When money dies, what will save us?

When money dies, the barbarous relic – gold – comes into its own. A rising gold price reflects, above all other things, a loss of trust in the value of fiat currencies

Since the mid 1950s to now, the price of gold has seen some dramatic price rises, and if you had invested in gold back then, you'd be sitting pretty rich about now. Yet perhaps counter-intuitively, this actually tells you less about the attractions of gold as an investment than it does about the way the value of the pound, and virtually all other fiat currencies, has been eroded in the intervening years by the ravages of inflation. The two things are opposite sides of the same coin (as it were). Gold has broadly held its value relative to the cost of everything else, but sovereign currencies have not.

With current world markets on the verge of free-fall, and sovereign nation debt at record all time highs, it is this fear that is fuelling the current frenzied demand for gold, and the consequent near doubling of its price over the past year to just over $2,000 (£1,494) an ounce in recent weeks. In uncertain times, gold comes into its own as a means of defending wealth. Over the past 50 years, the dollar price of gold has risen 54-fold. In my view, there is no reason it shouldn’t do the same again over the next 50. Which is why I urge people to please take some time to read, listen and start investing in precious metals.

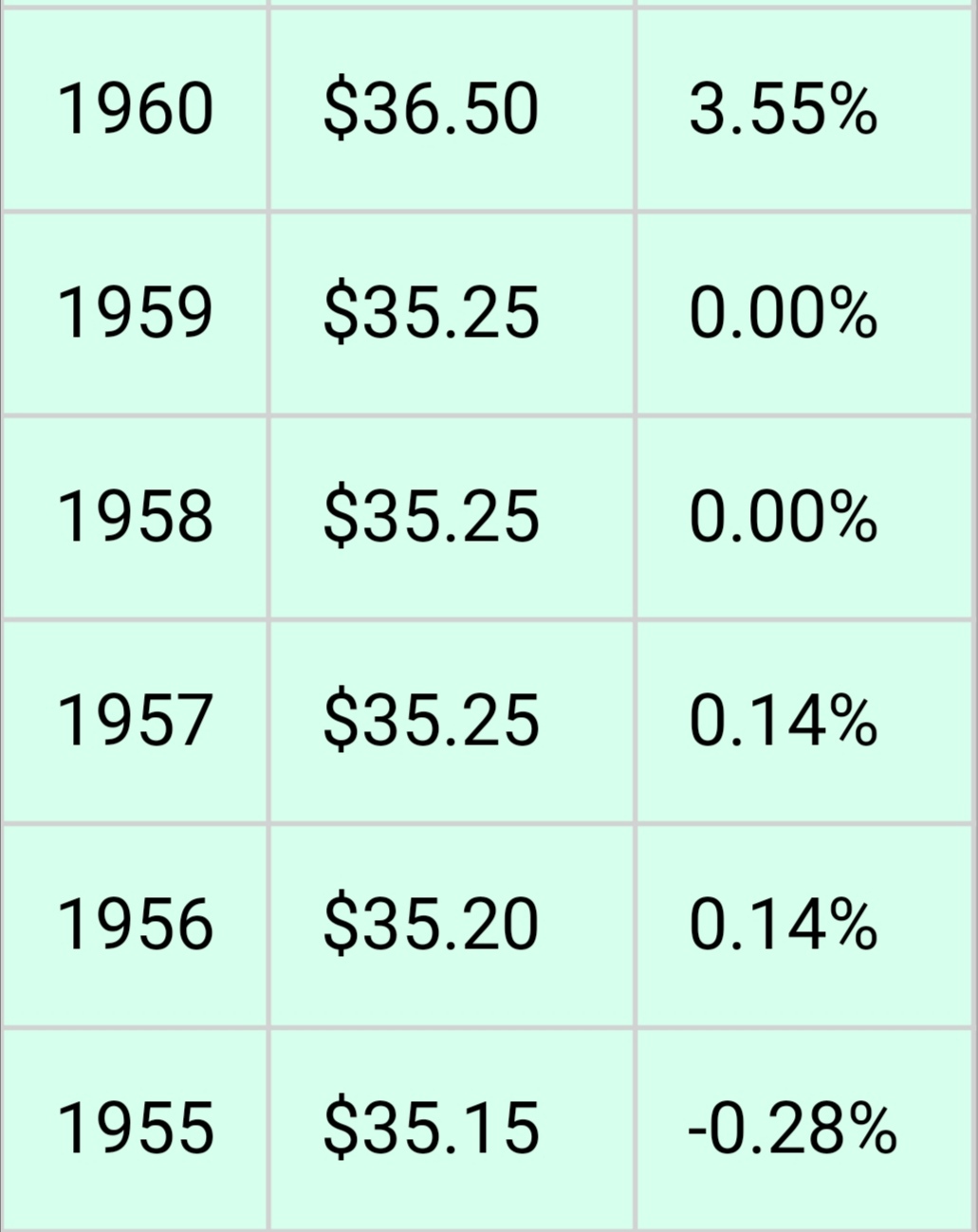

Price of 1oz of gold - Very stable prices through the 50s

Call it an insurance policy against “when money dies”, but lots of others are plainly thinking in the same terms. It is now relatively commonplace among the super-rich to have at least some small part of their wealth diversified into gold. But precious metal investment should NEVER be seen as a rich-kid folly, or just for millionaire playboys and bankers. Nor is it just the wealthy who are using gold as a means of hedging themselves against a devalued dollar. The Chinese authorities have been steadily increasing their gold reserves for some years now, resulting in a massive transfer of the metal from West to East.

