum has the best potential for returns as it's time to come back is due. Silver is a popular option but looking at the last 10 years it has the least potential for big gains unless something significantly changes.

Again, I am a complete laymen when it comes to precious metals and looking at the 10 year charts was my first instinct. When you look at precious metals, you typically are focused on long term not short term gains.

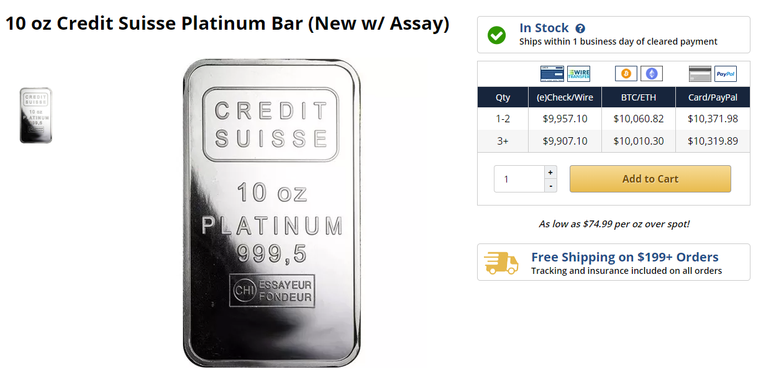

After looking through the charts and know I want to focus on platinum or silver, I started to look at my options. My gut instinct was to look at 1 kilo bars, as the premium on smaller pieces is pretty steep. I recently spoke with a few people about precious metals and they all recommended against purchasing 1 kilo bars as they are difficult to sell. It seems 10 oz bars are a better option if you want to avoid 1 oz coins.

It looks like a 10 oz silver bar will run around $300 based on the mint and design.

Platinum 10 oz bars are considerably more expensive and potentially harder to sell.

A lot of distributors allow you to purchase precious metals with crypto for an additional premium. I am not very comfortable doing such large transactions through the postal service sight unseen. I don't know of any precious metal dealers local to where I live. All I have seen are pawn shops paying pennies on the dollar for people pawning off family jewelry.

I am going to continue to do research and look around and decide my comfort level of buying expensive large chunks of metal through the Internet. I am still deciding the type of metal I want to invest in, my gut feeling is silver is the best bet even though platinum looks like the biggest potential based on the 10 year charts.

This is not financial advice, I am by no means an expert on precious metals and I am only sharing my thought process as I approach investing in precious metals.

Posted Using LeoFinance

Good evening. I think investing in gold is an interesting and promising option. It's my opinion. I liked your post. Thanks you

Silver is a no-brainer imo

proably the best best for the next 5 years

Hard to imagine Marky "the digital geek" buying PM? Seriously? :)

Must the the top in PM😀

Always thinking about ways to hedge my investments. Also considering something I can share with my son to give him a fighting chance.

You can start small. I don’t have any physical... too cumbersome. But you can have futures, or ETFs if that is your cup of tea. Price is high though right now. Metals are notoriously cyclical. I am an old industry guy. I have been in metals most of my adult life.

ETF’s are BS and totally 100% fixed. They are stocks and if the market crashes they will crash as well. They only have to have 5% physical metals in possession to create an ETF. If a big holder call for delivery the ETF is screwed. Physical is the only way to go with precious metals.

I love your optimism! :)

You could just ask most any member of silvergoldstackers (aka steemsilvergold) 😉.

There are tons of reputable online dealers. Apmex, monarch precious metals, bold precious metals, provident metals, vulture peak mines. Before the pandemic most of these dealers offered 10oz at spot deals for first time buyers in the websites. With demand for silver fairly high now those deals are harder to find.

Kilo bars are hard to sell and harder to store. In an “oh shit” scenario unloading smaller pieces is easier. If you are stacking just for weight, low premium and not collectibility it might be worth it to you to just buy a roll of generic one oz rounds.

Silver spot price at the moment is kind of dumb though. Rounds that sold for $17 or $18 at the start of the year are selling for $30 now. Great if you are already invested and looking to sell. Not so great if you are just starting. In some ways being into collector coins might be better now. Spot could easily drop meaning generic silver could quickly lose value. Collectible stuff might hold value at today’s prices better.

But I am no investor or financial advisor as they say. I just buy silver I like when the cost and my desire to own a piece match up.

@raybrockman has been pouring awesome silver lately. You should check it out on the silver gold stackers discord. He has been known to accept hive and steem for his pours. (Ray is a long time member of the silver gold community on steem/hive).

