Why precious metals are about to blast off.... You still have time to invest!

Investors in precious metals have probably noticed a trend emerging over the past few months that has seen gold soaring to record highs. What is the cause for this and more importantly will it continue? Well, its safe to say that 2020 has been anything but ordinary for markets. With an abundance of gloom and bad news wrought by the outbreak of Covid-19, demand for gold has flourished, catapulting the yellow metal higher due to several trends.

SOURCE

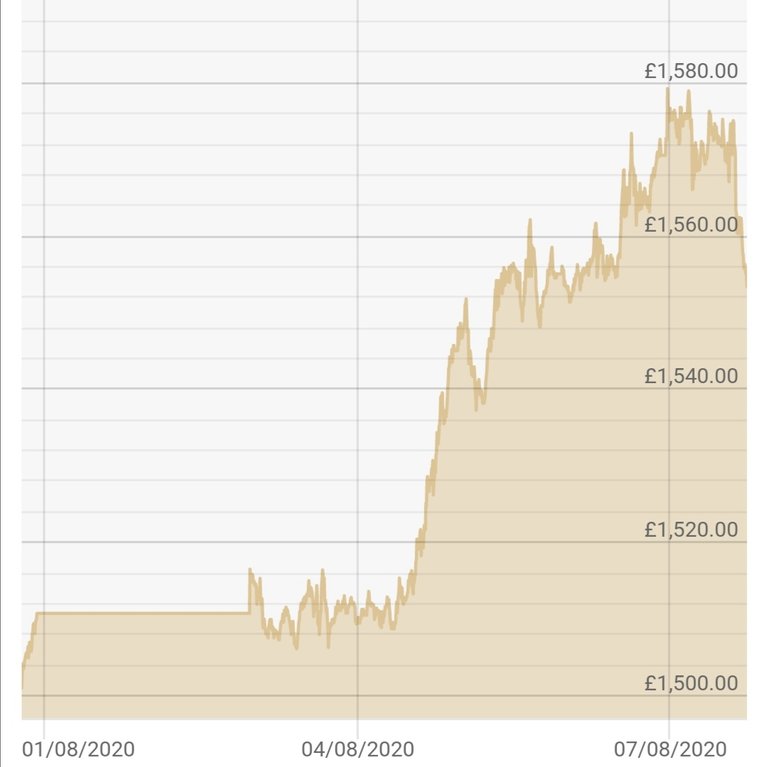

Gold recently topped out at an all-time high earlier this week, crossing over $2,000 (£1500) for the first time. The price was driven in large part by the erosion of the US dollar and seemed to easily overtake a previous high of $1931 set back in August, 2011. This took many investors by surprise, but not the precious metals junkies, such as myself, that have talked about the expected price rise for a very long time. To better understand the recent strength behind gold however, we must dig a little deeper. Truth be told, you do not have to look very far to uncover some warning signs of an imminent recession and tough times ahead.

Since the US dollar is still currently the "world's reserve currency", and since all commodities are priced in $USD, I will keep referring back to the dollar and the state of the US economy. So as an example, the recent economic data from the United States suggests the largest drop on record of GDP in a single quarter..... Beyond the US, the International Monetary Fund (IMF) is projecting a 5% annualized decline in the world economy. Me personally, I feel this is under estimated and no amount of plasters will stop this from hemorrhaging now.

Consequently, as a last resort (again), central banks globally have opted to juice up financial markets by injecting billions and billions of fiat currency to help stabilize economies throughout the developed world. In Europe and the United States this has resulted in new currency being printed at an alarming rate, with no signs of stopping or slowing down. The repercussion of increase in money supply leads to lower interest rates, while also increasing the amount of currency in circulation. As such, these currencies tend to weaken due to inflation, which is what is happening with the USD and other major currencies.

With normal safe haven currencies now in question, this also creates another layer of demand for gold, as it is seen as the principle option for doom and gloom investing. When all else fails, liquidity will always run to the safest option, and with the covod-19 virus not even close to abating, it is likely this trend will continue in the second half of 2020.

The price of silver has also spiked in recent weeks, a healthy 25% in July alone. This equates to netting an even larger increase than gold. Still, the price of this shiny, white metal is not even close to its all-time highs ($50) and is seen as undervalued.

With gold markets supercharged at the moment, silver could be an obvious beneficiary as investors look to put money into precious metals without breaking the bank (pun intended). The ratio between gold and silver is also suggesting silver is very cheap at the moment, which could see further gains and grounds for growth. Looking ahead, precious metals should be able to retain their luster with good news in short supply across the globe.

With many countries openly contemplating re-entering lockdowns in some capacity, any hope for a quick economic recovery seems wildly optimistic. In such a scenario, precious metals will continue to be in demand and although prices seem to high at the moment, this is just the beginning of the collapse, and it's not too late to start investing in precious metals.

Hi @welshstacker,

Thank you for participating in the #teamuk curated tag. We have upvoted your quality content.

For more information visit our discord https://discord.gg/8CVx2Am

They have blasted off already....just switching boosters right now lol

Posted Using LeoFinance

Just Starting to feel richer already.

History is repeating and we have a massive reversion to the mean on the cards. This is far from over but we might still have a few bumps along the way.

It's good to see silver finally waking from its slumber. The upside on that one is enormous if it can keep its momentum.

Thanks again for sharing your work, Welshstacker. The Local Coin Shop is going wild.

Tell them Welshie but we cannot save all :) There jsut is not enough gold and silver around.