We only need to look at Venezuela and Zimbabwe, to name two off the top of my head, where the currency has suffered hyperinflation. With Turkey looking to go the same way (very soon), could this be the start of the domino cascade that effects the world?? More or less everywhere, currency debasement is now rife to help pay for the burgeoning costs of the Covid-19 crisis and that’s set alarm bells ringing. Few serious economists would think a repeat of those monetary meltdown remotely possible in today’s advanced economies, all of which have strong institutional frameworks to keep inflation in check.......

**in case you missed it, that was sarcasm!!

Already we are seeing some loosening of inflation targeting regimes, not least by the Federal Reserve in the United States, which last month announced that full employment objectives would hitherto take priority, and that in future it would be targeting “average inflation” rather than a rolling target. This would allow inflation to run somewhat above target for some period of time without necessarily triggering an interest rate rise. What's that famous saying - "out of sight, out of mind"

Crucially, Jay Powell, the Fed chairman, failed to specify the time frame for such averaging, which would, theoretically, allow him to pull off the same trick as that of Gordon Brown with his notorious fiscal rules. In Brown’s case, the aim was to balance current spending across the cycle. By constantly extending the expected length of the cycle, the politically difficult task of bringing spending and taxes back into balance could be put off indefinitely.

And with anyone who really know how "MONEY" works will tell you "we all know, that didn’t end well that last time".....

Over the past twenty years, China’s gold reserves have risen five fold in volume terms to 1948 tonnes at the last count. Their value is still dwarfed by China’s stock of US Treasuries, but the gap is narrowing fast. What this says to me is that China appears to view gold as a more dependable bet than US government debt. Now this shouldn’t altogether surprise, given the massive build-up of US indebtedness. A further $1 trillion of fiscal expansionism is now only weeks away from Congressional approval, much of it likely to be financed by Federal Reserve money printing. So while free money seems great in the short term, and handouts can be a life saver on times, people need to think about WHO WILL PAY FOR THIS DEBT?? When all money has become essentially free, perennially incomeless gold is as good as anything.

Britain still owns 310 tonnes of the stuff, hoarded away in the Bank of England’s vaults. Yet it might have been so much more, but for Brown’s turn of the century determination to diversify away from the “barbarous relic” – as John Maynard Keynes famously called the precious metal – into a basket of fiat currencies. This certainly helped rescue a number of banks from ruinous short positions in the metal, and helped China substantially expand its own reserves at what later proved to be knock-down prices, but at considerable cost to the UK's wealth. The loss on the sales when judged against today’s elevated price is around £10bn...... NO drop in the ocean. The UK government was warned not to sell off its gold holdings by the few that saw what was coming, but they were labelled ignorant, old-fashioned, dinosaur, stuck in the stone age. Well looking back now, a somewhat expensive misjudgment it turned out to be.

For the moment, the presiding consensus view remains that we are heading into a great deflation. I’m not so sure. The least painful way of dealing with a big debt overhang is to inflate it away. Who knows; the gold bugs might actually be on to something.

As I say, a rising gold price reflects, above all other things, a loss of trust in the value of fiat currencies, for which there is good reason right now. But for the metal to really come into its own requires a prolonged period of relatively high inflation, similar to what occurred in the Seventies after the US came off the gold standard and president Nixon effectively opted for money printing and inflation over tax rises to pay for the Vietnam war.

Whatever; the fact is that gold tends to sustain its value over time. National currencies, eroded by inflation and political manipulation, do not.

Why do you think the price of gold has been rising? Let us know in the comments section below.

Want to find out more about gold and silver? Get the latest news, guides and information by following the best community on the blockchain - #silvergoldstackers. We're a group of like minded precious metal stackers that love to chat, share ideas and spread the word about the benefits of "stacking". Please feel free to leave a comment below or join us in the community page, or on discord.

Posted Using LeoFinance

Hi @welshstacker,

Thank you for participating in the #teamuk curated tag. We have upvoted your quality content.

For more information visit our discord https://discord.gg/8CVx2Am

You received an upvote of 100% from Precious the Silver Mermaid!

Thank you for contributing more great content to the #SilverGoldStackers tag.

The price of gold when i bought my first gold coin was just over $300 an oz. in 1984. I wish I didn’t have to sell all my collection to get out of a partnership that went bad. I’d be sitting pretty right now. Instead I’m still trying to build my stack. Life........it sure knows how to kick you in the nuts

You like balls....🤣🤣🤣

Keep dreaming......

The barbarous relic – gold ...and the U.S. Government still puts a value of $42.2222 per troy oz!!🤔

@welshstacker some will never "get it", steady stacking my friend!!!

Wait, what? I don't even know what you are saying but I do believe the US govt is cuckoo. How do they value it like that? $42!?

😱

Lol ....That's a very good question @summertooth Lol!!

Precious metal… Worthless barbaric relics LOL!!!😇

Congratulations @welshstacker! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @hivebuzz:

Gold will be forever.......it might just take forever for some to realize that this relic is an important part of anybody's portfolio!

Informative article! Thanks for putting it out there @welshstacker!

Is the price of gold and silver rising?

....or is the value of fiat currencies falling? It seems like stocks, PMs and cryptos are all correlated right now but really its only because they're all priced in dollars and it's the dollar that is wobbling.

Great post man.

All we can do at this point is stack sats and hope for the best, the zimbabwefication of many developing nations such as my own will happen soon

Posted Using LeoFinance Beta