I got an 8.45oz pure silver sugar skull from Ray a couple months ago at spot ($18.59 at the time) and paid steem! It felt like getting metal for free. 😄

I don't have a huge sum to spare for metals investing, but every now and then, I'll buy a little 'junk silver,' 90% silver US coins from 1964 and earlier. I also like 1 oz. fine silver rounds.

The 10 year chart is a good step, but for a historical perspective, it's worth looking back 100 years when metals were money, too. Look at the silver to gold ratio now, and then look back at what it was when they were both used as coins in circulation.

Bimetallism was a flawed concept, since fixing the silver/gold ratio legally did not account for natural fluctuations in commodity markets, but it was once roughly 20:1. In a full-blown currency collapse, silver demand as a monetary metal would likely result in a massive spike.

It's speculation, of course. But the upside as everything goes sideways now is comforting.

"ask and you shall find, seek and it shall be given, knock and the door shall be opened unto you"...at #silvergoldstackers ,it's not rocket science.

I would highly recommend putting a portion of you assets into precious metals. The recommended amount is 10% of your liquid assets. Equity on your house plus all other investments.

The problem right now is the dealers are charging very high premiums on all physical metals. I would suggest finding an LCS (local coin shop) near you and make friends with them. Most LCS’s charge $1 or $1.50 over spot for silver. Silver would be my first suggestion buying. If have any more questions feel free to comment back or you could DM me on the Silvergoldstackers discord.

PS - I wouldn’t buy any bars over 10 oz., they are a little harder to sell especially when the prices go up. A kilo is 32.215 ozs. That’s over $1000 a bar right now.

Also you have to consider resale value. Silver & Gold most Buy Gold places or LCS’s will pay you 90% spot for them, unless you choose to sell it yourself on eBay or the likes. While platinum and palladium they might give you 70% for if you are lucky. They usually don’t hold onto them and instantly sell them to a smelter and make 10-15% on them.

I think you should research a bit about possible use cases for those metals and how are they mined, how many mines there have been historically and so on. I would guess palladium has some use cases but don't know about others.

if you want some advice about silver id suggest leaving the bars alone as they are just bars. The initial attraction is more oz per $$$ which is all good but coins like Chinese pandas and others are a better investment long term IMO. They have a collectors appeal as well as the under lying spot price. The royal mint queens beasts are a great example of a coin with massive collectors appeal at the moment. You could in theory sell every 5 years your old coins and buy the current years and gather up more and more metal. Platinum is attractive but the problem is most of the demand is industrial which is only going to dry up as the world switches to electric. Silver is a fake market and its quite evil though. The price is nothing to do with supply demand so when it comes to selling its going to bubble quickly and you need to get out and walk away. Palladium is rare as rocking horse and was controlled by russia until the recent price explosion because basically they have run out. It has solid fundamentals but the premiums on physical are usually high. I was lucky i bought an oz at 500 dollars. Precious metals are insurance and even though im well in profit on all mine im still reluctant to sell because id feel naked without them.

While I agree on buying semi numismatic coins over bars, that is not recommended for a new stacker. Making the wrong coin choice you will lose the premium immediately and have just a piece of silver. The Queens Beast series is a winner but the series in one coin away from being over. The time for that series is over for a new buyer. The current premiums on American Silver Eagles is stupid and you’ll never recoup that money unless silver goes to $50 an ounce. Starting off bars are the best bet until you learn the market and what coins have a potential for being winners. Only 2-3% of all coins released become winners, even extremely low mintage ones. Platinum & palladium are very hard to sell on the aftermarket, and carry a huge premium to buy as a coin or bar. I strongly recommend getting into precious metals as they never lose buying power EVER. I have been a coin collector/stacker for three decades and have had to liquidate to get out of a bad partnership. I have hit many homeruns in my days but have struck out several times as well.

i think a lot depends on what country you live in. Im in UK so its entirely different. We pay VAT for a start unless you can buy from Germany. For me its a no brainer to buy coins instead of bars. The queens beasts were just an example of why you want coins and not bars. Chinese pandas are pretty much guaranteed to keep their value no matter what the market does. In America they tend to sell to coin shops and in the UK we just dont have that same thing going on so entirely different.

I get the whole VAT thing and think it ridiculous. The problem with pandas now is there are way to many produced and they are very prone to milk spots which turns your high premium coin to a piece of silver.

Outside of the USA it is only gold. Strangely in the US most use silver as hedge. I just posted about the events going on in COMEX where people with paper silver contracts now ask for the physical silver. The price (like gold) already spiked/doubled last months. Normally you would not start buying now unless you feel the silver will spike a lot more. If so, many think this will be this month. Others like me are ready to sell their silver which I purchased cheap in MArch 2020. (Nice to see our goldsilverstacker community react here)

I am lucky to have a fair and honest Local Coin Shop in my neighborhood. I try to buy at or near spot prices and stay away from the numismatic or higher premium coins. Junk Silver can be fun and entertaining. Good luck in your search.

GoldenEaglecoins.com has been reliable for me.

The 1% premium on crypto is because bitpay charges the retailers that, and in this instance the retailer passes that fee to us.

They will buy back the metal, too.

RoadtoRoota.com is the metal guy that got me to finally buy.

He says there is beaucoup gold hidden in the grand canyon, buy silver.

I like buying silver or gold ETFs (such as SLV or GLD) as opposed to buying the actual physical metal. Don't have to worry about safe keeping or buying a chunk of tungsten on accident. Lots of liquidity and low fees. Plus you don't get killed by the spread like you do from gold/silver dealer.

Only downside is if you are buying the metal because you are hedging against an impending apocalypse, you may not be able to get much for your paper ETF certificates. Though in my opinion if said apocalypse actually happened, we'd have a lot bigger things to worry about and I don't think silver or gold would actually have much demand. People would want things they could actually use.

buy the 1kg stuff and DIY hacksaw it into smaller pieces :)

@themarkymark your gut instinct is probably right, silver its seems has the most upside potential. I would recommend purchasing “tubes” of US silver eagles. Easiest to sell in the future, and highly sought after. Bars are ok, but why not just purchase a 20 oz “bar” of silver eagles (that would be a tube of 20 actually), which can be divided up 20 ways.

American Eagles are tubes of 20 not 25. Canadian Maples & Libertads are 25 per tube.

I stand corrected. Thanks

I wasn’t trying to be a jerk. Just wanted the correct info.

No worries...being Canadian, maples are my main thing. You would think that there should be a universal standard for tubes. Make em all 20 or 25!

It’s about half and half. UK, Canada and Mexico do 25 except for Queens Beast they are 10’s. US, Austria, Germany do 20.

Hi @themarkymark! I think it's a good idea to somehow invest in precious metals. History proved itself that gold, silver, and other precious metals can be worth a lot perhaps if hoarded and sold at the right time. =D

Start small in my opinion, it’s what I have done for years now. I started with lots of 3 or 5 silver eagles or maples, started when they were at 30.00 in 2013, and we all know what happened, but instead of being discouraged, I kept buying all the way down. I knew it had to start climbing back up sooner or later, now that it’s back to 30.00, I seem to have invested a nice amount with nice profits if I wish. I do believe silver will continue to climb possibly triple digits, who knows.

Also buying gold. I started with a 1/4 ounce, then just bought 5grams, 2.5 grams, even 1 grams as I could afford.

To me it’s about putting in what I can afford not to miss, 50 bucks here 80 bucks there... adds up nice 😀

Shameless affiliate link here, but I've been a user of OwnX.com for quite a few years. All I do is automatically throw a certain amount each paycheck into this account and every time you get to 0.5 oz of gold or 20 oz of silver you can take delivery. They sell Gold, Silver, Platinum, and Palladium. Each time you make a purchase, they supposedly hold that silver for you in an insured vault until you're ready for delivery. Then you can pick from 1 oz coins or different size bars. You can also sell your holdings in your account as well.

It's insured through the mail and always requires a signature, so it won't just get dumped in your mailbox. I've dealt with their customer service a bit when FedEx kept missing me, and they're very helpful. They do charge a percentage of the metal for insurance and delivery and it fluctuates depending on the coins or bars you get. If you want to make a large purchase, there are better ways. But to slowly build up precious metal holdings over time without breaking your wallet or even thinking about it, OwnX has been a good choice for me and allowed me to build up a good collection over time.

Actually I'm considering getting into investing on gold.

I don't think gold is gonna go away from our lives anytime soon.

Many people who invest in precious metals are gold bugs who probably have never sold any, don't trust FIAT currency and own guns and prepare for the zombie apocalypse or some crap. Get a few opinions. The government has seized gold and silver before and will do it again when they need money.

Just looking at the price and making a decision based on if it is near its all-time high is a poor investment strategy for anything, precious metals are hardly any different.

Asides from market conditions (technicals and fundamentals) that influence everything on the market, mining precious metals and their industrial uses is the most important factor influencing price.

In the case of silver, there are actually a ton of mines that are simply mothballed because the price is too low to make mining it worthwhile. So the price of silver has a ceiling because when it reaches a magical price, many silver mines will open back up (oil also follows this pattern).

The thing about precious metals is you can store them underground forever and people can't really steal it since unrefined ore isn't very valuable or easy to move around.

I get a feeling most people investing in silver cannot afford gold, have some whacky economic theory, or are buying showpieces and collector's items like coins or whatever. Collectors are rational, but that's a little different from precious metals investing. I recommend just buy the cheapest certified bullion to start with.

Platinum is heavily influenced by industrial needs. A while ago because of its use as a catylist, especially for fuel cells, there was a massive price surge. However, it turns out it wasn't as rare or as important in industry as thought. It's still rare and important, but markets were hyped. I feel it will fall into the silver trap. Demand is relatively arithmetic and so is the supply.

Palladium I feel will end up where platinum is. Both of these don't have the 1000s of years history of silver and gold. Palladium is the newest to the mix.

Gold...gold...gold, this one is the best. Nothing bad to say about gold. Out of all the precious metals always go with gold.

Certificates and other derivatives are fine, too. Actually, they are the cheapest especially if you plan on trading and not just stockpiling it until you die or get robbed.

A very interesting comment , Gold you say is the deal but there is no scarcity there either , at some point they will reach deeper layers under the ground and find way more gold , therefor crashing the value , also the market , like precious stones is controlled , i ve heard Russia has special diamonds 10x harder than our regular diamonds and they ve got millions of them in a specific area , that says it all, Any markets can be rigged and they are .

I read you dont go for silver but considering the low price of it to me it is a great investment .

Thank you for your insight

There are definitely more gold reserves out there. The price may also be capped when it becomes more economically viable to mine. Unlike silver, we aren't even close to that number yet.

Another huge red flag with silver is distribution. It has been cornered a few times. It's impossible to do this with gold.

Silver also spiked 8 years ago because its use as an antimicrobial agent became trendy. However since then we have found out copper and a few far cheaper base metals like zinc are no more toxic and just as or more effective. So silver's industry demand has dampened.

Gold on the otherhand has extremely unique properties.

Diamonds are a well known market manipulation and can be produced artificially. Their value is intrinsic.

The microdiamonds are harder than gemstone diamonds, but not 100x. Are you thinking of carbon nanotunes? Thats just graphite and only expensive in large perfect quantities.

Yes i get your point that is why i wont buy official coin silver but rather have a collection , it is beautiful , useful and is worth more than the plain metal .

For the diamonds in russia it is a very odd story , i dont know what to believe , it still turns in my head but it was like super diamonds they found out of nowhere and nothing like those on earth anywhere else .

Silver is the deal ..Gold reached an extreme pick already ,gold was a great investment 10 years ago ...Silver for now is totally under rated .

The problem is , if you buy officially you will pay high taxes and when the economic crash occurs , the gover can come after you and take it , same for fiats on bank accounts , at least in Europe we have that problem .

https://twitter.com/MarkyHive/status/1302987278957064198

If you look at history gold and silver are better since they have been around (and valuable) for thousands of years. Personally I am sticking to Silver as well and the most popular things are 1oz Silver Coins and 90% Constitutional Coins. Silver Coins usually sell the best and you can buy them as monster boxes with 500 coins a box. Constitutional is nice if you think we are heading for a big collapse/ hyperinflation and you want money that actually has value. Preppers love 90% Silver.

Coins are also harder to fake and therefore better to sell P2P.

I literally clicked on this to tell you not to forget Platinium. I've been researching scrapping Platinium because some old devices like thermocouples have Platinium wires. I won't get into why I think this metal is valuable ... plus the market speaks for itself.

Of cpourse nothing I say here is financial advice: That being said, I think you are making a smart choice investing in metals. They are certainly more reliable than paper money in my mind.

I'm trying to convince @silverstackeruk to release Hive silver rounds like he did with Steem.

PS i think repeating patterns is a good way to look at metals like you said.

It's possible either silver is the best investment because its lower and they will all spike or Plat. is the best because its due for the biggest spike based on projection.

I dont have any Gold at the moment because I was thinking along the same lines you were although this could be a huge mistake its hard to say.

Interesting research, I though gold is the best bet, now I learned new things.

I buy from JMBullion